BNPL Singapore: How to accept Buy Now Pay Later online and in-store

Find out how Buy Now, Pay Later payments work, and how to accept popular BNPL methods in Singapore.

Buy Now Pay Later (BNPL) payments are becoming increasingly popular in Singapore, as they give customers greater flexibility and encourage bigger purchases.

In this quick guide, find out how BNPL payments work in Singapore, why accepting BNPL can help your small business, and how to set up BNPL payments on your online or physical store.

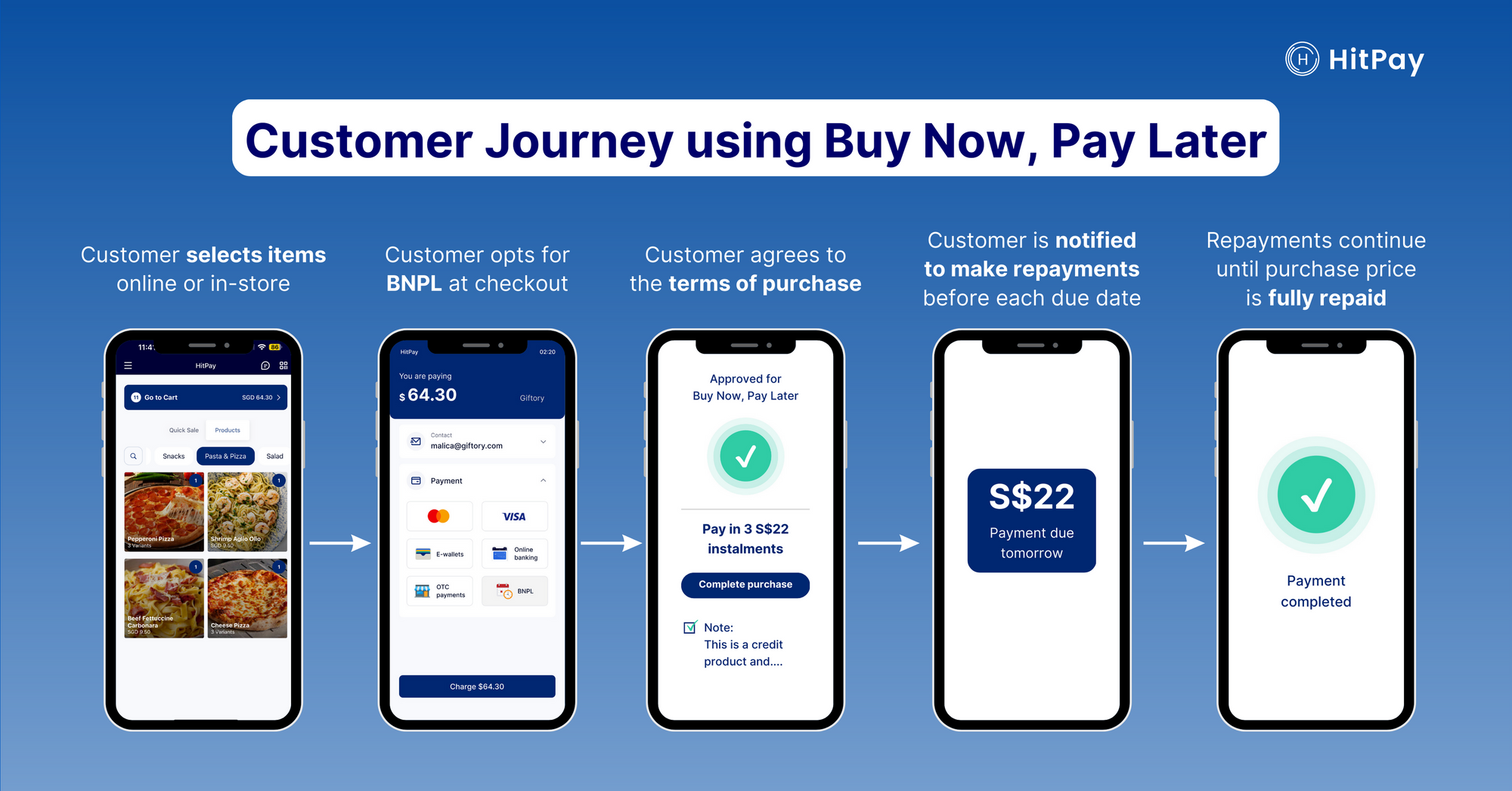

What is Buy Now, Pay Later (BNPL)?

With Buy Now, Pay Later, customers split the purchase cost into smaller repayments over 3-4 months. If customers pay each repayment on time, they are not charged any interest rates or fees.

Meanwhile, merchants receive the full payment upfront. To sum up, BNPL lets merchants give customers greater flexibility, without affecting the merchant's payout schedule.

How is BNPL different from installment purchase plans (IPP)?

It’s easier for customers to become BNPL users compared to paying with an installment purchase plan (IPP).

IPPs are offered by banks and credit card companies, and are subject to their approval. BNPL payments tend to be more accessible. For example, to use PayLater by Grab, a customer only needs to be a Grab user for at least six months and aged 21 years and over. They can then instantly activate PayLater in the Grab app with no need for further documentation or waiting periods.

Benefits of accepting BNPL payment methods like PayLater by Grab and Atome

Increase sales for your small business 🛍

BNPL lets customers spread the cost of their purchase over a longer time, which encourages them to purchase more.

Offering BNPL payment options increases the likelihood of a sale by 30% and boosts average order value by up to 17%. It’s a win-win for you and your customers as they get a more flexible way to pay, while you can improve your sales.

Offer customers their preferred way to pay 👛

Buy now pay later gives customers greater flexibility — which makes it more likely for them to complete a purchase. It’s a way to reach people who may not prefer (or cannot access) credit cards or upfront cash, thanks to BNPL's ease of access.

Singapore's BNPL usage, based on Milieu data for 2021 reveals:

- Consumers in Singapore most consider using BNPL services for home furnishings and electronics purchases.

- However, almost half of BNPL purchases were S$100 or less

- People aged 25-40 were the most significant users of BNPL

- Rewards and promotions motivate Singaporeans to use a BNPL service

Offering BNPL services could help to improve your payment experience and boost sales if you're trying to reach this specific demographic.

Promote your business to a broader audience 👥

BNPL payment options like Grab’s PayLater or Atome expose your business to the millions of people who use each platform.

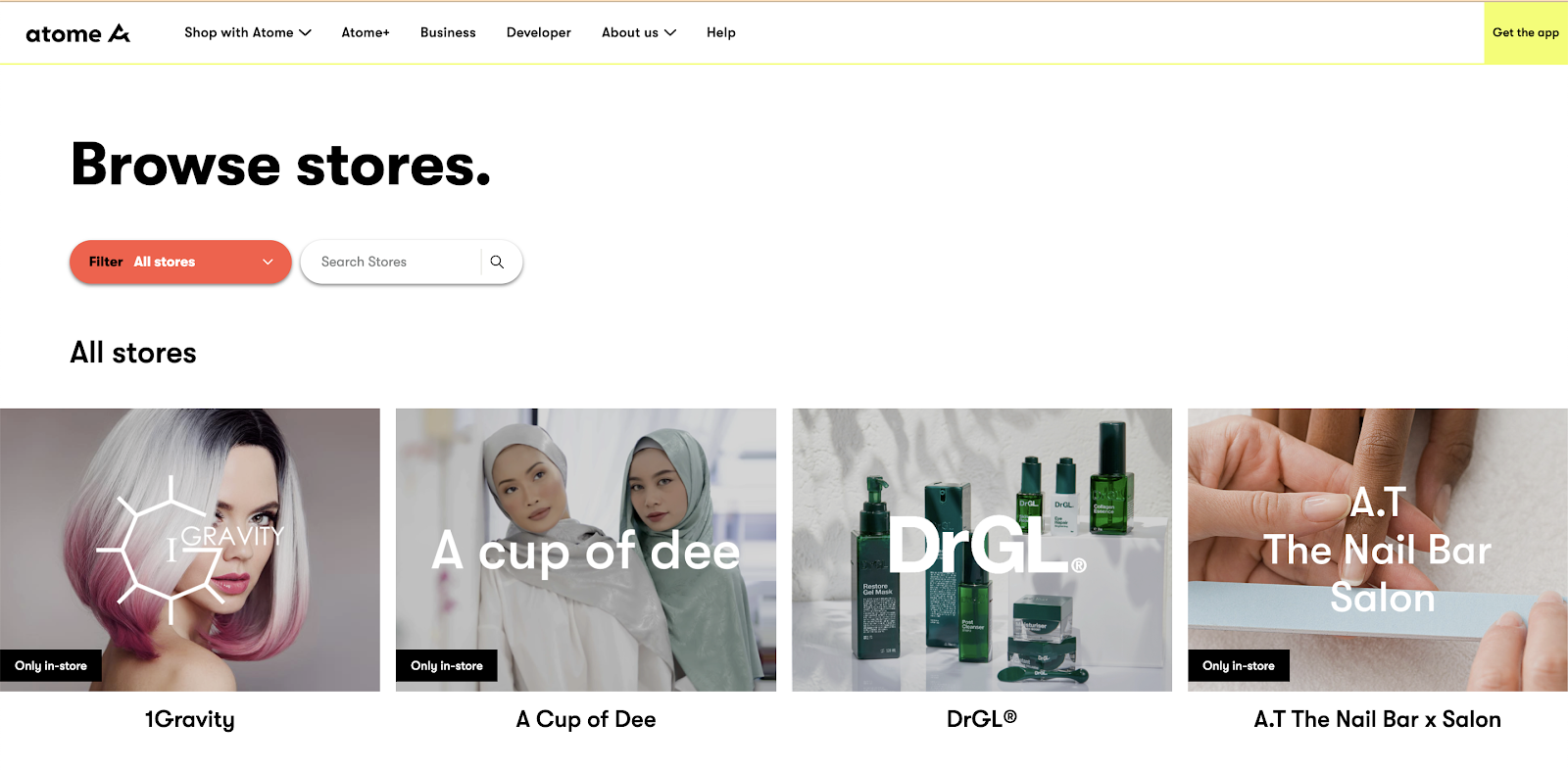

For example, Atome actively lists stores that use their service on their website, while Grab lists merchants on their app using Grab PayLater.

Directory of merchants using Atome

Each BNPL platform has its own rewards programs like GrabRewards and Atome+ to help you attract and retain customers.

Popular BNPL payment methods in Singapore

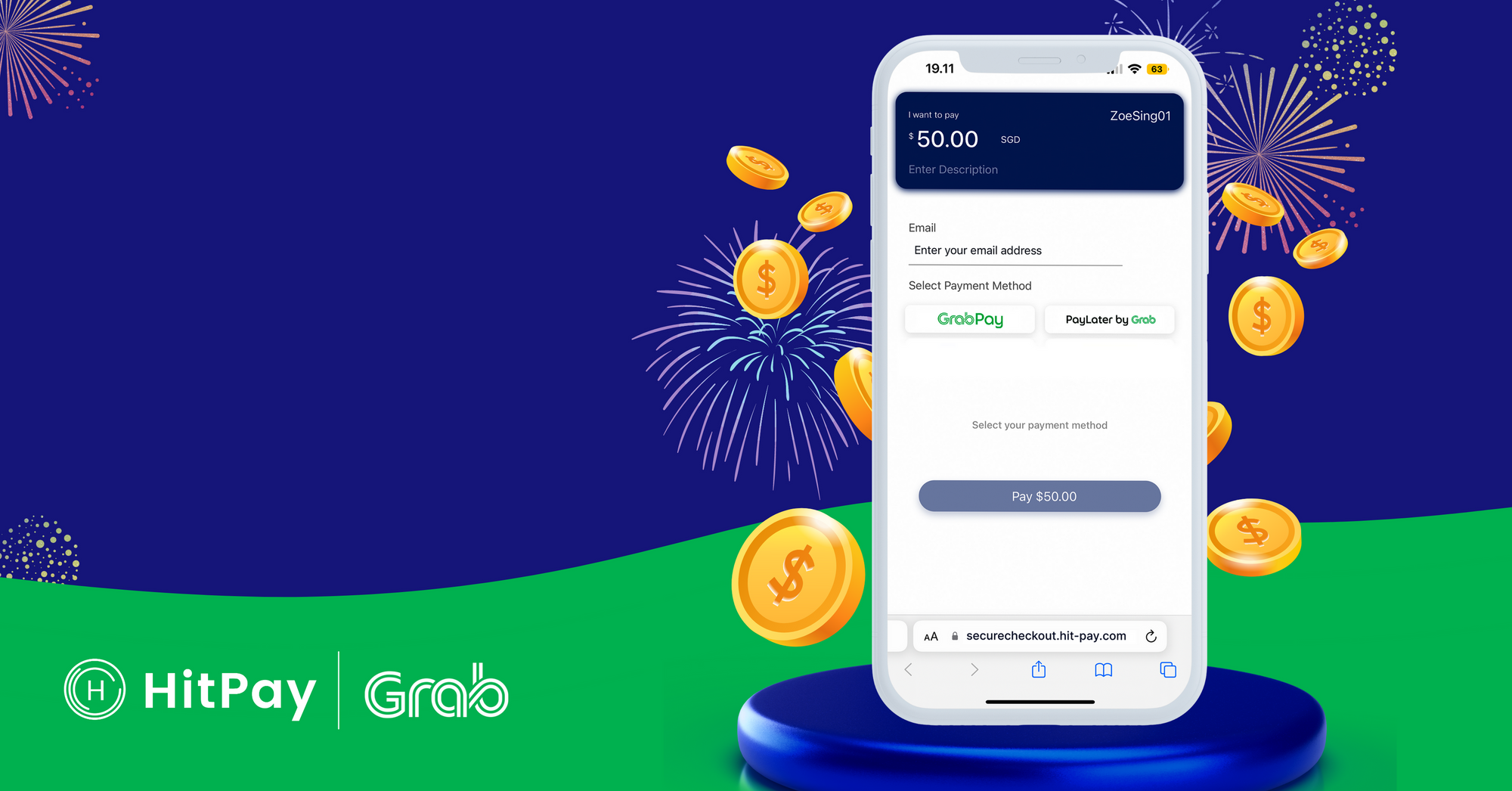

PayLater by Grab

Repayment schedule: 4 months or pay in the next month

HitPay transaction fee: 5.5%

HitPay payout period: T+2 calendar days

Learn more: Offer PayLater by Grab anywhere you sell

Click here to enable PayLater by Grab now.

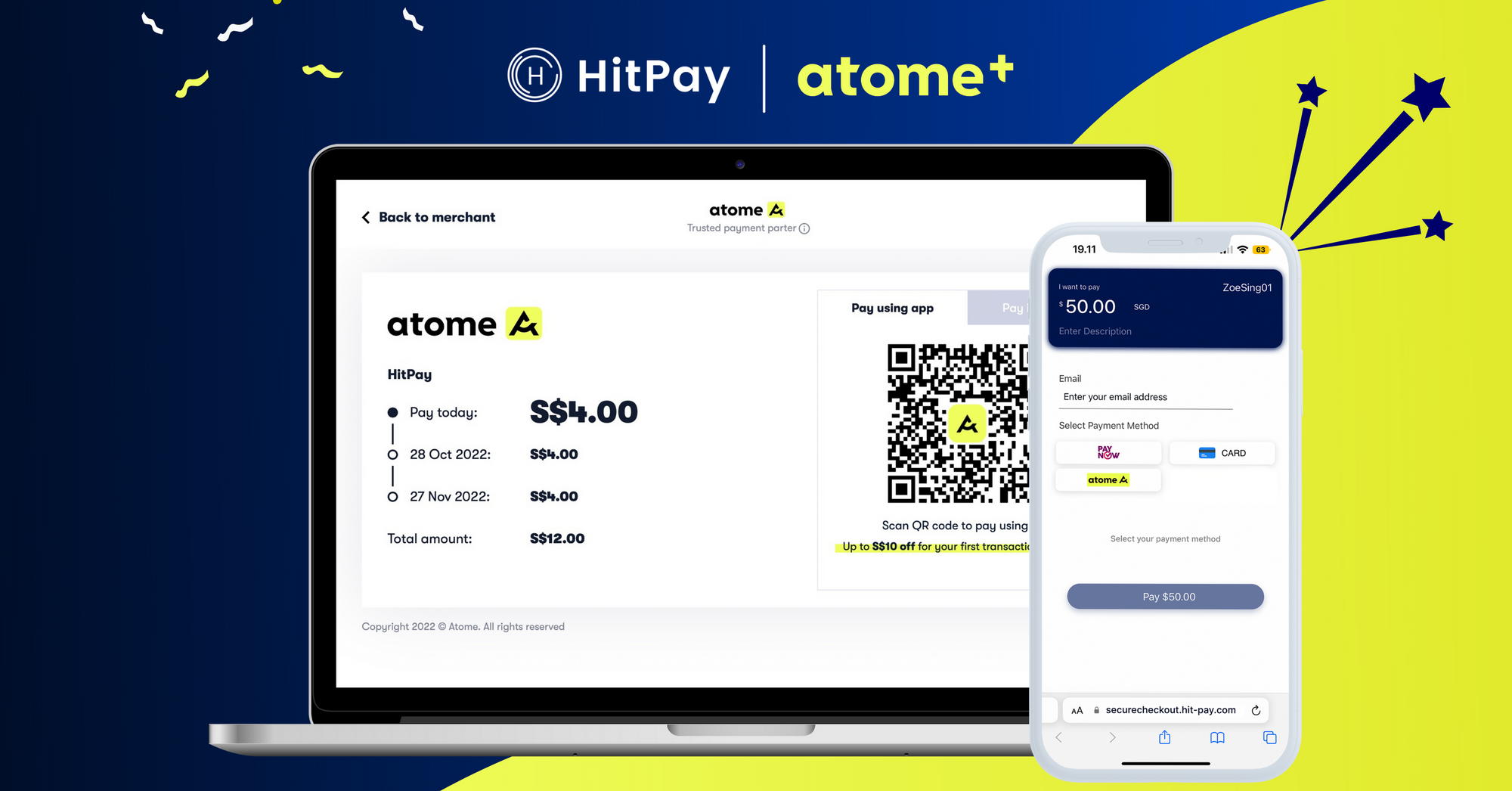

Atome

Repayment schedule: 3 months

HitPay transaction fee: 5.5%

HitPay payout period: T+1 calendar days

Minimum transaction amount: S$1.50

Maximum transaction amount: S$1,000 for debit cards, S$3,000 for credit cards

Learn more: HitPay and Atome launch 0% interest BNPL payments

Click here to enable Atome now.

Set up Buy Now, Pay Later payment methods in Singapore

With HitPay, you can accept BNPL payments anywhere you sell. Here's what you can enjoy:

All BNPL payment methods (and more) available in one platform

With HitPay, you can access popular BNPL payment methods in Singapore including Grab’s PayLater and Atome in one platform. Plus, you have the flexibility to choose which BNPL methods to display on each sales channel.

Besides BNPL, HitPay also offers local and international payment methods like e-wallets, Singapore's PayNow, and bank transfers in one platform. No coding required!

Includes integration with HitPay POS for in-store payments

Got a physical store? Use HitPay POS to accept in-store payments with BNPL providers in Singapore.

Access HitPay’s POS time-saving payment methods, including

- Scan to Pay: Enjoy contactless payment with your HitPay app

- Tap to Pay: Accept customer payments without a credit card terminal - perfect for collecting payments on the go

Enjoy SME-friendly customer support

Got questions or need support in a pinch? We offer email support to help you get the answers you need quickly.

Simple pricing

Unlike other payment gateways, HitPay has no subscription fees or contract lock-ins. You only pay per transaction with the BNPL transaction fee stated above.

Set up all the BNPL methods you need with HitPay

Follow these step-by-step instructions to set up your preferred buy-now-pay-later payment methods on HitPay in minutes.

Got questions? Contact our support team here.

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!

![Perbandingan 13 Payment Link di Indonesia [2024]: Pilihan Metode Pembayaran Terbaik Untuk Bisnis Online Anda](/content/images/size/w720/2023/05/Newsletter-Design---2023-05-02T221135.775.png)