New Zealand Payment Gateway Comparison: Shopify vs. Stripe, PayPal and HitPay

Check out the pros and cons of popular payment gateway providers in NZ— Shopify, Stripe, PayPal, and HitPay New Zealand.

As credit cards and e-wallets grow in popularity, it's more important for merchants to accept digital payments. But how do you choose the right payment platform for your small business?

The best payment gateways are secure and easy to use — with integrations to help you sell both online and in-person. An omnichannel payment gateway can also save time and money by letting you manage payments and inventory, all on one platform.

In this quick New Zealand payment gateway comparison, we summarise the pros and cons of popular payment gateway providers — Shopify, Stripe, PayPal, and HitPay New Zealand. Read on!

Best payment gateways in New Zealand

1) Stripe

With a presence in countries all around the world, Stripe Payments is great if you want to serve international customers.

Pros:

✅ Instant onboarding

✅ No setup or recurring fees

Cons:

❌ Requires a developer to set up most features and payment options

❌ No inbuilt integration with Google Forms

❌ Merchants must pay for business tools like discount customisation and invoicing

2) Shopify Payments

Shopify's in-built payment gateway is the easiest option for businesses on Shopify — though payment methods are limited in New Zealand.

Pros:

✅ Instant onboarding, seamless integration with Shopify

✅ E-commerce selling tools

Cons:

❌ Pricey subscription plans from US$29 to US$299 a month

❌ Limited payment methods in New Zealand. If you want to offer other payment options like Afterpay, you'll need to add these separately

3) PayPal

As one of the most established payment providers in the world, PayPal is great for merchants who just want a no-frills, secure payment gateway.

Pros:

✅ Supports 25+ currencies and is available in over 200 countries

✅ Provides an option for instalment payments

✅ Provides PayPal Seller Protection

Cons:

❌ Doesn't offer any e-commerce business tools

❌ No credit card terminal

❌ Limited payment methods

❌ Slowest onboarding and settlement time

4) HitPay New Zealand

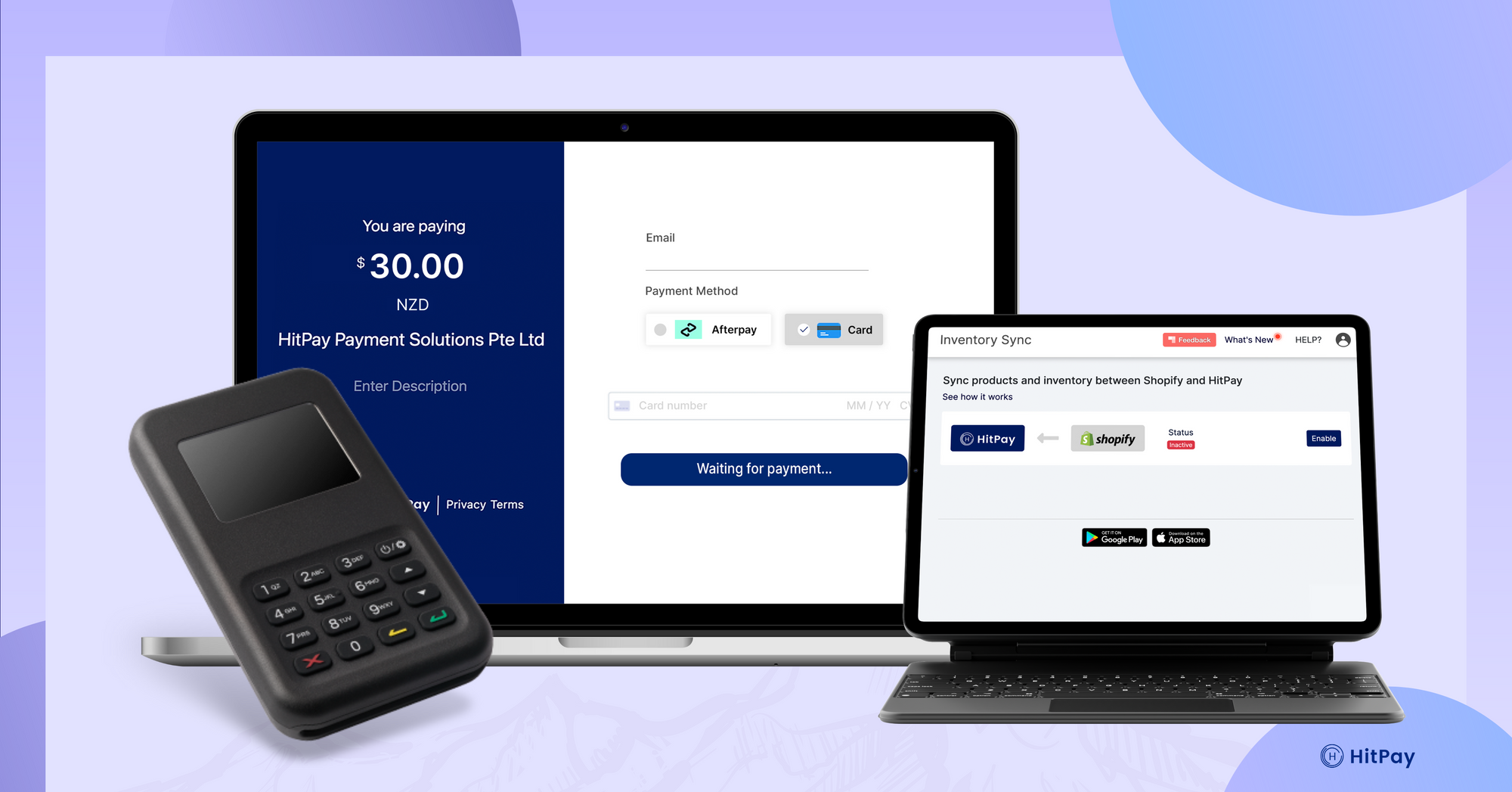

HitPay is a one-stop, omnichannel payments platform built for small businesses and SMEs. Founded in Singapore, HitPay has just launched in New Zealand.

Pros:

✅ No-code integrations on any e-commerce platform (e.g. Shopify, WooCommerce) and any sales channel (e.g. WhatsApp, email, Instagram)

✅ Free business software including recurring billing management, invoice generator, and an online store

✅ Integrated POS system to automatically sync online and offline sales

✅ Accounting integrations with Xero and Quickbooks

Cons:

❌ Afterpay not available yet but will be coming soon

New Zealand Payment Gateway Comparison

Payment Gateway Features

Major e-commerce platforms include Shopify, WooCommerce, EasyStore, Prestashop, Magento, OpenCart, Shopcada, Ecwid, Wix, and Google Forms.

Business software includes Recurring billing, Online store with inventory and order management, Invoicing software, POS system, and Payment links

Read also: 7 must-have small business software

Pricing and Settlement Time

Payment Methods in New Zealand

Best omnichannel payments platform in New Zealand

If you want a one-stop, omnichannel payment platform, HitPay New Zealand may be the right fit for you. Set up your free account to instantly accept payments in-person and online!

Click here to sign up for a free HitPay New Zealand account

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!