How to Register a Business in New Zealand (2023 Guide)

This article provides information on how to register a business in New Zealand, including the steps involved, the costs, and the benefits. We also cover what to do after your company is registered.

Are you thinking about starting a business in New Zealand? One of the first things you'll need to do is register your company with the Companies Office. This is a simple process that can be completed online, and it gives your business a number of advantages.

What does it mean to be a registered business in NZ?

A registered business in New Zealand is a business that has been registered with the Companies Office. This means that the business has a unique identity and is legally recognized by the New Zealand government. Registration with the Companies Office is a simple process that can be completed online.

Once a business is registered, it is assigned a unique New Zealand Business Number (NZBN). The NZBN is a 13-digit number that identifies the business to government agencies and other businesses. The NZBN is required for several important business activities, such as opening a bank account, applying for government funding, and registering for GST.

In this guide, we take a closer look at how to register a company in New Zealand, and the advantages of doing so.

What are the benefits of registering my business?

Registering your business in New Zealand offers several advantages, including increased credibility and professionalism, limited liability, access to government funding and support, the ability to raise capital, and tax benefits. We explore the benefits in detail below:

- Increased credibility and professionalism: A registered business looks more credible and professional to potential customers and suppliers. This is because registered businesses are subject to certain legal requirements, such as having to file annual returns and disclose their ownership structure. As a result, potential customers and suppliers can be confident that they are dealing with a legitimate business.

- Limited liability: Limited liability means that your personal assets are protected from being used to pay off business debts. This is an important protection for business owners, as it reduces their personal financial risk.

- Access to government funding and support: Registered businesses may be eligible for government funding and support programs. These programs can provide financial assistance, advice, and other resources to help businesses grow and succeed.

- Ability to raise capital: Registered businesses may be able to raise capital through the sale of shares or other securities. This can be a valuable source of funding for businesses that are looking to expand or invest in new products or services.

- Tax benefits: Registered businesses may be eligible for certain tax benefits, such as the ability to deduct business expenses from their income. This can help to reduce the overall tax burden on businesses.

- Easier to do business: Registered businesses are more credible and reliable than other companies because they are legally recognized by the government. This makes it easier for them to enter into contracts, obtain financing, and secure insurance.

- Intellectual property protection: Registered businesses can more easily protect their intellectual property, such as trademarks and copyrights. This is because registered businesses have a legal record of their ownership of intellectual property.

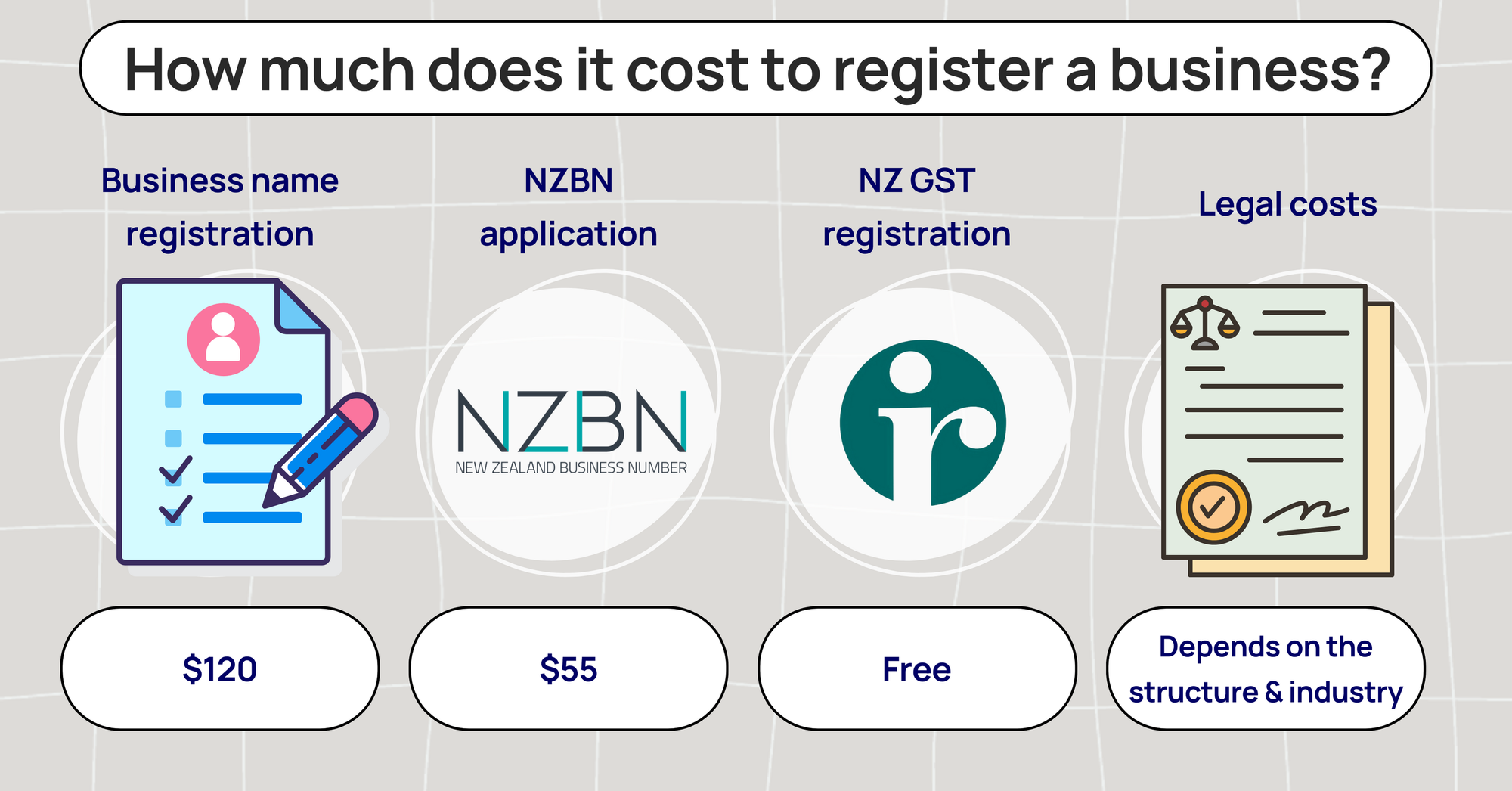

How much does it cost to register a business in New Zealand?

The cost of registering a business in New Zealand is relatively low. For most businesses, the total cost will be less than $200. Below is a breakdown of the different components.

- Business name registration: $120. You can register your business name online through the Companies Office website. There is a fee of $120 for registering a business name.

- NZBN application: $55. All businesses in New Zealand must have an NZBN. An NZBN is a unique 13-digit number that identifies your business to government agencies and other businesses. You can apply for an NZBN online through the Companies Office website. There is a fee of $55 for applying for an NZBN.

- NZ GST registration: Free. If your business has a turnover of more than $60,000 per year, you need to register for GST. GST is a value-added tax that is applied to most goods and services in New Zealand. You can register for GST online through the Inland Revenue website. There is no fee for registering for GST.

- Legal costs: Other legal requirements for registering a business in New Zealand vary depending on your business structure and industry. For example, you may need to register with your local council or obtain certain licenses or permits.

What are the different types of business structures in New Zealand?

There are four main types of business structures in New Zealand:

- Sole proprietorship: A sole proprietorship is the simplest and most common type of business structure. It is owned and operated by one person.

- Partnership: A partnership is owned and operated by two or more people. There are two types of partnerships: general partnerships and limited partnerships.

- Company: A company is a separate legal entity from its owners. There are two types of companies: limited liability companies (LLCs) and unlimited liability companies (ULCs).

- Trust: A trust is a legal arrangement where one person (the trustee) holds assets on behalf of another person (the beneficiary).

Here is a brief overview of each type of business structure in New Zealand:

Sole proprietorship:

- Pros: Easy to set up and manage, full control over the business, no double taxation.

- Cons: Unlimited liability, no separation between personal and business assets, difficult to raise capital.

Partnership:

- Pros: Easy to set up and manage, shared responsibility and decision-making, no double taxation.

- Cons: Unlimited liability for general partners, limited liability for limited partners, potential for conflict between partners.

Company:

- Pros: Limited liability, separate legal entity, easier to raise capital.

- Cons: More complex to set up and manage, subject to double taxation.

Trust:

- Pros: Can be used to protect assets, flexible ownership structure, tax benefits.

- Cons: Complex to set up and manage, can be expensive to maintain.

The best type of business structure for you will depend on your individual circumstances and business goals. If you are unsure which type of business structure is right for you, you should seek professional advice from an accountant or lawyer.

How to register your business in New Zealand

Step 1: Choose a business structure

The first step in registering your business is to choose a business structure. There are four main types of business structures in New Zealand as mentioned above.

Step 2: Register your business name

Once you have chosen a business structure, you need to register your business name. You can do this online through the Companies Office website.

Your business name must be unique and must not be offensive or misleading. You can check whether your business name is available by searching the Companies Office register of business names.

Step 3: Apply for a New Zealand Business Number (NZBN)

All businesses in New Zealand must have an NZBN. An NZBN is a unique 13-digit number that identifies your business to government agencies and other businesses.

You can apply for an NZBN online through the Companies Office website. There is a small fee for applying for an NZBN.

Step 4: Register for GST (if applicable)

If your business has a turnover of more than $60,000 per year, you need to register for GST. GST is a value-added tax that is applied to most goods and services in New Zealand.

You can register for GST online through the Inland Revenue website. There is no fee for registering for GST.

Step 5: Meet other legal requirements

Depending on your business structure and industry, there may be other legal requirements that you need to meet. For example, if you are running a food business, you will need to register with your local council.

You can find information about the legal requirements for different types of businesses on the website of the New Zealand government.

Once you have completed all of the above steps, your business will be registered in New Zealand. You can now start trading and operating your business.

What do I do after I have registered my business?

Congrats! You have a registered company. Now it's time for the fun part and to set up the key infrastructure you need to build a successful company.

- Set up a business bank account. This will allow you to keep your personal and business finances separate. This is important for both legal and financial reasons. It will make it easier to track your business income and expenses, and it will also protect your personal assets in the event of a lawsuit or other business-related liability.

- Set up a payment system to accept payments from customers. There are different ways to do this, including:

- Online payments: Online payments are a popular option for businesses that sell products or services online. It's important to choose an established and reliable online payment processing solution, such as HitPay.

- In-person payments: If you have a brick-and-mortar store, you will need to set up a way to accept in-person payments. This could include using a point-of-sale (POS) system, accepting credit and debit cards, or offering cash payments.

- several

HitPay is a payment processing solution that offers a variety of features and benefits for small businesses. HitPay is easy to use and affordable, and it offers a variety of payment methods, including credit and debit cards, online payments, and mobile payments and does not include a monthly subscription fee.

- Obtain the necessary licenses and permits. Depending on your industry, you may need to obtain certain licenses or permits from the government. For example, if you are starting a food business, you will need to register with your local council. You can find information about the legal requirements for different types of businesses on the website of the New Zealand government.

- Purchase business insurance. Business insurance can protect you from financial losses in the event of a lawsuit or other unforeseen event. There are a variety of different types of business insurance available, so it is important to choose the right policy for your business needs. You can get advice from an insurance broker or agent to help you choose the right policy.

- Market your business. Let potential customers know about your business and what you have to offer. There are several different ways to market your business, such as:

- Online marketing: Online marketing includes things like creating a website and social media accounts, running online ads, and search engine optimization (SEO).

- Offline marketing: Offline marketing includes things like printing flyers and business cards, participating in trade shows and events, and running local ads.

- Provide excellent customer service. This is essential for building a successful business. Make sure that you are responsive to customer inquiries and that you go the extra mile to make your customers happy.

Starting and registering a business in New Zealand is a simple process that offers many benefits. By choosing the right business structure, registering your company, and getting an NZBN, you're setting up your business for success. Registration is a small investment that can protect your personal assets, make it easier to get funding, and save you money on taxes.

Once your business is registered, you need to get the basics in place, such as a bank account, payment systems, licenses, insurance, and a marketing plan. Providing excellent customer service and adapting to change will be essential to your long-term success.

With all these things in place, you're not just starting a business; you're building an asset that can thrive in New Zealand's vibrant economy. Welcome to the exciting world of entrepreneurship, where hard work and dedication can turn your vision into a reality. 🚀

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

- New Zealand Payment Gateway Comparison: Shopify vs. Stripe, PayPal and HitPay

- Sell Digital Products Online with the HitPay Online Store

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!