Facing iZettle Issues? Discover a Cost-Effective, Reliable iZettle Alternative for SMEs

This article examines the limitations of iZettle for SMEs and introduces HitPay as a viable alternative, focusing on its beneficial features and suitability for small and medium-sized businesses.

For small and medium-sized enterprises (SMEs), selecting the right payment processing service is more than just a routine decision; it's a strategic one. While iZettle has been a popular choice, there are numerous reasons why SMEs are now exploring alternatives.

This article aims to shed light on these reasons and introduce HitPay as a practical iZettle alternative, tailored to the unique needs of SMEs.

Why Look Beyond iZettle?

iZettle, popular in payment processing, has drawbacks that are challenging for SMEs. Firstly, its transaction charges are high, especially for payment links at 2.5% per sale, reducing profits.

Payment settlements also take 2-3 days, which can disrupt the cash flow for businesses that depend on quicker transactions.

Since April 2021, the lack of an e-commerce subscription in iZettle has forced businesses to find external online store solutions, adding extra costs and complexity.

In terms of stock management, iZettle offers basic features but misses out on advanced functionalities like ordering directly from the app, which hampers efficient inventory management.

The platform's business management tools are somewhat limited, with notable difficulties in tracking staff performance and a lack of compatibility with CRM software. This can be a barrier for businesses aiming to manage customer relationships effectively.

Additionally, iZettle's reporting focuses mainly on basic payment and sales data, lacking the comprehensive insights offered by competitors.

Finally, its integration with third-party apps is not as extensive as other platforms, limiting the flexibility for businesses to adapt to different operational tools.

HitPay’s Features and Benefits

In contrast to iZettle, HitPay presents itself as a robust alternative, particularly addressing the challenges faced by SMEs.

HitPay's pricing structure is one of its key advantages. With fees starting from just 1% and no hidden costs or subscription fees, HitPay offers transparent and straightforward pricing.

This approach allows businesses to plan their finances more effectively, without the surprise expenses that can come with high transaction charges like those seen in iZettle, particularly for payment links.

Another notable strength of HitPay is its payout period, starting from just 2 days. This expedited process is essential for businesses that rely on quick cash flow management. In contrast to iZettle’s longer settlement times, HitPay’s quicker transaction turnarounds can significantly aid in maintaining smooth cash flow for SMEs.

HitPay also shines with its easy-to-manage store builder, which supports a diverse range of products. This feature simplifies the process of running an online store, offering a solution to the challenges posed by iZettle’s lack of an e-commerce subscription. Businesses using HitPay can effortlessly set up and manage their online presence without incurring extra costs and complexities.

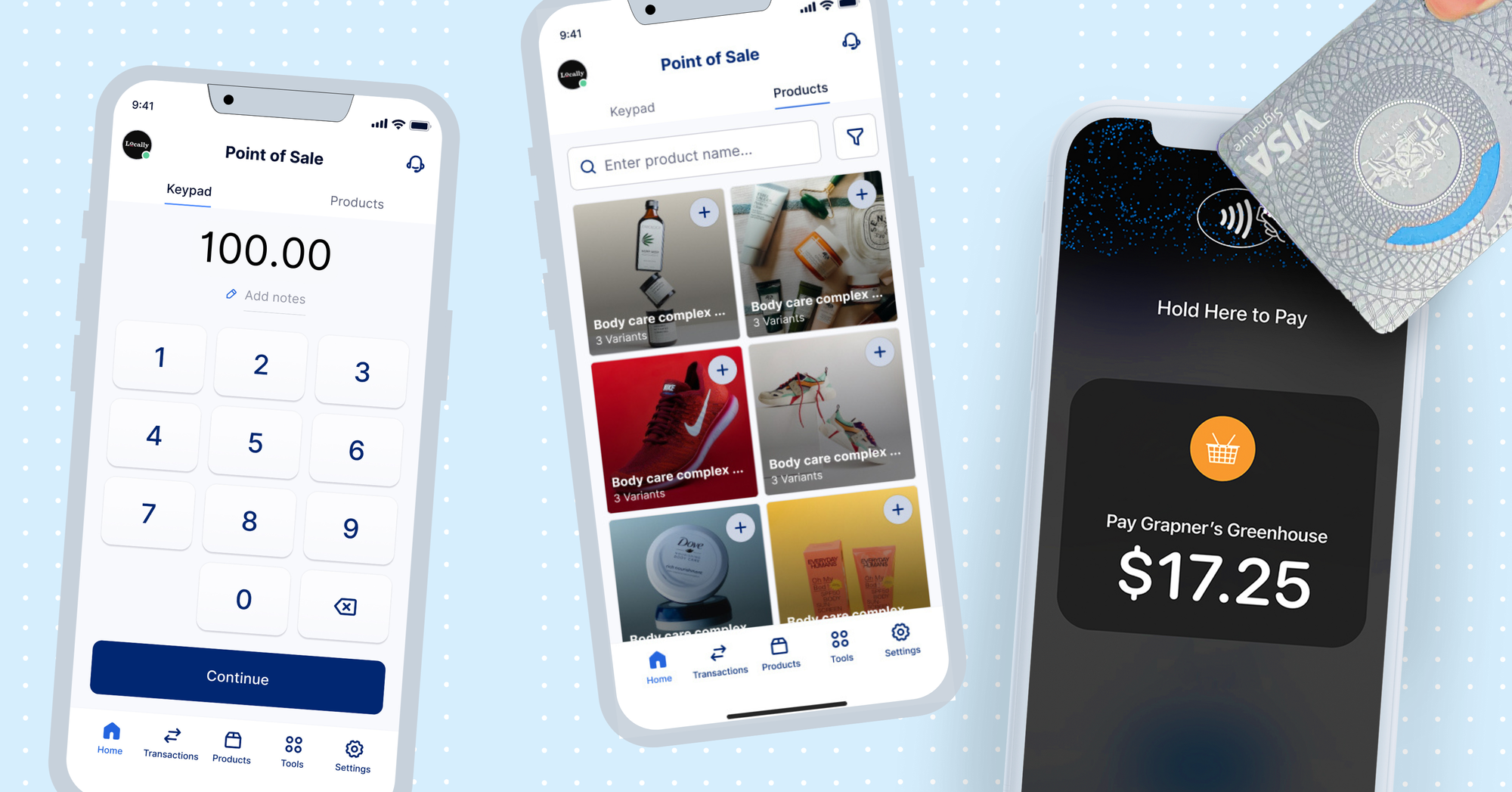

Additionally, HitPay’s POS system is particularly impressive. It offers advanced features at no extra charge, ideal for effective sales management and transaction tracking.

This system also allows for unlimited locations, making it incredibly scalable and adaptable for businesses looking to expand. This versatility is a significant upgrade over iZettle’s basic stock management features, ensuring more efficient inventory management.

In terms of business tools integration, HitPay excels with its compatibility with major e-commerce platforms and accounting software. This seamless integration streamlines overall business management, contrasting with iZettle’s limited capabilities in staff performance tracking and CRM software compatibility.

Additionally, HitPay facilitates the handling of invoices and regular billing, streamlining financial tasks, and offering better business operation insights. This capability is a significant improvement over iZettle’s focus on basic payment and sales data, lacking comprehensive insights.

Lastly, HitPay’s integration with various credit card terminals is tailored to suit different business types, offering more flexibility and smoother transactions.

This adaptability is particularly important for businesses looking for a payment service that can adjust to their unique operational needs, a flexibility sometimes constrained by iZettle’s limited third-party app integration.

Overall, HitPay offers a comprehensive and flexible solution for businesses, especially those seeking alternatives to iZettle.

Its transparent pricing, quick payouts, versatile store builder, advanced POS features, and seamless integration with business tools make it an attractive option for SMEs looking for efficiency, reliability, and improved financial management.

By choosing HitPay, SMEs can enjoy a blend of functionality, ease, and support, essential for thriving in today’s fast-paced market.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also: