Mobile POS Machines in New Zealand: The Ultimate Guide for 2023

Learn how mobile POS systems make taking payments easy and flexible for businesses in New Zealand, and find the right one for you.

Mobile point-of-sale (mPOS) systems are changing the way businesses operate. By turning any tablet or smartphone into a checkout point, mPOS systems give businesses the flexibility to accept payments and manage their operations from anywhere.

If you're looking for a way to improve the flexibility, efficiency, and customer service of your business, then an mPOS system is a great option to consider. In this blog, we will provide an in-depth guide on mobile POS systems.

What is a mobile POS machine?

A mobile POS machine is a portable device that allows businesses to accept payments from customers anywhere.

Mobile POS machines are typically smaller and lighter than traditional POS systems, making them easy to carry and use on the go.

Why should New Zealand businesses use mobile POS machines?

Mobile POS machines offer a number of benefits for New Zealand businesses, including:

- Increased convenience for customers: Mobile POS machines allow businesses to accept payments from customers anywhere, whether they are in a store, at a market, or out in the field. This can lead to increased sales and customer satisfaction.

- Reduced costs: Mobile POS machines can help businesses to reduce costs associated with traditional POS systems, such as rental fees and maintenance costs as they are often rented from a third party vendor.

- Improved flexibility: Mobile POS machines give businesses the flexibility to operate from anywhere, which can be especially beneficial for businesses that are mobile or seasonal.

Benefits of mobile POS machines for New Zealand businesses

Mobile POS machines offer a number of specific benefits for businesses, including:

- Support for local and international payments: Mobile POS machines that are supported by payment processors can accept a wide range of payment methods, including credit cards, debit cards, and contactless payments. This makes it easy for businesses to accept payments from both local and international customers.

- Integration with other business software: Many mobile POS machines can be integrated with other business software, such as accounting software and inventory management software. This can help businesses to streamline their operations and improve efficiency.

- Cloud-based access: Many mobile POS machines are cloud-based, which means that they can be accessed from anywhere with an internet connection. This gives businesses the flexibility to operate from anywhere, and it also makes it easy to back up data and keep it secure.

Types of mobile POS machines

There are three main types of mobile POS machines:

- Portable POS machines

- Tablet POS machines

- Smartphone POS machines

Portable POS machines are the smallest and lightest type of mobile POS machine. They are typically handheld devices that can be easily carried around. Portable POS machines are a good option for businesses that need to be able to accept payments on the go, such as food trucks, market stalls, and mobile businesses.

Tablet POS machines are larger and more powerful than portable POS machines. They typically have a touchscreen display and can be used to accept payments, manage inventory, and track sales. Tablet POS machines are a good option for businesses that need a more versatile POS solution, such as retail stores, restaurants, and service businesses.

Smartphone POS machines are the newest type of mobile POS machine. They are essentially POS apps that can be installed on smartphones. Smartphone POS machines are a good option for businesses that want a lightweight and affordable POS solution.

Features to consider when choosing a mobile POS machine

When choosing a mobile POS machine, there are a number of features to consider, including:

- Payment processing capabilities: Make sure that the mobile POS machine supports the payment methods that you need to accept. For example, if you accept international payments, then you will need a mobile POS machine that supports multiple currencies.

- Inventory management features: If you need to track inventory, then choose a mobile POS machine with inventory management features. This can help you to keep track of your stock levels and avoid overselling.

- Customer relationship management (CRM) features: If you want to collect customer data, then choose a mobile POS machine with CRM features. This can help you to track customer interactions and preferences, which can be used to improve marketing and sales strategies.

- Reporting and analytics features: If you want to track your sales and other business data, then choose a mobile POS machine with reporting and analytics features. This can help you to identify trends and make informed business decisions.

- Ease of use: Choose a mobile POS machine that is easy to use for both you and your employees. This will help to reduce training costs and improve efficiency.

- Price: Mobile POS machines can range in price from a few hundred dollars to several thousand dollars and there are a number of pricing elements to consider:

- Hardware costs: The cost of the mobile POS hardware itself can range from a few hundred dollars to several thousand dollars, depending on the type of machine and the features that are included. For example, a basic portable POS machine may cost around $300, while a high-end tablet POS machine may cost over $1,000.

- Software costs: Some mobile POS systems require businesses to purchase a software license, which can cost anywhere from $10 to $100 or more per month. Other mobile POS systems are cloud-based, and businesses pay a monthly subscription fee to access the software.

- Payment processing fees: Mobile POS vendors typically charge a fee for each transaction that is processed through their system. These fees can vary depending on the vendor and the type of payment that is being processed. For example, credit card transactions typically have higher fees than debit card transactions.

- Additional costs: Some mobile POS vendors also charge additional fees, such as setup fees, monthly maintenance fees, and interchange fees.

HitPay POS capabilities

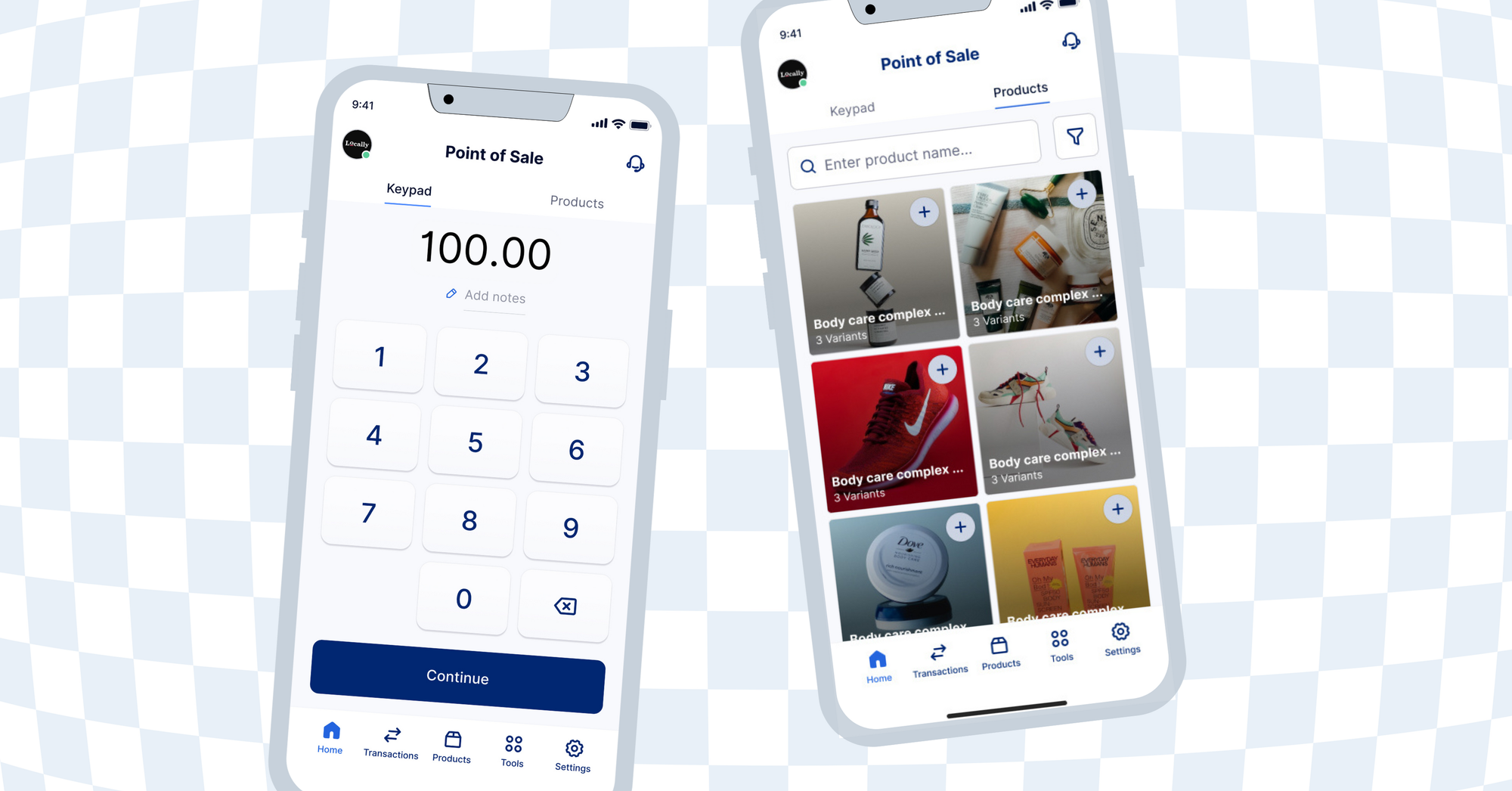

HitPay POS is a mobile point-of-sale system that allows businesses to accept payments in person using a credit card terminal or their mobile device. Businesses can even accept credit card payments without a terminal using the free HitPay mobile app.

HitPay POS offers a number of advantages, including:

- No subscription fees: Unlike some other mobile POS systems, HitPay does not charge monthly or annual subscription fees for its POS software. Businesses only pay for each transaction that they process. There is a one time fee for purchase of the hardware.

- All features unlocked: Even with a free HitPay account, businesses have access to all of the features offered by the platform, including payment processing, inventory management, and customer relationship management (CRM) tools.

- Wide range of local payment methods: HitPay supports a wide variety of local payment methods, including credit cards, bank transfers, e-wallets, and Buy Now, Pay Later options. This allows businesses to offer their customers the payment options that they prefer.

- Easy inventory tracking: Businesses that use Shopify can sync their Shopify inventory with HitPay POS for free. This ensures that their online and in-person inventory levels are always up-to-date.

However, HitPay POS also has a few limitations:

- Requires Shopify integration: HitPay POS is not built into Shopify, unlike Shopify POS. However, HitPay offers a free Shopify app that can be installed in minutes with no coding required.

- Some local payment methods are not yet available: HitPay is currently working to add support for more local payment methods, including Afterpay (Australia and New Zealand), WeChatPay, Klarna, and Affirm (United States).

Overall, HitPay POS is a good option for businesses that are looking for a mobile POS system with no subscription fees and a wide range of local payment methods.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

- New Zealand Payment Gateway Comparison: Shopify vs. Stripe, PayPal and HitPay

- Shopify POS and HitPay review: Comparing the best POS systems for small businesses [2023]

- How to use HitPay’s multi-location POS system to manage sales across multiple stores

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!