7 Top Payment Gateway Providers in Singapore: Discover the Best Payment Gateway Solution

Payment gateways play a crucial role in e-commerce, acting as a bridge between merchants and financial institutions to securely process online transactions. In Singapore's thriving e-commerce market, selecting the right payment gateway is essential for businesses to provide a seamless and secure checkout experience. In this article, we provide a detailed list of the top payment gateway providers in Singapore to help you choose the right payment gateway for your business.

Top 7 Payment Gateway Providers in Singapore

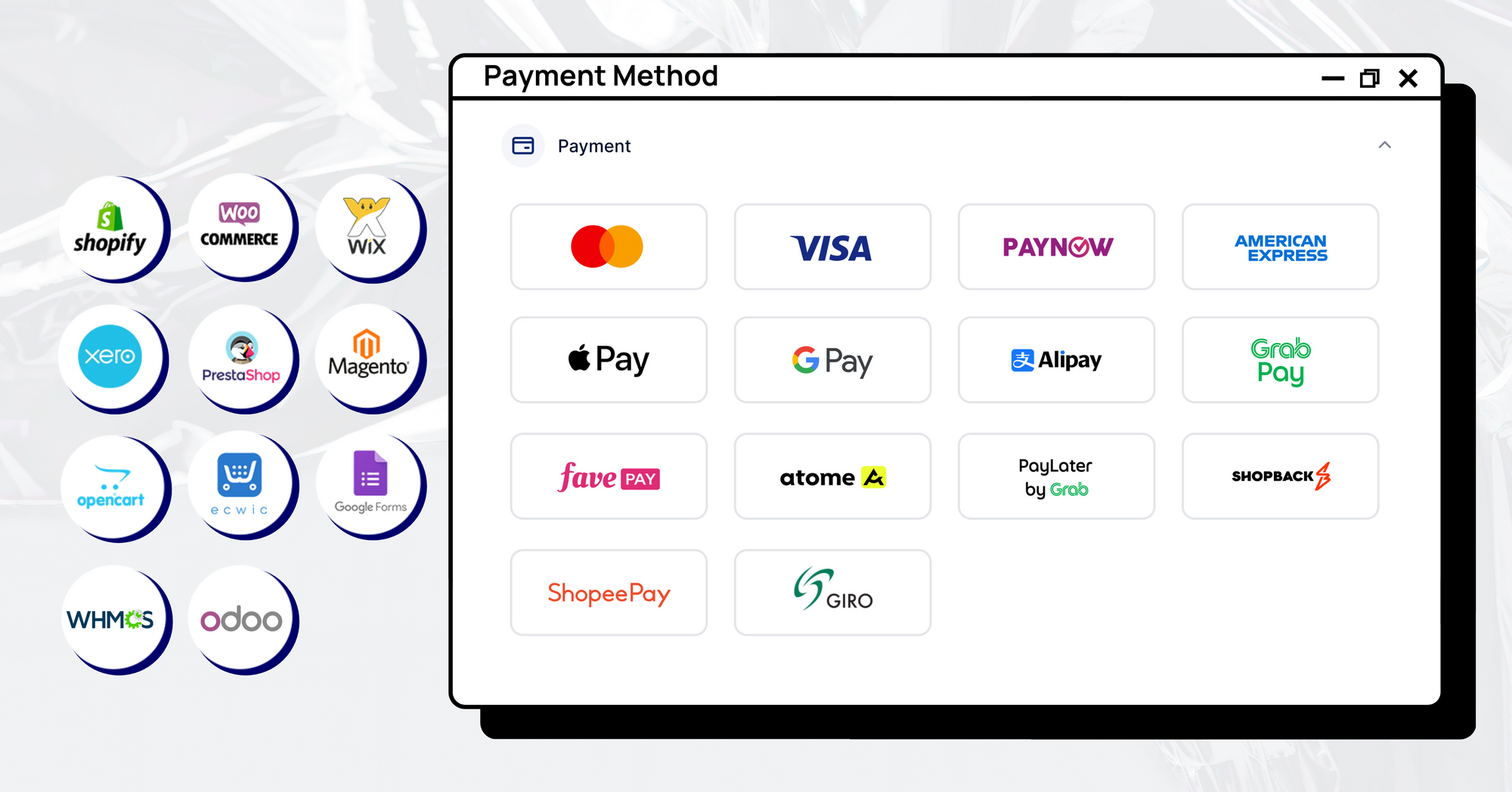

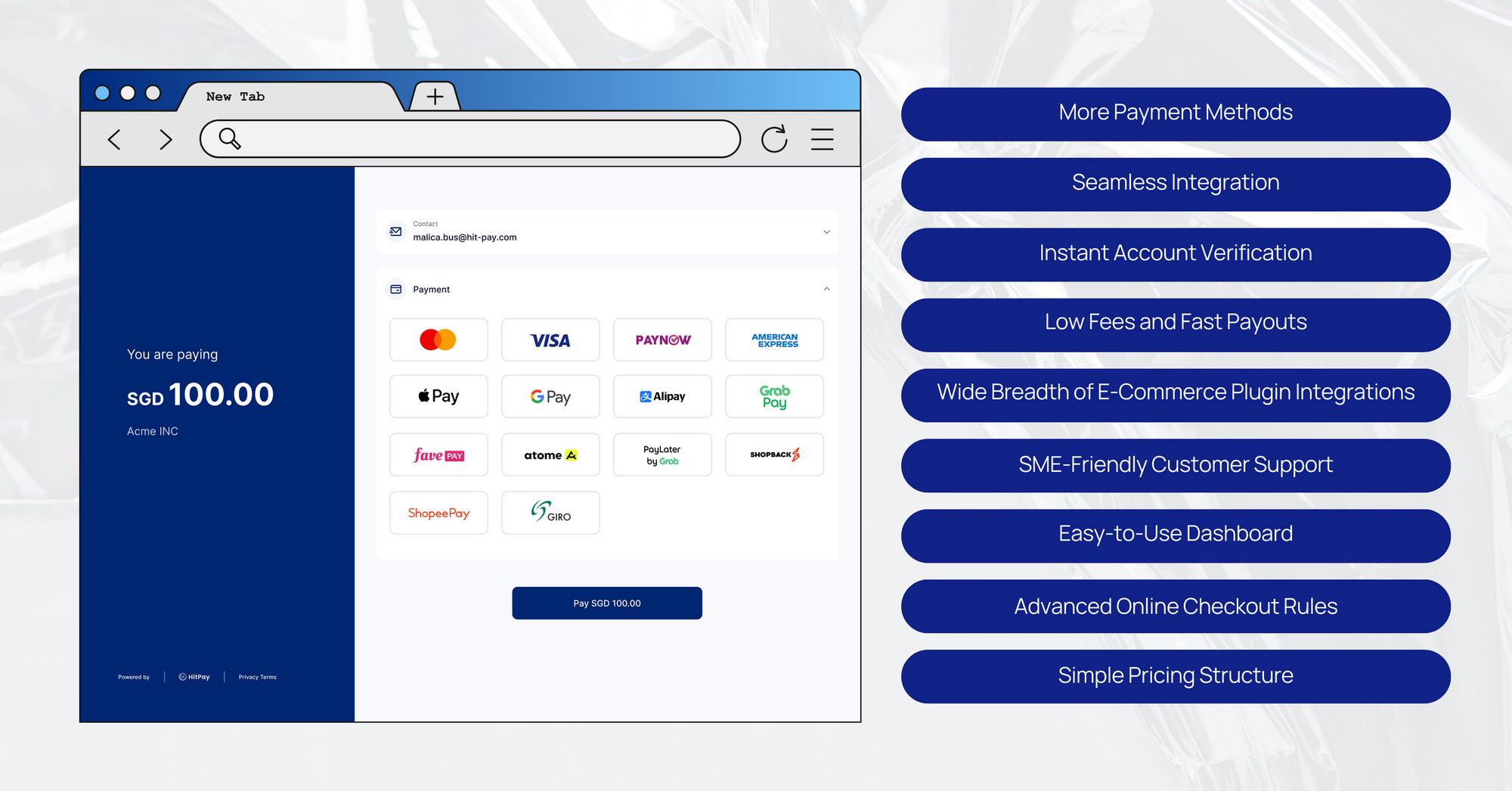

1) HitPay

HitPay is a Singapore-based payment gateway that offers a wide range of features and benefits for small and medium-sized enterprises (SMEs). Some of its key features include seamless integration with popular e-commerce platforms, support for multiple payment methods, and competitive pricing. HitPay stands out among its competitors for its SME-friendly approach, easy-to-use dashboard, and advanced online checkout rules that help businesses save on payment processing fees and increase conversions.

Integration with HitPay is straightforward, with no code required. Businesses can create an account, get verified instantly or within 1-2 days, and start accepting payments through various methods such as cards, bank transfers, e-wallets, and pay later options. HitPay offers low fees and same or next-day payouts, making it a cost-effective choice for businesses.

HitPay's pricing is simple and transparent, with no setup, recurring, or upfront costs. Businesses pay per transaction, with fees starting at 2.8% + S$0.50 for domestic online card transactions.

2) PayPal

PayPal is a globally recognized payment gateway that offers secure and convenient payment processing for online businesses. Its key features include acceptance of payments via debit and credit cards, as well as PayPal itself, and integration with various e-commerce platforms.

However, PayPal's transaction fees can be relatively high compared to other payment gateway providers. Domestic transactions are charged at 3.9% + S$0.50, while international transactions incur a fee of 4.4% + a fixed fee depending on the region.

Despite these drawbacks, PayPal remains a popular choice for businesses due to its wide reach, established reputation, and ease of use.

3) Stripe

Stripe is a popular payment gateway with several advantages and disadvantages. On the positive side, it comes with no annual or set-up fees and offers instant onboarding. Stripe accepts more than 130 currencies, making it a versatile choice for businesses targeting international customers.

However, Stripe has a few downsides as well. It charges relatively high transaction fees and doesn't provide free accounting integrations and business software. Additionally, customizing or installing certain payment options with Stripe may require coding experience, which can be a barrier for some businesses.

4) Rapyd

Rapyd is a global fintech-as-a-service platform that provides a comprehensive suite of payment solutions, including a payment gateway for businesses in Singapore. Its key features include support for multiple payment methods, currencies, and local payment options, making it an ideal choice for businesses targeting both local and international customers. Rapyd also offers fraud protection and risk management services to ensure secure transactions.

Rapyd's pricing structure varies depending on the services chosen by the business, with transaction fees starting at 2.9% + S$0.30 for card payments.

5) FOMO Pay

FOMO Pay is a Singapore-based payment gateway that specializes in providing one-stop mobile payment solutions for businesses. Its key features include integration with various e-commerce platforms, support for popular local and international payment methods, and competitive pricing. FOMO Pay is particularly suitable for businesses looking to offer mobile payment options to their customers, such as QR code payments and e-wallets.

6) Xfers

Xfers is a Singapore-based payment gateway that focuses on providing businesses with a seamless payment infrastructure. Its key features include support for popular local payment methods, such as PayNow and bank transfers, easy integration with e-commerce platforms, and competitive pricing. Xfers is an excellent choice for businesses looking to cater to the local market and offer a variety of payment options to their customers.

Xfers' pricing is transparent, with transaction fees starting at 2.2% + S$0.30 for online card payments. It also offers custom pricing for high-volume businesses and additional services, such as payouts and wallet solutions.

7) Adyen

Adyen is a global payment gateway that offers a range of features and benefits for businesses in Singapore. Key features include support for multiple payment methods and currencies, easy integration with e-commerce platforms, and advanced fraud protection. Adyen is a suitable choice for businesses targeting both local and international customers and looking for a robust and secure payment infrastructure.

Overall, each of these payment gateway providers offers unique features and benefits, making it essential for businesses to carefully evaluate their options and choose the one that best meets their needs.

How to Choose the Right Payment Gateway in Singapore

When selecting the right payment gateway for your business in Singapore, it's essential to consider several factors, including fees and costs, supported platforms and integrations, security features, accepted payment methods, and customer support resources.

Assessing fees and costs is crucial, as different payment gateways have varying pricing structures. It's important to choose a provider that offers competitive rates without compromising on features and security. Additionally, understanding the supported platforms and integrations can help you determine how easily the payment gateway can be integrated into your existing systems and e-commerce platforms.

Security features and reputation play a significant role in the choice of a payment gateway, as they can impact the trust and confidence of your customers in making transactions on your website. Look for a provider with a strong track record of security and fraud prevention measures to ensure the safety of your customers' information.

Accepted payment methods are another critical factor, as offering a wide range of payment options can help cater to the diverse needs of your customers. Ensure the payment gateway supports popular local and international payment methods to maximize convenience for your customers.

Lastly, consider the customer support and resources offered by the payment gateway provider. A responsive and knowledgeable support team can be invaluable in addressing any issues or concerns that may arise with your payment processing.

In conclusion, taking the time to thoroughly evaluate and compare payment gateway providers in Singapore can help you make an informed decision that best suits your business's needs and contributes to its success.

Ready to choose your payment gateway in Singapore?

If you're an SME or small business, HitPay may be the best payment gateway for you. Here's why:

- More Payment Methods: HitPay supports both local and international payment methods, including PayNow, cards, bank transfers, e-wallets, and Buy Now, Pay Later, making it convenient for customers to choose their preferred payment method.

- Seamless Integration: HitPay offers easy integration with popular e-commerce platforms without any extra effort or coding required. This allows businesses to quickly set up and start accepting payments.

- Instant Account Verification: Businesses can create an account with HitPay and get verified instantly or within 1-2 days, allowing them to start running their business and accepting payments quickly.

- Low Fees and Fast Payouts: HitPay offers competitive transaction fees and same or next-day payouts, making it a cost-effective choice for small businesses.

- Wide Breadth of E-Commerce Plugin Integrations: HitPay easily integrates with popular e-commerce platforms, streamlining the payment process for businesses and their customers.

- SME-Friendly Customer Support: HitPay understands the needs of SMEs and provides customer support over your preferred communication platform, ensuring that any issues or concerns are promptly addressed.

- Easy-to-Use Dashboard: HitPay offers a simple and user-friendly dashboard, making it easy for business owners to manage and monitor their transactions.

- Advanced Online Checkout Rules: HitPay's advanced checkout rules help businesses save on payment processing fees and increase conversions without any coding or developer intervention required.

- Simple Pricing Structure: HitPay charges on a per-transaction basis, with no contracts, setup, recurring, or upfront costs, ensuring transparent and straightforward pricing for businesses.

Ready to get started?

Check out the HitPay website or contact our team to learn more.

![Perbandingan 13 Payment Link di Indonesia [2024]: Pilihan Metode Pembayaran Terbaik Untuk Bisnis Online Anda](/content/images/size/w720/2023/05/Newsletter-Design---2023-05-02T221135.775.png)