Automate subscription payments in Singapore with HitPay’s Recurring Billing

Running a membership-based or subscription business in Singapore? HitPay’s Recurring Billing helps you sell subscription plans and collect recurring payments from customers. You don’t even need a website to get started!

What you can do, at a glance:

- Accept recurring payments from customers

- Collect membership fees if you run a gym or a subscription-based business

- Create a single link with all recurring plan options on one page

- Track and collect recurring bills for a subscription-based product or service

Read on to learn how to create a recurring billing plan, save time by using templates, and how to automate payment reminders to customers. We also cover FAQs on subscription payments, like what to do if a card linked to a plan gets declined.

How to create a recurring billing plan with HitPay

Creating a new Recurring Plan

Step 1: Log in to your HitPay Dashboard. Select Recurring Plans and click on Create New.

Step 2: Fill in the relevant details for your new Recurring Plan

- Search Customer: Select the customer you want to create the recurring plan for. If you don’t have any customer profiles yet, you can create a customer in HitPay with the Customer tab (on the left-side menu).

- Plan Name: Give your new plan a name

- Description: Enter some information about the plan. For example, a candle-making business might offer a monthly subscription box.

- Renewal Cycle: Decide if the plan renews every week, month, or year.

- Selling Price: How much your customer pays for the plan

- Select Start Date: The first day of your customer’s billing cycle

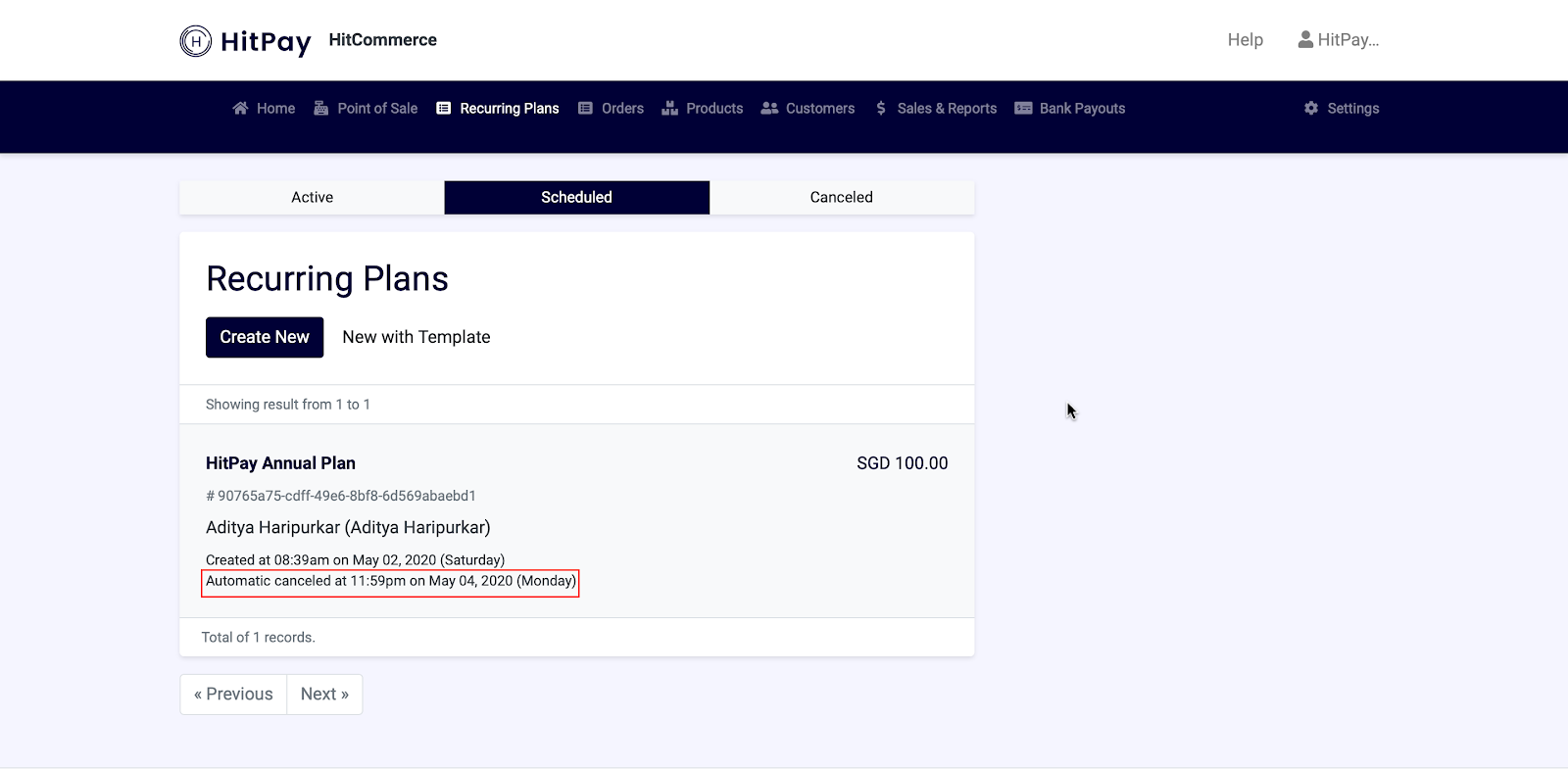

Step 3: Save and you're done! After creating your plan, the plan moves to the Scheduled tab, which becomes Active on the plan’s Start Date.

Important note: If your customer doesn’t attach a card or GIRO details to your recurring plan by the Start Date, the plan will be automatically cancelled. To help prompt customers, HitPay offers automated reminders — read more below!

Saving a new Recurring Plan Template

If you sell standardised subscription plans (e.g. gym memberships, monthly product boxes), a Recurring Plan Template can help you save time. Simply set up recurring billing for the plans you offer, for example: monthly, 6-month, and 12-month payment plans.

Here’s how to set up a Recurring Plan Template.

Step 1: From Recurring Plans, select the New with Template option.

Step 2: Click on Manage Template to create a new Recurring Plan Template.

Step 3: Set up your template. The process is similar to creating a new template for a single customer.

Step 4: Click Add Recurring Plan and you're done!

How to create a recurring billing plan with HitPay

Once you’ve created the recurring billing plan, customers need to attach their credit card or GIRO details (for DBS/POSB customers) by the start date. Otherwise, the plan will automatically be cancelled.

Fortunately, HitPay makes it easy to remind customers to attach their credit card or GIRO details. Here are three options:

Option 1: Email customers an invoice

Option 2: Share a plan link with your customer

Option 3: Assist customers with GIRO or direct debit setup (only for DBS/POSB accounts)

Option 1: Email customers an invoice

Click on Send Link to send an invoice to your customer through email. This sends an invoice, prompting them to include their card details to pay for the recurring plan.

Option 2: Share a plan link with your customer

Copy the plan link to share with your customer through email, WhatsApp, or social media direct messages.

Option 3: Assist customers with GIRO or direct debit setup (only for DBS/POSB accounts)

With HitPay, you can accept direct debit and GIRO payments from DBS/POSB customers without any additional setup.

If your customer is unsure how to set up recurring billing with GIRO, send them these steps:

Step 1: Click on the recurring billing invoice link. You will see a checkout page. with a unique bill reference number for you to add HitPay (our payment software provider) as a GIRO Billing organisation through the DBS/POSB Internet Banking’s website.

Step 2: Go to your DBS/POSB Internet Banking website and add HitPay as a GIRO billing organisation. Click on Pay > Add Giro Arrangement.

Step 3: Select HitPay from the dropdown list under Billing Organisation

Step 4: Paste the Bill Reference number from the HitPay recurring billing invoice link.

Step 5: Click Submit

And you’re done!

You’ll receive an email that looks like this once your merchant has deducted payment from your bank account.

FAQs about Recurring Billing

What happens if an attached card associated with an active plan gets declined?

If an attached card is declined on the scheduled charge date, your customer receives an email requesting them to update their card details using the link.

HitPay will also notify you by email about the failed charge.

Your customer has seven days to update their billing details to a valid card from the failed charge date. Otherwise, the recurring plan will be cancelled.

Will HitPay notify me when a customer has attached a card to a plan?

You’ll receive an email notification once a customer has attached a valid card to the plan. The plan also moves from Scheduled to Active in the HitPay dashboard.

You can view the customer’s billing and card details within the dashboard.

Will GIRO payments be available for other banks besides DBS/POSB?

Support for GIRO payments for other banks will be launched throughout 2022. Join our newsletter to stay updated!

Easily automate subscription payments with HitPay’s Recurring Billing

We’ve made HitPay’s Recurring Billing feature super simple to set up and run so you can free up more time and headspace on administrative tasks.

Spend less time manually collecting payments and tracking billing cycles from your customers and more time doing what you do best — growing your business!

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease.

Join our growing merchant community today!

![Perbandingan 13 Payment Link di Indonesia [2024]: Pilihan Metode Pembayaran Terbaik Untuk Bisnis Online Anda](/content/images/size/w720/2023/05/Newsletter-Design---2023-05-02T221135.775.png)