Why Do You Need a Payment Gateway?

The article explains the differences between payment gateways, POS systems, and payment processors in e-commerce. It highlights their roles in ensuring secure transactions.

With the global e-commerce market rapidly expanding, businesses need a secure payment gateway to optimize their payment processes.

HitPay, a trusted all-in-one payment platform used by over 20,000 businesses across Southeast Asia, provides SMEs with a seamless solution that integrates online, point-of-sale, and B2B payments.

In this article, we’ll explore key considerations when choosing a payment gateway, the advantages of offering multiple payment options, and how selecting the right platform can fuel your business growth.

Key Takeaways

- A payment gateway is crucial for secure transactions in the growing e-commerce market.

- It improves customer experiences by providing a simple, fast checkout process.

- Utilizing a payment gateway can significantly enhance customer loyalty and lifetime value.

- Secure payment processing protects businesses from fraudulent activities.

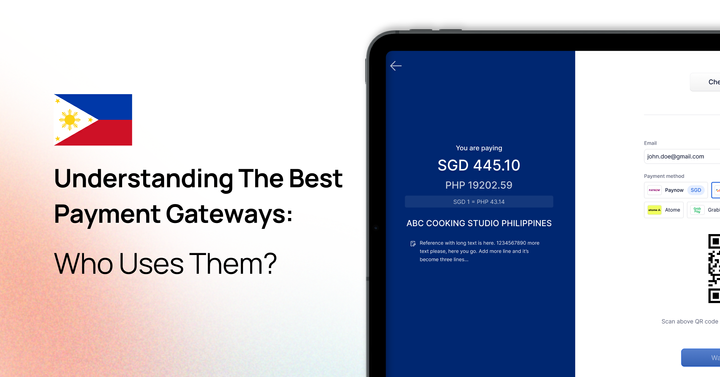

- Choosing the right payment gateway can ease international transactions and accommodate multiple currencies.

What is a Payment Gateway?

A payment gateway is a key tool for processing digital transactions securely. It enables businesses to accept online payments by connecting their website to a payment processor, ensuring transactions are seamless and secure. For e-commerce businesses, understanding how a payment gateway works is essential.

Payment gateways come in different forms to suit various needs—some are designed for online payments, while others cater to in-store transactions using technologies like Near Field Communication (NFC) for touchless payments. Knowing the options available helps you choose the best fit for your business.

A smooth and user-friendly checkout process is critical for online shopping. Research shows that 18% of shoppers abandon their carts due to payment issues. By implementing a reliable payment gateway, you can enhance customer satisfaction and minimize checkout problems.

How Payment Gateways Work: A Simple Overview

With the global e-commerce market projected to reach $8.5 trillion by 2026, payment gateways are essential for online businesses. They act as a secure link between customers and merchants, ensuring data remains protected throughout the payment process.

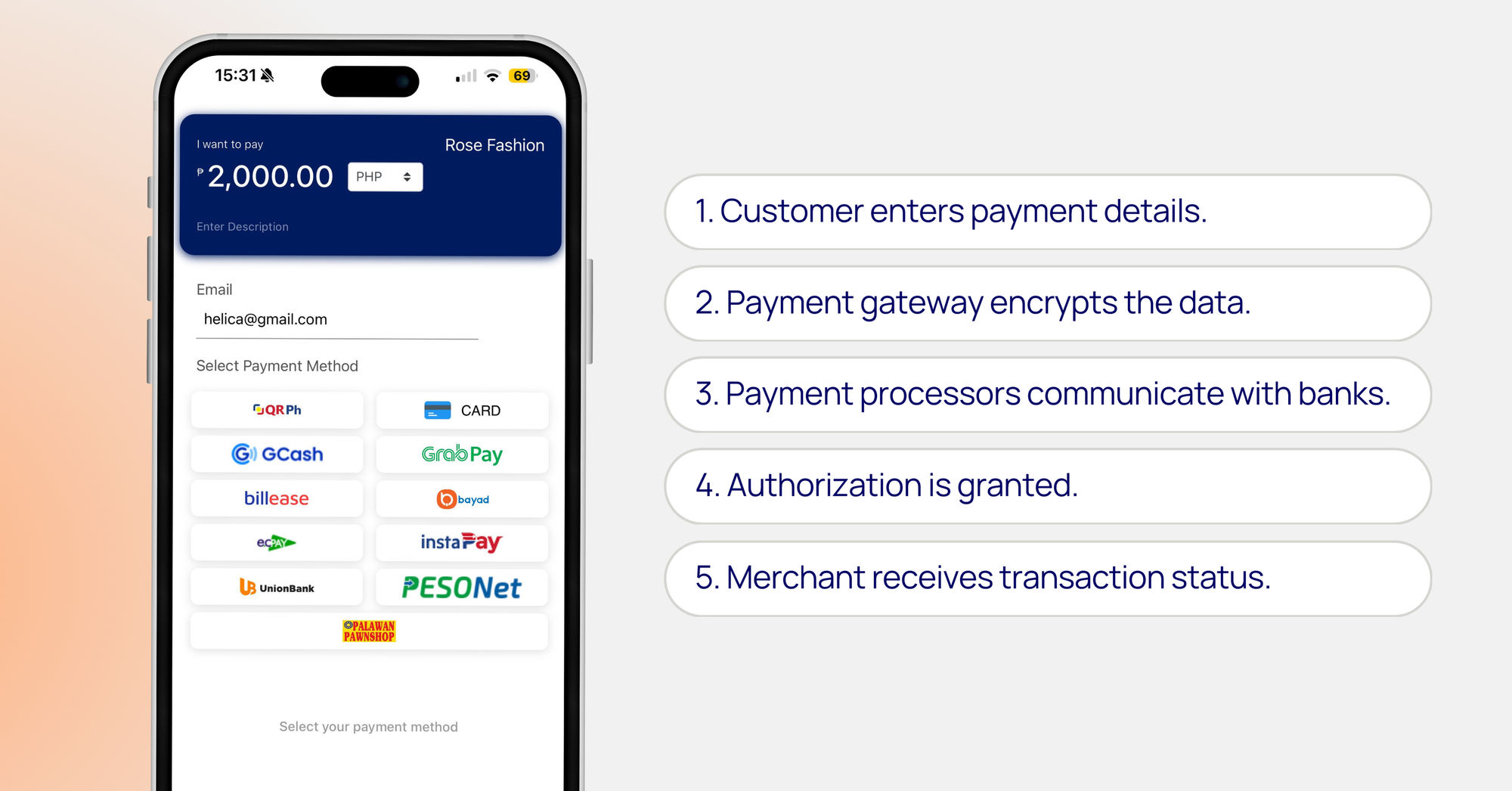

How Online Payments Work: A Step-by-Step Explanation

When a customer makes a purchase online, the payment gateway takes action by securing sensitive information like card details and transmitting it to the payment processor.

The processor communicates with the credit card network and the customer’s bank to verify funds and approve the transaction. Once approved, the payment gateway notifies the merchant. This entire process happens in seconds, ensuring a smooth shopping experience.

Steps include:

- Customer enters payment details.

- Payment gateway encrypts the data.

- Payment processors communicate with banks.

- Authorization is granted.

- Merchant receives transaction status.

There are various types of payment gateways, such as hosted and self-hosted, each offering unique benefits depending on your business needs. These gateways rely on advanced technology like encryption to keep transactions secure.

Payment Gateway vs. Payment Processor: What’s the Difference?

Understanding the difference between a payment gateway and a payment processor is crucial for businesses. A payment gateway securely captures customer payment information and serves as the first line of defense against fraud during transactions.

Once the payment gateway secures the data, the payment processor takes over. It handles the transaction by communicating with banks and financial institutions to move the funds.

- Payment Gateway: Secures payment information, encrypts data, and provides the interface for customers to make payments.

- Payment Processor: Facilitates the actual transfer of funds, communicates with banks, and ensures payments reach the merchant.

Some processors charge businesses a fee, either as a small charge per transaction or a percentage of the total sale.

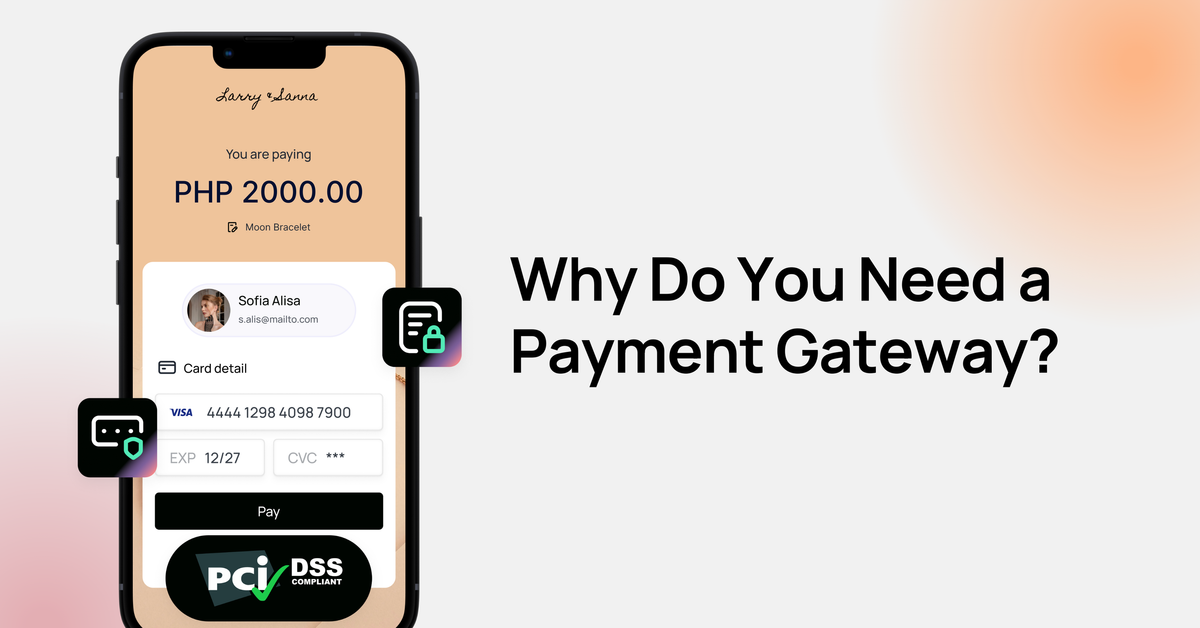

Payment gateways adhere to strict security standards, like the Payment Card Industry Data Security Standard (PCI DSS), ensuring sensitive payment information remains protected.

Many merchants prefer solutions like HitPay that combine both gateway and processor functions. This all-in-one approach simplifies payment management and builds greater customer trust.

In summary, knowing the roles of payment gateways and processors helps you choose the right system for your business, ensuring smooth operations and stronger customer confidence.

Key Features of a Secure Payment Gateway

Secure payment gateways have key features that make online transactions safer. These features protect sensitive info and make payments smooth and trustworthy.

- Encryption and Data Protection: Encryption is a top feature of secure payment gateways. It keeps data like credit card numbers safe during transactions. SSL and TLS create secure connections, making data unreadable to hackers.

- Fraud Detection and Prevention Tools: Real-time fraud detection is key for secure payments. These tools use machine learning to spot and stop fraud early. This keeps the payment environment safe, making customers and businesses trust it more.

- PCI DSS Compliance: Following PCI DSS rules is a must for secure payment gateways. These standards keep credit card transactions safe and protect customer data.

- Seamless Transaction Processing: A secure payment gateway makes transactions smooth and fast.

Key Benefits of Using a Payment Gateway

Integrating a payment gateway into your online business can streamline operations and enhance customer experience. It offers several advantages that make online shopping more secure and convenient for everyone.

Enhanced Security and Fraud Prevention

Security is a top priority in online shopping for both buyers and sellers. Payment gateways employ advanced measures such as high-level encryption and intelligent fraud detection tools. These safeguards give businesses peace of mind, knowing their transactions are protected against potential threats.

Seamless Integration with Local Payment Methods

Payment gateways allow you to accept a variety of local payment options, making it easier for more customers to shop with you. This flexibility broadens your store’s appeal, especially in regions where digital payments are rapidly growing. The global digital payment market is projected to reach $361.3 billion by 2030.

Simplifying Payment Processes

A payment gateway simplifies payment management for your business by reducing errors and processing transactions instantly. This allows you to focus on what matters most—growing your business—without worrying about payment issues.

Boosting Sales and Conversion Rates

Integrating a payment gateway can significantly increase sales. Businesses often see a 15-20% rise in revenue due to faster and smoother checkout experiences. Easy and quick payments lead to happier customers, improved loyalty, and more repeat business.

Common Challenges Without a Payment Gateway

Operating a business without a payment gateway presents several challenges. Understanding these issues can guide you in making informed decisions about your payment processes.

Risks of Manual Payment Processing

Manual payment processing is prone to errors and inefficiencies. Data entry mistakes can lead to inaccurate billing, frustrating customers and damaging your reputation.

Additionally, without automation, payment processing is slower, potentially resulting in lost sales and delayed revenue. Tracking payments manually also complicates financial management, making it harder to stay organized.

Customer Trust Issues Without Secure Payment Options

In a survey, more than 67% of customers stopped mid-shopping because something has aroused their suspicion. Lack of secure payment options can erode customer trust. When customers don’t see reliable and secure payment methods, they’re less likely to complete their purchases, leading to abandoned carts. Building trust requires offering payment options that make customers feel confident their financial information is safe.

Operational Inefficiencies and Increased Costs

Running a business without a payment gateway often leads to operational inefficiencies, which translate into higher costs. Manual processing consumes more time and resources, taking your focus away from growth.

Handling refunds and disputes becomes more cumbersome, slowing down operations and limiting your ability to scale. By automating payment processes, you can allocate more resources to expanding your business and improving customer relationships.

Choosing the Right Payment Gateway for Your Business in the Philippines

Selecting the right payment gateway is crucial for optimizing your business operations in the Philippines. You need to consider factors like security, costs, and how well the gateway supports local payment preferences. With various options available, finding the right solution can enhance both customer experience and business efficiency.

Factors to Consider: Security, Cost, and Local Support

- Security: Ensuring safe transactions is essential. Look for payment gateways that offer robust security measures, including encryption and fraud detection tools.

- Cost: Transaction fees and pricing structures can directly impact your bottom line. It’s important to weigh these costs against the features offered.

- Local Support: Choose a gateway that understands the Philippine market, offers localized payment options, and provides responsive customer support tailored to local businesses.

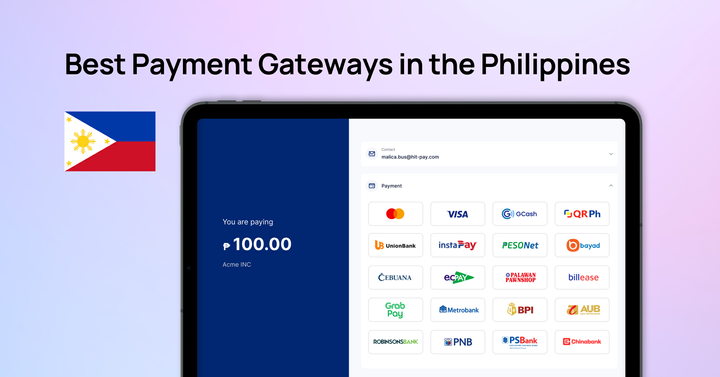

Popular Payment Gateways in the Philippines

Many payment gateways are popular in the Philippines for their ease of use and features. Some top ones are:

When picking a payment gateway for your business in the Philippines, focus on security and costs. The payment gateways available meet different needs, so choosing the right one is key to your success.

How to Set Up a Payment Gateway for Your Online Business

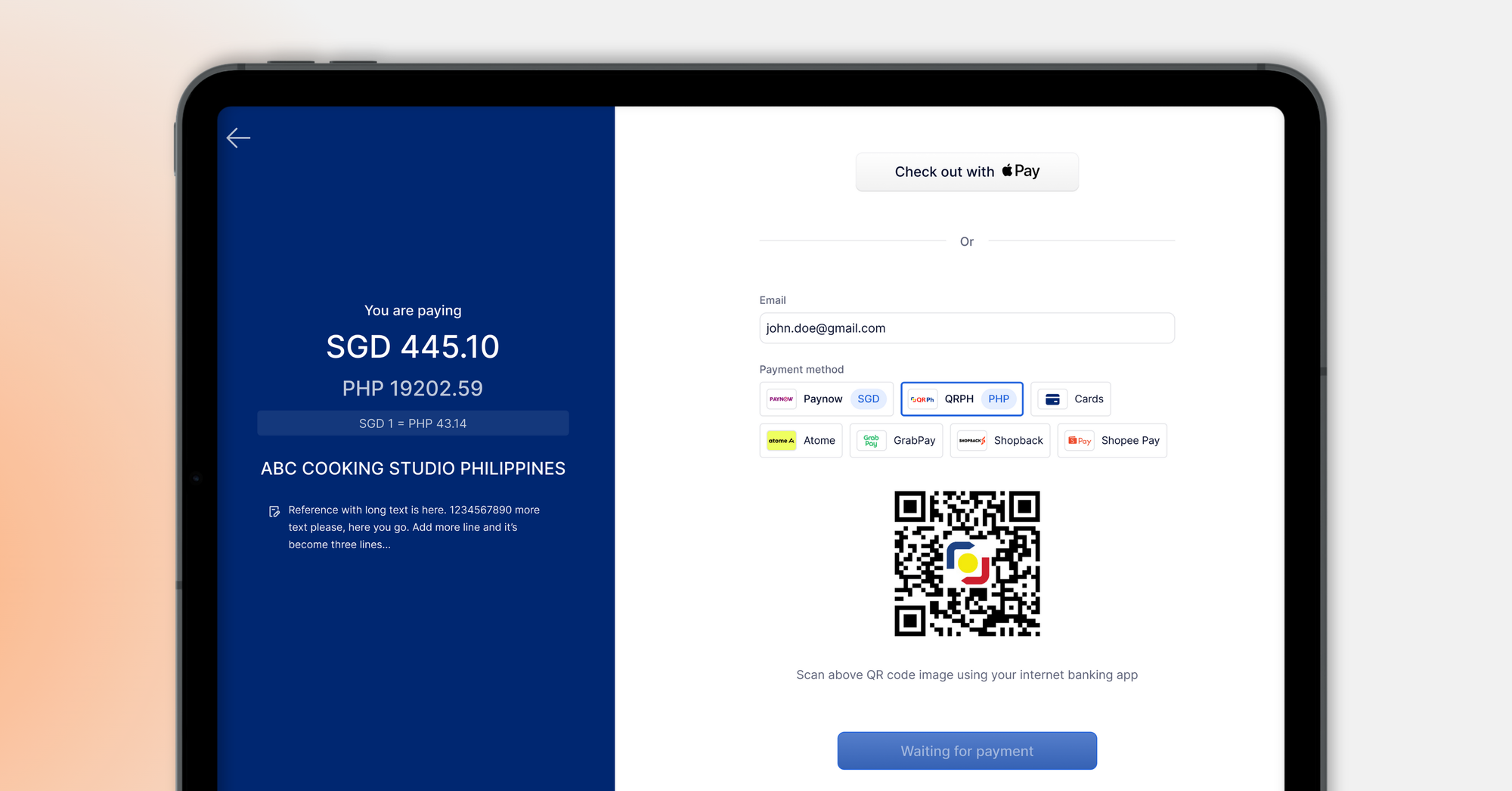

Setting up a payment gateway involves selecting the right payment gateway provider, integrating it with local banks, and making the checkout process seamless for customers.

Integrating Your Payment Gateway with Local Banks and Payment Methods

Connecting your payment gateway with local banks is crucial for processing payments efficiently. Start by setting up a merchant account with your business and banking details. After that, proceed with the technical setup to ensure seamless operations.

Here’s a step-by-step guide to get started:

- Select a Payment Gateway Provider: Choose one that aligns with your business needs, considering factors like fees, supported payment methods, and security features.

- Review Fees and Security: Consider transaction fees, costs for different payment methods, and ensure the provider offers robust security measures like encryption and fraud prevention.

- Integrate with Your Website: Use APIs provided by the gateway to connect it with your online store, ensuring smooth communication between your site and the payment provider.

- Enable Payment Options: Offer a variety of payment methods, such as credit cards, digital wallets, and bank transfers, to cater to different customer preferences.

- Test the System: Conduct thorough testing to ensure payments are processed smoothly and securely before going live.

By following these steps, you can set up a payment gateway that supports hassle-free payments and enhances the customer experience.

Get Started With HitPay’s Secure Payment Gateway Solution

In the growing e-commerce market, a reliable payment gateway is crucial. It ensures secure transactions, builds customer trust, and supports various payment methods like credit cards, e-wallets, and bank transfers to meet diverse customer preferences.

A trusted payment gateway also streamlines the checkout process, reducing cart abandonment with features like saved payment info and one-click payments. This encourages repeat purchases and boosts customer loyalty.

Beyond smooth transactions, a secure payment gateway gives your business a competitive edge in the online market. By prioritizing safety and efficiency, you can better serve your customers and thrive in the dynamic e-commerce landscape.

Enhance your business with HitPay’s advanced payment gateway—accept local and international payments with seamless integration, no coding required. Enjoy low fees, fast payouts, and extensive plugin support.

Get started today with HitPay's simple, pay-per-transaction pricing and no hidden costs. Sign up now and start selling within days.

Have questions? Our support team is ready to assist you on your preferred platform. Elevate your payment process with HitPay!

Frequently Asked Questions About Payment Gateways

What is a payment gateway?

A payment gateway is an online tool that helps businesses process digital payments safely. It connects a customer's payment method to the business's payment system. It accepts many payment types, like credit and debit cards, digital wallets, and bank transfers.

How do payment gateways enhance online transactions?

Payment gateways make online payments safer by encrypting payment information. This keeps customer data safe and speeds up transactions.

What’s the difference between a payment gateway and a payment processor?

A payment gateway takes and encrypts payment info from customers. A payment processor handles the transaction by talking to the customer's bank and credit card networks. Both are needed for online payments but do different jobs.

Why are payment gateways important for businesses in the Philippines?

Payment gateways are key for secure online payments, building trust with customers. They make payments easy for businesses in the Philippines's growing e-commerce market.

What key features should I look for in a secure payment gateway?

Look for a secure payment gateway with advanced encryption, fraud detection tools, PCI DSS compliance, and smooth transactions. This ensures a safe and efficient payment process.