Xendit Payment Gateway Review: Alternatives, Pros, and Cons

In addition to being the best alternative payment gateway besides Xendit, HitPay provides an exceptional customer service experience.

The online business landscape has made it easier for customers to make transactions, thanks to various payment providers. But with many options in Indonesia, it's crucial to carefully choose a payment gateway that fits your business.

Before settling on any payment gateway, take the time to check reviews from other customers and explore alternative payment gateways. This will give you a well-rounded view, helping you make a precise comparison. It's important to ensure that the payment gateway you pick is the best fit for your needs.

In this article, we will provide a detailed overview of one of the popular payment gateways in Indonesia, Xendit. Additionally, we will also present the best alternatives so that you can make a careful comparison before making a decision.

What is Xendit Payment Gateway?

Xendit is a fintech company that provides accessible payment service solutions for both small and medium-sized enterprises (SMEs) and large businesses. Xendit functions not only as a payment gateway within Indonesia but extends its offerings to various payment solutions across several Southeast Asian countries, including the Philippines, Malaysia, Thailand, and Vietnam. Offering a wide array of choices with more than 38 available payment methods, Xendit ensures a diverse range of payment options throughout Indonesia.

Xendit Payment Gateway Review

Customer Reviews

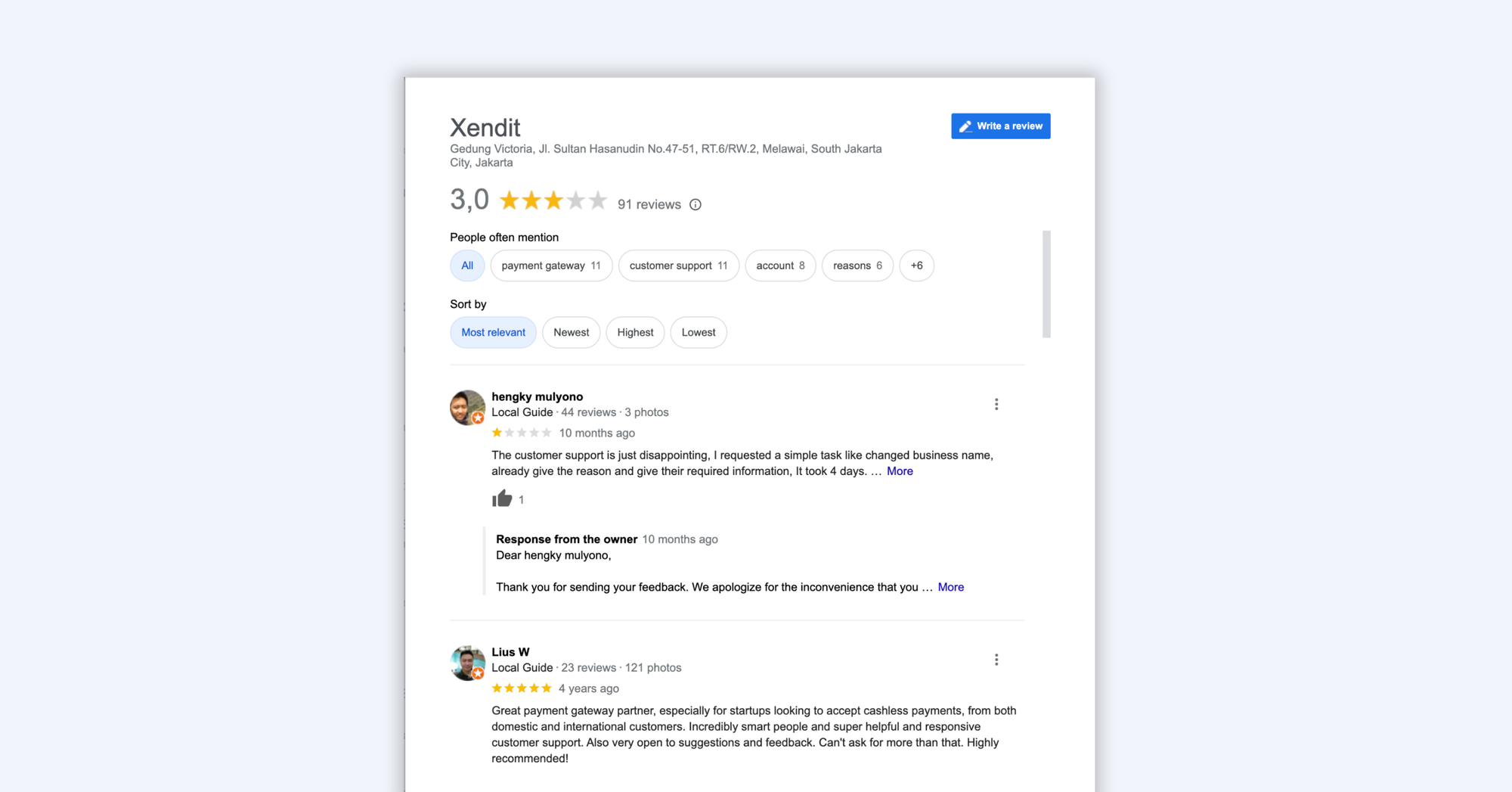

Xendit, a popular payment gateway in Indonesia, has gained widespread usage across various sectors, ranging from SMEs to large businesses. This is attributed to Xendit's features that facilitate both domestic and international transactions.

However, a review of Xendit on Google reveals several complaints and dissatisfaction among users in Indonesia. Some of these issues include suboptimal responsiveness from customer support, delays in the approval process for new accounts by Xendit, and a high number of suspended or frozen accounts, leading to difficulties in withdrawing funds.

Additionally, there are complaints about the declining quality of Xendit's services over time, particularly concerning slow responses from customer service in addressing and resolving issues.

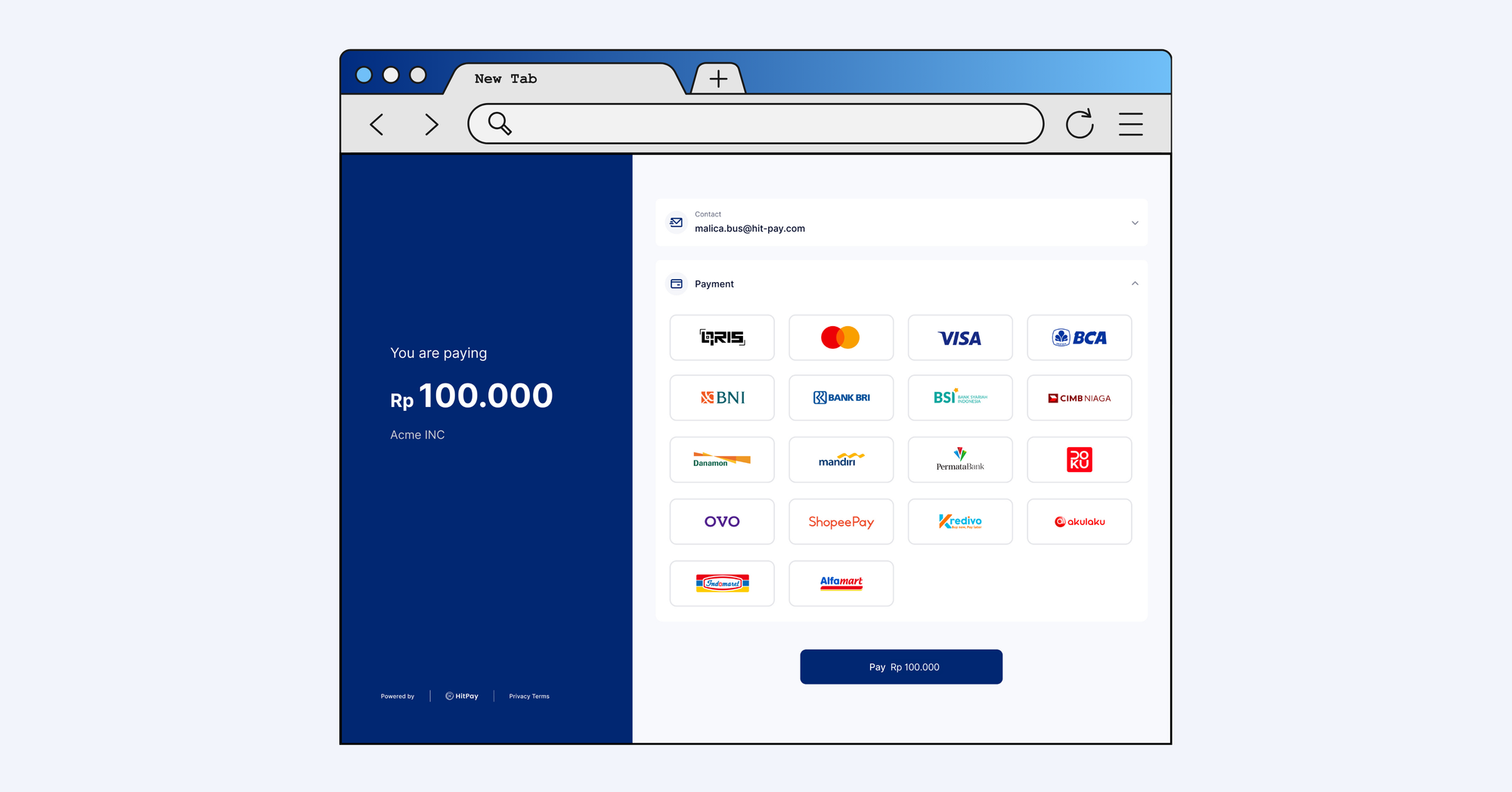

As an alternative, some Xendit users opt to switch to other payment gateways, such as HitPay. HitPay is considered a more suitable option by these users, not only because it provides features equivalent to Xendit but also due to its more responsive customer service, which is viewed as a major advantage by many users.

Pros and Cons of Xendit

Pros

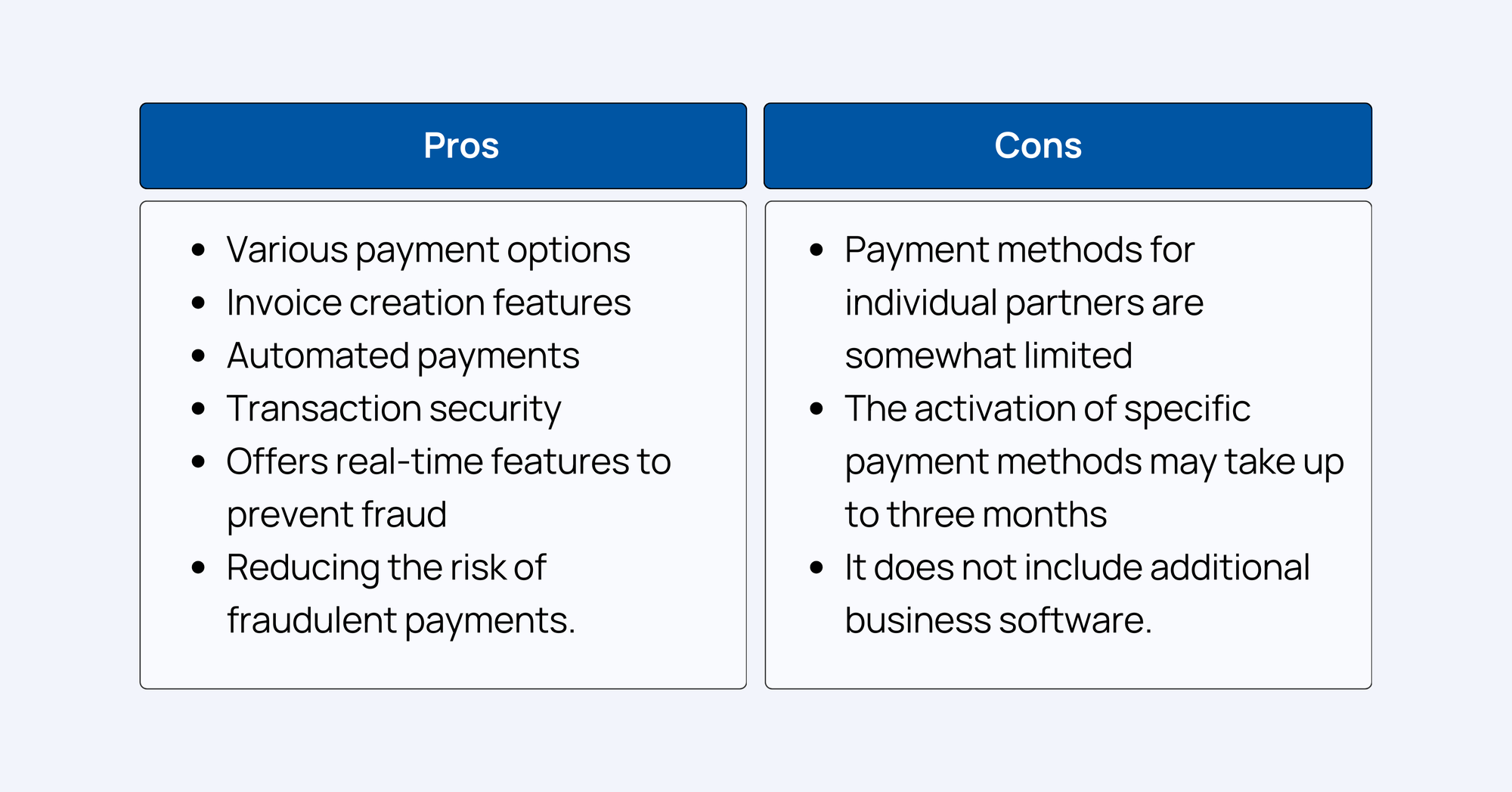

Xendit, like most payment gateways, stands out for its various payment options, invoice creation features, automated payments, and transaction security. Xendit also offers real-time features to prevent fraud, reducing the risk of fraudulent payments.

Similar to Xendit, HitPay's payment gateway also provides all the essential features along with additional complimentary offerings, such as additional business software and the Hitpay Online Store. This aids merchants in showcasing and selling products directly on the HitPay online store platform.

Cons

While Xendit is popular among large businesses, there are some drawbacks to consider. Payment methods for individual partners are somewhat limited, the activation of specific payment methods may take up to three months, and it does not include additional business software. For those requiring inventory management and e-commerce store capabilities, another platform may be necessary.

As an alternative, HitPay provides more comprehensive payment support, with easier and faster registration and activation processes. HitPay's customer support is readily available to assist when needed.

HitPay Payment Gateway: A Popular Choice as an Alternative to Xendit Payment Gateway Among SMEs in Indonesia

The decision regarding the choice of payment gateway is entirely in your hands. While both Xendit and HitPay have their respective advantages, HitPay can be considered superior and more suitable for SMEs in Indonesia. This is because HitPay offers responsive customer support, free business software, support for local and international payment methods, and compatibility with many leading platforms.

Moreover, HitPay provides an exceptional customer service experience, as evidenced by the impressive positive reviews from our customers in Indonesia.

If you're planning to use HitPay, you can sign up for free now or contact our team to get a free demo

- Read also: Xendit Payment Gateway vs. HitPay: Which is the Best Payment Gateway Solution for SMEs in Indonesia?

- Read also: Comparison of Payment Gateways in Indonesia [2023] - HitPay vs. Xendit, Midtrans, and Doku

About HitPay

HitPay is a comprehensive sales platform aiming to provide a full-stack payment solution without coding for SMEs. Thousands of partners have thrived with HitPay's products, helping them easily receive online or in-person payments. Join our partner community now!

![Perbandingan 13 Payment Link di Indonesia [2024]: Pilihan Metode Pembayaran Terbaik Untuk Bisnis Online Anda](/content/images/size/w720/2023/05/Newsletter-Design---2023-05-02T221135.775.png)