How To Find The Best Payment Gateway for Your Business

Choosing the right payment gateway is essential for businesses in the Philippines to ensure secure transactions, improve customer experience, and increase sales. This guide explores key considerations like fees, security, integration, and support to help you select the best option for your needs.

The online shopping world is getting bigger, set to make up almost 23% of all sales by 2027. In the Philippines, businesses need to offer easy and safe ways for customers to pay online. The right payment gateway can make shopping better, keep data safe, boost sales, and protect against fraud.

HitPay, a versatile payment gateway, offers seamless integration and multiple payment options, making it an excellent choice for businesses looking to optimize their payment processes.

This guide will help you pick the best payment gateway for your business in the Philippines. We'll look at what payment gateways do, how they work, and what to think about when choosing one.

Key Takeaways

- Payment gateways facilitate the transfer of funds from the customer's bank to the business's account, involving steps like collection, deposit, reconciliation, and reporting.

- Thoroughly consider factors like transaction fees, security measures, integration capabilities, customer support, and fraud detection tools when selecting a payment gateway.

- The right payment gateway can enhance customer experience, improve security, increase sales, offer real-time processing, streamline operations, and prevent fraud.

What is a Payment Gateway?

A payment gateway is like a digital POS terminal. When you shop online, you don't swipe your card like you do in stores. Instead, you type your card info on a website or app. The payment gateway checks your info, makes the payment, and tells you and the business it's done.

Key Functions of a Payment Gateway

Card payments in the Philippines are expected to grow by 17.2% this year, reaching P3.4 trillion. Payment gateways take many kinds of digital payments, like debit and credit cards, and more. They make sure your payment info gets safely from you to the business and then to the payment processor.

Here are some main jobs of a payment gateway:

- They keep your payment information safe and send it over securely.

- They check and make the payment happen.

- They send you updates and confirmations right away.

- They move money from your account to the store's account.

- They work with many payment methods, like cards, e-wallets, and more.

- They help prevent fraud to keep your money safe.

Using a payment gateway lets businesses take online payments safely and easily. This makes buying things online smooth for their customers.

How Do Payment Gateways Work?

Payment gateways are key for safe and easy online payments for all businesses. They connect customers, merchants, and banks together. This makes sure payments go through smoothly and get approved.

Learning how payment gateways work helps you understand the online payment world. It also helps you make smart choices for your online payments.

The Payment Gateway Process

The payment gateway process has a few main steps:

- Customer Checkout: When a customer buys something on your site or app, they go to the payment gateway's secure page.

- Data Encryption: The payment gateway encrypts the customer's payment info, like credit card numbers. This keeps the data safe as it travels.

- Transaction Verification: The payment gateway sends the encrypted data to the bank, which checks if the transaction is okay and looks for fraud.

- Authorization and Settlement: If the transaction is good, the bank tells the payment gateway, and the money moves from the merchant's bank to the customer's bank.

- Reporting and Reconciliation: The payment gateway gives the merchant detailed reports on transactions. This helps them keep track of payments and manage their money well.

Knowing how payment gateways work helps you make your online payments better. It lowers the chance of fraud and gives your customers a smooth and safe way to pay.

What's the Difference Between A Payment Gateway and A Payment Processor?

Many people mix up "payment gateway" and "payment processor". But they are not the same thing. Knowing the difference is key for businesses wanting to take online payments safely and easily.

- A payment gateway makes sure payment info gets to the right place safely. It connects your site or app to the banks that move the money. It also keeps payment info like credit card numbers safe during checkout.

- A payment processor moves the money from the customer to the store. It sends the payment information, makes sure it's okayed, and then moves the money around. This is the part that makes sure the money gets from one account to another.

Payment gateways and processors work together to make online buying smooth. The gateway takes care of the customer side and keeps data safe. The processor deals with the money moves and checks if everything is okay.

When you sign up with a comprehensive payment solution like HitPay, you get both the payment gateway and processor in one package. This means:

- You don't need to set up separate systems

- The entire payment process is handled seamlessly

- You can focus on running your business rather than managing multiple payment services

By choosing an all-in-one solution, you simplify your payment setup while ensuring a smooth and secure transaction process for your customers.

| Payment Gateway | Payment Processor |

|---|---|

| Securely transmits payment information | Handles the movement of funds between accounts |

| Authorizes transactions | Routes transaction data, facilitates authorization, and settles funds |

| Encrypts sensitive data like credit card numbers | Ensures compliance with payment regulations |

| Provides the front-end interface for customers | Offers additional services like fraud detection and chargeback management |

For online shops, you need both a payment gateway and a processor to take payments. The gateway talks to the customer, and the processor takes care of the money moves. Knowing how these two work helps businesses pick the best payment tools for their online shops.

How Does a Payment Gateway Encrypt and Secure Transactions?

Online payments need to be safe. Payment gateways make sure your money and info stay safe. With data breaches costing nearly $9.5 million on average, keeping transactions secure is key.

Payment gateways use SSL and TLS to keep transactions safe. These protocols make a secure link between the user and the gateway. This lowers the chance of data getting stolen. They follow the PCI DSS to keep data safe and stop fraud.

Tokenization adds more security. It changes sensitive info like credit card numbers into unique tokens. This makes transactions safer and keeps real card details secret from hackers.

Multi-factor authentication adds more protection. It asks for more than one ID to get in. This makes it harder for hackers to get in. It keeps customer info safe.

Payment gateways also have fraud detection to stop fake transactions. Keeping their software updated helps protect against risks.

| Security Feature | Description | Benefits |

|---|---|---|

| Encryption | Uses SSL or TLS for secure communication. | Protects sensitive information during transmission. |

| Tokenization | Replaces sensitive data with unique tokens. | Minimizes risk by keeping card details hidden. |

| Multi-Factor Authentication | Requires multiple forms of identification. | Adds a layer of security against unauthorized access. |

| Fraud Detection | Identifies and prevents fraudulent activities. | Enhances transaction security and user trust. |

With these strong security steps, payment gateways keep your business and customers safe. They make transactions fast and secure. This builds trust and loyalty with customers and cuts down on losses.

Choosing the Best Payment Gateway For Your Business

Finding the right payment gateway is key for your business. It affects how well you handle transactions and the experience for your customers.

The Philippines experienced the second highest eCommerce growth in 2023, achieving an impressive increase of 24.1%.

When picking a payment gateway, think about these important things to get the best one for your small business.

Factors to Consider When Selecting a Payment Gateway

- Transaction fees: Make sure you know all the fees, including setup, monthly, and extra charges.

- Payment methods supported: Your payment gateway should let your customers pay how they like, like with credit/debit cards, digital wallets, and mobile payments.

- Security and compliance: Choose a gateway that keeps customer info safe by being level-1 PCI DSS compliant.

- Integration capabilities: See how well the gateway works with your online store. It should make checking out easy for customers.

- Customer experience: Think about how easy the gateway is to use, if it works well on mobile, and if it's friendly for customers.

- Global transactions: If you sell worldwide, pick a gateway that supports many currencies and has low fees for international transactions.

- Customer support: Make sure the gateway has good support options like email, phone, and live chat.

- Fraud detection: Go for gateways that have strong ways to stop fraud to keep your business safe.

- Reliability and uptime: Choose a gateway that is always working well and rarely goes down.

Comparing Different Payment Gateway Providers

| Payment Gateway | Supported Payment Methods | Security Features | Integrations |

|---|---|---|---|

| HitPay | Major Credit and Debit Cards, E-Wallets, Bank Transfer, Mobile Payments | PCI DSS Compliance, SSL/TLS Encryption, Fraud Monitoring, Tokenization | Shopify, WooCommerce, Magento, Wix |

| Paymongo | Credit/Debit Cards, Online Banking, E-Wallets | PCI DSS Compliance, 3D Secure, Fraud Monitoring, BSP regulated | PrestaShop, Shopify, WooCommerce, Magento |

| Xendit | Credit/Debit Cards, E-Wallets | PCI DSS Compliance, 3D Secure, Tokenization | Shopify, WooCommerce, Magento, BookingLayer |

For further information, read our Best Payment Gateway in the Philippines Comparison.

Ensuring Secure Online Payments: Are Payment Gateways Safe?

When we talk about money online, keeping it safe is key. Payment gateways help make sure our online payments are secure. They use top-notch security and follow strict rules to keep both businesses and customers safe.

Common Security Features

Payment gateways use many security steps to keep your info safe. These steps include:

- Encryption to keep data safe while it moves.

- Secure Socket Layer (SSL) to make sure messages are safe.

- Fraud detection tools to watch for odd transactions.

- Multi-factor Authentication (MFA) for extra security before you buy.

Payment Card Industry Data Security Standard (PCI DSS)

The Payment Card Industry Data Security Standard (PCI DSS) has strict rules for payment gateways. Following these rules is a must to keep cardholder data safe. Not following them can lead to big fines and legal trouble, so it's important for shops to pick gateways that meet these standards.

Implementing Secure Payment Solutions for Your Online Store

To keep your shop safe and build trust with customers, think about using secure payment ways. Keep your security up to date, store less data, and use strong user checks.

This can really help protect your shop from threats. Secure payment ways help you gain customer trust and reach more people around the world.

How to Protect Payment Data and Prevent Fraudulent Transactions

Fraud prevention in payment gateways uses smart analytics and learning to spot bad transactions. This helps watch transactions in real time and stop fraud like chargebacks.

Using well-known payment ways, like credit cards or bank transfers, means you get strong security help. Adding things like tokenization and SSL encryption can make protecting customer payments even better. Putting these plans first can make your online shop stand out.

| Security Feature | Description | Benefit |

|---|---|---|

| Encryption | Makes sensitive data unreadable with special codes. | Keeps data safe while it travels and makes it hard for hackers. |

| MFA | Needs more than one way to prove who you are for transactions. | Makes sure you are who you say you are, cutting down on unauthorized access. |

| Fraud Detection | Uses learning machines to check transaction patterns. | Finds and stops possible fraud fast. |

| PCI DSS Compliance | Set of rules for keeping cardholder data safe. | Keeps customer data safe and limits risk for shops. |

Integrating Online Payment Gateways into Your Business

Adding a payment gateway to your online store makes shopping smooth and easy. First, set up a payment processing API for quick and safe transactions. This boosts customer happiness and can lead to more sales.

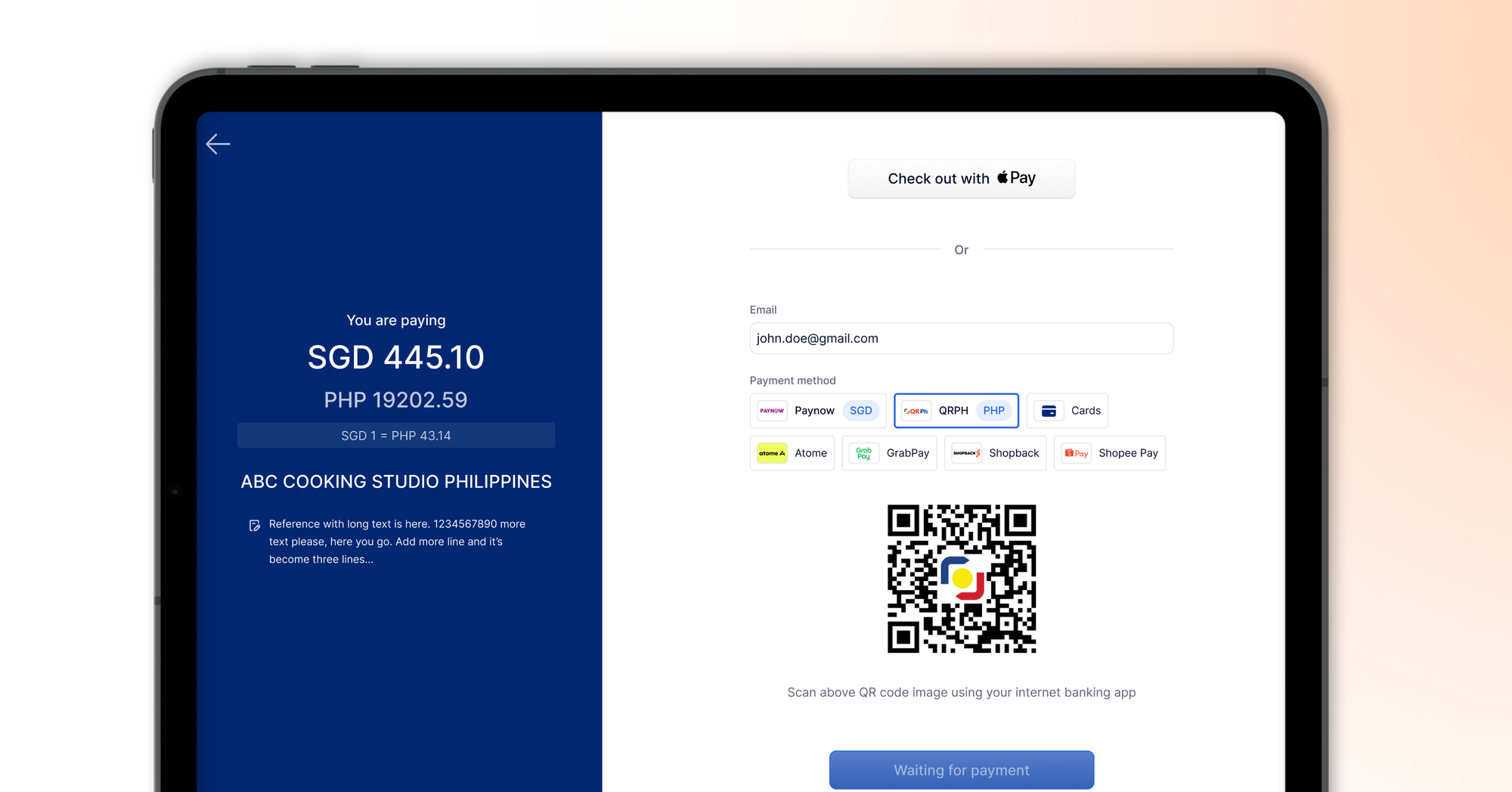

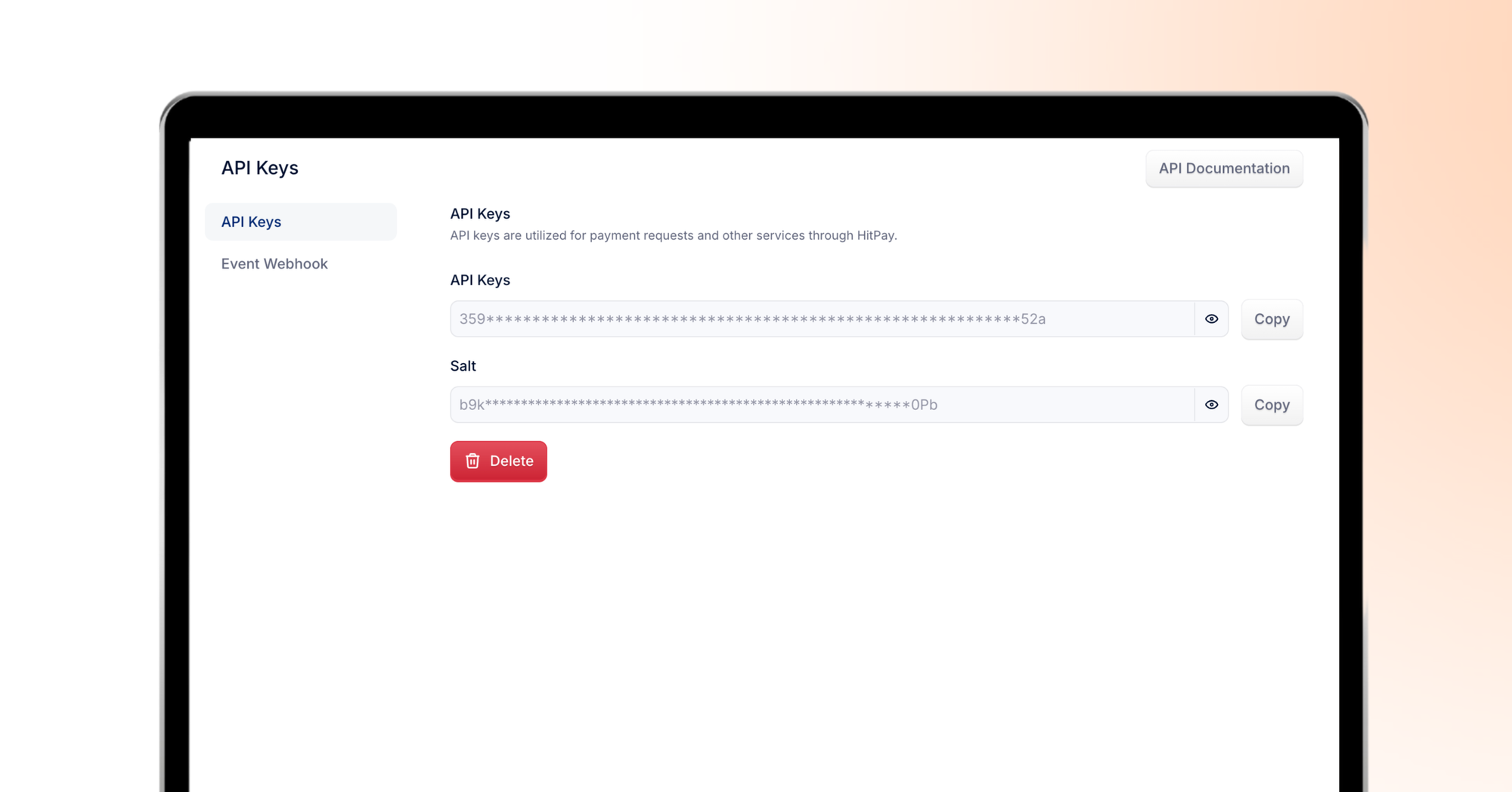

Setting Up API for Seamless Payment Processing

Getting a payment processing API is key for a good payment gateway setup. It lets customers pay safely and fast. Here's what you need to do:

- Choose a trusted payment gateway like HitPay.

- Get the API keys from your chosen provider.

- Put the payment gateway on your website.

- Test it to make sure it works well and safely.

- Start taking payments from customers.

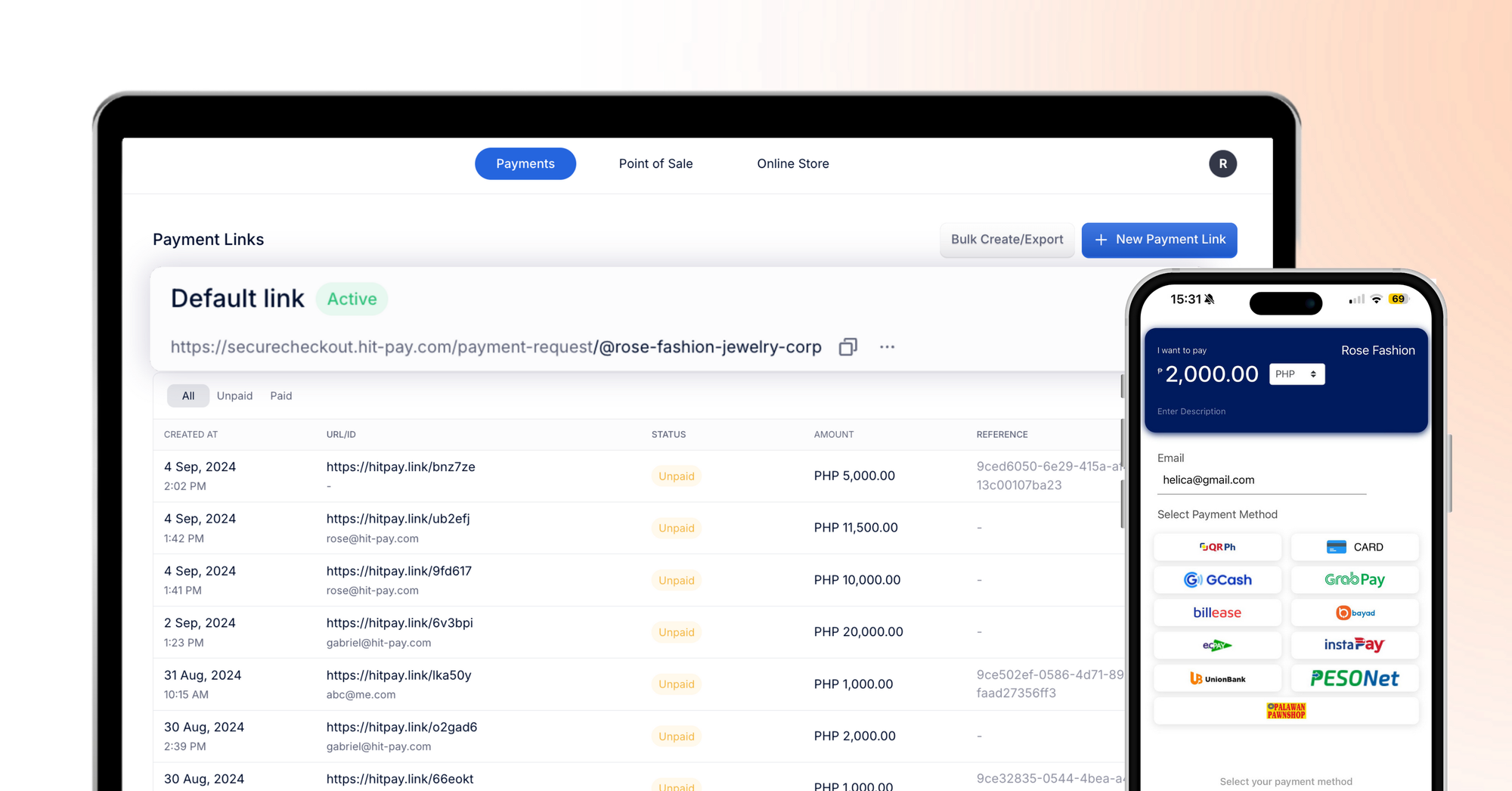

Creating Payment Links and Payment Pages

Creating custom payment links and pages is another way to add a payment gateway. It lets customers pick how they want to pay, making their experience better. Here's how:

- Make payment links easy to share via email or social media.

- Have special payment pages that look like your brand.

- Let customers choose from many payment methods, like cards and digital wallets.

Customizing Payment Options for Customers

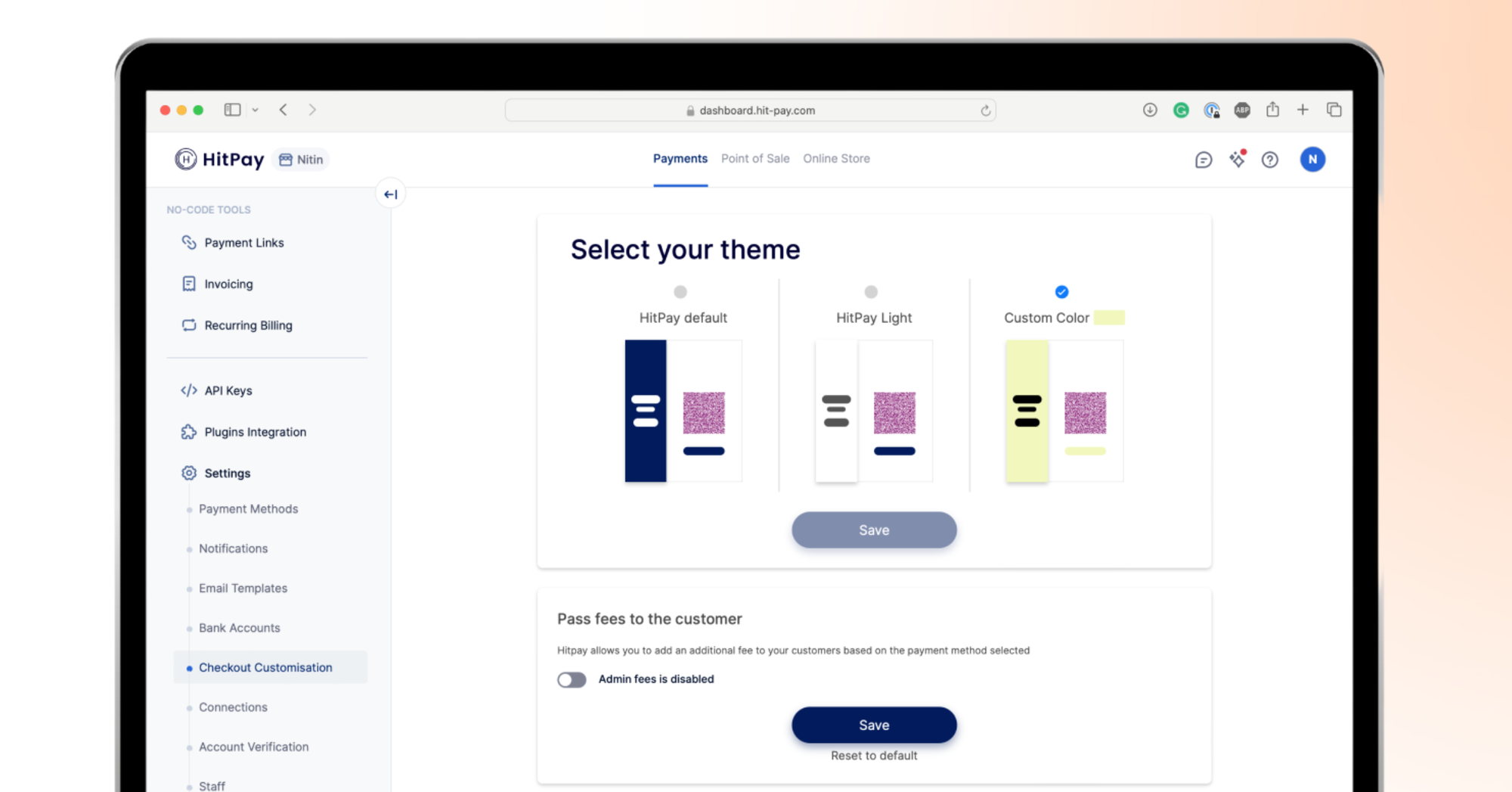

Letting customers customize their payment can make them happier with your store. Make sure the payment area looks good and is easy to use. Here's how:

- Match the payment area's look and feel with your brand.

- Offer many payment options to reach more people.

Use analytics to see how customers act and change your options as needed.

| Key Steps | Description |

|---|---|

| Choose a Payment Gateway | Pick a provider that fits your business needs and budget. |

| Setup API | Get API keys and add them to your systems for handling transactions. |

| Customize Payment Pages | Make payment pages that match your brand for a better customer experience. |

| Testing | Test everything carefully to make sure it works well for users. |

| Go Live | Let customers start buying safely and easily. |

Comparison Between Different Payment Gateway Solutions

In the Philippines, businesses have many payment gateway options. HitPay, Paymongo, Xendit, Maya, and Dragonpay are top choices. Each has features for different business needs.

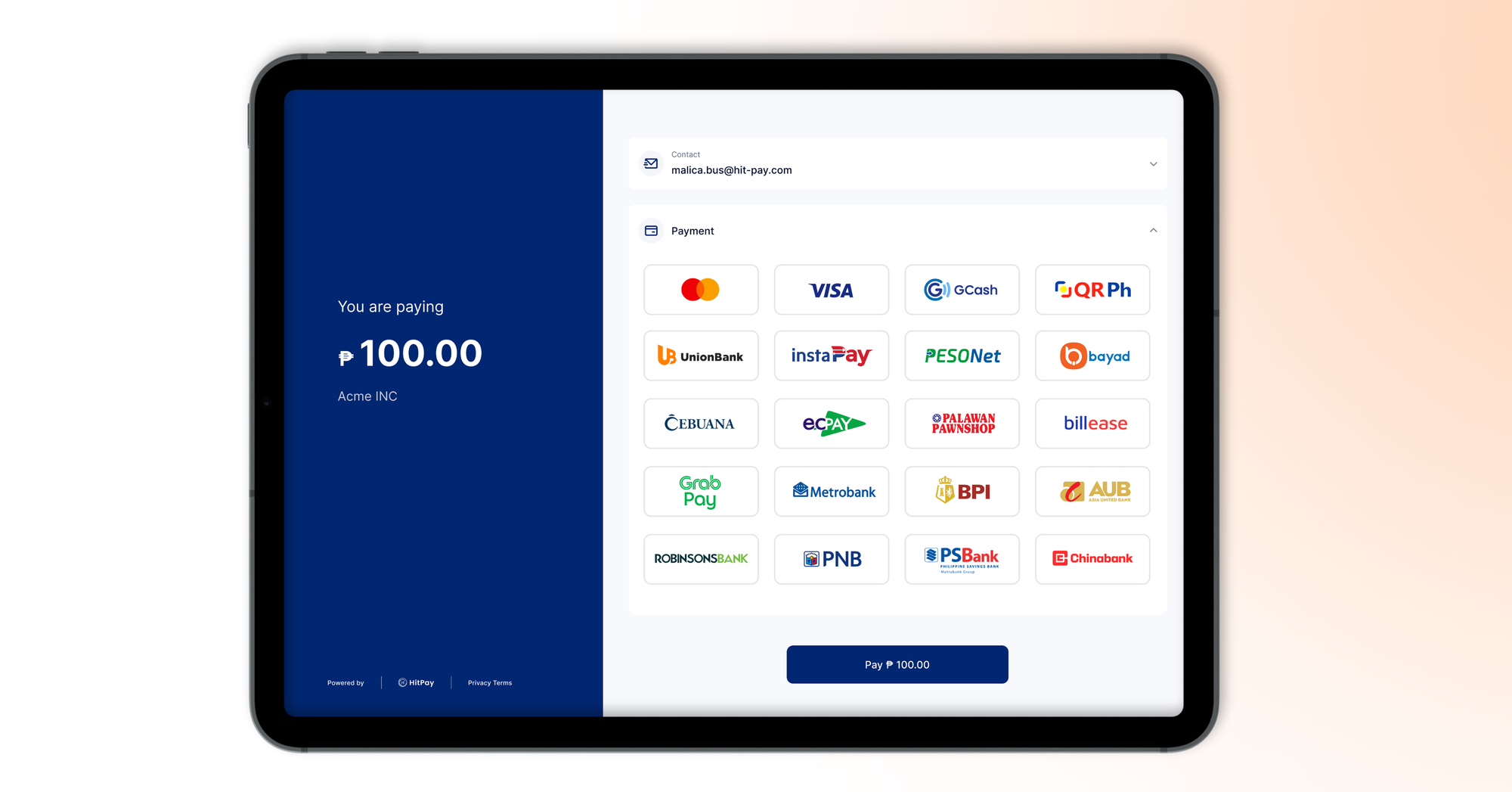

HitPay

HitPay stands out as the one-stop payment platform for small and medium-sized enterprises in the Philippines. It offers a pay-per-transaction model with no hidden fees, making it cost-effective for businesses of all sizes. HitPay provides fast payout schedules, with funds typically available on the same or next business day, helping businesses manage cash flow effectively.

One of HitPay's key strengths is its exceptional customer support, ensuring businesses receive assistance when needed. The platform boasts attractive rates, making it a competitive choice in the market.

HitPay is perfect for:

- E-commerce sellers using platforms like Shopify, Wix, or WooCommerce

- Businesses with custom-built websites

- Small business owners selling on social media

- Physical store owners looking to accept multiple digital payment methods

With HitPay, businesses can accept payments anywhere they sell, whether through e-commerce platforms, custom websites, social media, or physical stores. The platform offers free, no-code e-commerce plugins, developer APIs, and a free Online Store option.

Additional benefits of HitPay include:

- Free point-of-sale (POS) software

- Wide range of e-commerce integrations

- Express onboarding (1-2 days) and quick payouts

- Free business tools like invoice generators and online store builders

Paymongo

Paymongo caters specifically to local businesses in the Philippines. It offers:

- Support for credit cards, e-wallets, and online banking

- A user-friendly dashboard for transaction management

- API integration for custom websites

- Payment links for social media selling

- No setup or monthly fees

However, Paymongo lacks physical point-of-sale terminals, which may be a drawback for businesses with brick-and-mortar stores.

Xendit

Xendit is tailored for startups and growing businesses. Its key features include:

- A wide range of payment methods, including cards, e-wallets, and bank transfers

- Advanced fraud detection systems

- Detailed analytics and reporting tools

- Customizable checkout experiences

- Support for recurring payments and subscriptions

Xendit's focus on technology and scalability makes it particularly attractive for online businesses and those expecting rapid growth.

Maya

Maya stands out by combining digital banking with payment solutions. It offers:

- An all-in-one financial platform with digital wallet capabilities

- Integration with other financial technologies

- Physical point-of-sale terminals for in-store payments

- A mobile app for both consumers and merchants

- Support for QR code payments

Maya's integrated approach makes it suitable for businesses looking for a comprehensive financial solution beyond just payment processing.

Dragonpay Payment Gateway

Dragonpay differentiates itself with its focus on flexibility and wide-ranging payment options:

- Support for over-the-counter payments at convenience stores and pawnshops

- Bank transfer options for customers without credit cards

- E-wallet integrations

- API for custom integrations

- No setup or monthly fees

Dragonpay's strength lies in its ability to cater to a broad spectrum of customers, including those who prefer traditional payment methods.

| Payment Gateway | Key Features | Target Audience |

|---|---|---|

| HitPay | All-in-one platform, supports multiple payment methods | All business sizes |

| Paymongo | Regional compatibility, easy integration | Local businesses |

| Xendit | Seamless experience, effective transactional management | Startups and SMEs |

| Maya | Digital banking features, user-friendly interface | Tech-savvy users |

| Dragonpay | Diversified payment options, over-the-counter services | Businesses targeting various market segments |

Each payment gateway has its own strengths. Businesses should think about what they need. Look at payment types, fees, and how easy it is to use. This way, they can pick the best gateway for their online payments.

Conclusion

Choosing the right payment gateway is key for businesses in the Philippines today. You need to think about fees, payment options, security, how easy it is to use, and if it works worldwide. This way, you can pick a payment gateway that fits your business and gives your customers a smooth, safe, and easy way to pay online.

When picking a payment gateway for your business in the Philippines, look at their security, how easy it is to use, prices, customer support, and if it can grow with your business. Making a smart choice that meets your business needs and what your customers like can help you make more sales, keep customers happy, and make more money.

Get Started With HitPay’s Secure Payment Gateway

Enhance your e-commerce business with HitPay's advanced payment gateway. Accept local and international payments with seamless integration and no coding required. Enjoy low fees, fast payouts, and extensive plugin support.

Get started today with HitPay's simple, pay-per-transaction pricing and no hidden costs. Sign up now and start selling within days.

Have questions? Our support team is ready to assist you on your preferred platform.

Frequently Asked Questions About Payment Gateways

Can I Start My Own Payment Gateway?

Starting your own payment gateway is possible, but it's a complex process. You'll need to comply with strict financial regulations, invest in robust security measures, and develop advanced technology infrastructure.

It's usually more practical for most businesses to use established payment gateway providers unless you have significant resources and technical expertise.

Is POS a Payment Gateway?

While related, a Point of Sale (POS) system and a payment gateway are different. A POS system is used for in-person transactions, processing payments at physical locations.

A payment gateway, on the other hand, is designed for online transactions, securely transmitting payment information between customers, merchants, and banks. Some modern POS systems may include payment gateway functionality for omnichannel selling.

Who Uses Payment Gateways?

Payment gateways are used by a wide range of businesses that accept online payments. This includes:

- E-commerce stores

- Subscription-based services

- Online marketplaces

- Digital service providers

- Non-profit organizations accepting online donations

- Any business with a website that processes payments

What is the Difference Between a Bank and a Payment Gateway?

Banks and payment gateways play different roles in online transactions:

- Banks: Hold funds, issue credit/debit cards, and ultimately approve or decline transactions.

- Payment gateways: Act as intermediaries, securely transmitting payment information between customers, merchants, and banks. They don't hold funds but facilitate the transaction process.

Payment gateways work with banks to complete online transactions, but they're separate entities providing different services.

Who is Responsible for a Payment Gateway?

Payment gateway providers are responsible for the operation, security, and maintenance of their payment gateways. These companies ensure that:

- Transactions are processed securely and efficiently

- The gateway complies with industry standards (like PCI DSS)

- Customer data is protected

- The system is regularly updated and maintained

As a merchant, you're responsible for choosing a reputable payment gateway provider and properly integrating it into your website or app. You'll also need to follow best practices for security and customer data handling on your end.