2023 POS Guide: Stripe, Zettle, Square, HitPay, eHopper POS for NZ

This article highlights the top free POS systems in New Zealand, detailing their features, advantages, and pricing.

A point-of-sale (POS) system is a software application that helps businesses track sales, manage inventory, and process payments.

POS systems can be used in a variety of retail and service businesses, including restaurants, bars, cafes, and shops.

Top 5 Free POS Software in New Zealand (2023)

- Stripe POS

- PayPal Zettle

- Square

- HitPay POS

- eHopper POS

Top 5 Free POS Software in New Zealand in 2023 (Detailed View)

1) Stripe POS

Stripe POS is a free point-of-sale system that allows businesses to accept credit and debit cards, as well as mobile payments. It also offers a variety of integrations with other business software, such as accounting and CRM systems.

Pros

- Free to use

- Transparent pricing

Cons:

- Some features are difficult to learn

- Mainly geared towards online businesses

Pricing:

- Free to use

- Processing fee of 2.9% plus 30 cents per transaction

- Processing fee of 2.7% plus 5 cents per in-person transaction

- BBPOS WisePOS E: NZ$49

- BBPOS WisePad 3: NZ$99

Overall, Stripe POS is a good option for businesses looking for a free and easy-to-use POS system. However, it is important to bear in mind that the processing fees can be high, and some features may be difficult to learn. Additionally, Stripe POS is mainly geared towards online businesses.

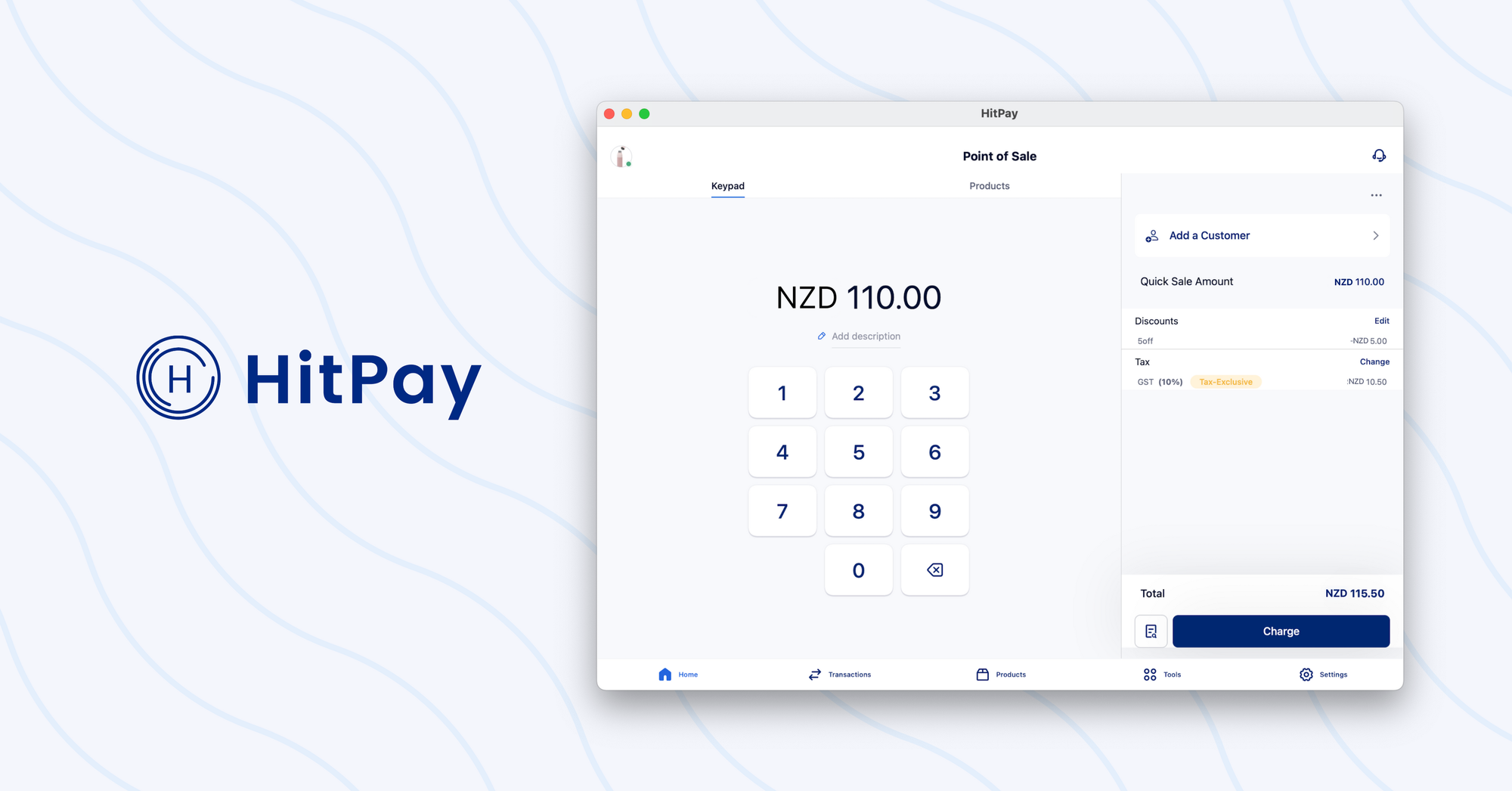

2) HitPay POS

HitPay has a wide range of credit card terminals to meet your needs, regardless of whether you need a standalone, mobile, or a terminal that can accept contactless payments.

Pros:

- Reliable, secure, and easy to use

- Fast and secure transactions

- Cost-effective solution

- No minimum-term contracts

- Free POS software

- Fast onboarding and delivery

- Lightweight and portable

- Customizable branding

- Real-time transaction monitoring

Cons:

- New entrant into the market in New Zealand

Pricing:

HitPay credit card terminals offer a number of benefits for small businesses, including easy setup, secure transactions, device compatibility, comprehensive guides, and Tap to Pay functionality.

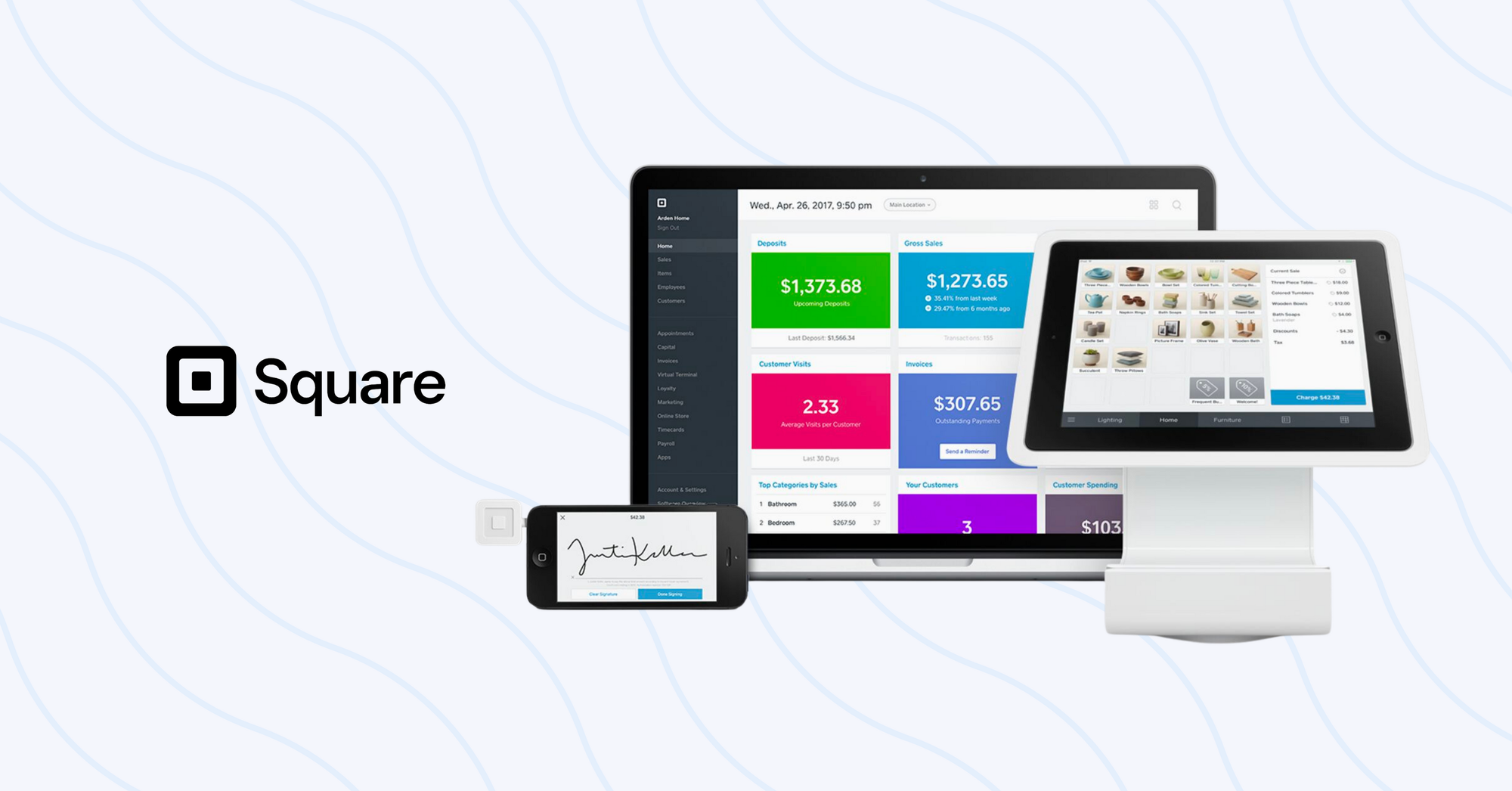

3) Square POS

Square POS is a free point-of-sale system that allows businesses to accept credit and debit cards, as well as mobile payments. It also offers a variety of integrations with other business software, such as accounting and CRM systems.

Pros:

- Free magstripe reader

- No monthly fees

- Operates offline

- Predictable and inexpensive rates

Cons:

- Irregular activity can lead to account freezes

- Afterpay processing fee is high

Pricing:

- Free magstripe reader

- 2.6% plus 10 cents per tap, dip, or swipe transaction

- 6% plus $0.30 per Afterpay transaction

Overall, Square POS is a good option for businesses that are looking for a free and easy-to-use POS system. However, it is important to keep in mind that the Afterpay processing fee is high, and irregular activity can lead to account freezes. Additionally, Square POS may not be the best option for businesses that need a lot of features or integrations.

4) PayPal Zettle POS

PayPal Zettle POS is a point-of-sale system that allows businesses to accept credit and debit cards, as well as mobile payments. It also offers inventory management and integrates with QuickBooks.

Pros:

- Cheap QR code payments

- Includes inventory management

- Accepts Venmo and PayPal QR code payments

- Integrates with QuickBooks

Cons:

- Limited to one plan; no add-ons

- Must pay for hardware

Pricing:

- $29 for the first card reader

- $79 for subsequent card readers

- 2.29% plus 9 cents per card-present transaction

- 1.9% plus 10 cents per transaction for transactions $10.01 and above

- 2.4% plus 5 cents per transaction for transactions $10 and below

Overall, PayPal Zettle POS is a good option for businesses that are looking for a POS system with cheap QR code payments and inventory management. However, it is important to keep in mind that there is only one plan available, and businesses must pay for hardware.

5) eHopper POS

eHopper POS is a point-of-sale system that allows businesses to accept credit and debit cards, as well as mobile payments. It also offers inventory management, customer management, and basic reporting.

Pros:

- Free card processing

- Includes free payment terminal and e-commerce site

- Android, iOS, and Windows compatible

Cons:

- Customer service complaints and no customer support with the free plan

- Reportedly buggy features

Pricing:

- Free plan:

- 1 POS

- 50 products

- 300 transactions per month

- Inventory management

- Tip management

- Customer management

- Basic reporting

- Modifier management

- Paid plans:

- Start at $29 per month

Overall, eHopper POS is a good option for businesses in the U.S. that are looking for a free POS system with free card processing. However, it is important to keep in mind that there have been customer service complaints and reports of buggy features. Additionally, businesses that choose the free plan will not have access to customer support.

How much does a POS system cost?

The cost of a POS system can vary depending on a number of factors, including:

- The type of POS system: Cloud-based POS systems are typically more affordable than on-premise POS systems. On-premise POS systems require upfront hardware costs, but they may be more cost-effective in the long run for businesses with high transaction volumes.

- The features you need: POS systems can offer a variety of features, such as inventory management, customer relationship management (CRM), and employee management. The more features you need, the more expensive the POS system is likely to be.

- The size of your business: POS systems designed for small businesses are typically less expensive than POS systems designed for large businesses. This is because small businesses typically have less complex needs.

- The brand: Some POS brands are more expensive than others. This is often due to the brand's reputation and the quality of its products and services.

Payment structure

There are two main types of payment structures for POS systems: subscription-based and transaction-based.

- Subscription-based POS systems charge a monthly or annual fee for access to the software. This fee typically includes all of the features of the POS system, as well as any updates or support.

- Transaction-based POS systems charge a fee for each transaction that is processed through the system. This fee is typically a percentage of the transaction amount.

Some POS systems use a combination of subscription and transaction fees. For example, a POS system might charge a monthly subscription fee for access to the software, and then charge a small transaction fee for each credit card transaction.

Which payment structure is best for you depends on your specific needs and budget. If you are a small business with a low transaction volume, then a subscription-based POS system may be the best option for you. If you are a large business with a high transaction volume, then a transaction-based POS system may be the best option for you.

| Payment structure | Description | Pros | Cons |

|---|---|---|---|

| Subscription-based | Pay a monthly or annual fee for access to the software. | Predictable monthly costs. All features of the POS system are included. | Can be more expensive than transaction-based POS systems for businesses with high transaction volumes. |

| Transaction-based | Pay a fee for each transaction that is processed through the system. | Fees are only charged when you make a sale. Can be more cost-effective for businesses with high transaction volumes. | Can be difficult to budget for monthly costs. Fees can add up over time. |

What are the benefits of using a POS system?

1) Increased efficiency

POS systems can help businesses to increase their efficiency by automating many of the tasks that are involved in processing sales. For example, POS systems can automatically calculate taxes, discounts, and shipping costs. They can also generate invoices and receipts. This can free up employees to focus on other tasks, such as customer service and sales.

2) Improved customer service

POS systems can help businesses to improve their customer service by providing them with a better understanding of their customers' needs and preferences. For example, POS systems can track customer purchase history and identify trends. This information can be used to create targeted marketing campaigns and offer personalized recommendations to customers.

3) Better inventory management

POS systems can help businesses to better manage their inventory by tracking the quantity of items in stock and generating alerts when stock levels are low. This can help businesses to avoid stockouts and ensure that they always have the products that their customers want on hand.

4) More accurate financial tracking

POS systems can help businesses to more accurately track their finances by recording all sales and expenses. This information can be used to generate financial reports that can help businesses to make informed decisions about their operations.

5) Enhanced security

POS systems can help businesses to enhance their security by encrypting sensitive data, such as credit card numbers. This can help to protect businesses from data breaches and fraud.

How to choose a POS system

Choosing a POS system can be a daunting task, but it is important to take the time to choose the right system for your business. Here are a few important factors to consider when selecting a POS system:

1) Consider the features you need

When choosing a POS system, it is important to consider the features that you need. Some of the most common features include:

- Inventory management: This feature tracks the quantity of items in stock and generates alerts when stock levels are low.

- Customer relationship management (CRM): This feature tracks customer purchase history and identifies trends. This information can be used to create targeted marketing campaigns and offer personalized recommendations to customers.

- Employee management: This feature tracks employee time and attendance and generates payroll reports.

- Payment processing: This feature integrates with credit card processors and allows businesses to accept payments from customers.

- Reporting: This feature generates reports on sales, inventory, and other business data.

2) Consider the size of your business

The size of your business is another important factor to consider when choosing a POS system. If you are a small business, you may not need a POS system with all of the bells and whistles. You may be able to get away with a more basic system.

However, if you are a large business, you will need a POS system that can handle a high volume of transactions and provide you with the data and insights you need to make informed decisions about your business.

3) Consider your budget

POS systems can range in price from a few hundred dollars to tens of thousands of dollars. It is important to set a budget before you start shopping for a POS system.

When setting your budget, be sure to factor in the cost of the hardware, software, and any additional features you may need.

4) Consider the compatibility of the system with your existing hardware and software

If you already have some hardware or software in place, such as a credit card processor or accounting system, you will need to make sure that the POS system you choose is compatible with your existing systems.

Many POS systems offer integration with popular hardware and software solutions. However, it is always best to check with the POS system vendor to make sure that the system is compatible with your specific needs.

How do I set up a POS system?

Once you have chosen a POS system, the next step is to set it up. This process can vary depending on the system you choose, but most systems will come with instructions. You may also need to purchase some additional hardware, such as a credit card reader or POS terminal.

Here are the general steps on how to set up a POS system:

- Choose a location for your POS system. The POS system should be placed in a central location where it is easily accessible to your employees and customers.

- Unpack the hardware and software. Make sure that you have all of the necessary hardware and software before you start setting up the system.

- Install the hardware. This may include connecting the credit card reader, POS terminal, cash drawer, and receipt printer to your computer.

- Install the software. Follow the instructions that came with the software to install it on your computer.

- Configure the system. This will include setting up your product catalog, tax rates, and payment processing settings.

- Train your employees. Make sure that your employees know how to use the POS system to process sales, manage inventory, and generate reports.

- Test the system. Process a few test sales to make sure that the system is working properly.

- Launch the system. Once you are satisfied that the system is working properly, you can start using it to process sales.

As New Zealand businesses scan the horizon for a credit card machine that combines efficiency with economy, HitPay stands out with its no-rental, pay-per-transaction model, especially for those just stepping into the digital payment arena.

While Stripe POS, PayPal Zettle, Square, and eHopper POS each bring their own strengths to the table, the streamlined simplicity and cost-effective approach of HitPay could well tip the scales for savvy business owners looking to modernize their payment systems without overcommitting resources.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

- New Zealand Payment Gateway Comparison: Shopify vs. Stripe, PayPal and HitPay

- Sell Digital Products Online with the HitPay Online Store

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!