The Ultimate Guide to Payment Gateways for NZ BigCommerce Stores (2023)

This guide discusses payment gateways for BigCommerce in New Zealand, highlighting Stripe, PayPal, and HitPay. Learn about their features, pros, and cons for secure online transactions.

BigCommerce is an open SaaS e-commerce platform that allows businesses to create and manage their online stores. It offers a wide range of features and integrations, including a variety of payment gateways. A payment gateway is a service that processes payments for online businesses.

In this guide, we will cover everything you need to know about payment gateways, including what they are, why they are important, and how to choose the right one for your BigCommerce store.

We will also take a closer look at HitPay, a popular BigCommerce payment gateway with a variety of features and benefits.

What is a payment gateway?

A payment gateway is a service that authorizes and processes payments for online businesses. When a customer makes a purchase online, the payment gateway encrypts their payment information and sends it to the merchant's bank for authorization.

Once the authorization is approved, the payment gateway sends the payment to the merchant's bank account. Payment gateways are essential for online businesses because they allow them to accept payments from customers from all over the world and provide a secure and convenient checkout experience.

Benefits of payment gateways for NZ businesses

There are many benefits of using a payment gateway for New Zealand businesses, including:

- Convenience: Payment gateways allow customers to pay for goods and services online quickly and easily. This can lead to increased sales and revenue for businesses. For example, a New Zealand-based online retailer can use a payment gateway to accept payments from customers in New Zealand dollars using popular payment methods such as Visa, Mastercard, Amex and Apple Pay.

- Security: Payment gateways use encryption and other security measures to protect customer's payment information. This can help to reduce fraud and chargebacks. For example, a New Zealand-based business that sells subscription products or services can use a payment gateway to set up recurring billing without having to worry about the security of their customers' payment information.

- Compliance: Payment gateways can help businesses comply with PCI and other payment industry regulations. For example, a New Zealand-based business that sells digital products or services can use a payment gateway to accept payments from customers all over the world while still complying with all applicable regulations.

- Global reach: Payment gateways can allow businesses to accept payments from customers all over the world. This can help businesses to expand their reach and increase their sales. For example, a New Zealand-based business that wants to improve the customer experience can use a payment gateway to offer a faster and more secure checkout process, which can lead to more repeat and referred customers.

- Improved customer experience: Payment gateways can help to improve the customer experience by providing a seamless and secure checkout process. For example, a New Zealand-based business that wants to accept payments from customers in multiple currencies can use a payment gateway to do so without having to worry about the complexity of currency conversion.

Overall, payment gateways can provide a number of benefits for New Zealand businesses of all sizes. By using a payment gateway, businesses can improve the customer experience, increase sales, and expand their reach.

How to choose a payment gateway for your BigCommerce store?

To choose the best payment gateway for your BigCommerce store, there are a few factors you will need to consider:

1. The payment methods you want to offer:

Make sure the payment gateway you choose supports the payment methods that your customers want to use. Some popular payment methods include Visa, Mastercard, Amex and Apple Pay. If you are selling to customers in multiple countries, you may also want to consider offering country-specific payment methods.

2. The transaction fees:

Payment gateways charge transaction fees, so it is important to compare the fees of different gateways before choosing one. Some gateways have lower transaction fees for high-volume businesses, while others have lower fees for specific payment methods.

3. The features and services offered:

Some payment gateways offer a wide range of features, while others offer a more basic set. Some of the most common features and services offered by payment gateways include:

- Recurring billing: This allows you to automatically charge your customers for a subscription or other recurring payment. It simplifies subscription management for businesses as you can manage subscription plans, with multiple billing cycle options such as weekly, monthly, and annual.

- Fraud protection: This helps to protect your business from fraudulent transactions.

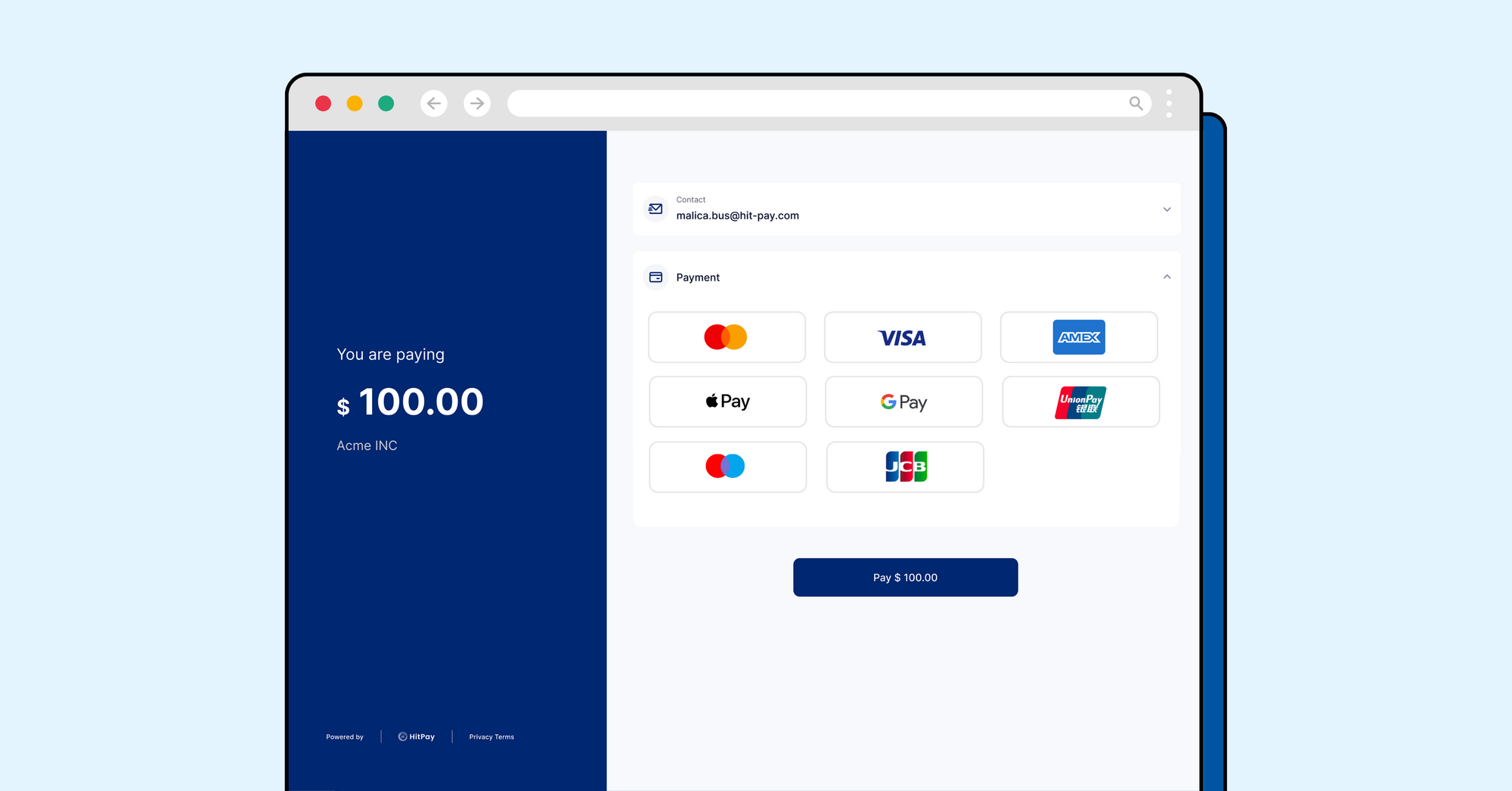

- International payments: This allows you to accept payments from customers in other countries by using payment methods such as Visa, Mastercard, Amex, Apply Pay, Google Pay, Union Pay, Maestro and JCB.

- Reporting and analytics: This provides you with data on your transactions, so you can track your sales and identify areas for improvement.

- Chargeback protection: This protects you from chargebacks, which are disputes filed by customers who claim that they did not authorize a transaction.

4. The security and fraud protection measures:

Make sure the payment gateway you choose uses strong security measures to protect your customers' payment information. Some gateways offer features such as tokenization and fraud detection to help protect your business from fraud.

5. The level of customer support:

Make sure the payment gateway you choose offers good customer support in case you have any problems. Read reviews from other merchants to see what they have to say about the customer support of different gateways.

Once you have considered all of the factors above, you will be able to choose the best payment gateway for your BigCommerce store.

HitPay and BigCommerce

HitPay is a one-stop, omnichannel payments platform built for small businesses and SMEs. Founded in Singapore, HitPay has just launched in New Zealand and the BigCommerce payment gateway integration is coming soon. HitPay offers a wide range of features and benefits, including:

- No-code integrations with major e-commerce platforms and sales channels

- Free business software, including recurring billing management, invoice generator, and online store

- Integrated POS system to automatically sync online and offline sales

- Accounting integrations with Xero and Quickbooks

Pros

- No setup or monthly fees

- Competitive transaction fees

- Easy to use and integrates with major e-commerce platforms and sales channels

- Free business software, including recurring billing management, invoice generator, and online store

- Integrated POS system to automatically sync online and offline sales

- Accounting integrations with Xero and Quickbooks

Cons

- Afterpay is not yet available, but it is coming soon in Q1 2024

- Whilst HitPay is well-established in Singapore and Southeast Asia (15.000+ customers), it is a relatively new company in New Zealand

HitPay is a good payment gateway option for small businesses in New Zealand who are looking for a comprehensive and affordable payment gateway.

HitPay offers a wide range of features and benefits, including no setup or monthly fees, competitive transaction fees, ease of use, and integration with major e-commerce platforms and sales channels.

HitPay also offers free business software and an integrated POS system. While HitPay is a relatively new company, it is a good option for small businesses in New Zealand who are looking for a comprehensive and affordable payment gateway.

You can register your interest for the HitPay BigCommerce integration here.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

- New Zealand Payment Gateway Comparison: Shopify vs. Stripe, PayPal and HitPay

- Sell Digital Products Online with the HitPay Online Store

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!