Guide to credit card chargebacks on HitPay — How to prevent fraudulent disputes on your store

Learn how chargebacks work, and how HitPay protects you from fraudulent transactions and chargeback fees.

Chargebacks (also known as disputes) help protect customers from fraudulent transactions made on their credit card.

Unfortunately, merchants suffer when fraudsters take advantage of the chargeback process — getting back their payment even though they've received the product.

Read on to understand what chargebacks are, how they work, and how HitPay protects merchants from fraudulent chargebacks.

What's a chargeback?

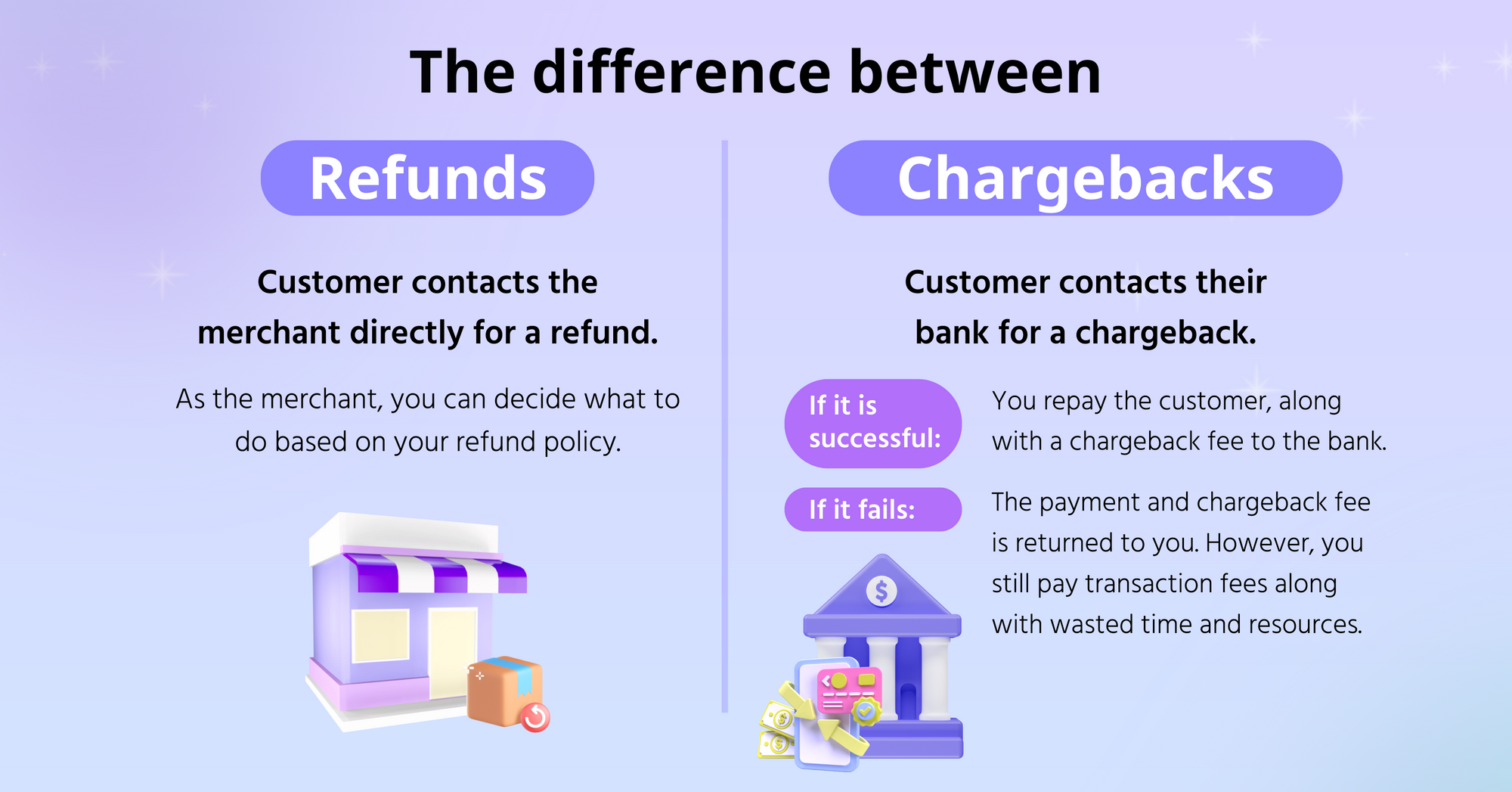

A chargeback happens when a customer disputes a transaction on their credit card. For example, a customer may have received a damaged product. They can then contact their bank for a chargeback. The bank immediately reverses the charge — returning the money paid to the merchant, with an additional chargeback fee.

This is different from a refund, where the customer contacts the merchant directly. Based on the merchant's refund policy, the merchant might choose to reject the customer's refund request.

For chargebacks, the customer files the dispute with their bank or card issuer.

- If the chargeback is successful, the merchant returns the payment to the customer and pays a chargeback fee to the bank/card issuer.

- If the chargeback fails, the payment and chargeback fee is returned to the merchant. However, merchants still suffer from transaction fees as well as wasted time and resources.

Chargeback fees — Why did I get charged, and how much do they cost?

Banks enforce chargeback fees in return for managing the chargeback process. It's also meant to encourage merchants to fix customer issues that lead to chargebacks.

However, most chargebacks favour the customer — reversing the payment before the dispute is proven to be valid.

How much chargebacks really cost

Whenever a customer files a chargeback on your store, you get a chargeback fee — which often ranges from US$15 and above.

If the customer wins the chargeback and keeps the product, you also lose the revenue and potential profit from that product.

Even if you win the chargeback dispute, you still make a loss from transaction fees as well as wasted time and resources.

How HitPay protects you from fraudulent chargebacks

We understand how frustrating chargebacks can be — especially when they're not justified. To protect merchants, HitPay implements 3D Secure as the default requirement for all online card transactions.

3D Secure adds another verification layer for online card transactions. Most importantly, 3D Secure helps merchants avoid liability for fraudulent chargebacks.

What this means for customers: When making a purchase online, customers must complete an extra step to prove that it's really them making the transaction.

For example, by entering a one-time password (OTP) sent to their mobile number.

What this means for merchants: With 3D Secure, the liability for fraudulent chargebacks shifts from merchants to the bank.

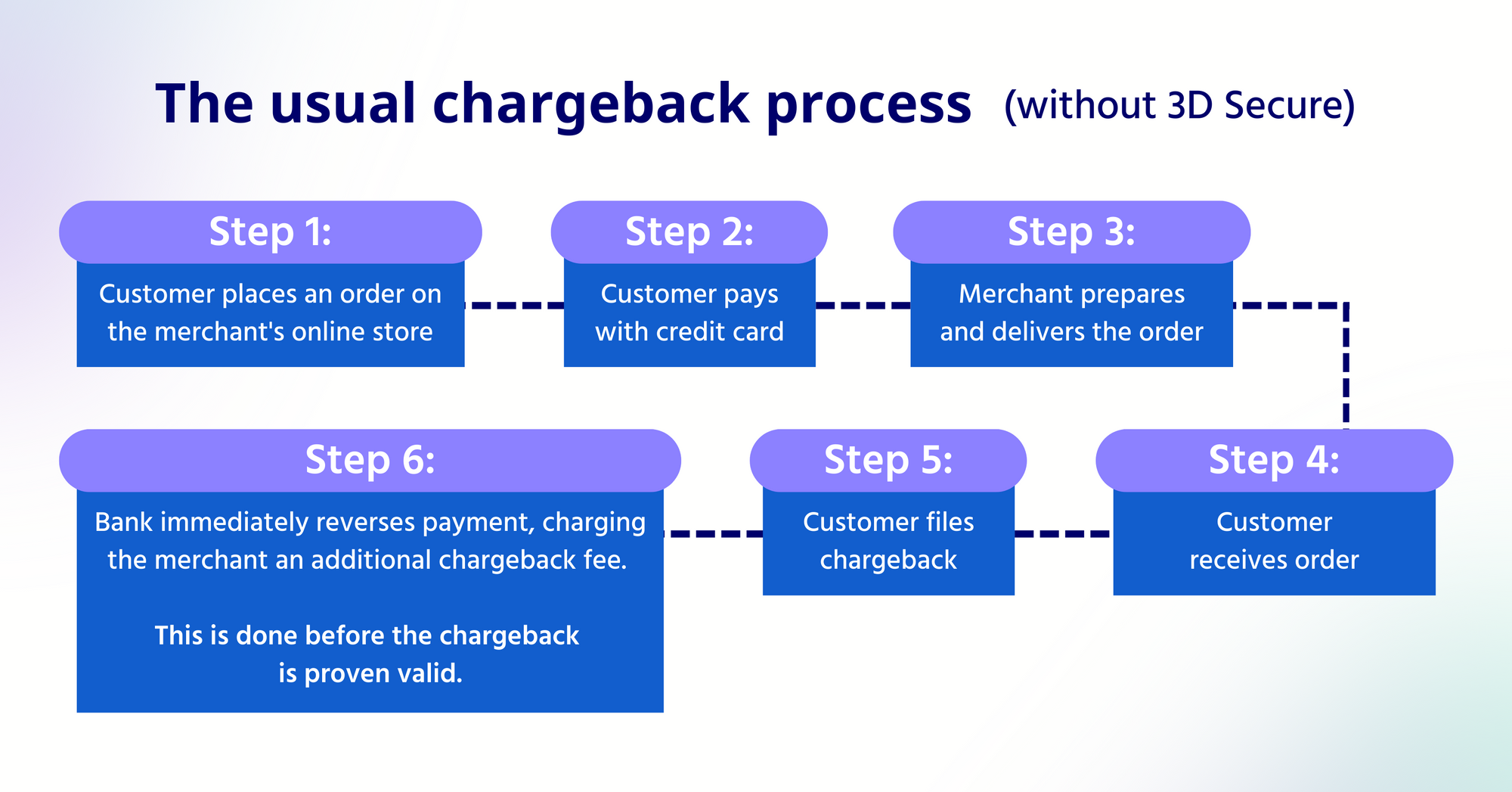

The usual chargeback process (without 3D secure)

Step 1: Customer places an order on the merchant's online store

Step 2: Customer pays with credit card

Step 3: Merchant prepares and delivers the order

Step 4: Customer receives order

Step 5: Customer files chargeback

Step 6: Bank immediately reverses payment, charging the merchant an additional chargeback fee. This is done even before the chargeback is proven to be valid.

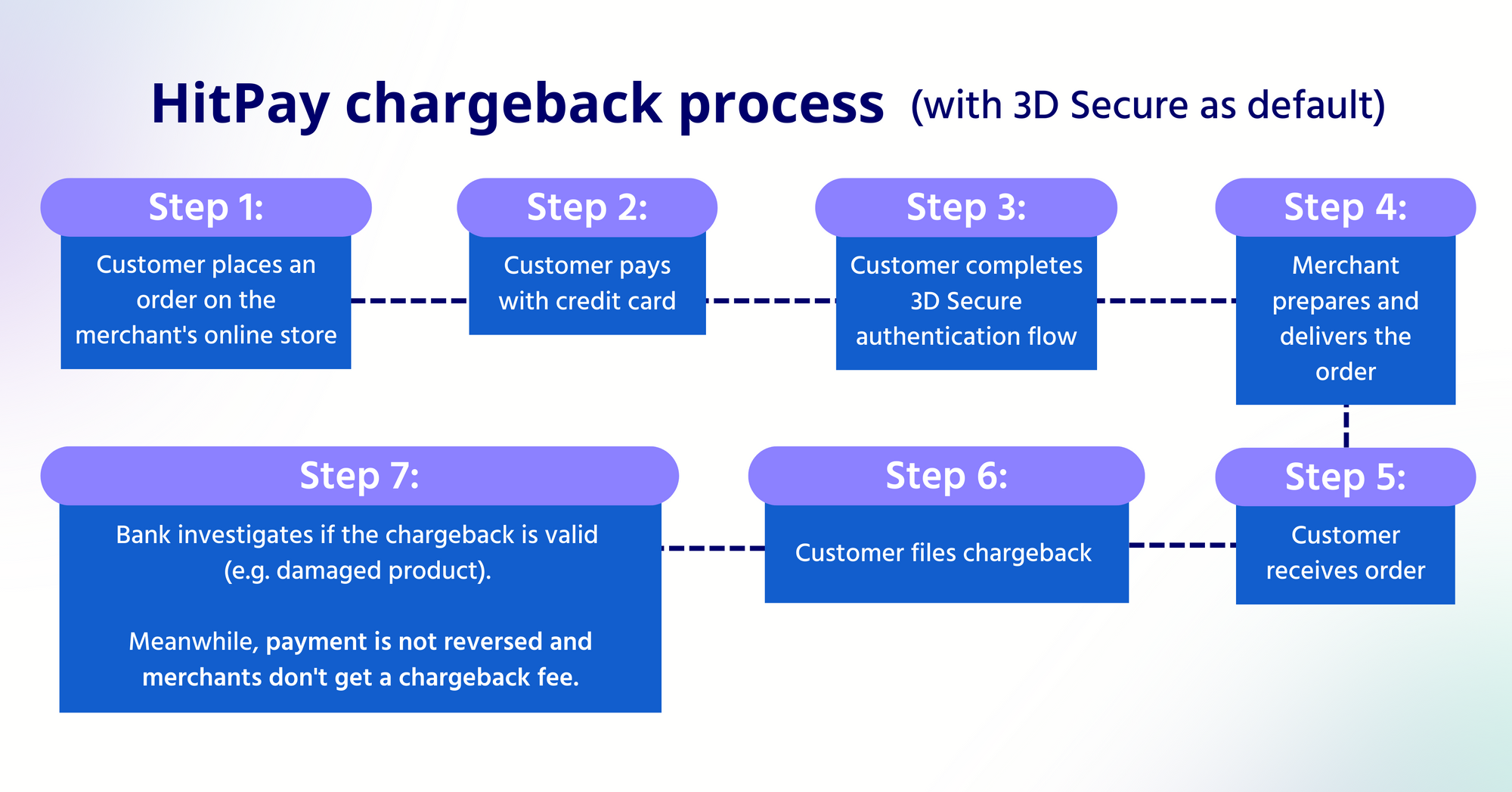

The HitPay chargeback process (with 3D secure as default)

Step 1: Customer places an order on the merchant's online store

Step 2: Customer pays with credit card

Step 3: Customer completes 3D Secure authentication flow

Step 4: Merchant prepares and delivers the order

Step 5: Customer receives order

Step 6: Customer files chargeback

Step 7: Bank investigates if the chargeback is valid (e.g. damaged product).

In the meantime, the payment is not reversed and merchants don't get a chargeback fee.

With 3D Secure, it's a lot harder for scammers win a fraudulent chargeback, as the bank needs to investigate if the dispute is valid.

Do note that 3DS does not prevent all chargebacks, only fraudulent ones. If a transaction is 3DS authenticated and a chargeback is filed, this is usually not due to fraud but due to a valid dispute — for example, a defective product.

HitPay Chargeback FAQs

What should I do if I get chargeback fee?

You'll only be charged a chargeback fee if the bank finds that the chargeback dispute is valid. Here's what you can do:

- Contribute additional evidence

You might be able to submit evidence to prove that the charge is valid. Check directly with your customer's bank for details on the process. - Contact the customer

Reach out to the customer directly.

If the customer decides to drop the chargeback, they must contact their bank to cancel the dispute.

Alternatively, you can offer a refund (and avoid the bank's chargeback fee). - Accept the chargeback

If you agree that a chargeback is valid, you can accept it and take steps to prevent future chargebacks.

Does 3D Secure apply for offline payments?

3D Secure only applies to online card payments. Offline card payments (e.g. using credit card terminals) are at lower risk of fraud, as the sale is made in-person.

Does 3D Secure apply for alternative payment methods?

Alternative payment methods may include e-wallets and BNPL installments.

Unlike credit cards, alternative payment methods don't trigger an immediate chargeback (and chargeback fee) when a customer files a dispute. Customers must put in effort to prove the validity of their dispute and get the payment reversal. This greatly lowers the possibility of fraudulent chargebacks.

Have more questions about preventing fraudulent chargebacks?

We're always happy to help. Get in touch with the HitPay team at support@hit-pay.com.

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease.

Join our growing merchant community today!

![Perbandingan 13 Payment Link di Indonesia [2024]: Pilihan Metode Pembayaran Terbaik Untuk Bisnis Online Anda](/content/images/size/w720/2023/05/Newsletter-Design---2023-05-02T221135.775.png)