PayPal New Zealand: Insights and an Alternative (2023)

This article explores the advantages of using PayPal NZ for online transactions, discusses its fee structure, and introduces HitPay as a more cost-effective alternative for businesses in New Zealand.

PayPal is one of the most popular online payment systems in the world. It is a safe, convenient, and global way to pay and get paid online.

PayPal NZ is the New Zealand version of PayPal, and it offers all of the same benefits as the global PayPal service.

In this article, we will discuss the benefits of using PayPal NZ, explore the fees PayPal charge and analyse a cheaper alternative to PayPal NZ.

What is PayPal?

PayPal is a global online payments system that allows people to send and receive money online. It is one of the most popular payment methods in the world, with over 446 million active accounts.

PayPal can be used to send money to friends and family, to pay for goods and services online, and to receive payments for goods and services sold online. PayPal is also used by businesses to accept payments from customers.

Does PayPal exist in New Zealand?

Yes, PayPal is available in New Zealand. New Zealanders can use PayPal to send and receive money from around the world, as well as to shop online at millions of merchants worldwide.

To sign up for a PayPal account in New Zealand, you must be a resident of New Zealand and have a valid New Zealand bank account or credit card.

How safe is PayPal NZ?

PayPal is a safe way to make and receive online payments. It uses a variety of security measures to protect its users' financial information, including:

- Data encryption: All of PayPal's data is encrypted to protect it from unauthorized access.

- Fraud protection: PayPal has a sophisticated fraud detection system that helps to identify and prevent fraudulent transactions.

- Buyer protection: PayPal offers buyer protection for eligible purchases, which means that buyers can be reimbursed for the full amount of their purchase plus shipping costs if they don't receive the item or if it doesn't match the seller's description.

PayPal also offers a number of additional security features, such as two-factor authentication and purchase protection.

What are the advantages of using PayPal in New Zealand?

There are many benefits to using PayPal in New Zealand, including:

- Convenience: PayPal is a very convenient way to make and receive online payments. You can shop online at millions of merchants worldwide with just your email address and password.

- Security: PayPal is a very secure way to make and receive online payments. It uses a variety of security measures to protect its users' financial information.

- Buyer protection: PayPal offers buyer protection for eligible purchases, which means that buyers can be reimbursed for the full amount of their purchase plus shipping costs if they don't receive the item or if it doesn't match the seller's description.

- Global reach: PayPal is available in over 200 countries and territories, which means that you can use it to send and receive money from around the world.

- Seller protection: PayPal also offers seller protection for eligible transactions, which means that sellers can be protected from fraudulent claims and chargebacks.

What are the disadvantages of using PayPal in New Zealand?

While PayPal is a popular payment processor for businesses of all sizes, there are a few disadvantages to consider, especially for New Zealand businesses:

- Doesn't offer any e-commerce business tools. PayPal is primarily a payment processor, so it doesn't offer any of the e-commerce business tools that many businesses need, such as website builders, inventory management systems, or shipping integrations.

- No credit card terminal. PayPal doesn't offer a credit card terminal, so businesses that want to accept payments in person will need to purchase a separate terminal from another provider.

- Limited payment methods. PayPal doesn't support as many payment methods as some other payment processors, such as Stripe. This can be a disadvantage for businesses that want to offer their customers a wider range of payment options.

- Slowest onboarding and settlement time. PayPal has a slower onboarding and settlement time than some other payment processors. This means that it may take longer for businesses to get approved for a PayPal account and to receive funds from their sales.

In addition to the above disadvantages, PayPal's fees can also be relatively high, especially for international transactions. This is why many New Zealand businesses choose to use alternative payment processors, such as HitPay.

Does PayPal charge fees in NZ?

Yes, PayPal does charge fees for some transactions. The fees vary depending on the type of transaction and the currencies involved.

Here are the current PayPal fees in New Zealand:

- Sending money to another person in New Zealand: 0.45 NZD + 3.4%

- Receiving money from another person in New Zealand: No fee

- International transactions: 4.4% + a fixed fee

- Withdrawing cash from an ATM: 2.90 NZD + 3.5% of the amount withdrawn

Can you take money out of PayPal NZ?

Yes, you can take money out of PayPal NZ. You can transfer money from your PayPal account to your bank account, or you can withdraw it as cash from an ATM.

To transfer money from your PayPal account to your bank account, you must have a linked New Zealand bank account. The transfer usually takes 1-2 business days.

To withdraw cash from PayPal NZ, you must have a linked New Zealand credit or debit card. You can withdraw cash from any ATM that accepts your card.

Affordable alternative to PayPal NZ

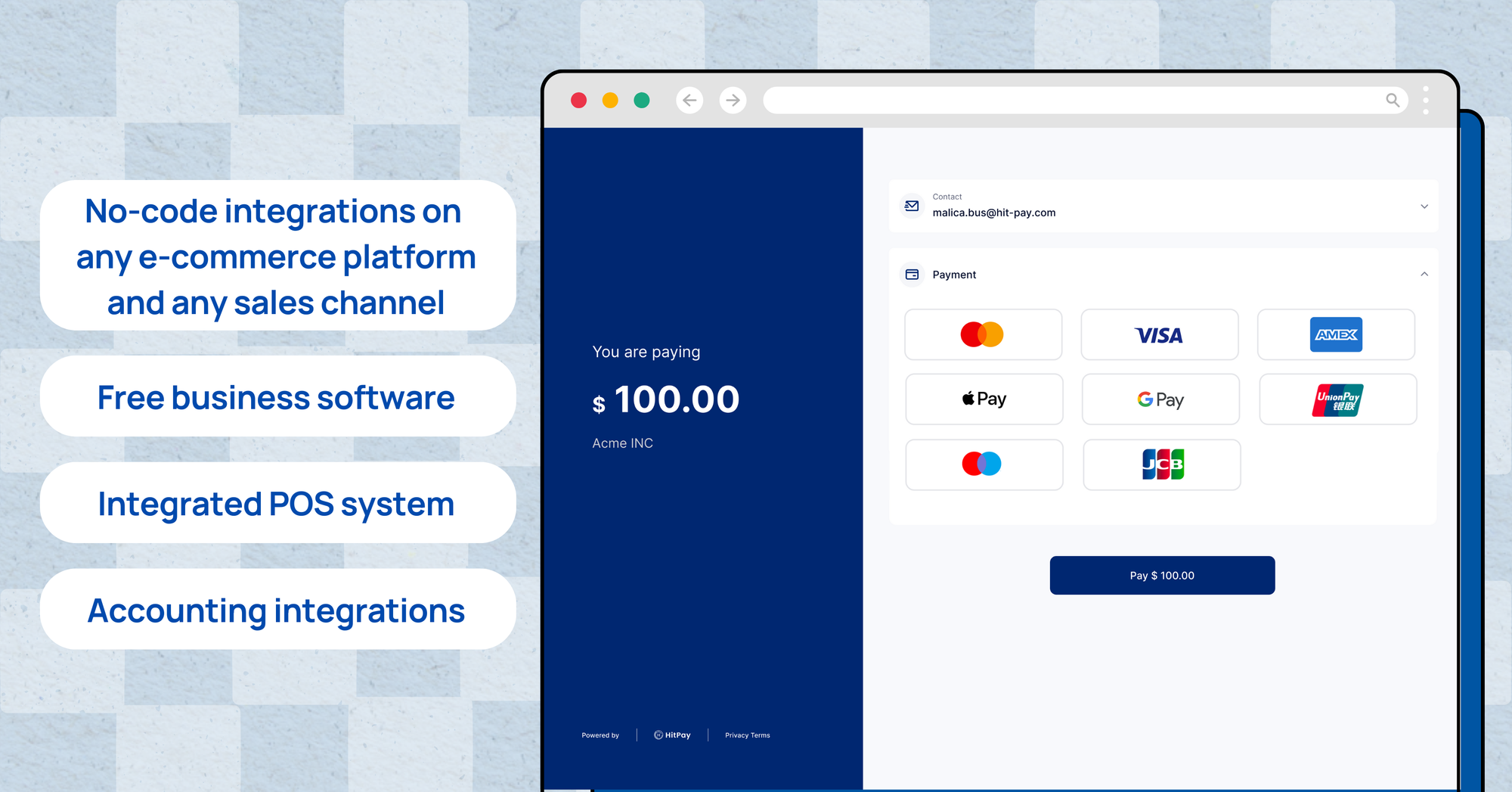

HitPay is a Singapore-based payment processor that offers a more affordable and more seamless alternative to PayPal NZ. HitPay is available in New Zealand and offers a number of features that make it a great option for small businesses and SMEs, including:

- No-code integrations on any e-commerce platform and any sales channel. HitPay makes it easy to accept payments on your website, social media, and even offline.

- Free business software. HitPay includes a suite of free business software, including recurring billing management, invoice generator, and an online store.

- Integrated POS system. HitPay's POS system makes it easy to sync your online and offline sales.

- Accounting integrations. HitPay integrates with Xero and Quickbooks, so you can easily track your finances.

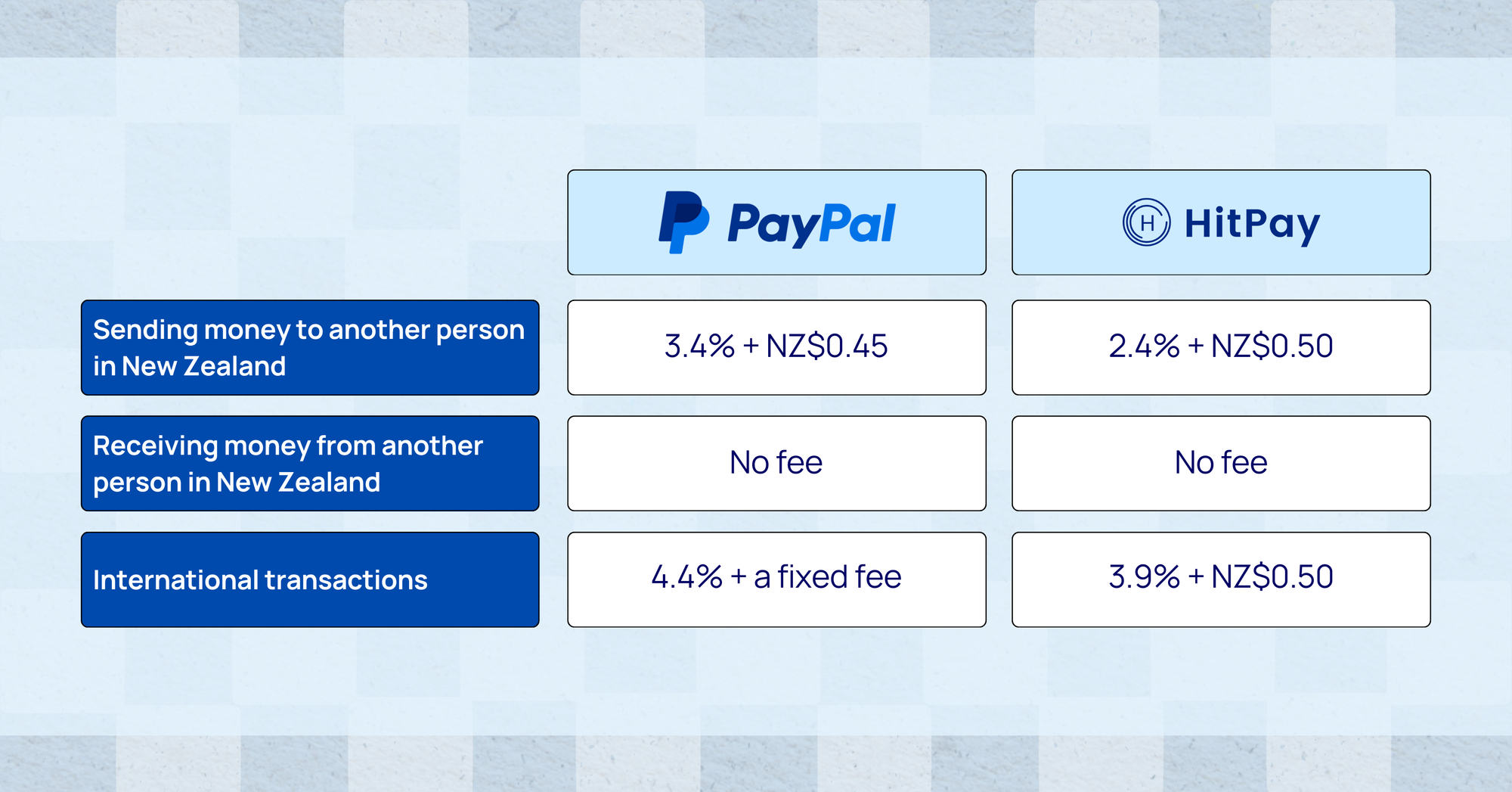

HitPay New Zealand Fees vs PayPal

HitPay charges the following fees for in-person payments in New Zealand:

- Domestic Cards: 2.4% + NZ$0.50 per transaction.

- International Cards: 3.9% + NZ$0.50 per transaction.

As you can see, HitPay's fees are significantly lower than PayPal NZ's fees. For example, PayPal NZ charges 3.4% + NZ$0.45 for sending money to another person in New Zealand.

This means that if you send NZ$100 to another person in New Zealand using PayPal NZ, you will pay a fee of NZ$3.85. However, if you use HitPay, you will only pay a fee of NZ$2.90.

Overall, HitPay is a great option for businesses and SMEs in New Zealand. It offers a comprehensive set of features, competitive pricing, and a commitment to security.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

- New Zealand Payment Gateway Comparison: Shopify vs. Stripe, PayPal and HitPay

- Shopify POS and HitPay review: Comparing the best POS systems for small businesses [2023]

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!