Which PayID Payment Gateway Is Best for SMEs in Australia?: Comparing Finmo, Rapyd, HitPay, Asia Pay, and Global Payments

We compare the top PayID payment gateways in Australia — Finmo, Rapyd, HitPay, Asia Pay, and Global Payments.

If you run a business in Australia, you'll want to set up PayID as a new payment method on your online shop and/or physical store. PayID is registered by Australian Payments Plus, and is a faster and more secure way for customers to transfer money.

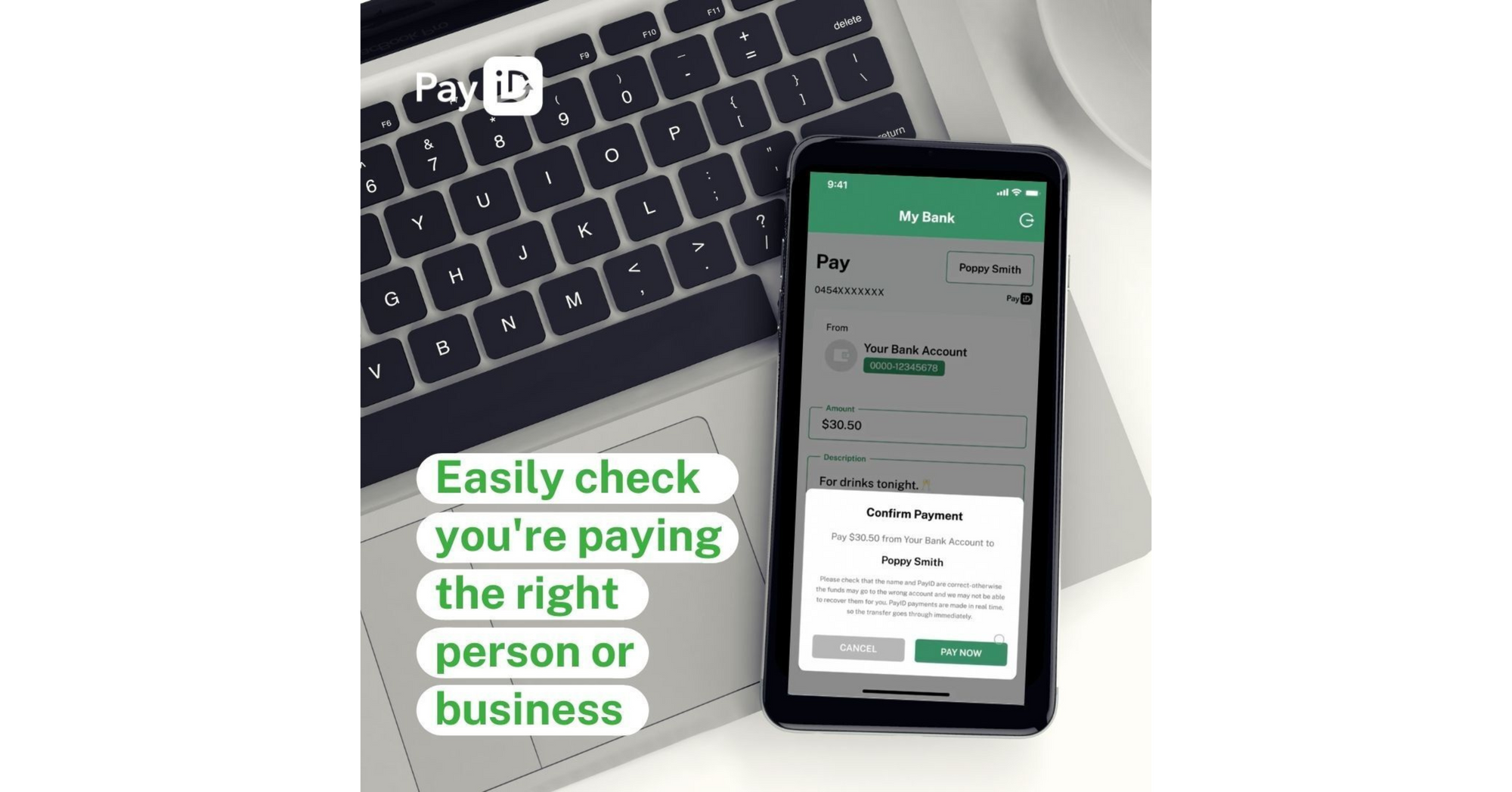

With PayID, customers can transfer money using their mobile phone number or email address, instead of traditional bank account details.

Why set up PayID?

- PayID is safer than other digital payment methods

PayID must be linked to a mobile number, email address, ABN, or Organisation Identifier. This enables your customers to see your business name before they confirm payment — which prevents mistakes and PayID scam transfers. According to PayID safety reports, a quarter of payments to PayID have been revised or stopped after the customer sees the recepient details. - PayID payouts are instant

Unlike credit card payouts (which generally take upwards of T+2 days), PayID payments are instantly credited to your bank account. - PayID is free to set up

This makes it accessible to most consumers in Australia, compared to other digital payment methods like credit cards

How do I sell with PayID?

Setting up PayID is simple.

1) Register your PayID via your internet or mobile banking app.

2) Create an account with a PayID payment gateway. Your payment gateway should provide e-commerce plugins and integrations to help you set up PayID on your online shop or physical store.

So, how do I choose a PayID payment gateway?

With a few PayID payment gateway providers in Australia, how do you know which one is right for your SME?

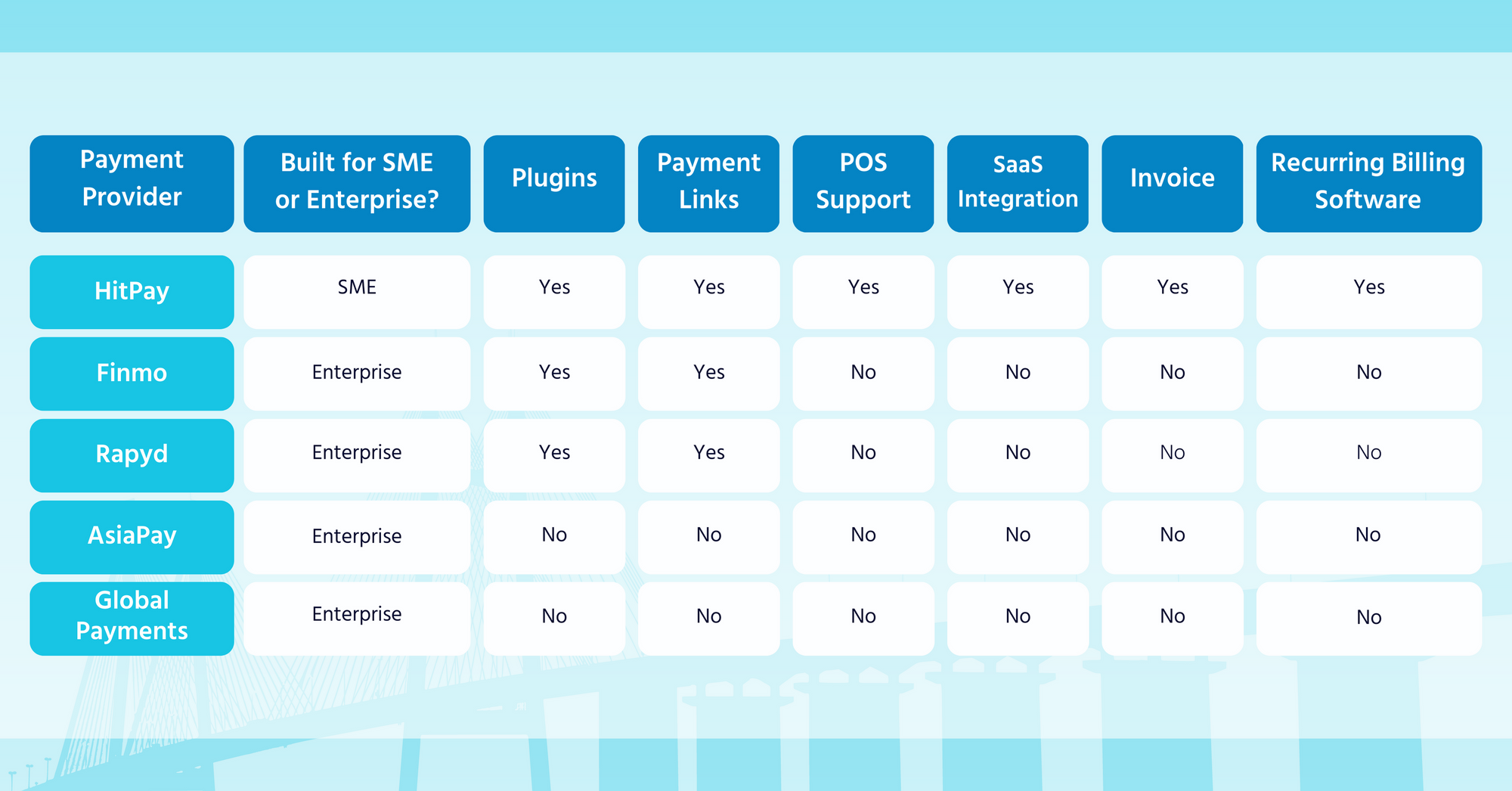

In this blog post, we compare top 5 PayID payment gateway providers in Australia — Finmo, Rapyd, HitPay, Asia Pay, and Global Payments. By the end of this article, you'll have a better understanding of each PayID payment gateway's benefits and be able to make an informed decision for your business.

1) Finmo

Finmo is a full-stack, enterprise-focused payments platform that has been operating in Australia since 2021. Finmo offers PayID integrations with major e-commerce platforms but they does not have POS support, invoicing, or recurring billing software.

Good for: Enterprise

Pricing model: Contact Finmo sales team for pricing plans

Pros:

✅ Offers e-commerce plugins

✅ Payment links

Cons:

❌ No POS support

❌ No invoicing

❌ No recurring billing

❌ No SaaS integrations

2) HitPay

HitPay is an all-in-one payment gateway with features and pricing built for SMEs. HitPay offers PayID integration with e-commerce plugins, POS systems, SaaS applications, invoicing software, recurring billing software, and payment links. Xero users will also enjoy HitPay's no-code PayID integration.

Good for: SMEs and independent creators

Pricing model: Pay-per-transaction only

Pros:

✅ Offers e-commerce plugins and payment links

✅ POS support for PayID

✅ Recurring billing software with PayID

✅ Invoicing software with PayID

✅ SaaS integrations

Cons:

❌ HitPay offers PayID, EFTPOS, and card payments — however, BNPL (e.g. Afterpay) are not yet available but coming soon

3) Rapyd

Rapyd is another popular PayID payment gateway in Australia, with a focus on enterprise businesses. Like Finmo, Rapyd offers PayID integrations with e-commerce platforms like Shopify and WooCommerce, but lacks POS support, invoicing, or recurring billing software.

Good for: Enterprise

Pricing model: Contact Rapyd sales team for pricing plans

Pros:

✅ Offers e-commerce plugins

✅ Payment links

Cons:

❌ No POS support

❌ No SaaS integrations

❌ No invoicing

❌ No recurring billing

4) AsiaPay

Headquartered in Hong Kong, AsiaPay offers multi-currency payment solutions for banks and enterprises in Australia and worldwide.

AsiaPay's payment gateway, PayDollar, offers card payments along with PayID acceptance. However, AsiaPay may not be suitable for SMEs as it lacks no-code payment integrations for online and offline sales channels.

Good for: Enterprise

Pricing model: Contact AsiaPay sales team for pricing plans

Pros:

✅ Established global payment provider for banks and enterprises

Cons:

❌ No e-commerce plugins

❌ No payment links

❌ No POS support

❌ No SaaS integrations

❌ No invoicing

❌ Offers recurring billing function, but needs technical knowledge to set up

5) Global Payments

Global Payments is an established payments platform that offers PayID and card payment options. Their payment features are highly customisable, allowing businesses to integrate their payment systems with other business software and systems. However, like AsiaPay, Global Payments lacks no-code payment integrations for online and offline sales channels.

Good for: Enterprise

Pricing model: Contact Global Payments sales team for pricing plans

Pros:

✅ Customisable payment features; great for enterprises with a strong developer team

Cons:

❌ No e-commerce plugins

❌ No payment links

❌ No POS support

❌ No SaaS integrations

❌ No invoicing

❌ No recurring billing

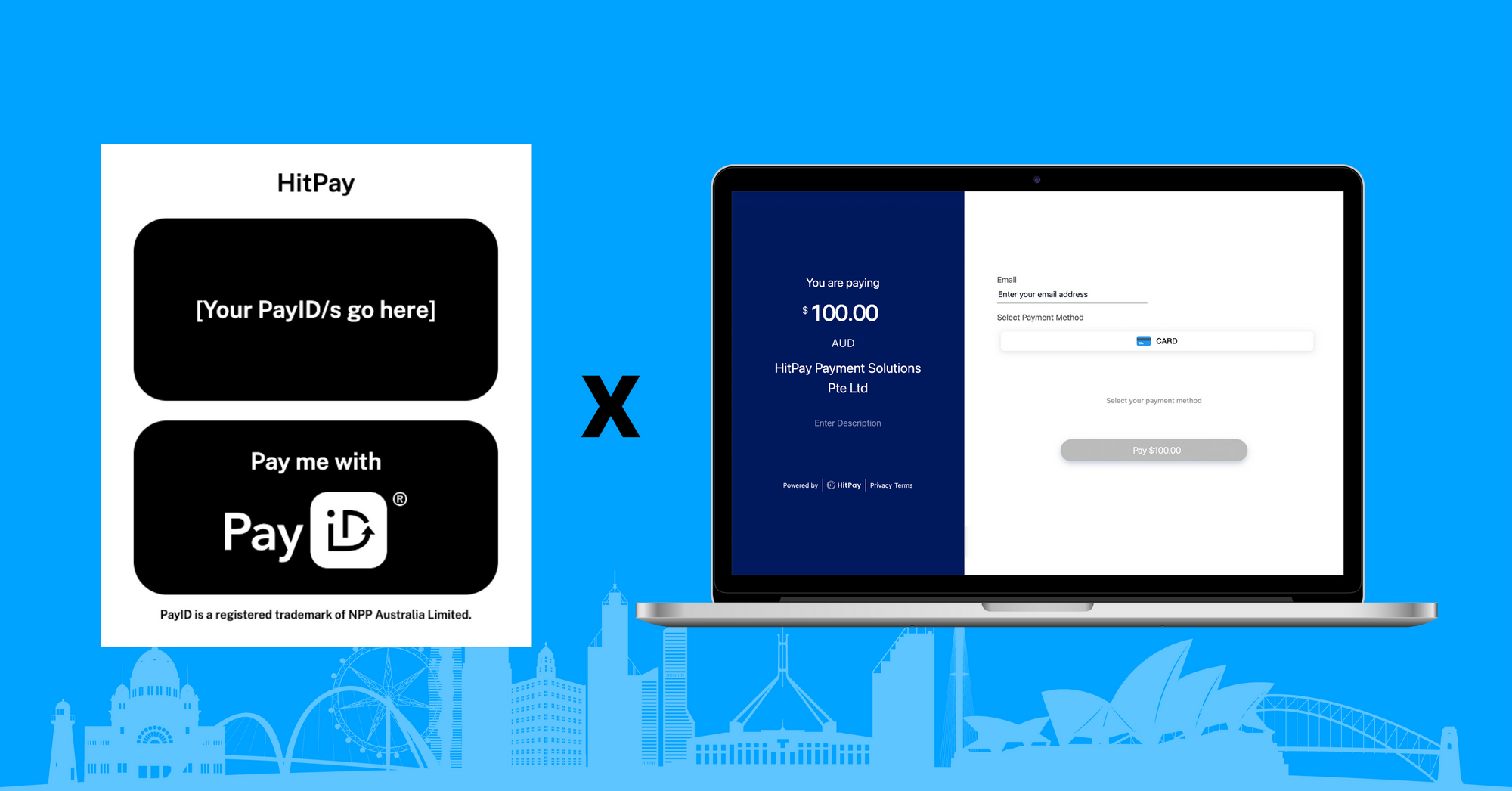

Try the best PayID payment gateway for SMEs

If you're a growing business or creator that needs an omnichannel PayID payment gateway, HitPay may be the solution for you.

HitPay is a great choice for businesses that require a comprehensive, all-in-one payment solution, with zero coding or technical expertise required.

Integrating PayID into your business is a breeze thanks to no-code integrations available for platforms such as Shopify, WooCommerce, Wix, Xero, and others.

Setting up PayID on your business is simple, with no-code PayID integrations for Shopify, WooCommerce, Wix, Xero, and more.

Compared to other PayID providers, HitPay offers:

- No-code integrations on any platform — online and offline

- Integrated POS system to automatically sync online and offline sales

- PayID accounting integrations with Xero

- SaaS business software

- No setup or annual fees. Only pay per transaction

Want to see how HitPay works?

Book a free demo with us today!

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!