Compare Most Affordable Payment Gateways in New Zealand: HitPay, Shopify Payments, PayPal, Paystation, and Paymate

The article discusses the benefits of using a payment gateway for your New Zealand business, and compares the fees of different payment gateways available in New Zealand. HitPay is one of the most affordable payment gateways in New Zealand, with a transaction fee of 2.4% + 30 cents per transaction.

A payment gateway is a third-party service that allows merchants to accept credit and debit card payments online.

It acts as a middleman between the merchant's website and the customer's bank, encrypting the customer's sensitive data and processing the payment.

Why is it important for New Zealand businesses?

A payment gateway is an essential tool for any New Zealand business that wants to grow and succeed. It provides a secure and convenient way for customers to pay for products and services, and it can help businesses to automate their payments and get detailed reports.

Here are some of the specific benefits of using a payment gateway for your New Zealand business:

- Accept payments from customers all over the world: A payment gateway allows you to accept payments from customers in different countries, which can help you to expand your business internationally.

- Offer a variety of payment methods: Payment gateways allow you to offer a variety of payment methods to your customers, such as credit cards, debit cards, and online payment services.

- Automate your payments: Payment gateways can automate your payments, which can save you time and money.

- Get detailed reports: Payment gateways provide detailed reports of your transactions, which can help you to track your sales and identify trends.

- Reduce the risk of fraud: Payment gateways use fraud protection measures to help protect your business from fraudulent transactions.

- Comply with PCI security standards: Payment gateways help you to comply with PCI security standards, which are important for protecting your customers' data.

Overall, a payment gateway is a vital tool for any New Zealand business that wants to succeed in the global marketplace. Here are some examples of how New Zealand businesses can use payment gateways to their advantage:

- An online retailer can use a payment gateway to accept payments from customers all over the world, without having to set up their own merchant account with each bank.

- A brick-and-mortar store can use a payment gateway to accept online payments from customers, and to process mobile payments in-store.

- A subscription business can use a payment gateway to automate recurring billing.

- A tourism operator can use a payment gateway to accept payments from international visitors.

Can I build my own payment gateway?

Yes, you can build your own payment gateway. However, it is not recommended for most businesses.

Building a payment gateway is a complex and expensive process. It is also important to note that payment gateways must be PCI compliant in order to process credit card payments. PCI compliance is a set of security standards that are designed to protect customer data.

Why are payment gateways so expensive?

Payment gateways are expensive because they provide a valuable service. They allow merchants to accept payments from customers all over the world and they protect customer data from fraud as outlined below:

- Security: Payment gateways must be PCI compliant in order to process credit card payments. PCI compliance is a set of security standards that are designed to protect customer data. Maintaining PCI compliance is expensive for payment gateways.

- Fraud protection: Payment gateways use fraud protection measures to help protect merchants from fraudulent transactions. Fraud protection measures can be expensive to develop and implement.

- Technology: Payment gateways must use the latest technology to process payments securely and efficiently. Investing in new technology can be expensive for payment gateways.

- Customer support: Payment gateways must offer good customer support to merchants and customers. Providing good customer support can be expensive for payment gateways.

Payment gateway fees explained

The pricing structure of payment gateways can vary depending on the type of merchant and the volume of transactions. Generally, payment gateways will charge merchants for the following:

- Transaction fees: Payment gateways charge a transaction fee for each payment that they process. Transaction fees typically range from 2% to 3% of the total transaction amount.

- Setup fees: Some payment gateways charge a setup fee for new merchants. Setup fees can range from a few hundred dollars to a few thousand dollars.

- Monthly fees: Some payment gateways (not HitPay) charge a monthly fee for their services. Monthly fees can range from a few dollars to a few hundred dollars.

Tips on how to reduce payment gateway fees

Payment gateway fees can be a significant expense for businesses, especially those that process a high volume of transactions. However, there are a number of ways that businesses can reduce these fees.

- Compare the fees of different payment gateways: There are many different payment gateways available, so merchants should compare the fees of different providers before choosing one.

- Negotiate with payment gateways: Merchants who process a high volume of transactions may be able to negotiate lower transaction fees with payment gateways.

- Use a payment gateway that is offered by your bank or credit card company: Some banks and credit card companies offer their customers free or discounted payment gateways.

- Consider using a local payment gateway: Local payment gateways may offer lower fees than international payment gateways.

Which payment gateway charges the least in New Zealand?

HitPay is a New Zealand-based payment gateway that charges a transaction fee of 2.4% + 30 cents per transaction. This makes it one of the most affordable payment gateways in New Zealand.

Top 5 payment gateways in New Zealand

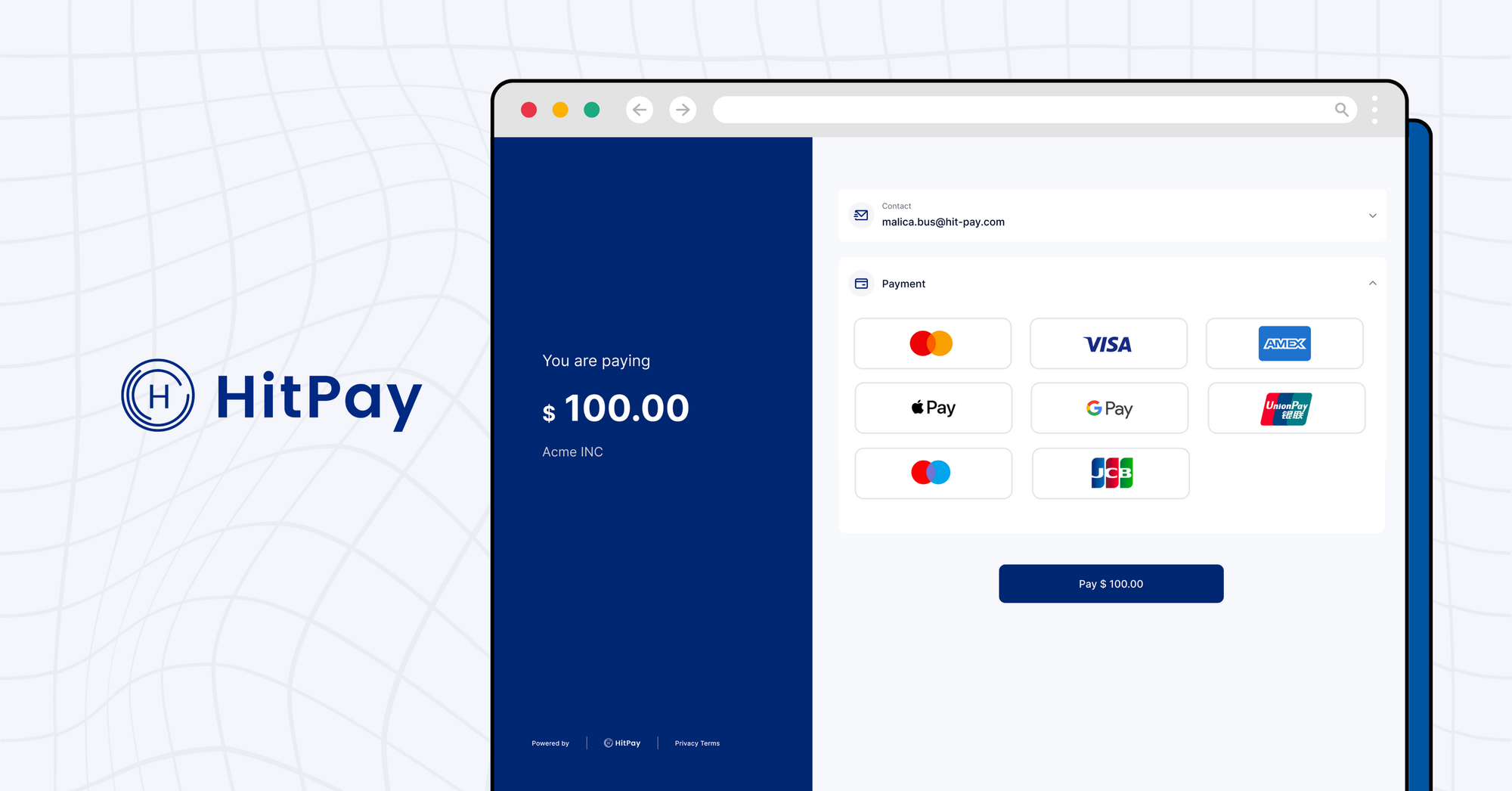

1) HitPay

HitPay is a new payment platform for small businesses and SMEs that allows them to accept payments from all channels, including e-commerce, social media, and in-person.

It offers free business software, including recurring billing management, invoice generator, and an online store. It also has an integrated point-of-sale (POS) system that automatically syncs online and offline sales.

HitPay is newer in New Zealand than some other payment gateways, but it offers the most competitive fees. For in-person payments in New Zealand, HitPay charges 2.4% + NZ$0.50 per transaction for domestic cards and 3.9% + NZ$0.50 per transaction for international cards.

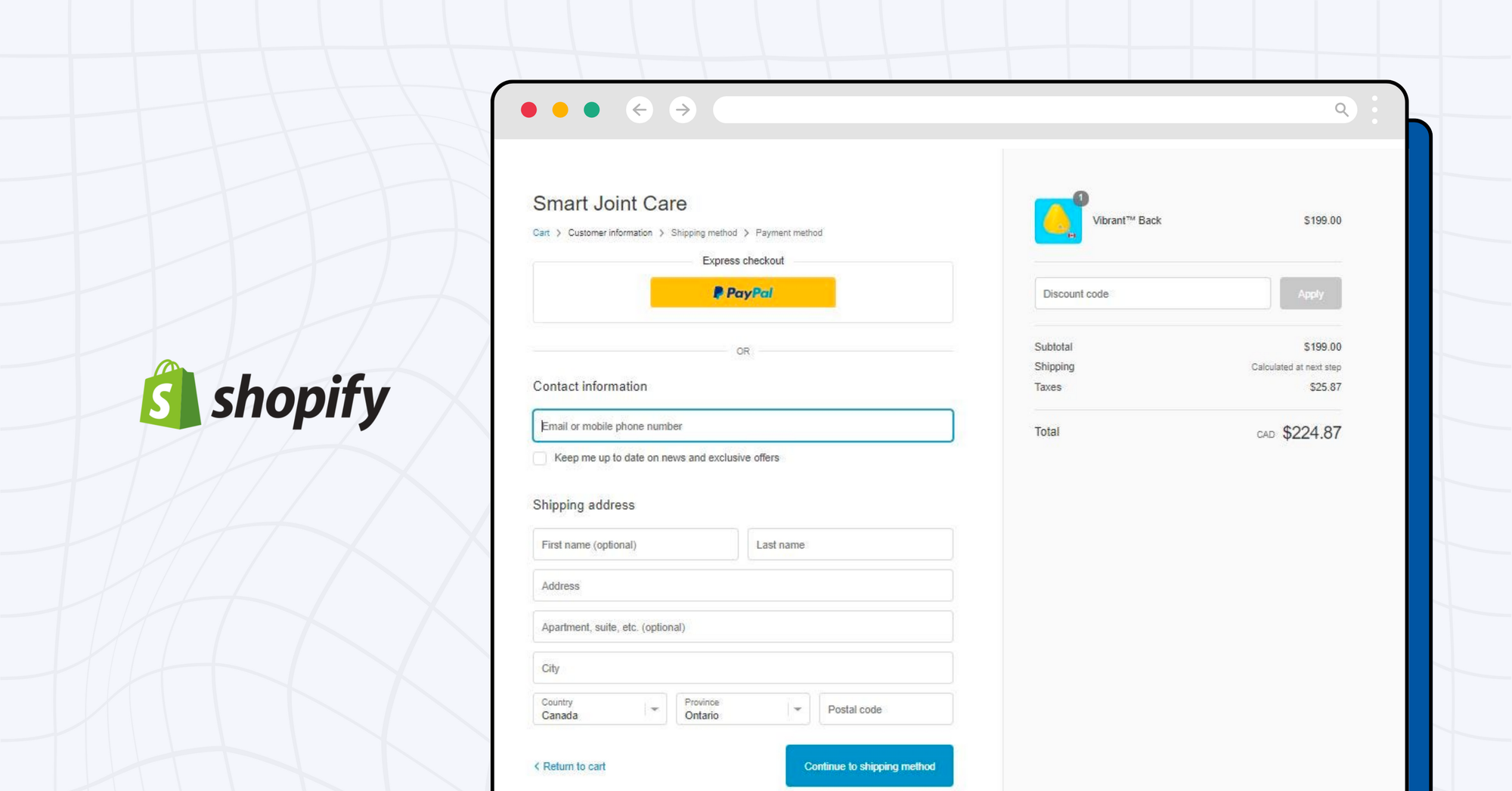

2) Shopify Payments

Shopify Payments is a payment gateway that is integrated with Shopify, making it easy for Shopify store owners to accept payments from their customers.

It is easy to set up and use, secure, and PCI compliant. It is also integrated with Shopify, so merchants can manage their payments and orders from one place.

However, Shopify Payments is not available in all countries and may not offer all of the features that some Shopify store owners need. It also charges a transaction fee of 2.9% + 30 cents per transaction for online payments and 2.6% + 30 cents per transaction for in-person payments.

Additionally, if you sell in multiple currencies, Shopify Payments will convert your customers' payments to your store's currency at the current exchange rate, with a 2.5% fee for currency conversion.

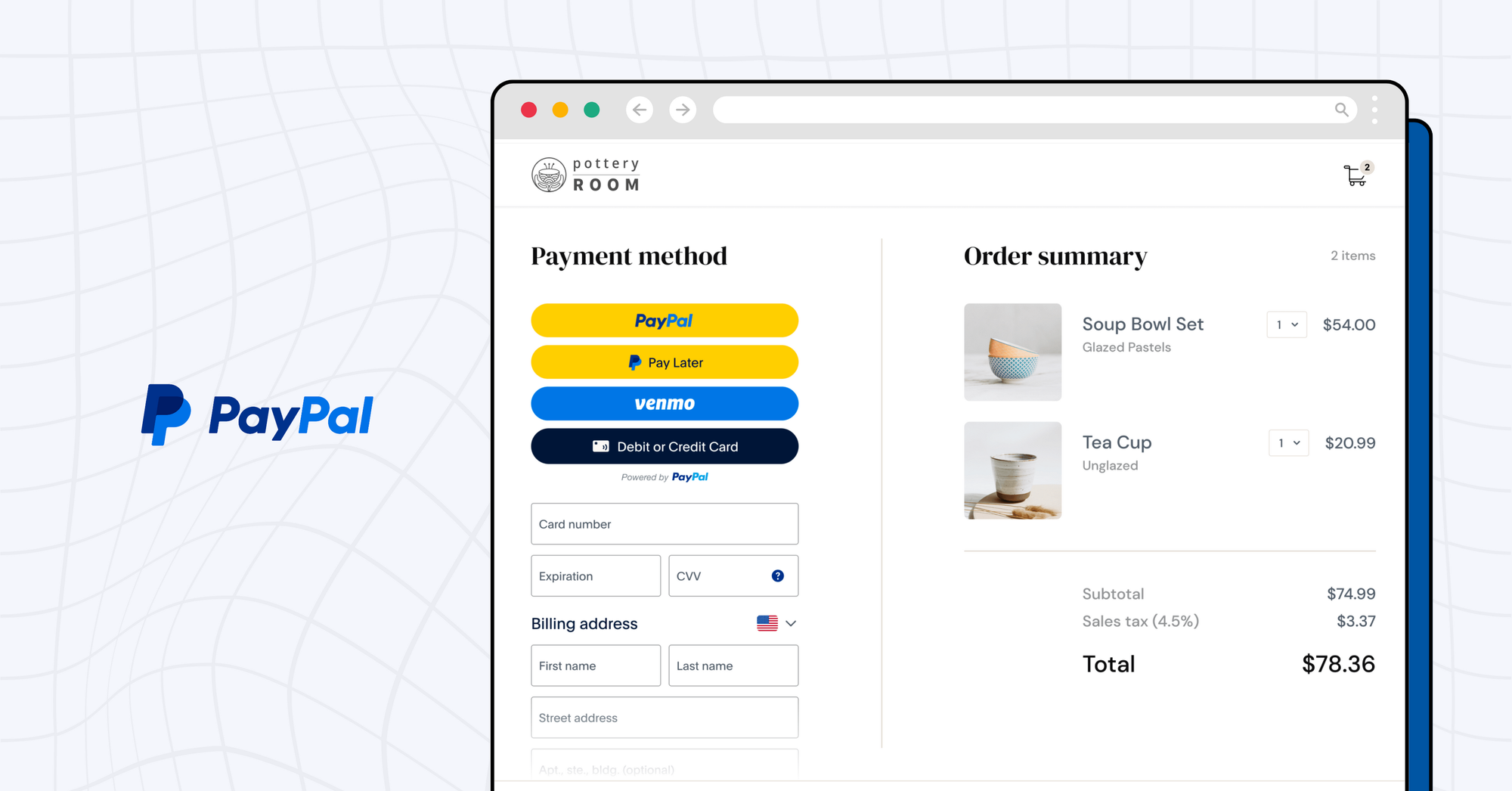

3) PayPal

PayPal is one of the most popular payment gateways in the world and is a good option for businesses of all sizes. It is a well-known and trusted brand that is accepted by millions of merchants worldwide. It is also easy to use.

However, PayPal's fees can be high for some businesses, and customer support can be slow. PayPal charges a fee of 0.45 NZD + 3.4% for sending money to another person in New Zealand.

There is no fee for receiving money from another person in New Zealand. PayPal also charges a fee of 4.4% + a fixed fee for international transactions.

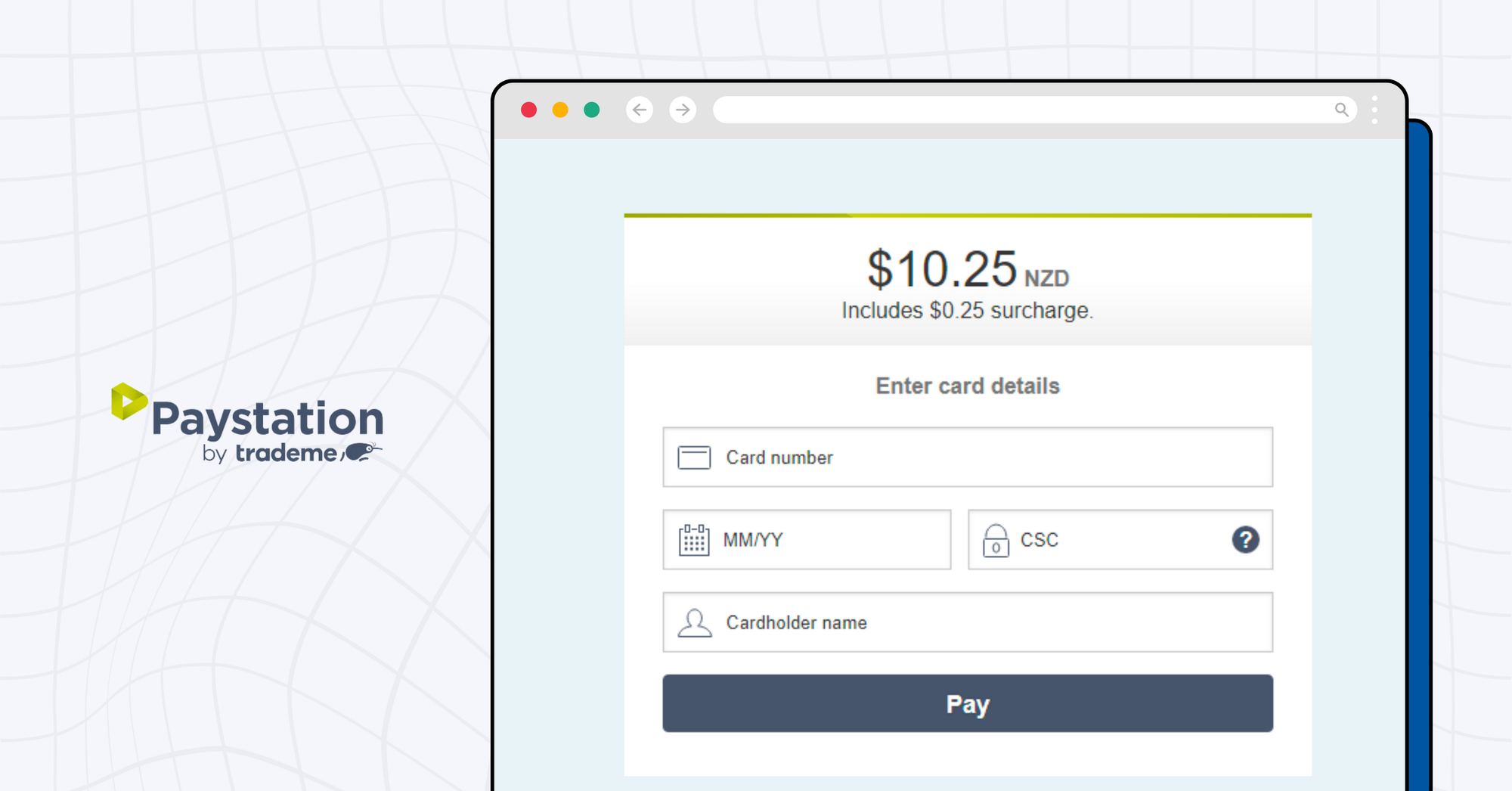

4) Paystation

Paystation is a payment gateway that offers a variety of features, including support for multiple currencies, recurring billing, and fraud protection. It is also PCI-compliant.

Paystation's fees are competitive, with a transaction fee of 2.7% + 30 cents per transaction for online payments and 2.4% + 30 cents per transaction for in-person payments.

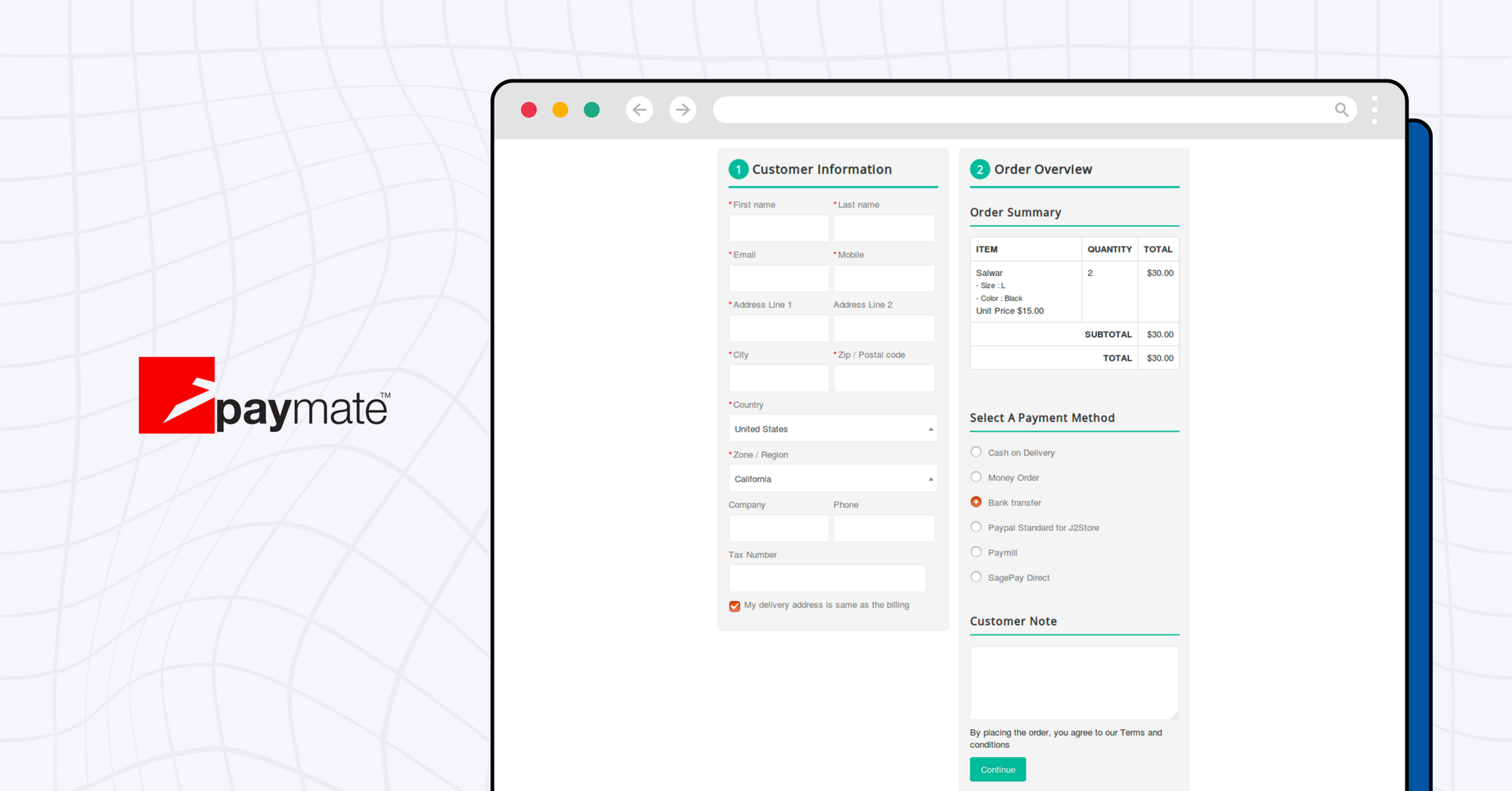

5) Paymate

Paymate is a payment gateway that offers a variety of features, including support for multiple currencies, recurring billing, and fraud protection. It is also PCI-compliant.

Paymate's fees are competitive, with a transaction fee of 2.9% + 30 cents per transaction for online payments and 2.6% + 30 cents per transaction for in-person payments.

In conclusion, a payment gateway is an essential tool for any New Zealand business that wants to grow and succeed. It provides a secure and convenient way for customers to pay for products and services, and it can help businesses to automate their payments, get detailed reports, reduce the risk of fraud, and comply with PCI security standards.

When choosing a payment gateway, businesses must carefully consider their unique needs and requirements. Factors such as the type of business, the volume of transactions, the desired fees, the features offered, and the customer support received should all be taken into account.

Ultimately, the right payment gateway will provide businesses with the tools they need to succeed in the global marketplace. If you are seeking a provider that offers competitive rates, seamless integration, and robust security, then HitPay is a great option to consider.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

- New Zealand Payment Gateway Comparison: Shopify vs. Stripe, PayPal and HitPay

- Sell Digital Products Online with the HitPay Online Store

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!