Malaysia Payment Gateway Comparison: iPay88 vs. eGHL, SenangPay, HitPay, Razer, and more

We compare 6 popular payment platforms in Malaysia and how to choose the right one for your small business.

Choosing an e-commerce payment gateway is essential to selling online. But how do you decide on the best payment gateway for your business?

It's important to pick a suitable payment gateway as this can significantly impact your business's growth and customer experience. Factors such as transaction fees, supported payment methods, and e-commerce platform integrations can greatly impact your business performance.

In this quick and easy Malaysia payment gateway comparison, we summarise the pros and cons of popular payment gateway providers — including SenangPay, iPay88, and PayPal. Plus, an honest review of HitPay vs Stripe and other major payment providers. Read on!

Top 6 popular payment gateways in Malaysia

1. SenangPay

Founded in 2015, SenangPay is one of the most popular payment gateways in Malaysia.

Pros:

✅ Supports payment through multiple channels, including social media, email, and payment links

✅ Supports a range of payment types including multi-currency, e-wallets, recurring payments, and mass payments

Cons:

❌ Charges annual fees from RM450

❌ Can take up to 14 days to set up

❌ Doesn't integrate with Shopify

2. Stripe Payments

As one of the most widely-used payment gateways worldwide, Stripe Payments is ideal if you serve international customers.

Pros:

✅ No annual or set-up fees

✅ Instant onboarding

✅ Accepts more than 130 currencies

Cons:

❌ High transaction fees

❌ Doesn't provide free accounting integrations and business software

❌ Requires coding experience to customise or install certain payment options

3. PayPal

Like Stripe, PayPal is another popular payment gateway in Malaysia for businesses that sell worldwide.

Pros:

✅ Supports 25+ currencies and is available in over 200 countries

✅ Provides an option for instalment payments

✅ Provides PayPal Seller Protection

Cons:

❌ Doesn’t support any local payment options like FPX and GrabPay

❌ Limited integrations with e-commerce platforms

4. eGHL

Specialising in South East Asia, eGHL operates in 5 countries and processes payments in over 48 currencies.

Pros:

✅ Instalment and regular payment options available

✅ Able to embed unlimited click-to-pay buttons on your website or social media profile

✅ Supports over 100 payment channels

Cons:

❌ Charges annual, setup, and transaction fees

❌ Doesn't provide free accounting integrations and business software

❌ Doesn't integrate with all major e-commerce platforms

5. Razer Merchant Services

Established in 2005, Razer Merchant Services provides over 110 payment methods across Malaysia and South East Asia.

Pros:

✅ End-to-end services from payment processing, logistics support, and performance reporting

Cons:

❌ Charges annual, setup, and transaction fees

❌ Limited payment methods. Doesn't support international Visa and Mastercard

6. iPay88

iPay88 offers a quick and easy checkout experience tailored for Malaysia.

Pros:

✅ Offers recurring payments

✅ Supports over 37 payment channels

Cons:

❌ Charges annual, setup, and transaction fees

❌ Limited payment methods. Doesn't support international Visa and Mastercard

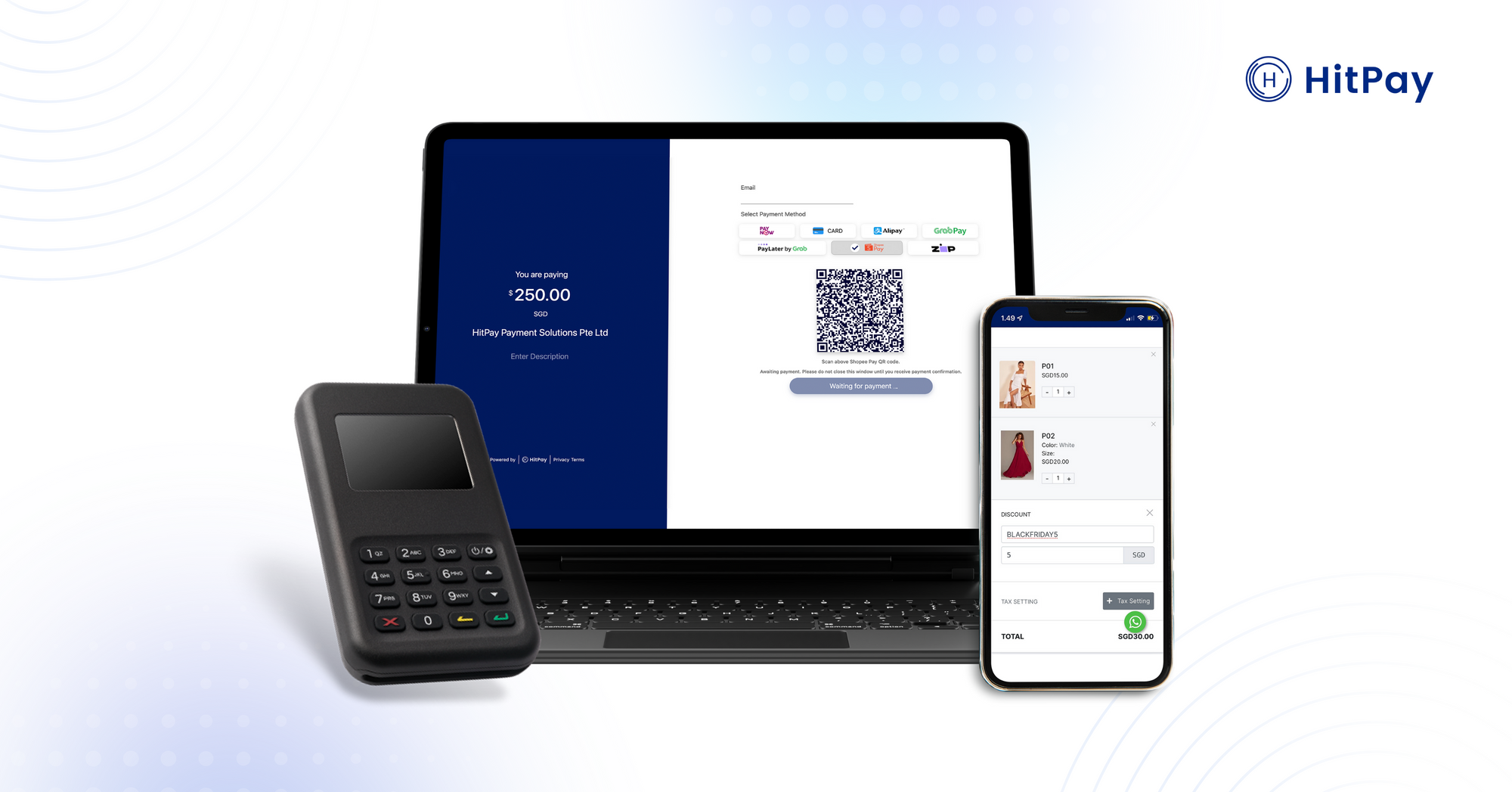

HitPay payment gateway

Founded in Singapore, HitPay is a one-stop payments platform in South East Asia and key markets around the world. HitPay is built specially for small businesses — with no setup or annual fees, and a full range of free business software. You can use HitPay to sell on any sales channel, including Shopify, WooCommerce, and Instagram.

Pros

✅ Offers all popular payment methods with just one HitPay account

✅ Wide range of e-commerce integrations — Shopify, WooCommerce, OpenCart, Ecwid, Prestashop, Wix, EasyStore, Shopcada, Magento, and Google Forms

✅ Free business software including an invoice generator, payment links, and an online store builder

✅ Free POS software on the HitPay mobile app

✅ No-code setup

✅ No setup, subscription, or annual fees. Only pay per transaction

✅ Express onboarding (1 - 2 business days) and payout time (T+1 business days)

Cons

❌ Additional payment methods coming soon in 2023 (e.g. DuitNow)

Click here to learn how HitPay Malaysia's features are specially designed for SMEs.

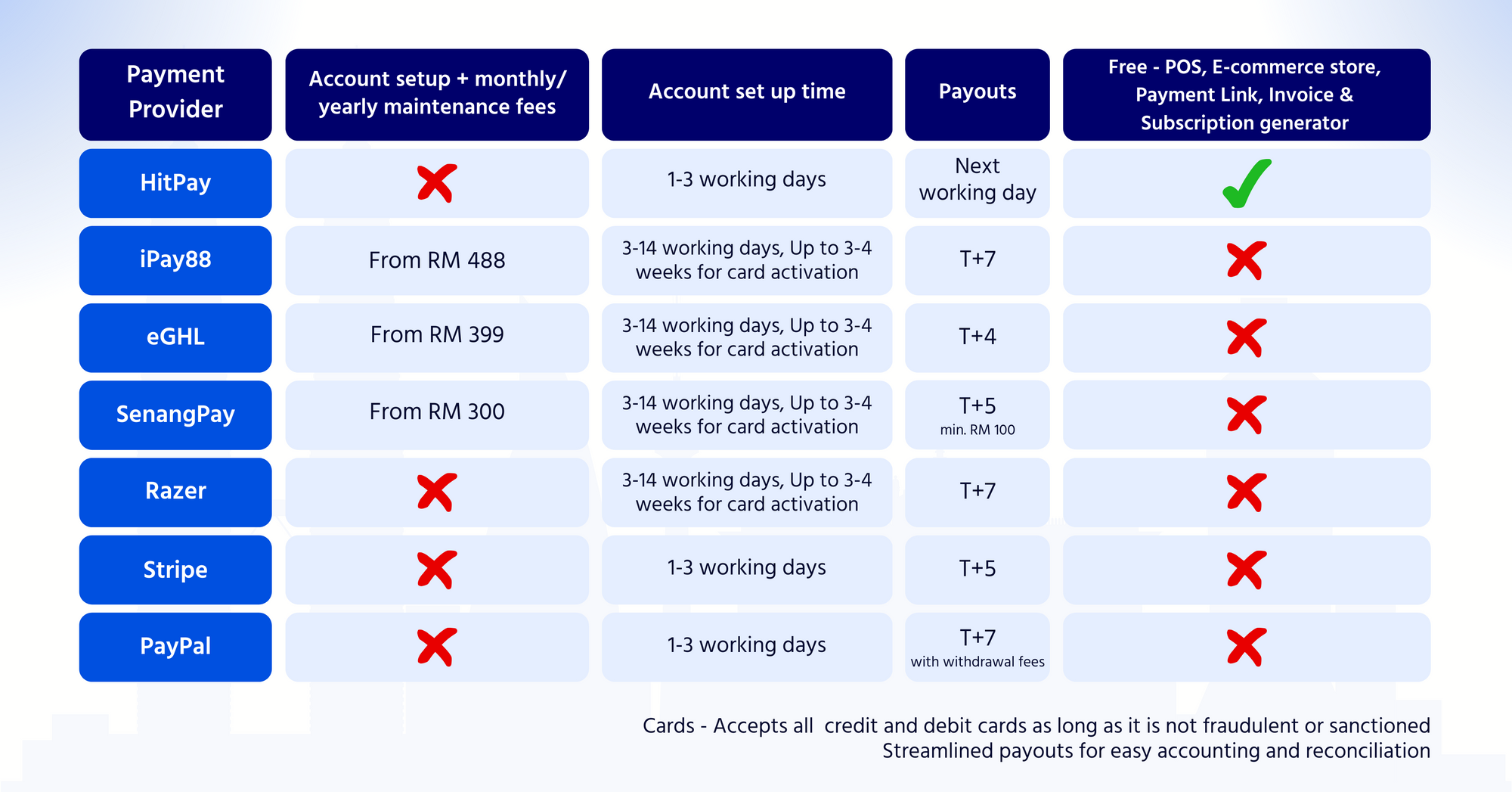

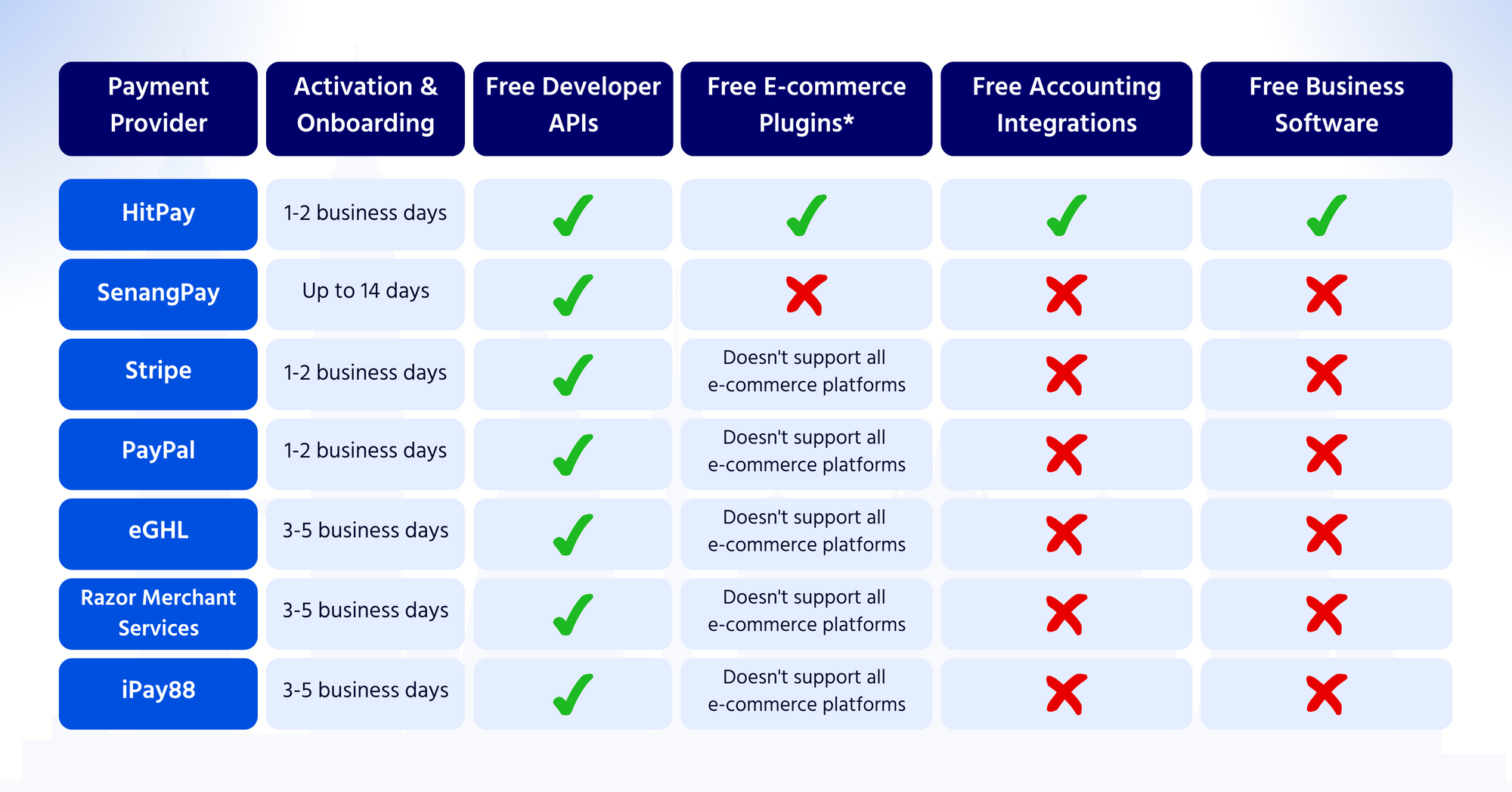

Malaysia Payment Gateway Comparison

Payment Gateway Features

Major e-commerce platforms include Shopify, WooCommerce, EasyStore, Prestashop, Magento, OpenCart, Shopcada, Ecwid, Wix, and Google Forms.

Business software includes Recurring billing, Online store with inventory and order management, Invoicing software, POS system, and Payment links

Read also: 7 must-have small business software

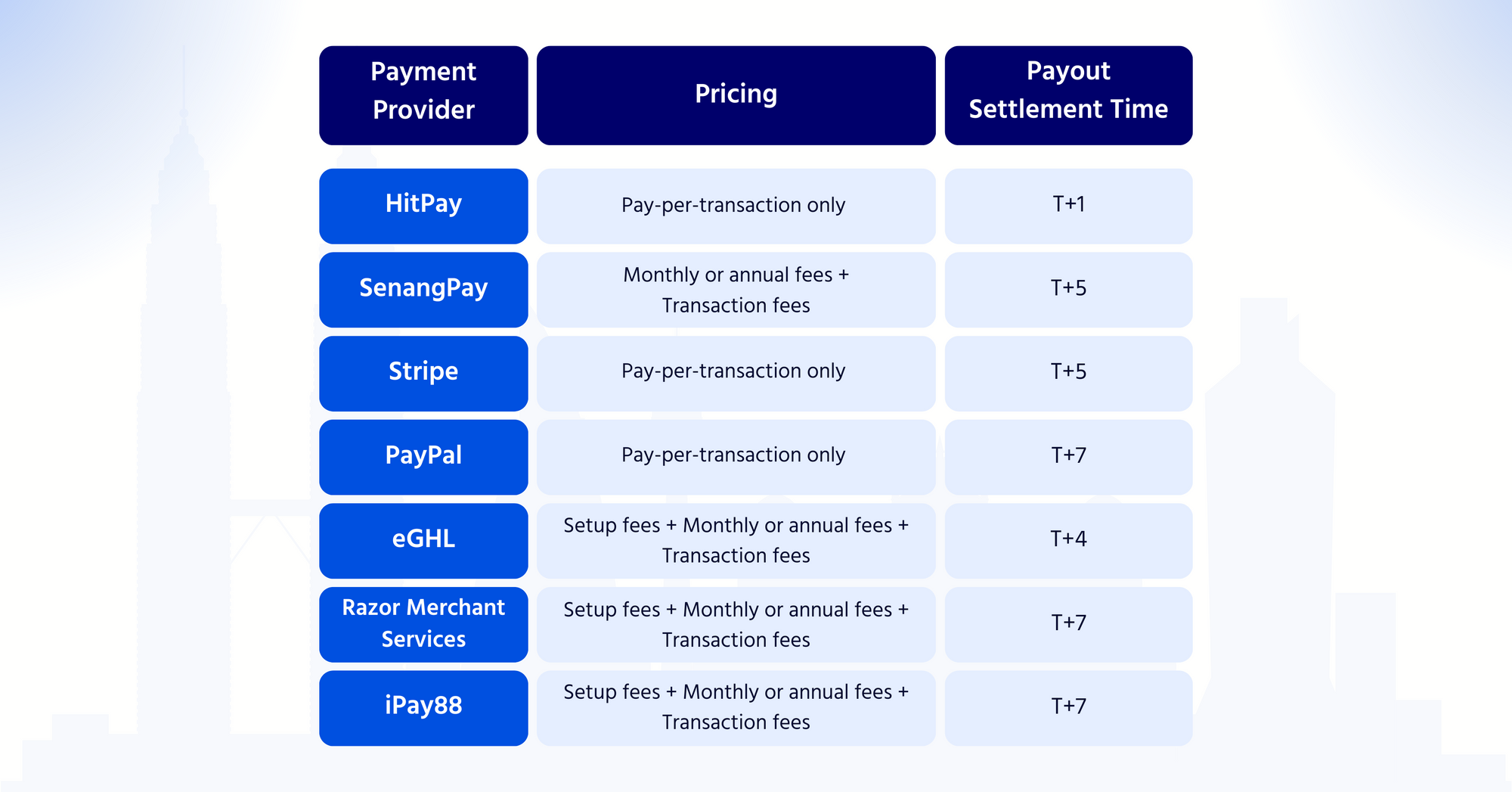

Pricing and Settlement Time

Supported Payment Methods in Malaysia

Set up your payment gateway in Malaysia

Choosing a payment gateway in Malaysia isn't a straightforward decision. If you run a small business, however, HitPay's low-cost one-stop platform may be the right fit for you.

Ready to start accepting payments?

Set up a HitPay account for free or find out more with a 1-on-1 demo.

Read also: 7 must-have small business software that are completely free

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!

![Perbandingan 13 Payment Link di Indonesia [2024]: Pilihan Metode Pembayaran Terbaik Untuk Bisnis Online Anda](/content/images/size/w720/2023/05/Newsletter-Design---2023-05-02T221135.775.png)