Payment Processors and Payment Gateways: Choosing the Best Option for Your Business in Indonesia

Choosing the right payment gateway for your business in Indonesia can be tough due to numerous options. Luckily, HitPay offers a versatile and user-friendly all-in-one payment solution tailored for Indonesian MSMEs.

Both payment gateways and payment processors serve as intermediaries in customer-seller transactions. Payment gateways, offered by fintech companies in the form of software or applications, enable sellers to receive funds from customers through an integrated payment system. On the other hand, payment processors, provided by financial companies, operate discreetly in the background.

What are payment gateways and payment processors?

A payment processor functions discreetly in the background, offering diverse payment services for online entrepreneurs. The payment processor establishes connections with both seller accounts and payment gateways, facilitating the exchange of information while ensuring security for users.

On the other hand, a payment gateway is similar to a site for online transactions. It enables users to accept payments from customers through various channels like bank transfers, debit/credit cards, or retail outlets such as Alfamart and Indomaret. The primary purpose of a payment gateway is to streamline the payment collection process directly from the website.

What is the importance of a payment processor for businesses?

Let's see how important it is to choose a payment processor that is suitable for MSMEs in Indonesia.

1. Efficiency and Smoothness

Payment processors get payment information from customers, authorize transactions, and send money to your business account without any problems. They are like the gears that make machines work. With a fast process, you can receive payments without any delays.

2. Security and Trust

Security is a key aspect of running a business. A reliable payment processor will protect sensitive customer data and maintain customer trust.

3. Client Experience

The "Customer First" principle also applies when selecting the right payment processor. The payment processor ensures a hassle-free and easy payment experience. Customers don't like complicated or confusing payment processes. Therefore, an ideal payment processor must have a good customer experience and simplify the user experience during transactions.

Factors to consider when choosing a payment processor

Determining the right payment processor is a crucial step in managing business finances. In addition to maintaining smooth cash flow, payment processors also protect against threats and ensure a seamless payment experience for customers. Below are several factors that need to be considered, especially for MSMEs in Indonesia.

1. Fees and Fee Structure

The costs of using a payment processor can have a significant impact on a business's finances, both short and long-term. Payment processors often have hidden fees, monthly subscription fees, and other additional fees. Therefore, comparison between providers and selection according to the financial goals of the business is very important.

2. Security

Security is an unavoidable aspect of today's digital era. Make sure the payment processor you choose complies with industry security protocols. A secure provider will protect customer data and reduce the risk of data breaches.

3. Local Market Compatibility

Payment processors in Indonesia need to accept the local payment methods that are most convenient for their customers. These may include credit cards, debit cards, online banking, digital wallets, and QR payments. This will ensure no potential customers are missed due to certain payment preferences.

4. Ease of Use

Payment processors should be able to integrate easily into your existing infrastructure and provide a user-friendly interface for you and your customers. Additionally, pay attention to the ease of integration with an e-commerce platform or online shop. Apart from that, ensure that the payment process for customers runs smoothly without any obstacles.

5. Customer Support

Customer support is still important for dealing with tough situations, even as technology keeps getting better. Choose a payment processor that provides reliable customer support via phone, email, or live chat to ensure a hassle-free experience for you and your customers.

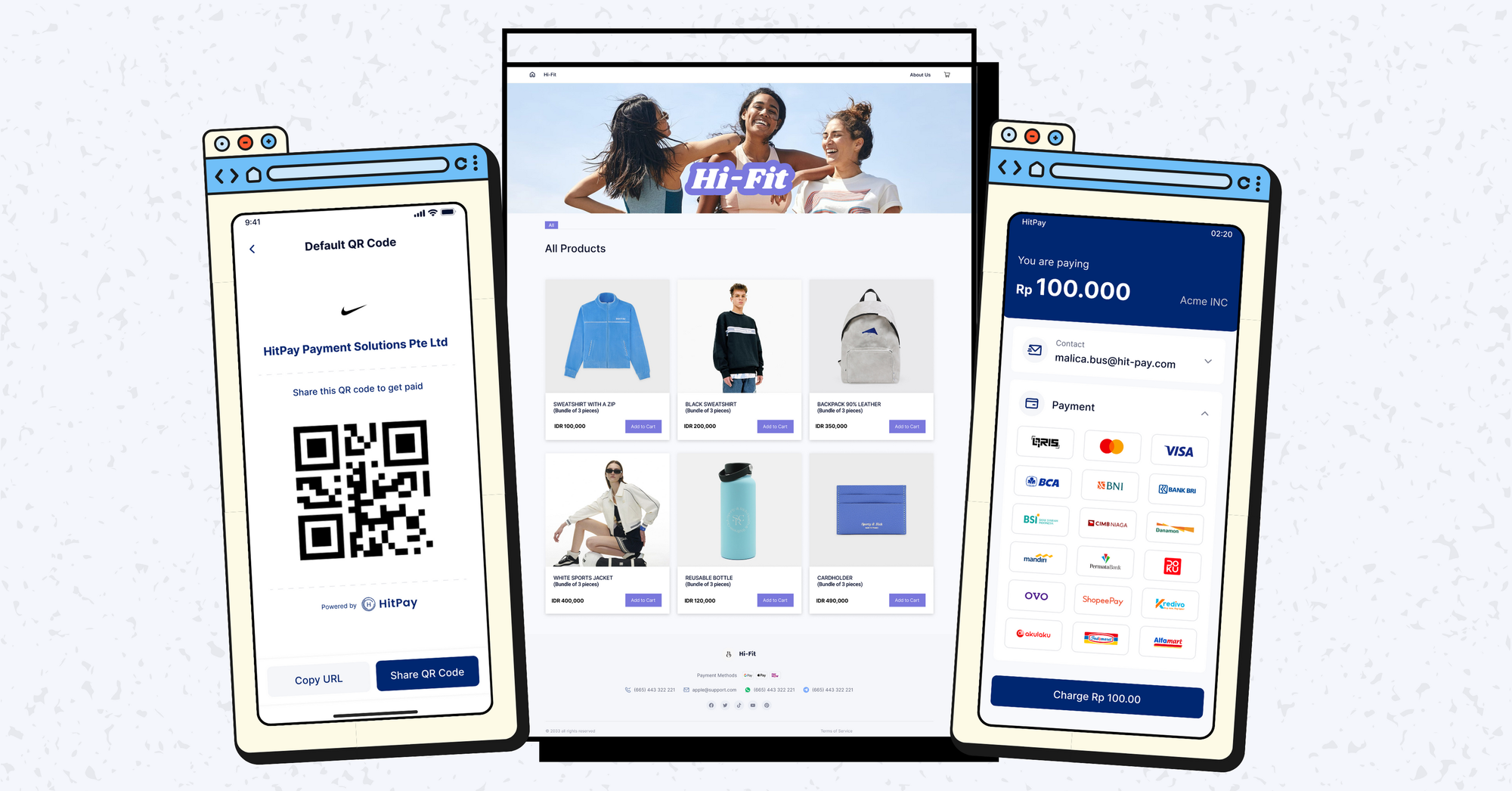

HitPay: Most Affordable Payment Gateway for Indonesian MSMEs

With so many payment gateway options available in Indonesia, finding the most suitable option for your business can be challenging. However, don't worry, because HitPay is here as an all-in-one payment solutiona that is very flexible and user-friendly for MSMEs in Indonesia.

Compared to other payment gateway platforms in Indonesia, HitPay provides several advantages, including:

- Supports all digital payment methods in Indonesia, allowing customers to choose the payment method according to their preferences.

- Only pay per transaction, with no setup fees, subscription fees, or monthly transaction minimums. All e-commerce and payment features are provided at no additional cost.

- Integration with various e-commerce platforms such as Shopify, WooCommerce, Shopcada, Magento, Prestashop, and many more

- Fast and simple activation process. You can start receiving payments using HitPay in just 3 working days, faster than other payment gateway providers.

Integrate your business with HitPay for a more efficient payment process!

Schedule a free demo with HitPay or register to our platform grow with Indonesia's best payment gateway.

- Read also: Safe & Easy Way to Use QRIS OVO in Indonesia

- Read also: Advantages of Payment Gateways Like Midtrans & HitPay in Your Business Finances

![Perbandingan 13 Payment Link di Indonesia [2024]: Pilihan Metode Pembayaran Terbaik Untuk Bisnis Online Anda](/content/images/size/w720/2023/05/Newsletter-Design---2023-05-02T221135.775.png)