Looking Beyond Tyro? Discover an Affordable, Reliable Payment Solution for SMEs

Uncover why SMEs are opting for HitPay instead of Tyro, with a focus on faster setup, transparent pricing, exceptional customer service, and modern, efficient features for enhanced business management.

For small and medium-sized enterprises (SMEs), choosing the right payment processing service is crucial. It's a strategic decision that can significantly impact your business.

Tyro Payments, known for its EFTPOS machines, has been a popular option in Australia. But, as the business world evolves, many SMEs are starting to look for alternatives that better fit their changing needs.

This article will explain these reasons and show you how HitPay can be a good choice instead of Tyro Payments, especially for the special needs of small and medium businesses.

Why Look Beyond Tyro Payments?

Tyro Payments, a well-known option for handling payments in Australia, has several issues that small and medium-sized businesses should consider when looking for the best payment services.

A primary concern with Tyro is the wait time for terminal delivery. It can take up to two weeks to receive an EFTPOS terminal after application processing. This delay could be a significant inconvenience for businesses that require a quick setup to maintain their transaction flow.

In terms of costs, Tyro imposes monthly rental fees for its terminals. These ongoing charges might be burdensome for SMEs looking to reduce fixed expenses. Though Tyro’s transaction rates are competitive, the added monthly rental costs could add up, affecting the overall affordability.

Customer service is another area where Tyro has received mixed feedback. Some SMEs report issues with the responsiveness and effectiveness of Tyro's customer support, which can be a critical factor for businesses that rely on prompt assistance for their transactional needs.

The technology used in Tyro’s EFTPOS machines, while functional, is considered to be based on older models. This might not meet the expectations of businesses seeking the latest in payment technology, potentially impacting the efficiency of transactions and the overall user experience.

These points underline why small and medium businesses must think about their choices for processing payments. Tyro is a familiar name, but it's important to weigh its downsides against what your business needs and wants.

HitPay’s Features and Benefits

Contrasting with Tyro Payments, HitPay emerges as a strong contender, specifically addressing the challenges that SMEs face with Tyro.

One of HitPay's standout features is its quick and easy setup process. Businesses can create an account and get verified usually within 1-2 days, bypassing the long wait times for terminal delivery experienced with Tyro. This efficiency is crucial for SMEs that need to start processing payments without delay.

HitPay offers a budget-friendly and transparent pricing model. Unlike Tyro's monthly terminal rental costs, HitPay provides free software with simple pay-per-transaction pricing. This structure, free of recurring or upfront costs, allows SMEs to manage their finances more predictably and avoid unexpected expenses.

A major highlight of HitPay is its exceptional customer service. This aspect is crucial for those who've struggled to get timely support elsewhere. Recognizing the unique needs of small and medium businesses, HitPay offers responsive and helpful support over preferred communication platforms.

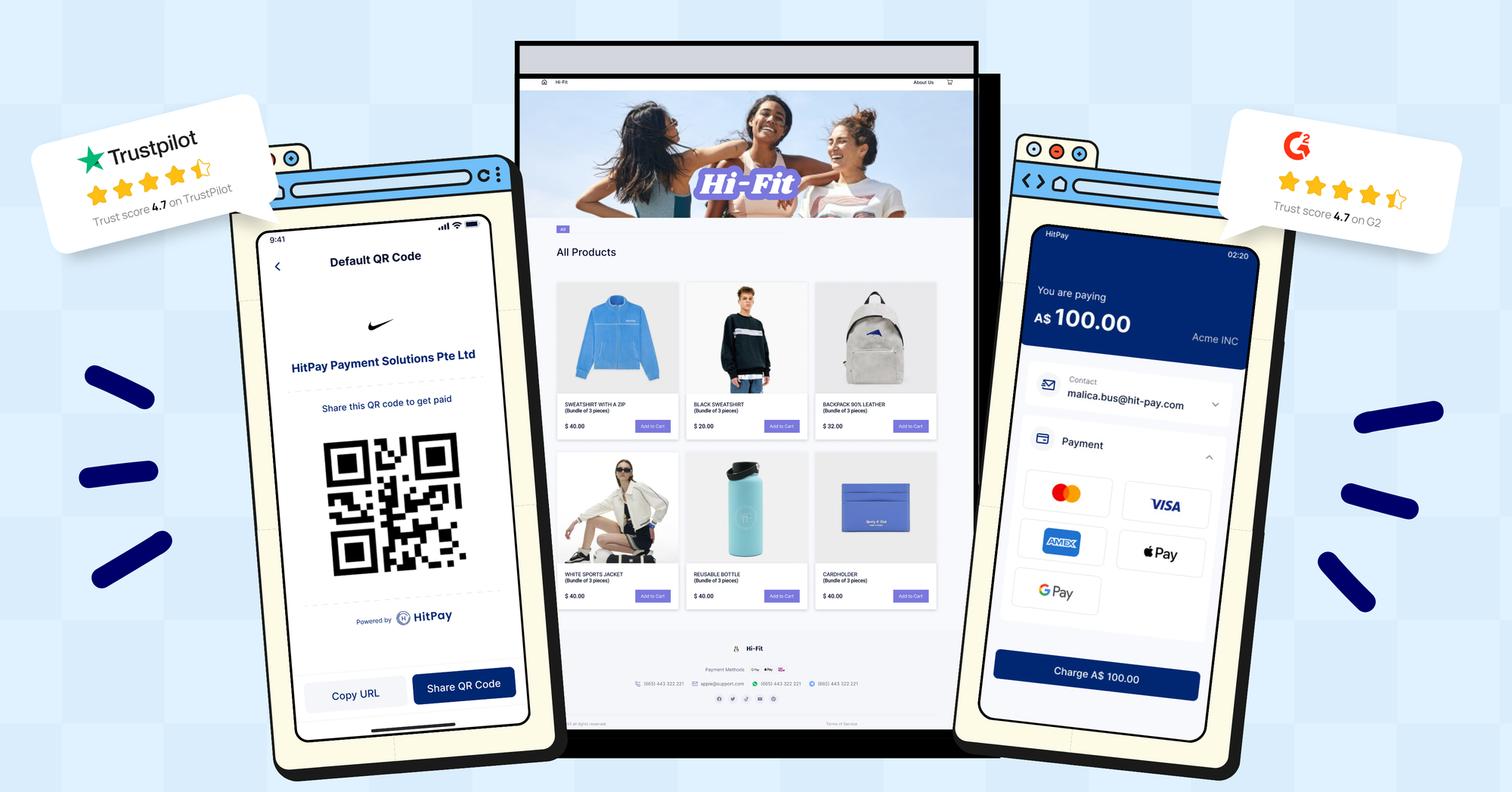

Its commitment to this level of service contributes to its high ratings and glowing reviews on Trustpilot and G2. Users consistently praise HitPay for its reliability and strong customer support, underscoring its effectiveness compared to the mixed reviews regarding Tyro’s customer support.

HitPay provides a variety of modern terminals that integrate seamlessly with POS systems. This modern technology stands in stark contrast to Tyro’s older terminal models, offering SMEs a more efficient and up-to-date payment processing experience.

HitPay supports a wide range of payment methods, both local and international (JCB, EFTPOS) without the additional fees that Tyro charges for certain services. This inclusivity, coupled with clear pricing, makes HitPay an economically sound choice for businesses handling diverse transactions.

In essence, HitPay presents a comprehensive and adaptable solution for SMEs, especially those considering alternatives to Tyro. Its quick setup, cost-effective pricing, and diverse payment options make it an appealing choice for businesses seeking efficiency, reliability, and improved financial management.

By opting for HitPay, SMEs can benefit from a mix of functionality, ease of use, and robust support – all essential elements for thriving in the current dynamic business environment.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

- Is Square Down? Try the Best Square Alternative That's Free

- Shopify POS and HitPay review: Comparing the best POS systems for small businesses [2023]

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!