What is PayTo? Exploring Payment Collection in Australia with PayID as an Alternative

Learn about PayTo's convenience for Australian SMEs and how HitPay integrates PayID as an alternative, ensuring secure and swift payments.

In Australia, one of the emerging payment collection methods is PayTo. In this article, we'll explore what PayTo is and how it works, providing you with essential insights into this payment option.

Additionally, we'll introduce an alternative method called PayID, which offers similar functions as PayTo along with more flexibility in managing payments.

Instead of using long bank account numbers, you just use your email or phone number. It's easy to remember and makes paying and getting paid way quicker. Additionally, when you use PayID with HitPay, you get to handle your payments more flexibly, enjoy better security, and see the money move instantly. Let's explore in more detail.

What is PayTo?

PayTo is a modern payment collection method in Australia that simplifies transactions for businesses and individuals.

It allows you to securely receive payments from your customers or friends by using a unique identifier linked to your bank account.

Instead of sharing lengthy bank details, you can simply share your PayTo ID, making payments quicker and more convenient

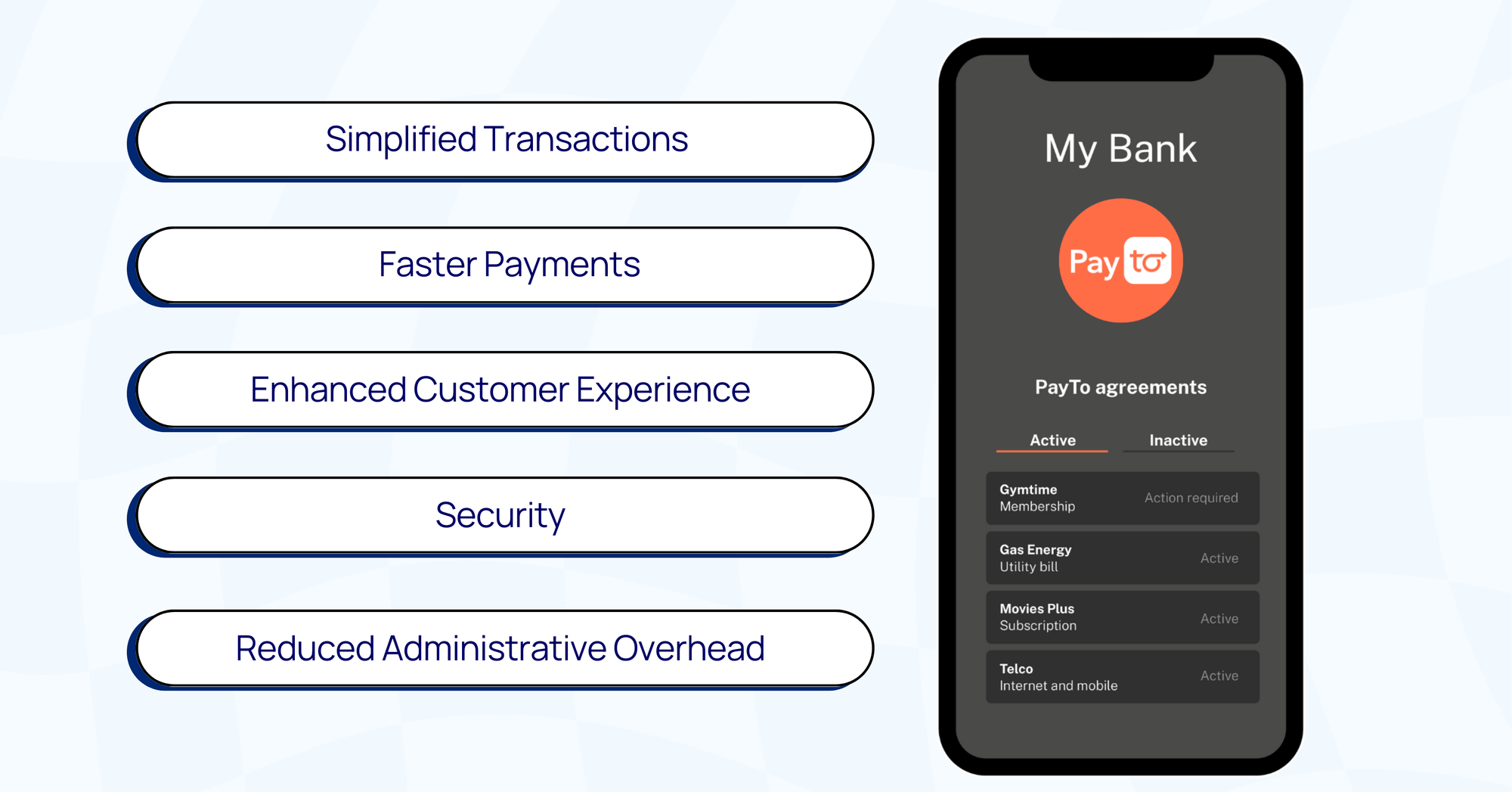

What are the advantages of PayTo?

PayTo offers several advantages, particularly beneficial for small and medium-sized enterprises (SMEs) in Australia:

- Simplified Transactions: PayTo streamlines the payment process by replacing complex bank account details with a single, user-friendly PayTo ID. This simplification reduces the chances of errors in payment instructions, making it easier for both businesses and customers.

- Faster Payments: SMEs often rely on prompt payments to maintain cash flow. PayTo expedites transactions, ensuring that funds reach your business swiftly. This speed is crucial for meeting financial commitments and seizing opportunities for growth.

- Enhanced Customer Experience: Providing customers with a convenient payment method, like PayTo, improves their experience. It reflects positively on your business and encourages repeat transactions and customer loyalty.

- Security: PayTo transactions are secure and protected by banking-level security measures. For SMEs, safeguarding financial transactions and customer data is paramount, and PayTo offers peace of mind in this regard.

- Reduced Administrative Overhead: With PayTo, businesses can automate payment collection processes, reducing the administrative burden associated with tracking payments and reconciling accounts. This efficiency allows SMEs to focus on core operations.

While PayTo is a valuable option, it's worth noting that an alternative, PayID, is also available. PayID offers similar benefits and is integrated into HitPay, a user-friendly platform that simplifies payment processing for SMEs in Australia. Both PayTo and PayID cater to the evolving payment needs of businesses and customers in the digital age.

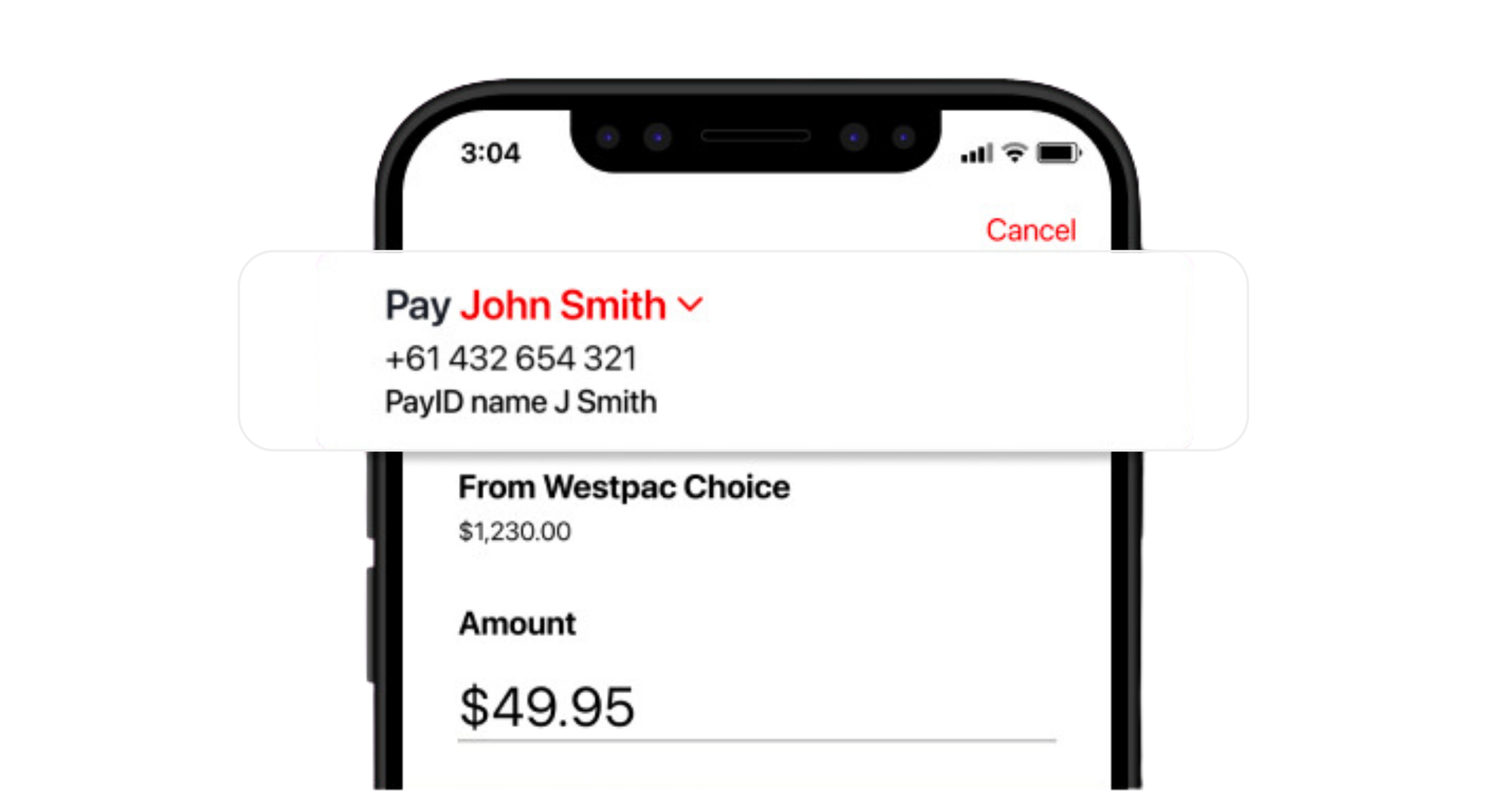

PayID: An alternative to PayTo

PayID is a payment method commonly used in Australia. It simplifies the process of sending and receiving payments by replacing traditional bank account numbers with more user-friendly identifiers, such as an email address or phone number.

This means that instead of sharing your complex bank details, you can provide your PayID, making transactions quicker and more straightforward.

PayID is widely adopted by banks and financial institutions in Australia, and it's designed to enhance the ease and speed of payments for individuals and businesses alike.

Users can link their bank accounts to their PayID, and when making payments or receiving funds, they only need to share their PayID instead of disclosing sensitive banking information.

One of the key advantages of PayID is its convenience. It's particularly helpful for small businesses and individuals who want to simplify their financial transactions. PayID also offers enhanced security features, making payments safer and more secure.

Overall, PayID is part of the ongoing digital transformation in the financial sector, making payments more accessible and efficient for everyone.

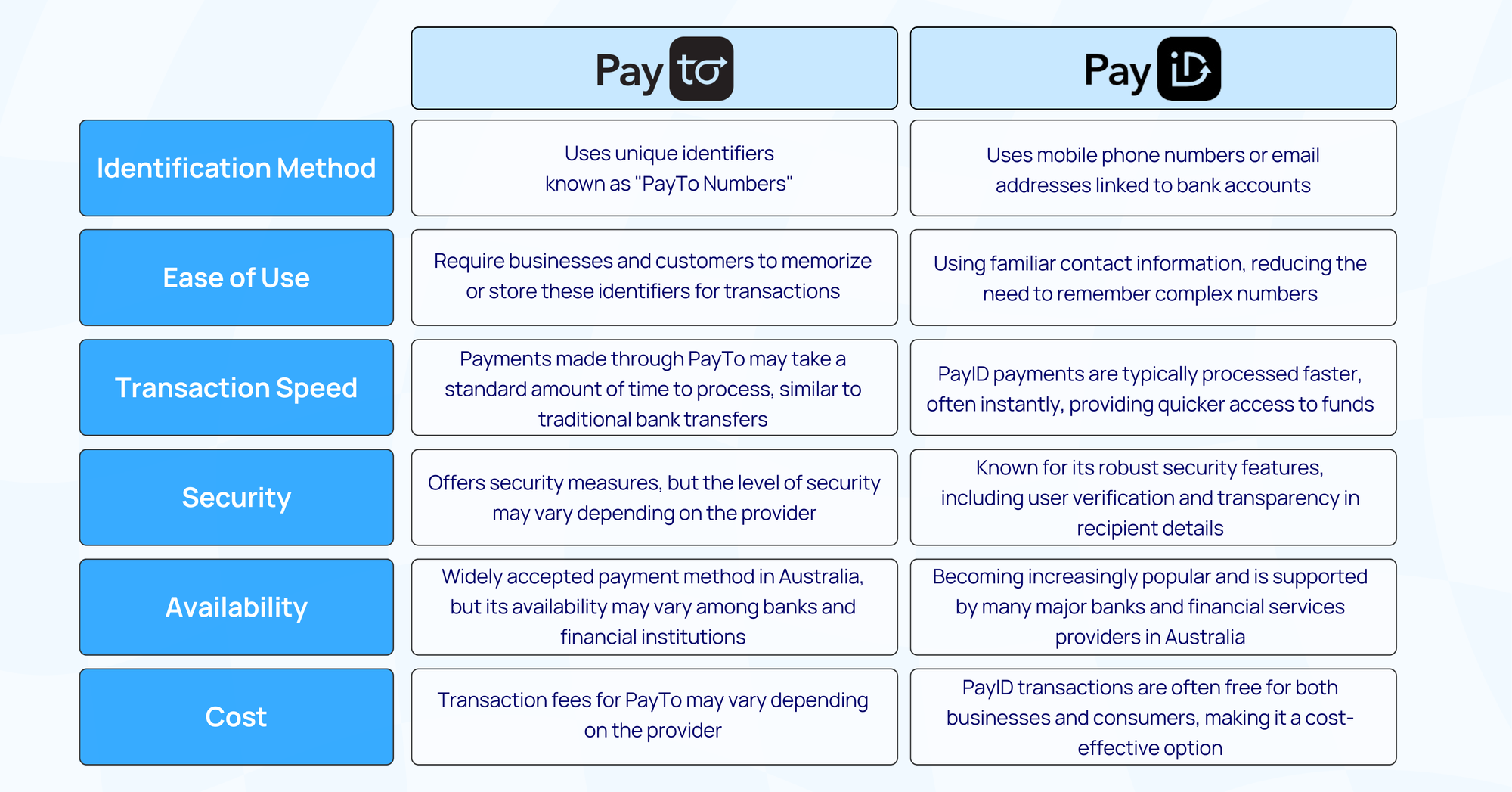

PayTo vs. PayID: Which Payment Method Is Right for You?

When it comes to payment methods in Australia, both PayTo and PayID offer convenient options for businesses and consumers. Let's take a closer look at how these two payment methods compare:

- Identification Method:

- PayTo: PayTo uses unique identifiers known as "PayTo Numbers," which are similar to traditional bank account numbers. These numbers are used for making payments.

- PayID: PayID relies on mobile phone numbers or email addresses linked to bank accounts, making it easier for users to remember and use.

- Ease of Use:

- PayTo: PayTo Numbers may require businesses and customers to memorize or store these identifiers for transactions.

- PayID: PayID simplifies payments by using familiar contact information, reducing the need to remember complex numbers.

- Transaction Speed:

- PayTo: Payments made through PayTo may take a standard amount of time to process, similar to traditional bank transfers.

- PayID: PayID payments are typically processed faster, often instantly, providing quicker access to funds.

- Security:

- PayTo: PayTo offers security measures, but the level of security may vary depending on the provider.

- PayID: PayID is known for its robust security features, including user verification and transparency in recipient details.

- Availability:

- PayTo: PayTo is a widely accepted payment method in Australia, but its availability may vary among banks and financial institutions.

- PayID: PayID is becoming increasingly popular and is supported by many major banks and financial services providers in Australia.

- Cost:

- PayTo: Transaction fees for PayTo may vary depending on the provider.

- PayID: PayID transactions are often free for both businesses and consumers, making it a cost-effective option.

In summary, both PayTo and PayID offer their own set of advantages. PayTo may be preferred by those accustomed to traditional bank account numbers, while PayID provides a user-friendly and secure experience with faster transactions.

The choice between these payment methods ultimately depends on your business's specific needs and the preferences of your customers.

PayID and HitPay

HitPay, the payment platform designed for small and medium-sized enterprises (SMEs), has joined forces with Azupay to introduce PayID payments for businesses in Australia.

This collaboration brings the convenience of PayID to merchants using HitPay's services, enabling them to seamlessly accept and offer PayID payments across various channels, including e-commerce stores, online platforms, and physical locations.

Why Choose PayID with HitPay?

PayID is a valuable addition to the range of local and international payment options available on HitPay, and here's why it's a smart choice for your Australian business:

- Enhanced Security: PayID offers a higher level of security compared to many other digital payment methods. Users are required to link their mobile number, ABN, Organisation Identifier, or email address, providing transparency to customers before they make a payment. This helps prevent PayID scam transfers and payment errors. Notably, PayID safety reports indicate that a significant portion of payments have been reviewed or modified by customers after seeing recipient details.

- Instant Payouts: Unlike the typical T+2 day waiting period for credit card payouts, PayID payments are credited to your bank account instantly. This rapid processing ensures that you have quicker access to your funds.

- Cost-Effective: PayID transactions are free for both businesses and consumers, making it an economical choice. This accessibility encourages more consumers in Australia to use PayID for their purchases, making it a preferred option over other digital payment methods, including credit cards.

- Seamless Setup: Setting up PayID with HitPay is hassle-free and doesn't require any coding or technical expertise. HitPay's integrations are designed to simplify the setup process, allowing you to implement PayID effortlessly across all your sales channels.

In summary, PayID on HitPay offers enhanced security, instant payouts, cost-effectiveness, and ease of implementation. These advantages make it a compelling choice for businesses in Australia looking to provide a convenient and secure payment experience for their customers.

Setup PayID on HitPay

Setting up PayID with HitPay is a hassle-free process that requires no coding, making it accessible and convenient for merchants. Here's a step-by-step guide:

- Sign Up for a HitPay Account: If you don't already have a HitPay account, the first step is to sign up. The account registration process is free and can be completed on the HitPay platform.

- Access Payment Methods Settings: After you've successfully registered and logged in to your HitPay account, navigate to the "Settings" section within your account dashboard.

- Submit Your Details: Within the "Settings," locate the "Payment Methods" section. Here, you'll find the PayID setup options. Simply follow the prompts to submit your details for PayID setup.

- Review and Approval: Once you've submitted your PayID details, your account will go through a review process by HitPay. This typically takes about one week to complete.

- Activation: After your PayID account is reviewed and approved by HitPay, it will be activated, and you can start using PayID for payment processing.

PayTo and PayID stand out as versatile solutions tailored to businesses and individuals. PayTo simplifies transactions with unique identifiers, while PayID offers a user-friendly alternative, replacing complex bank details with familiar contact information.

Both options benefit small and medium-sized enterprises (SMEs) with faster transactions, enhanced security, and streamlined processes. The choice between them hinges on specific business needs and customer preferences.

Lastly, when you partner with HitPay, you gain access to PayID's added advantages, ensuring a secure and efficient payment experience for your Australian business.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

- Which PayID Payment Gateway Is Best for SMEs in Australia?: Comparing Finmo, Rapyd, HitPay, Asia Pay, and Global Payments

- How to accept PayID customer payments with HitPay Australia

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!