What is the Difference Between a Bank and a Payment Gateway?

The article outlines the differences between banks and payment gateways in the context of digital payments. It explains that banks provide a wide range of financial services, while payment gateways focus on securely processing online transactions.

As digital payments become more popular in the Philippines, understanding the difference between banks and payment gateways is essential for businesses.

While both play crucial roles in payment processing, they function differently. Banks offer a broad range of financial services, while payment gateways focus on securely processing payment information for online transactions.

HitPay, a trusted payment platform supporting over 20,000 businesses across Southeast Asia, helps small and medium-sized enterprises (SMEs) manage payments seamlessly by integrating online, in-person, and B2B transactions into one unified system.

This article will explore the key differences between banks and payment gateways, their roles in the payment process, and how leveraging these solutions can help your business thrive as e-commerce continues to grow.

Key Takeaways

- The payment process involves multiple parties, including the merchant, customer, banks, and payment processors.

- Payment gateways securely collect and transmit customer payment information using SSL encryption.

- Businesses need both payment gateways and merchant accounts to take credit card payments online.

- Adding different payment options can make customers happier and stop them from leaving their carts.

Understanding the Role of Banks

Banks play a vital role in both personal and business finance. From providing loans and managing savings accounts to facilitating international transactions, banks offer a wide range of services that are essential for financial stability and growth.

Understanding how banks operate and the services they offer is key to making informed financial decisions, whether for personal goals or business ventures.

What is a Bank?

A bank is a financial institution where people and businesses can deposit money, obtain loans, and access various financial services.

In 2020, the Philippines had more than 29,000 financial institutions, including around 13,000 banks. In the Philippines, banks are central to economic development by providing capital, enabling transactions, and offering savings and investment products.

They are regulated under the National Payment Systems Act, which ensures that financial operations remain secure, efficient, and transparent.

Key Services Offered by Banks

Banks cater to diverse financial needs with services such as:

- Intraday credit and overdraft facilities

- Retail credit services

- Working capital provisions

- Payment instruments for non-cash transactions

- Timely account information for businesses

For businesses handling large transactions, effective cash management is critical, while retail customers benefit from accessible credit options. Banks also support financial markets with specialized services, ensuring smooth money flow and contributing to overall economic stability.

What is a Payment Gateway?

A payment gateway is essential in today’s digital landscape, enabling merchants to process online payments securely. In the Philippines, real-time payment transactions are expected to grow to 1.5 billion by 2027 from 625 million in 2022.

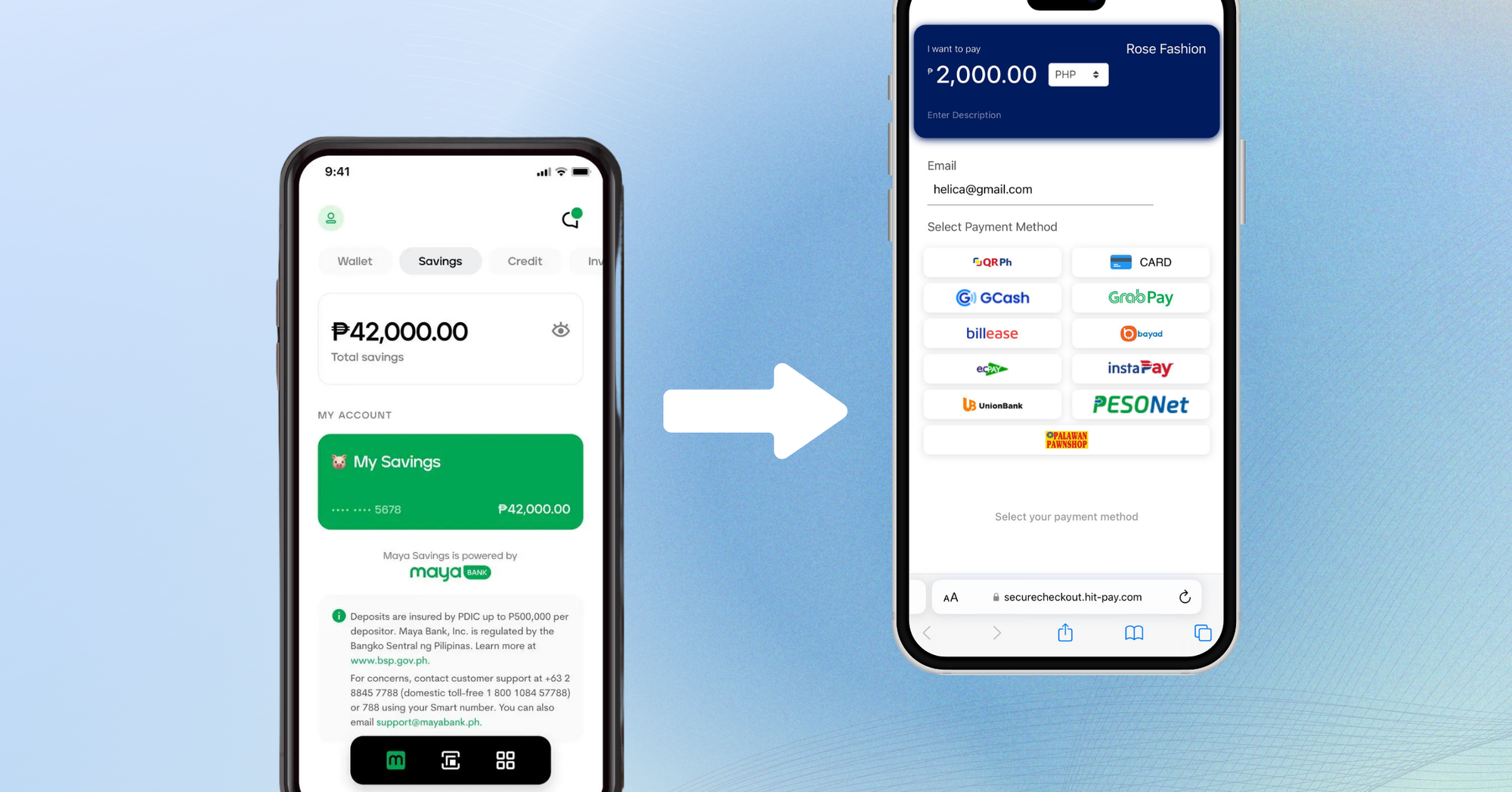

Payment gateways act as the bridge between customers and the merchant’s bank, ensuring that transaction data is protected while facilitating smooth, seamless purchases.

How Payment Gateways Work

A payment gateway performs several critical functions to ensure secure transactions.

- When a customer makes a purchase, their payment details are captured online. The gateway encrypts this information, safeguarding it from potential threats.

- The encrypted data is then sent to the merchant’s payment processor for verification, enabling businesses to accept various payment methods.

- Once verified, the transaction is completed, transferring funds from the customer’s bank to the merchant’s account.

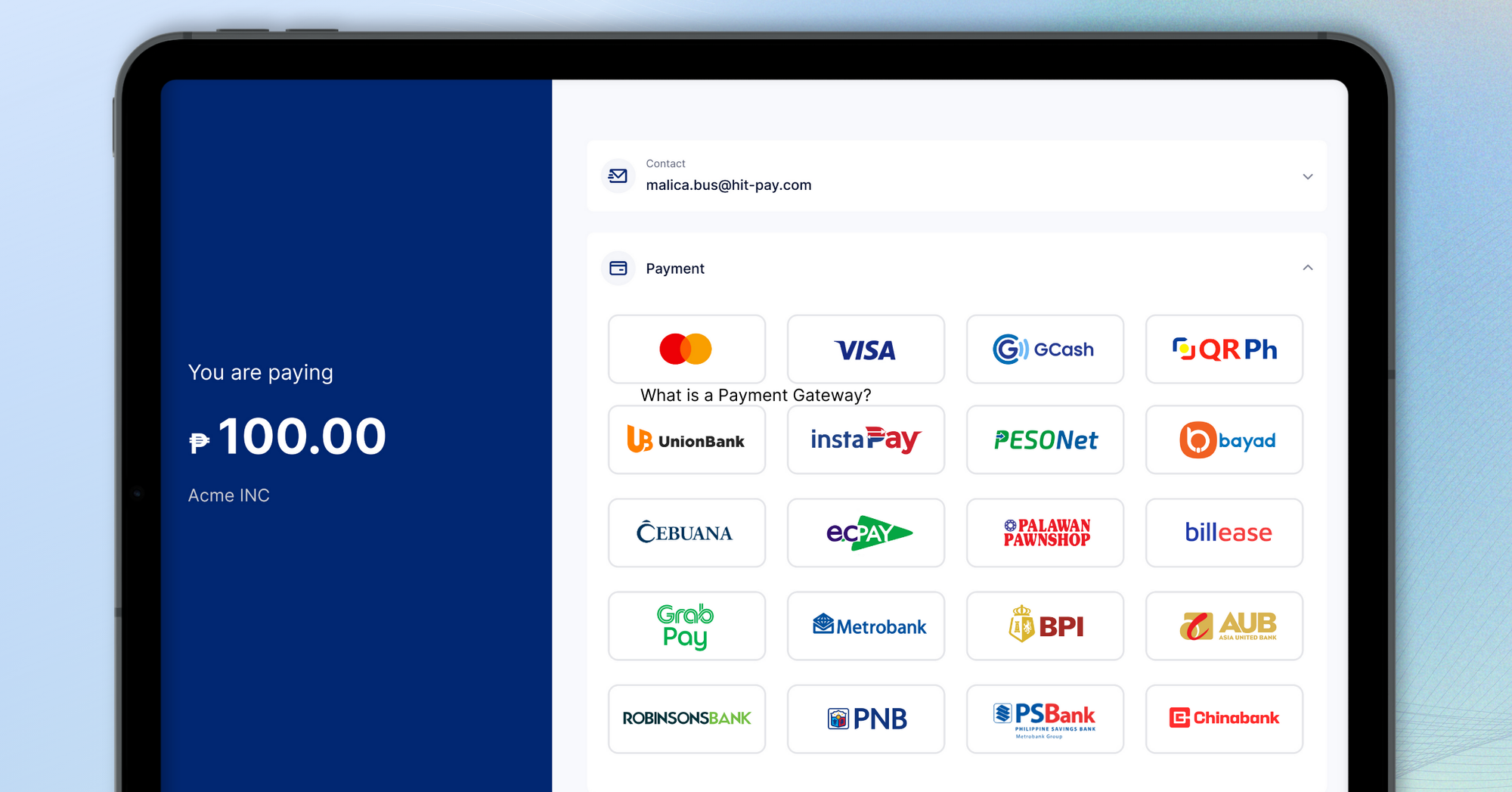

In the Philippines, businesses have a wide range of payment gateways to choose from, including those offered by payment service providers, banks, and fintech companies.

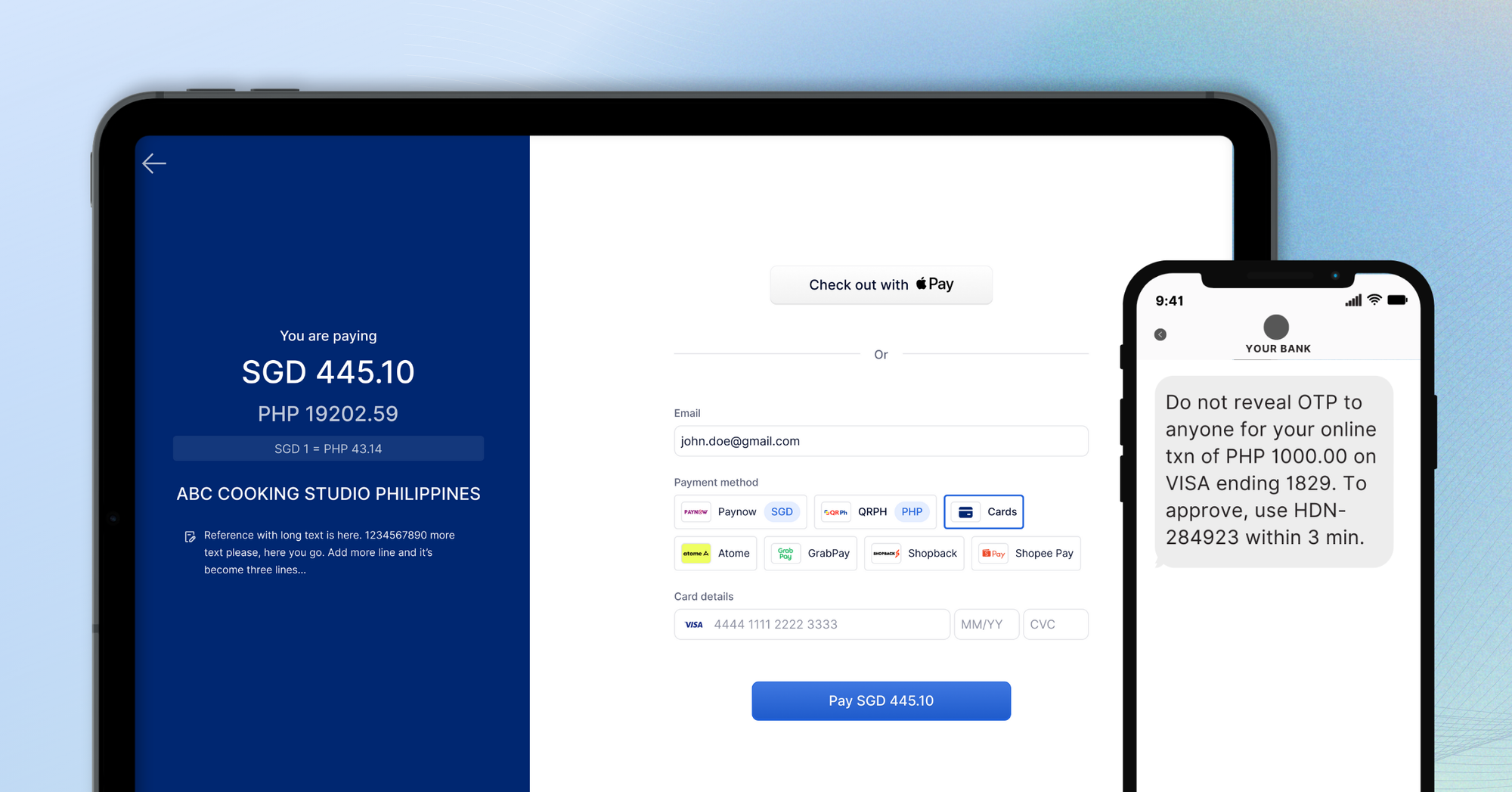

These gateways allow businesses to reach global customers, manage multiple currencies, and comply with international regulations, helping to expand their market reach.

However, it’s important to consider the associated costs. Payment gateways charge transaction fees that vary based on the provider and specific business needs. Choosing the right payment gateway not only enhances customer satisfaction but also ensures data security in today’s digital economy.

What is a Payment Processor?

A payment processor plays a vital role in transactions, connecting the merchant’s bank with the customer’s bank. It ensures that funds are securely transferred, whether payments are made online or in person.

How Payment Processors Work

Payment processors are key to online payments. They facilitate communication between merchants, credit card companies, and banks, providing essential services that optimize the payment process:

- Fraud Detection: Protects both merchants and customers from fraudulent activities.

- Chargeback Management: Handles disputes and ensures timely resolution.

- Regulatory Compliance: Ensures all transactions adhere to industry security standards.

Payment processors do more than simply transmit payment data—they offer additional services that enhance transaction security and overall efficiency.

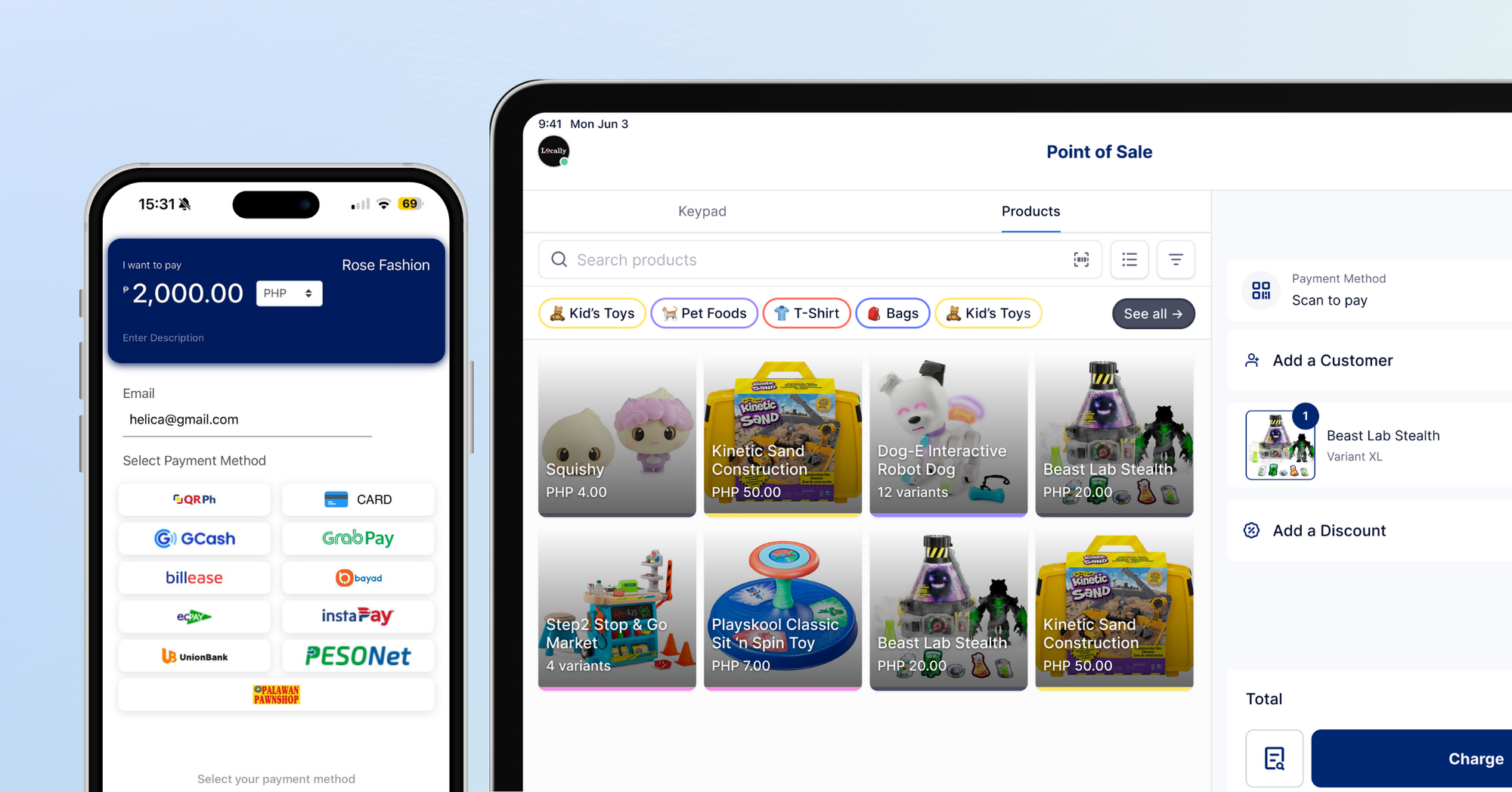

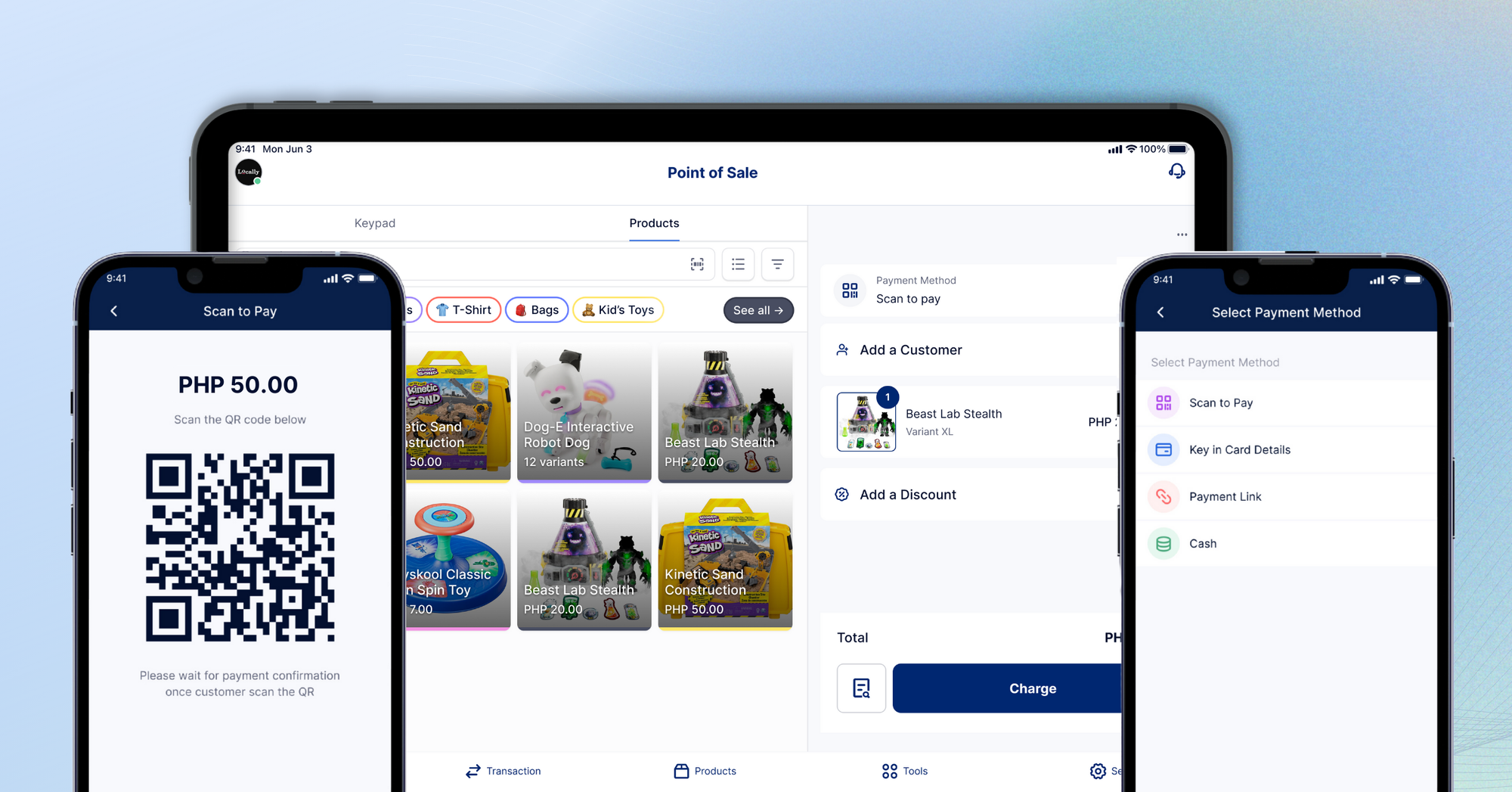

With HitPay, you don’t need separate systems—our solution offers secure payment processing, fraud detection, regulatory compliance, and seamless integration with various payment methods. Whether you're accepting payments online or in person, HitPay simplifies operations by providing everything you need in a single, easy-to-use platform.

How Do Banks Fit into the Payment Process?

Banks are very important in the payment process. They ensure that transactions are secure and processed smoothly. Understanding how banks function helps highlight their significant part in facilitating payments.

The Role of Banks in Payment Authorisation and Settlement

Banks are responsible for verifying and authorizing payments.

- When a payment is initiated, the payment gateway communicates with your bank to confirm if there are sufficient funds available.

- The bank reviews the transaction details and approves or declines the payment based on your account status.

- Once the payment is authorized, the bank manages the transfer of funds, moving money from the customer’s account to the merchant’s account.

By overseeing these transactions, banks ensure that payments are processed accurately, keeping the financial ecosystem secure for both buyers and sellers.

Banks, payment gateways, and processors work together well. Payment gateways send your payment information safely. Processors handle the payment's details. When they work together, payments go through fast and smoothly.

Key Differences Between Banks and Payment Gateways

Banks primarily manage customer accounts, deposits, and loans, while payment gateways are designed to ensure online transactions are processed securely and efficiently.

Functionality: Banking vs. Payment Processing

Banks and payment gateways play distinct roles in payment handling. Banks focus on financial services like deposits, loans, and account management. Payment gateways, on the other hand, specialize in securely processing online payments by transmitting payment data between the customer, the merchant, and financial institutions.

While banks manage the overall financial infrastructure, payment gateways focus on the secure and rapid transmission of payment data. Together, they provide businesses with the tools needed to handle both in-person and online transactions while maintaining high levels of security and trust.

Security Features and Fraud Prevention

Both banks and payment gateways prioritize security, but they approach it differently:

Banks:

- Protect customer funds and information through comprehensive fraud prevention measures.

- Employ strong authentication protocols to safeguard accounts.

Payment Gateways:

- Utilize encryption and tokenization to secure payment data during transactions.

- Implement fraud detection tools that monitor for suspicious activity in real-time.

- Manage chargebacks and deploy anti-fraud systems to mitigate risks in digital payments.

Integration with E-commerce and Online Businesses

Payment gateways are essential for e-commerce, enabling businesses to accept various payment methods, including credit cards, digital wallets, and UPI. This flexibility provides more options for both buyers and sellers.

Gateways like HitPay, make it easy for businesses to integrate diverse payment options into their websites. In contrast, banks typically offer broader financial services and may not provide the same level of support for online merchants.

Differences Between a Payment Gateway and a Payment Processor

As digital payment transactions in the Philippines grew from 42.1 percent of total monthly retail payments in 2022 to 52.8 percent in 2023, the country’s shift toward cashless transactions is accelerating.

Understanding the difference between a payment gateway and a payment processor is crucial as these technologies play key roles in enabling seamless online payments.

Roles and Responsibilities in the Payment Ecosystem

A payment gateway is like a virtual terminal for online buys. It's for card-not-present (CNP) payments, where people don't meet in person.

On the other hand, a payment processor makes sure the payment goes through and settles the funds. These two work together well, as they have different payment processing roles.

- The payment gateway encrypts customer info like credit card numbers and sends it safely to the processor.

- The processor checks with the bank to see if the payment is okay or not, then moves the money to the seller's account.

- Both systems keep transactions safe and follow strict online security rules, making sure everyone stays protected.

This whole process usually takes just a couple of seconds from start to finish. This teamwork is key for making online buys easy and safe, especially for online stores.

The Bank’s Role in Facilitating Secure Transactions

Banks are central to maintaining the security of online payments. They verify and authorize transactions while employing robust security measures to protect customer data from cyber threats and fraud.

By implementing layered security protocols like encryption and two-factor authentication, banks significantly reduce the risks associated with digital payments.

Beyond processing payments, banks adhere to strict regulatory standards and create a secure environment for all parties involved.

When to Rely on Banks for Payment Processing Needs

It’s advantageous to rely on banks for payment processing in certain scenarios, such as:

- When strong security measures are essential for protecting sensitive customer data.

- For large transactions that require additional verification and safeguards.

- When your industry demands compliance with stringent regulatory requirements.

- If your online store needs seamless integration with banking services.

Choosing the Right Financial Tools for Your Business in the Philippines

Selecting the right financial tools is crucial for managing business operations and driving growth. Businesses need to consider several factors that directly impact efficiency and long-term success.

Factors to Consider: Cost, Security, and Ease of Use

When picking financial tools and payment gateways, focus on these essential considerations:

- Cost: Evaluate tools based on pricing, including transaction fees, subscription plans, and additional costs. Understanding the financial commitment helps you make informed decisions.

- Security: Prioritize tools with robust security measures like encryption and fraud detection, ensuring your transactions are compliant with regulations and well-protected.

- Ease of Use: Opt for solutions that integrate smoothly with your existing systems. User-friendly tools enhance productivity, improve employee satisfaction, and deliver a better customer experience.

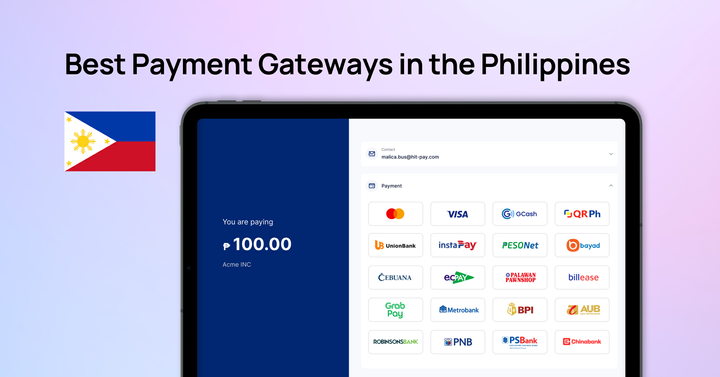

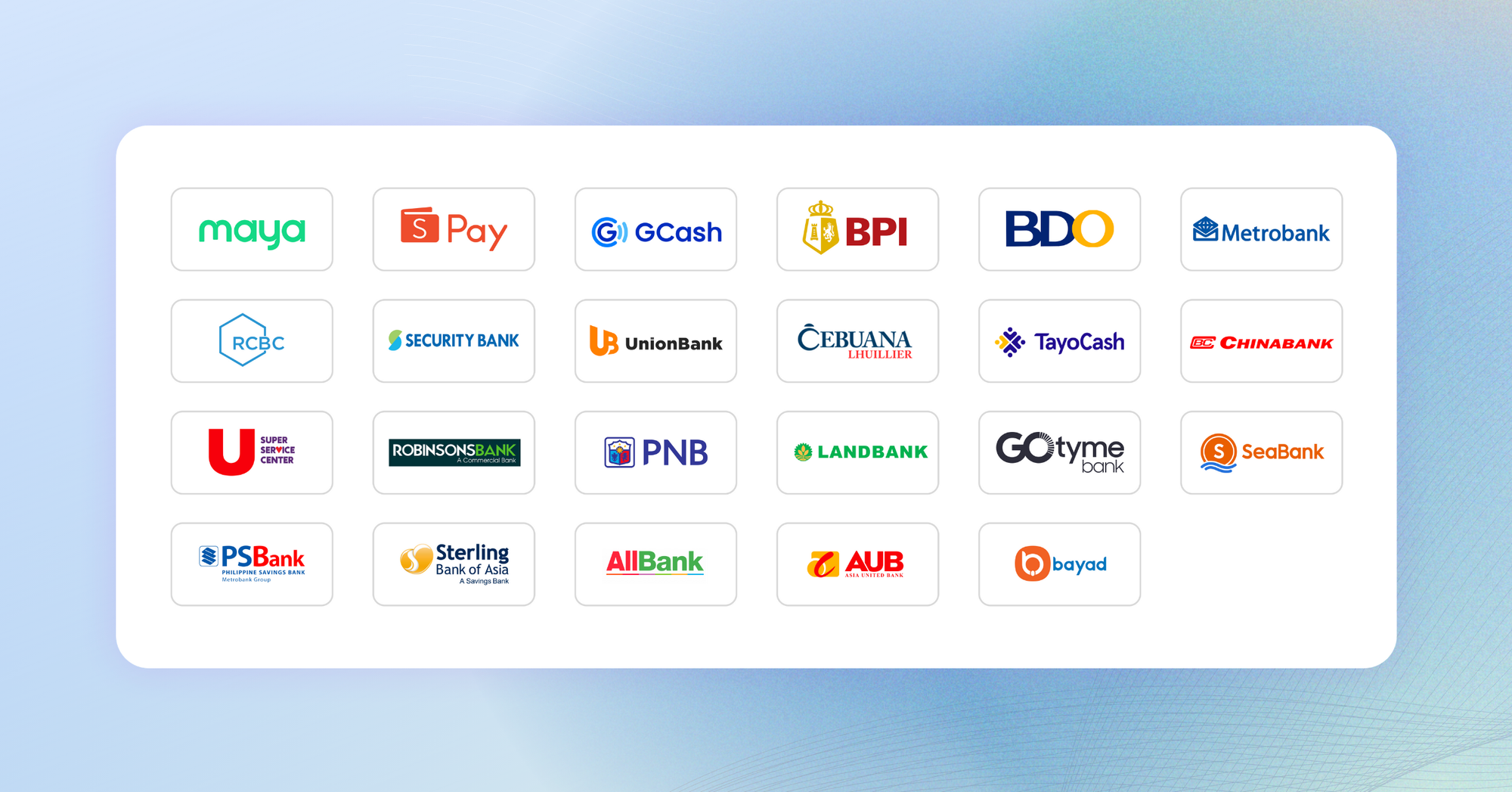

Popular Banks and Payment Gateways in the Philippines

Many banks and payment gateways are making a big difference in finance. Here are some top choices:

Get Started With HitPay’s Secure Payment Gateway Solution

Combine the reliability of banking with the speed of digital payment gateways to offer seamless transactions, enhancing both customer satisfaction and operational efficiency.

HitPay allows you to integrate popular payment platforms, reducing processing times and offering flexible payment options that drive sales and reduce cart abandonment.

To succeed in today’s digital payment landscape, prioritize security with robust encryption and compliance. HitPay’s all-in-one solution lets you accept local and international payments, with seamless integration, no coding required, and low fees.

Start selling quickly with HitPay’s transparent pay-per-transaction pricing—no hidden costs. Sign up now and start selling within days.

Have questions? Our support team is ready to assist you on your preferred platform. Elevate your payment process with HitPay!

Frequently Asked Questions About Payment Gateways

What is the main difference between a bank and a payment gateway in the Philippines?

A bank is where you keep your money and get loans. It's a place for financial services. A payment gateway is a technology that makes online buying safe and easy for customers and sellers.

What are the key services offered by banks in the Philippines?

Banks here give you savings and checking accounts, loans, and help with buying homes. They also offer investments, exchange money, and advice on money matters. This helps people and businesses manage their money well.

How do payment gateways work?

Payment gateways make sure your online transactions are safe. They encrypt your info and send it securely to the seller and banks. This makes paying online smooth and safe.

How do banks fit into the payment process?

Banks are key in making sure payments go through. They check if you have enough money, confirm the payment, and settle the deal between everyone involved.

What are the security features of banks and payment gateways?

Banks and payment gateways use top-notch security like encryption and fraud checks. They follow strict rules to keep your payment info safe from hackers.