Choosing the Right Payment Processor for SMEs in Malaysia: Enhance Your Payments With HitPay

In today's digital age, the success of your business in Malaysia hinges on your ability to adapt to changing consumer preferences and embrace technology. Central to this is the choice of a payment processor, which ensures the seamless flow of transactions between you and your customers.

In today's digital age, the success of your business in Malaysia lies in your ability to adapt to changing consumer preferences and embrace technology. Central to this is the choice of a payment processor, which ensures the seamless flow of transactions between you and your customers.

In Malaysia's ever-evolving market, where over 97% of the population is digitally inclined, the choice of a payment processor can make or break your business's success. However, with a number of payment processing options available in the Malaysian market, how do you choose the best payment processor for your business?

In this article, we'll assist you in discovering the importance of choosing a suitable payment processor and the factors to consider when doing so. Read on to learn about payment processing for your business!

Understanding the Importance of the Right Payment Processor

A payment processor is the engine that powers the financial transactions of your business. It works behind the scenes, ensuring that when a customer makes a payment, the process is smooth, secure, and efficient.

The potential financial impact of failed payments underscores the importance of choosing the right payment processor. Even a small fraction of unsuccessful transactions can significantly dent your business' revenue.

Research indicates that 62% of customers who encounter payment failures during a transaction won't return. Of course, this results in lost revenue and reputational harm. Hence, selecting a reliable payment processor is critical to preventing revenue loss and maintaining customer trust. Let’s consider the importance of selecting the right payment processor for your business.

Efficiency and Speed

Payment processors are like the gears in a well-oiled machine. They receive your customer's payment information, validate the transaction, and seamlessly transfer the funds to your business account. This process happens swiftly, ensuring you receive your money without unnecessary delays.

Security and Trust

The Malaysian e-commerce market grows at 13.2% yearly and is not immune to cyber threats, so security becomes paramount when conducting business. A reliable payment processor safeguards your customers' sensitive data, ensuring their trust remains intact.

Smooth Customer Experience

Familiar with the statement “Customers First”? It's also applicable when selecting the right processor. The truth is that this tool isn't just about you; it's also about your customers. Payment processors ensure that their payment experience is hassle-free and straightforward.

No customer likes complications or confusing steps in the payment process. Hence, an ideal payment processor streamlines the experience, making it easy for your customers to complete their transactions, thus boosting customer satisfaction and loyalty.

Factors to Consider When Choosing a Payment Processor

The right payment processor is your business' financial ally. It keeps the money flowing, protects against threats, and ensures customers have a seamless payment experience. While we've considered the importance of payment processors, it is vital to consider certain factors when selecting one for your business in Malaysia. Let's take a look at them.

Fees and Cost Structure

The cost of using a payment processor can significantly impact your business finances both in the short and long term. Many payment processors offer hidden transaction fees, monthly subscription charges, and other additional costs associated with using their services. Hence, it becomes vital to compare different payment processors and choose one that aligns with your business's financial goals.

Security

As we mentioned earlier, security is non-negotiable in today's digital landscape. When choosing a payment processor for your business, ensure it fully complies with industry-standard security protocols and regulations, such as PCI DSS (Payment Card Industry Data Security Standard). A secure payment processor helps protect your customers' sensitive data and minimizes the risk of data breaches.

Local Market Compatibility

Malaysia has unique payment preferences, including credit and debit cards, online banking, e-wallets, and even QR code payments. Your chosen payment processor should support the local payment methods that your target customers are most comfortable with. This ensures you do not sideline potential buyers who prefer specific payment options.

User-Friendliness

A payment processor should be easy to integrate into your existing infrastructure and user-friendly for you and your customers. Consider the processors' ease of integration with your e-commerce platform or point-of-sale system. Also, ensure the processor simplifies the checkout process for customers, as no one likes delays when paying for their products.

Customer Support

Despite technological advancement, we all still need human expertise to handle specific tools. This is why there is a need to have adequate customer support. To ensure a hassle-free experience, consider a payment processor that provides reliable and accessible customer support through phone, email, or live chat.

HitPay: A Smart Choice for Malaysian SMEs

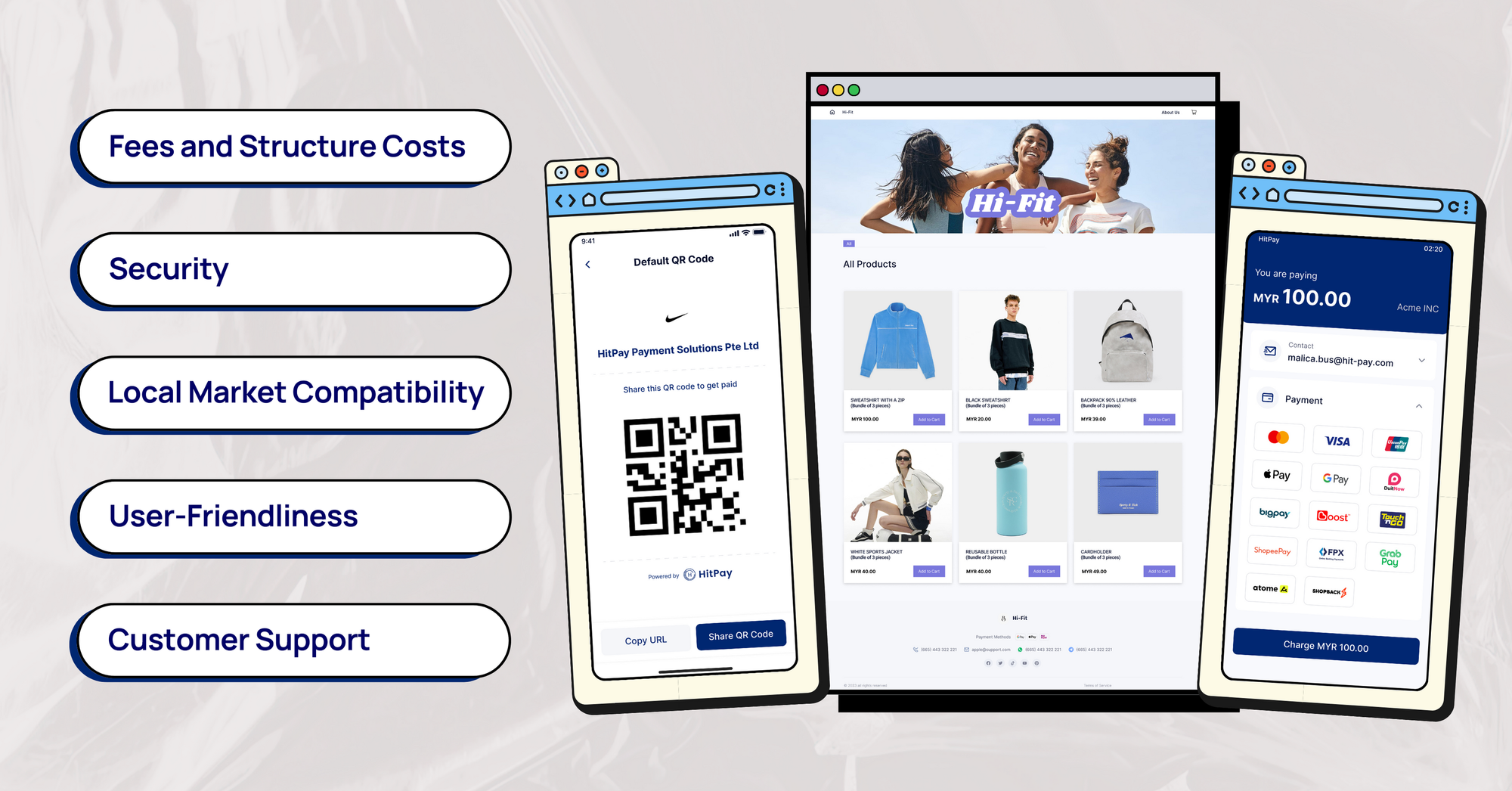

The factors we've discussed should give you a clue about the kind of payment processor you need for the smooth running of your business. But with numerous options in the market, it can be a challenge to pick the best from the rest. Well, there is no need to stress, as HitPay is a versatile and user-friendly payment processing solution for Malaysian SMEs.

Notably, HitPay aligns with the factors we've discussed, making it a strong contender for businesses looking for the right payment processor in the Malaysian market. How does this payment platform stand out from the rest? Let's take a look at some factors below.

- Fees and Structure Costs: HitPay offers competitive pricing with no monthly fees. This makes it an attractive option for businesses in Malaysia looking to minimize overhead costs while providing a seamless payment experience for their customers.

- Security: HitPay prioritizes security, safeguarding customer data through state-of-the-art encryption and security measures, thus reducing the risk of data breaches and protecting your reputation.

- Local Market Compatibility: The platform is designed with the local market in mind. It allows businesses to accept various payment methods, including credit and debit cards, online banking, and QR code payments. This flexibility caters to the diverse preferences of Malaysian consumers, increasing the likelihood of completing successful transactions.

- User-Friendliness: HitPay stands out for its user-friendly design and easy platform integration. It thus ensures a smooth and hassle-free experience for businesses and customers.

- Customer Support: HitPay provides responsive customer support. The HitPay team is available 24/7 to assist you in resolving any payment-related issues or concerns, making your experience as smooth as possible.

Integrate Your Business With HitPay For Efficient Payment Processing

Choosing the suitable payment processor for your business in Malaysia is a major decision that can significantly impact your success. To make an informed choice, you should consider fees, security, local market compatibility, user-friendliness, and customer support.

Interestingly, HitPay offers a compelling payment processing solution that aligns with the needs of Malaysian businesses. By choosing HitPay, you can streamline your transactions and enhance your customers' experience. Ultimately, you can supercharge your business's growth and profitability by signing up with HitPay today.

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease. Join our growing merchant community today!