How to Easily and Effectively Generate PayNow QR Codes for Customers in Singapore

Learn about PayNow QR and how to create a PayNow QR code for your customers in Singapore with HitPay, OCBC PayNow and DBS PayLah!

Once called “ugly, overused and doomed” in 2012, quick response (QR) codes are now ubiquitous thanks to their ability to access seamless payment options worldwide and in Singapore.

Your customers want quick and convenient payment methods in Singapore. PayNow QR code payments, whether through your mobile banking app, SGQR PayNow, or all-in-one payment solutions like HitPay, help meet these expectations.

Let’s dive into PayNow QR, how to create a PayNow QR code for your customers in Singapore using HitPay and why you might need more than your mobile banking app as you run your small business.

How to Get PayNow QR Code?

Getting a PayNow QR code for your business is a simple process. Whether you use mobile banking apps from DBS, OCBC, or UOB, or choose an all-in-one payment solution like HitPay, setting up a PayNow QR code only takes a few minutes. With PayNow QR, your customers can pay you instantly and securely, making this one of the most popular and efficient payment methods in Singapore.

What is PayNow QR and why is it essential for businesses in Singapore?

Among Southeast Asia countries, Singapore has the highest cashless payment adoption (97%), according to a global survey by Statista in 2022.

Singapore's real-time payment system, PayNow QR, has been a big part of this rapid adoption, making it a must-have payment method if you do business in Singapore.

With PayNow and PayNow Corporate, Singapore users and Singapore-registered businesses can send and receive money instantly with a mobile number or their NRIC/FIN. Wondering “how to get my PayNow QR code”? Follow our guide below to get started.

Read more: 7 reasons why your online store needs PayNow

What Are PayNow UEN, Static QR, and Dynamic QR?

The Unique Entity Number (UEN) is a standard identification number assigned to registered entities in Singapore. Businesses can link their UEN to the PayNow service, allowing them to accept and transfer funds securely without revealing their bank account details.

A Static QR code contains fixed information, such as the owner’s bank account number. It is generated once and can be reused multiple times for payments.

In contrast, a Dynamic QR code is generated for one-time use and can be customized. With a dynamic QR code, a business can generate multiple QR codes from the same bank account, each containing unique details like a specific payment amount or other relevant data.

How to use PayNow QR codes to speed up your payment process

To complete a transaction, customers simply need to know how to scan PayNow QR code on phone using their mobile banking app. They can scan the PayNow QR code displayed at your storefront or sent through email or messaging apps. Once the QR code is scanned, the payment process is quick, secure, and hassle-free.

- In-person payments: Display your PayNow QR code or SGQR PayNow code at your storefront or on your mobile device with HitPay’s Scan to Pay, OCBC’s Show my PayNow (QR Code), DBS’s Scan & Pay or UOB’s Scan to Pay

- In customer communications: Create and send your QR code to your customer’s email or share your PayNow QR code via messaging apps like Telegram, WhatsApp and Instagram direct message

- Online payment method: PayNow QR payments have lower transaction fees and faster payout than credit card payments - meaning you’ll earn more from your sales and get paid faster

Before, you had to share your bank account number with customers and wait for them to transfer money.

With PayNow QR, you remove all that friction. Your customer gets to keep their bank account data private and minimise errors while enjoying faster transfers at no additional cost.

How to generate a PayNow QR code with HitPay – a step-by-step guide

Wondering how to create QR code for PayNow or setting up a PayNow Account with ? Generating a PayNow QR code with HitPay is a straightforward process. Here's a step-by-step guide to help you get started.

How to Generate QR Code for PayNow?

If you’re wondering how to generate a QR code for PayNow, there are multiple ways to do it depending on the platform you use. HitPay, for example, allows you to generate a PayNow QR code instantly via its dashboard or mobile app. You can also generate a QR code through your mobile banking apps, like DBS, OCBC, or UOB, which provide easy-to-use features for generating and sharing your PayNow QR code.

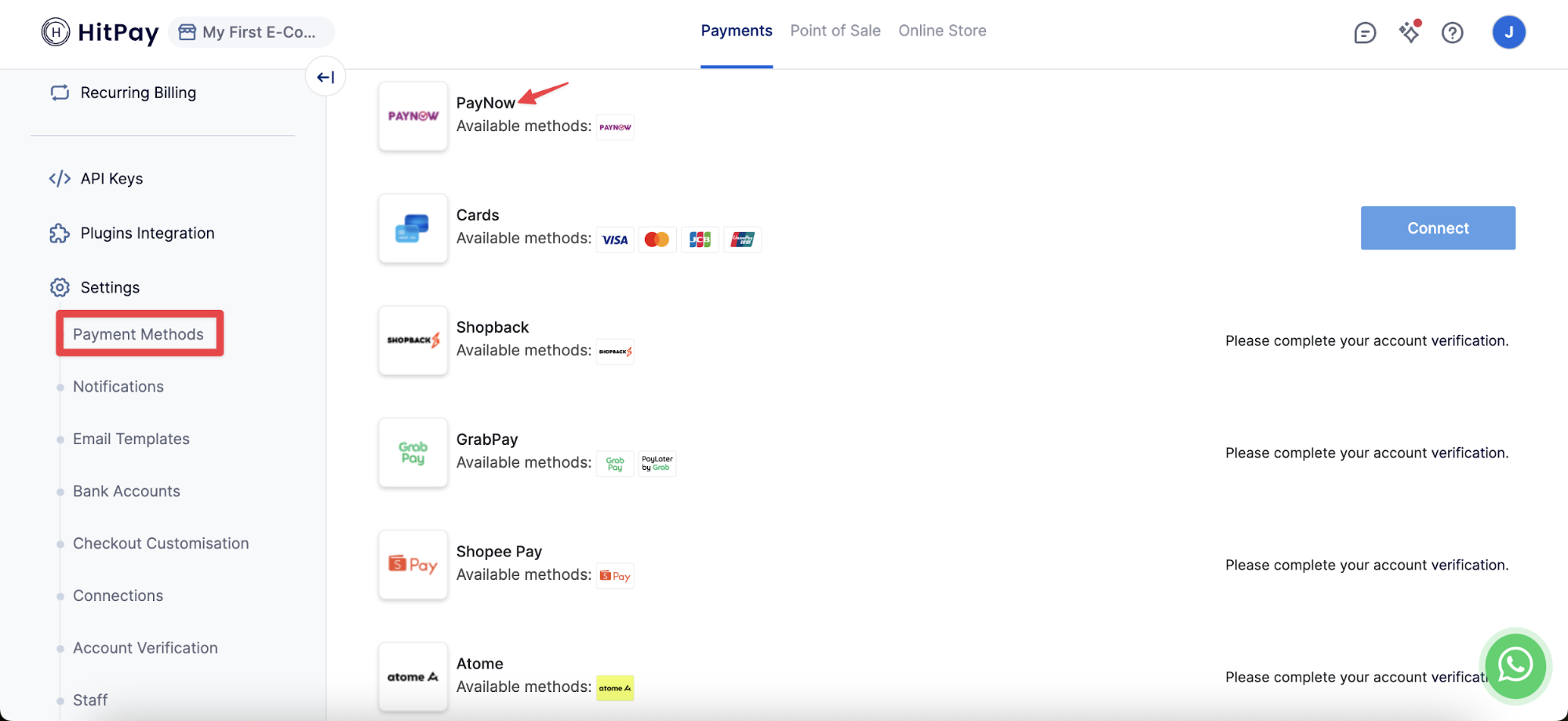

- Create a HitPay account.

Start by signing up for a HitPay account.

- Enable PayNow as a payment method.

Go to your HitPay dashboard (Settings > Payment Methods) and enable PayNow as a payment method. This ensures that your customers can use PayNow QR codes to complete transactions.

- Generate QR code for PayNow from HitPay’s mobile app

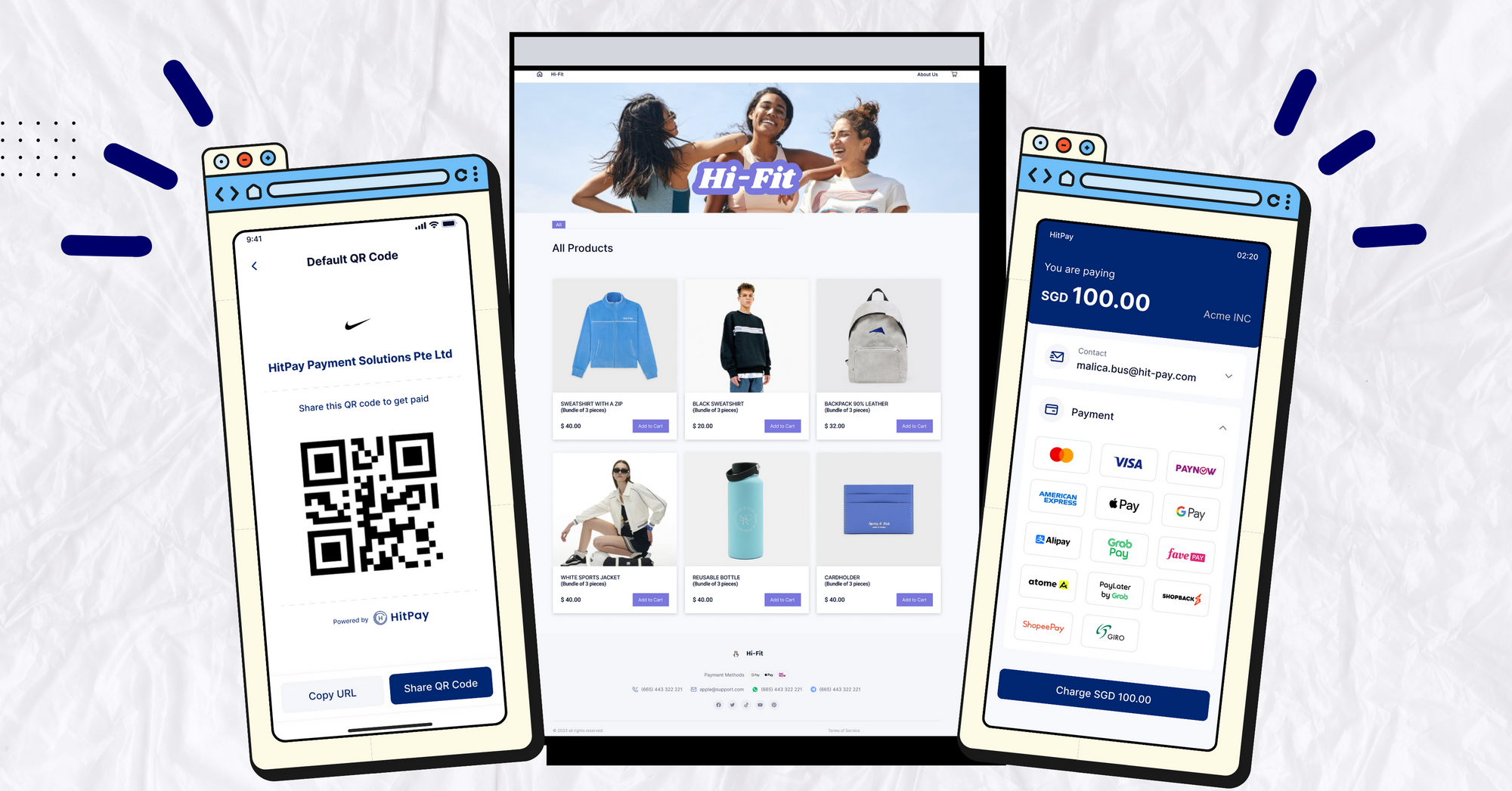

Use HitPay’s Scan to Pay to display your PayNow QR code on your mobile device or share your QR code with your customer. Your customers will then scan this QR code to start payment through their mobile banking app.

- Display and share your PayNow QR code for customers to scan.

Place your PayNow QR code or SGQR code in a visible place for customers to scan to accept payments from PayNow.

- Receive a payment confirmation:

Once the customer has scanned the PayNow QR code and made payment, you will receive a payment confirmation in your HitPay dashboard. You can fulfil the order for the customer.

How does HitPay compare to other PayNow QR code generators in Singapore?

In this section, we’ll compare HitPay with other popular PayNow QR code generators available in Singapore. These include:

- Payment gateways: Stripe Payments

- Mobile banking apps: OCBC PayNow (Scan to Pay), UOB Scan to Pay and DBS PayNow QR Code

- E-wallet: DBS PayLah!

Looking for a reliable PayNow QR code generator? Several platforms in Singapore offer this service. Mobile banking apps like DBS, OCBC, and UOB provide built-in QR code generators, allowing you to easily create PayNow QR codes for payments. Alternatively, solutions like HitPay offer a more comprehensive payment gateway, which includes a PayNow QR code generator as part of their all-in-one service. This allows businesses to accept PayNow payments with ease while integrating other payment methods like credit cards and e-wallets.

Stripe Payments:

Stripe Payments is a popular choice for online payments, known for its user-friendly interface, support for over 135 currencies, and strong brand recognition. In Singapore, Stripe supports PayNow QR payments at a 1.3% transaction fee, which is higher than HitPay’s fee of 0.65% + S$0.30 per transaction. However, PayNow Stripe integration is particularly useful for businesses, providing an easy and secure way to accept payments online. However, customizations may require coding knowledge.

Mobile Banking Apps: OCBC PayNow (Scan to Pay), UOB Scan to Pay and DBS PayNow (Scan QR Code)

Leading banks in Singapore, including OCBC, UOB, and DBS, offer their own PayNow QR code solutions through their mobile banking apps. These allow both individuals and businesses to generate a QR code for PayNow to accept or make payments conveniently.

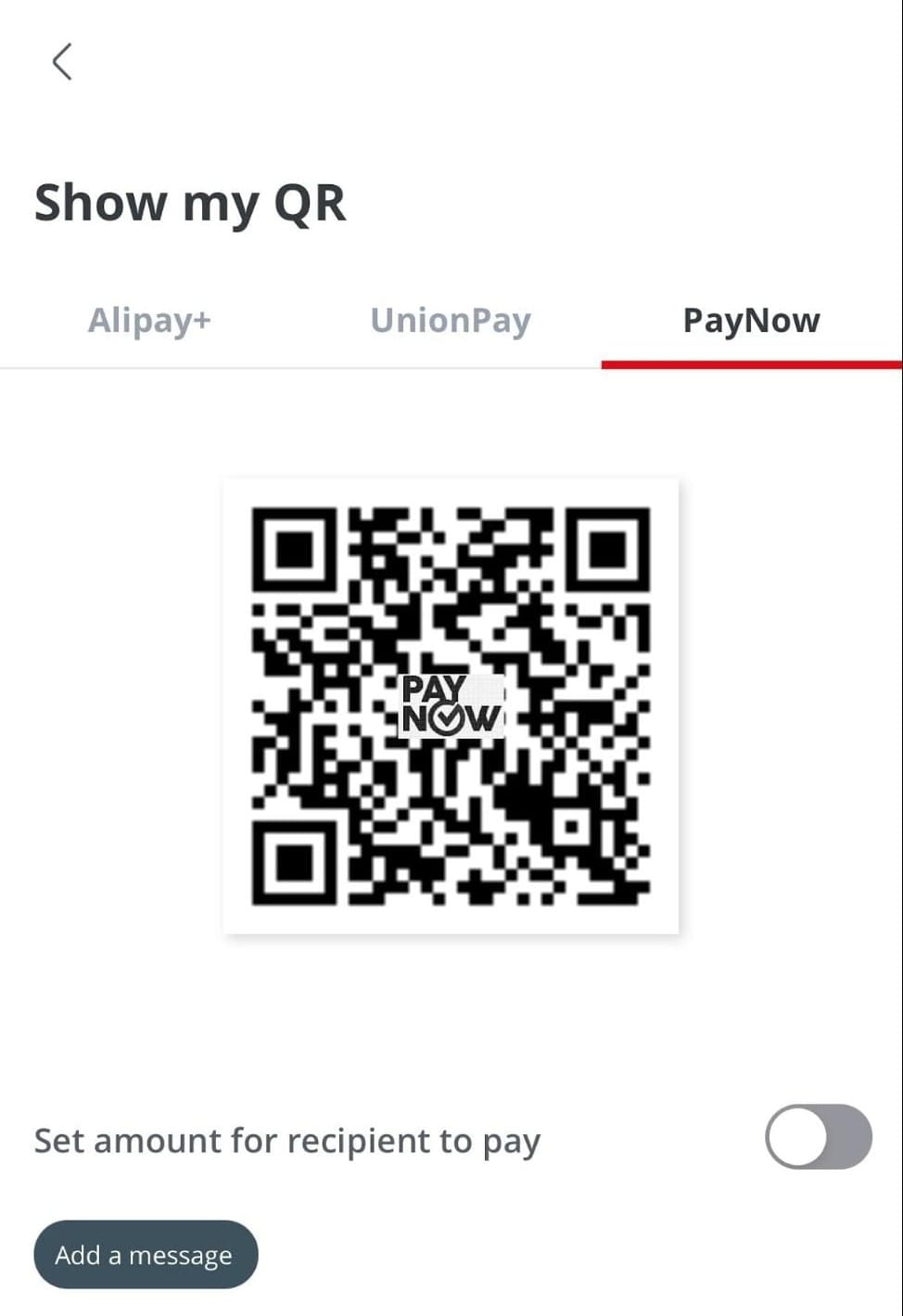

OCBC PayNow (Scan to Pay)

Wondering how to generate PayNow QR code for OCBC? Simply log in to your OCBC banking app. From the main menu, select the PayNow option. Then, choose the option to generate a QR code. This OCBC PayNow QR code can be displayed at your physical location for in-person payments or shared digitally with customers through email or messaging apps, enabling fast, secure transactions.

UOB Scan to Pay

UOB offers a similar service where users can easily generate and use PayNow QR codes to make transactions via the UOB app.

DBS PayNow QR Code

DBS PayNow is DBS’s PayNow QR code generator within the DBS digibank app. With DBS PayNow Scan QR code, you’ll enjoy all the benefits of PayNow in Singapore, including 24/7 access, and instant sending and receiving money from 21+ participating banks.

To learn how to set up PayNow DBS QR code, start by logging in to the DBS digibank app. From the home screen, navigate to the PayNow section under payments. You can register your mobile number or generate NRIC/FIN to link it to your bank account. Once linked, you can generate a PayNow QR code to accept payments instantly. This process allows you to use DBS PayNow for business transactions.

This code enables instant payments, 24/7 access, and seamless transactions between 21+ participating banks in Singapore. DBS PayNow is ideal for businesses looking for a reliable, straightforward solution for accepting payments.

DBS PayLah!: A Lifestyle E-Wallet

DBS PayLah! is a mobile wallet app that allows users to send funds to anyone, even non-DBS/POSB customers, using just their mobile numbers. While not a PayNow QR code generator, PayLah! offers a wide range of services such as:

- Overseas payments (e.g., UnionPay, Thailand’s PromptPay, Malaysia’s DuitNow)

- Rewards and discounts

- In-app features like food ordering

Difference Between DBS Paylah! vs PayNow

Although DBS Bank offers both PayLah! and PayNow services, they are separate. DBS PayNow is a QR code payment system for bank transactions, while DBS PayLah! functions more like an e-wallet for various lifestyle activities with features beyond payments, such as rewards and food ordering, making it similar to GrabPay, FavePay, and Singtel Dash.

DBS PayLah! also supports overseas payment methods like UnionPay, Thailand’s PromptPay, Malaysia’s DuitNow and other reward schemes, making it an attractive payment option for customers with DBS and POSB Bank accounts.

To learn how to setup PayLah, start by downloading the DBS PayLah! app from the app store. After installation, sign in using your DBS/POSB credentials or register with your mobile number. Once registered, you can link your bank account to PayLah and begin using it for various payment options, including sending money, paying bills, and scanning PayNow QR codes for fast transactions.

FavePay: Another Payment Option for Business Owners

As a business owner in Singapore, there is an option to use FavePay QR code to accept payments from customers easily. By implementing FavePay QR code, you're not only providing a convenient payment option for your customers but also tapping into Fave's ecosystem to potentially grow your business in Singapore.

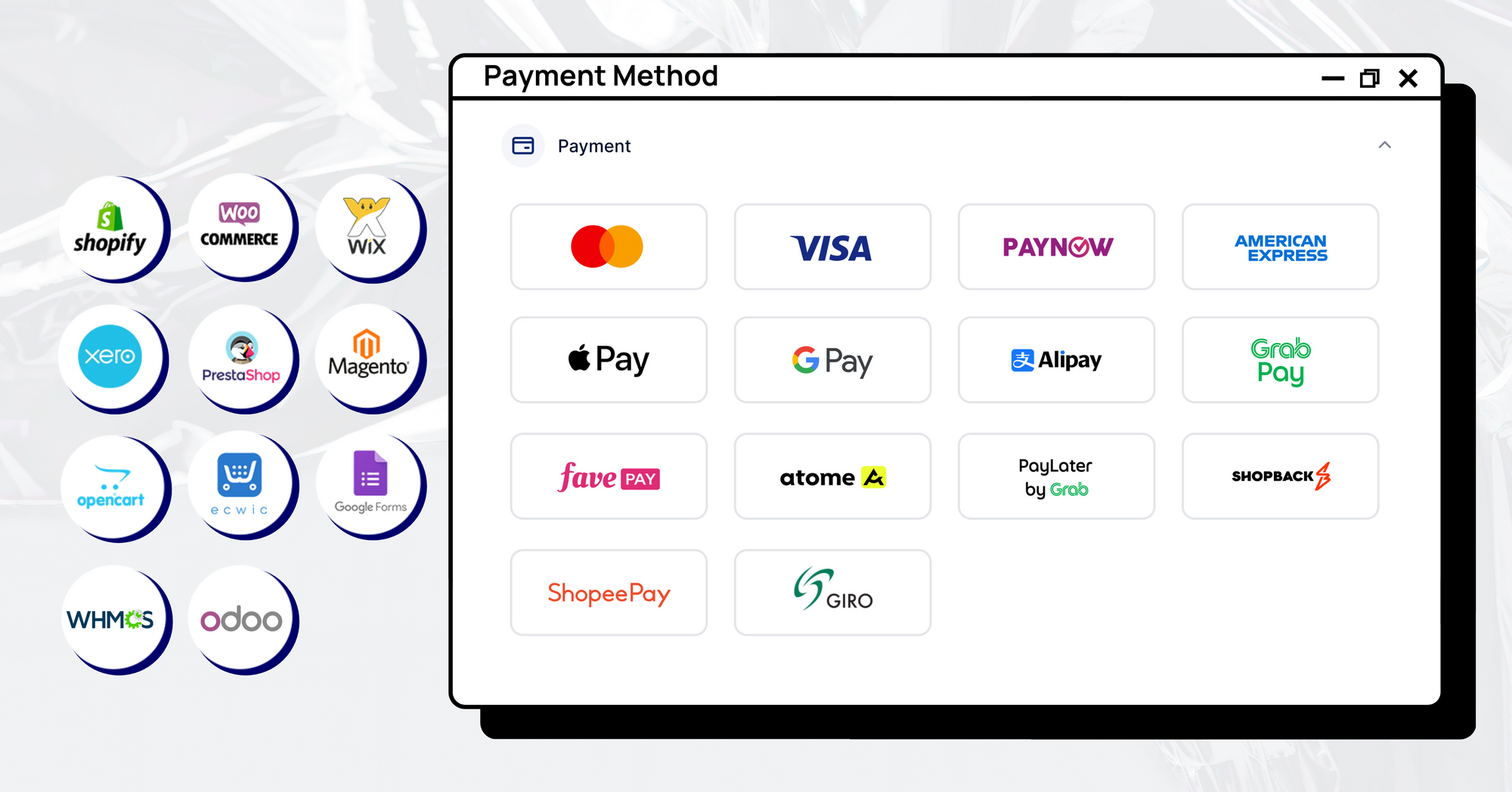

Benefits of HitPay over other PayNow QR code generators

Sticking to mobile banking apps and PayNow QR code generators is excellent if you want simple payment acceptance.

But if you need more options to get paid besides QR codes and help run your small business, HitPay’s payment gateway and all-in-one payment solution for SMEs will support you as you grow your business.

Here’s a glimpse of what you’ll get with HitPay over mobile banking apps

Support more payment methods besides PayNow QR:

HitPay supports in-person point of sale (POS) payments, payment links, and integrations with popular e-commerce platform integrations like Shopify, WooCommerce, and more. You save time on payment processing while giving customers a more streamlined checkout experience.

Includes free business tools to help you streamline operations while saving costs:

HitPay is more than a payment gateway or a PayNow QR code generator. HitPay also includes features to help you save time with no additional charge on administrative tasks like accounting, invoicing, and inventory management.

Next-day payouts

Cashflow management is essential for any business, and HitPay pays your cash balances within the next working day.

No monthly fees or annual fees:

View HitPay’s transparent pricing here.

Try your free PayNow QR Code Generator with HitPay

PayNow QR payments is one of the most popular payment methods in Singapore and it’s essential to offer this payment method to your customers

If you're using PayNow QR payments across different apps in Singapore, choose HitPay for a simpler and more streamlined process.

But small business owners often have a never-ending to-do list and too little time to finish everything. That’s why HitPay makes it easy for small business owners like yourself to save time on mundane tasks so you can focus on growing your business.

Ready to experience the ease of HitPay? Contact our team for a free demo today!

Read also:

- Sell Digital Products Online with the HitPay Online Store

- How to Start an Online Business in Singapore: Quick and Free Business Registration

- How Much Does a Payment Gateway Cost in Singapore?

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!

![Perbandingan 13 Payment Link di Indonesia [2024]: Pilihan Metode Pembayaran Terbaik Untuk Bisnis Online Anda](/content/images/size/w720/2023/05/Newsletter-Design---2023-05-02T221135.775.png)