Understanding Payment Gateways: How They Work and Examples

The article explores the role of payment gateways in online shopping. It covers their functionality, importance for businesses, types of gateways available, and key features that enhance security the overall shopping experience.

A payment gateway is a key player in online shopping, allowing merchants to securely accept credit and debit card payments, whether in stores or on their websites. Understanding how payment gateways work is essential for businesses, as they make the buying process easy and safe for customers, creating a better shopping experience for everyone!

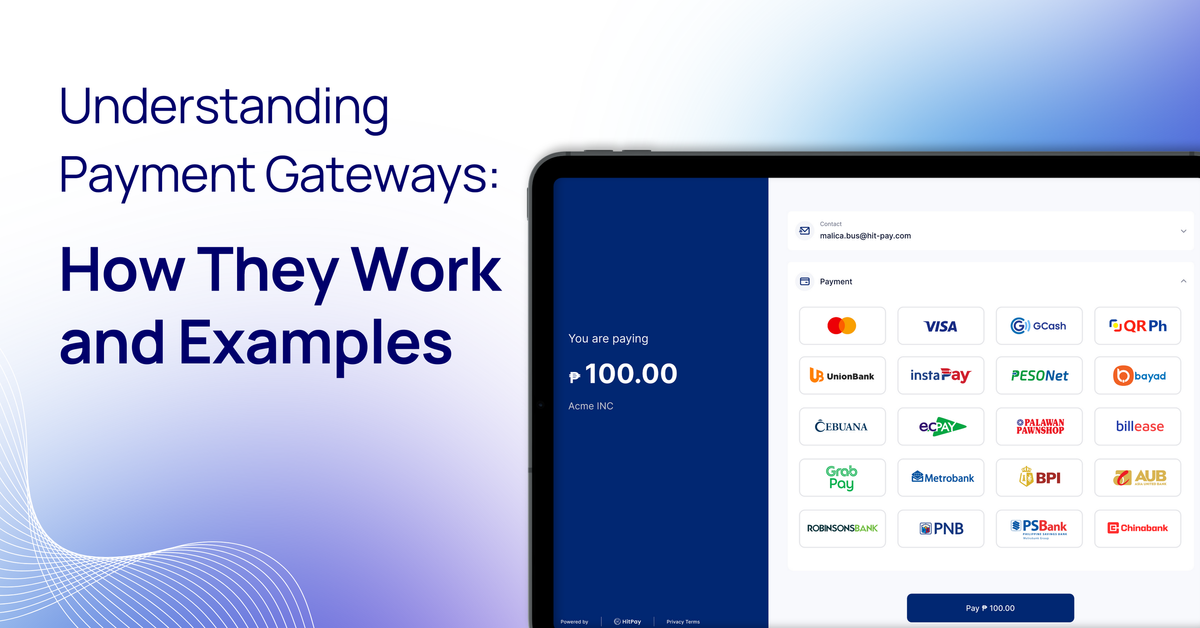

One standout option is HitPay, a versatile payment gateway that simplifies transactions for businesses of all sizes. HitPay enables merchants to accept a wide range of payment methods, including GCash, PESONet, and credit cards, without the need for complex integrations.

In the fast-changing online shopping world of the Philippines, knowing how payment gateways work is a must for businesses to do well. This guide will explore how payment gateways function, their importance in securing transactions, and provide examples of effective solutions.

Key Takeaways

- A payment gateway is needed for safe online payments.

- Payment gateways use encryption to keep data safe.

- Both in-store and online shops gain from using payment gateways.

- Learning about payment gateways can make customers happier and trust you more.

- Picking the right payment gateway is key for easy payments.

What is a Payment Gateway?

34% of shoppers shop online at least once a week. A payment gateway is important for online shopping. It allows businesses to safely accept payments over the internet. It works like a point-of-sale (POS) system but is designed for online use. When a customer makes a purchase, the payment gateway collects their payment information and sends it for approval.

This process keeps online payments secure. Payment gateways protect card information using encryption. They work with different payment processors to meet the needs of businesses. Some gateways charge fees based on the sale amount, while others have a fixed fee for each transaction.

Different businesses need different features. Some may want gateways for regular payments or special types of payments. It is also helpful to accept payments from other countries, which can increase sales.

Understanding payment gateways is essential for growing your business online. They make transactions easier and safer for both businesses and customers.

How Do Payment Gateways Work?

Payment gateways are essential for online sales. They start when a customer checks out. They then encrypt the card details and send them safely to the bank or processor.

Next, the payment processor verifies the transaction with the bank to confirm whether the payment is authorized. It then communicates the result to the website, indicating whether the payment was successfully processed or declined.

This process has a few important parts:

- Encryption of payment details

- Verification through payment processors

- Real-time feedback to the customer

There are different types of gateways. Some make customers leave the site to pay. Others let them pay right on the site. API gateways give businesses more control over payments.

Local bank gateways send payments to the right bank fast. This makes paying safer and easier. It also follows strict security rules.

| Type of Payment Gateway | Redirects Customer | Control Level | Security Features |

|---|---|---|---|

| Hosted Payment Gateway | Yes | Low | PCI Compliance |

| Self-hosted Payment Gateway | No | Medium | SSL Certification |

| API-hosted Payment Gateway | No | High | Requires PCI Compliance |

| Local Bank Integration Gateway | No | High | Secure Data Routing |

Understanding payment gateways helps businesses sell online safely. It makes paying online better, safer, and more efficient.

How Will An Online Payment Gateway Benefit My Business?

Using a payment gateway helps businesses a lot today. It makes transactions fast and smooth. This makes customers happy and helps keep them from leaving without buying.

It's also key to fight fraud with strong security. Online fraud is a big problem, expected to cause over $343 billion in losses by 2027. Payment gateways keep your customers' info safe with top-notch encryption and other methods.

- Support for various payment methods enhances customer convenience

- A customizable checkout process fosters customer loyalty and improves brand identity

- Payment gateways enable fast processing, improving cash flow

Payment gateways make things easier for your business. They work with systems like Stripe to accept payments in over 135 currencies. This means lower costs and less hassle for you.

They also help you sell more by cutting down on lost sales. With easy setup and strong support, you can focus on growing your business.

| Feature | Benefits |

|---|---|

| Fast Transactions | Reduces cart abandonment and enhances cash flow |

| Robust Security | Protects sensitive data and meets PCI DSS compliance |

| Support for Multiple Payment Methods | Enhances customer satisfaction and loyalty |

| Global Transactions | Facilitates international sales and currency conversions |

| Ease of Integration | Enables quick setup and operational efficiency |

In conclusion, using a payment gateway changes your business for the better. It gives you big advantages in today's digital world.

Key Differences Between a Payment Gateway and A Payment Processor

Understanding the differences between a payment gateway and a payment processor is important. They are not the same, even though people often mix them up. A payment gateway is key in taking and encrypting payment info online. It's the first step, handling customer info and making sure it's safe.

A payment processor is vital for moving money around. It links the customer, the store, and banks together. It checks the payment details and makes sure the store gets paid. So, the gateway takes care of the front-end security and info. The processor handles the back-end work to settle payments.

Payment Gateway Functions:

- Captures payment details.

- Secures customer data by adhering to PCI DSS standards.

- Primarily facilitates authorizations for online transactions.

Payment Processor Functions:

- Verifies payment details for accuracy.

- Manages funds between issuing and acquiring banks.

- Acts as a communication link among involved parties for transaction approval or denial.

For most online businesses, both a payment gateway and a payment processor are necessary for smooth, secure transactions. The gateway handles the customer-facing aspects and initial security, while the processor takes care of the financial logistics.

Modern payment solutions like HitPay often combine both gateway and processor functionalities into a single platform. This integration simplifies the setup process for merchants, providing a seamless payment experience from start to finish.

By understanding these roles, you can better choose the right payment solution that fits your business needs, whether you operate online, in-store, or both.

Different Types of Payment Gateways

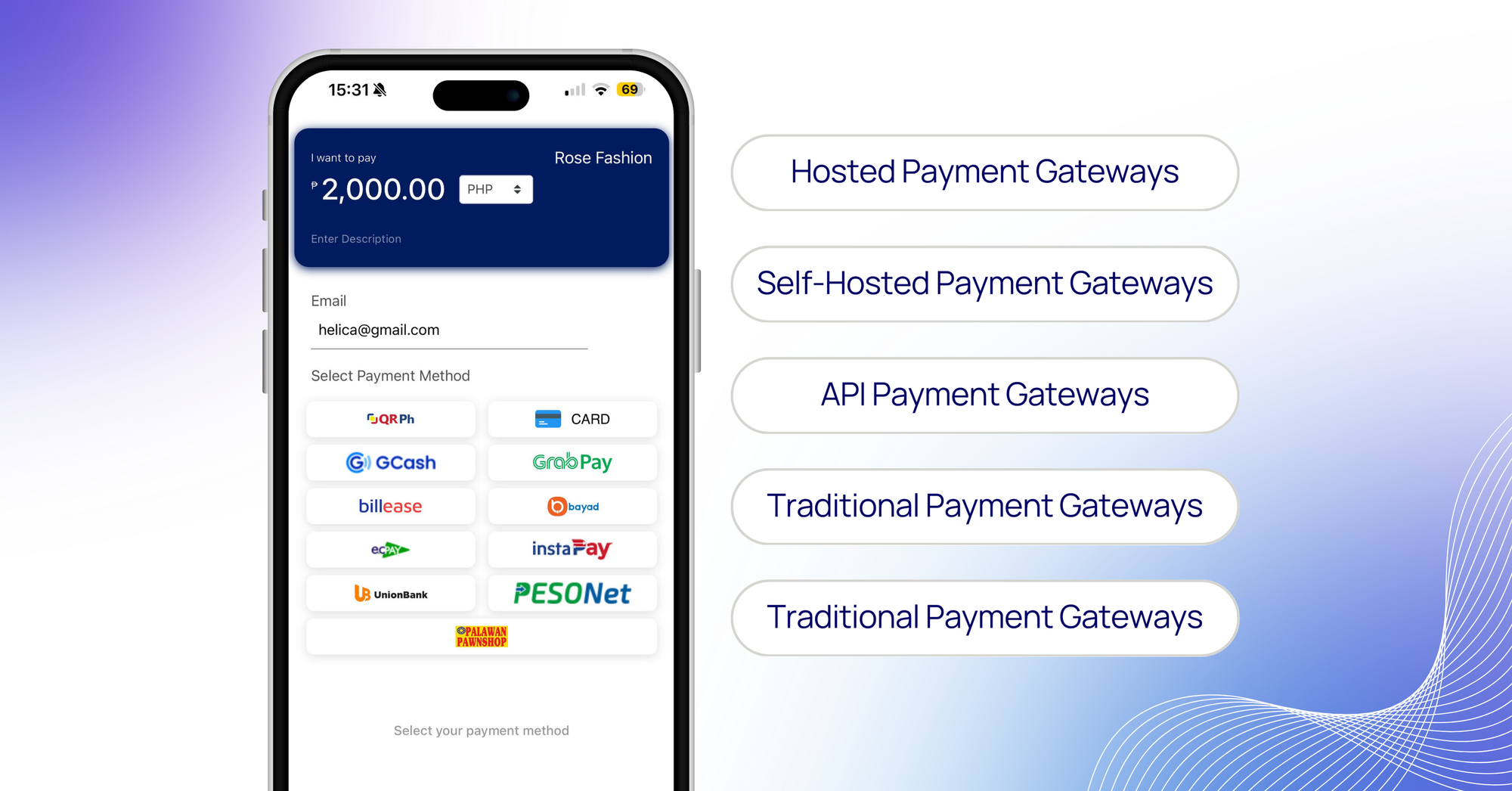

It's key to know the different types of payment gateways to pick the best one for your business. Each type has its pros and cons. These affect your choice based on how you want your customers to feel, the tech you need, and your budget.

Hosted Payment Gateways

Hosted payment gateways send customers to another site to pay. This makes it easier to follow PCI rules since you don't keep payment info. PayPal is a well-known example, reaching a total payment volume of $1.53 trillion in Q4 2023 over 25 billion transactions. The good points of hosted payment gateways are:

- Transactions are fully PCI compliant.

- Easy to install and customize.

- Low cost, often charging per transaction.

But, you might have less control over how customers feel during checkout. This can make payments slower if customers have to go to another site.

Self-Hosted Payment Gateways

Self-hosted payment gateways let customers pay on your site. This makes for a better customer experience and lets you watch over the whole process. But, you have to handle security and follow rules yourself. The benefits are:

- Excellent customer service and support.

- Ability to monitor the entire customer journey.

But, you might have to fix tech problems on your own. Starting up can also cost more money.

API Payment Gateways

API payment gateways are flexible and customizable, making them ideal for businesses needing special features. They can be used on both phones and computers, providing a unique checkout experience. The benefits include:

- Complete customization with full control.

- Quick transaction processing and real-time updates.

However, standardization was the most commonly observed challenge in the implementation of APIs in payment systems across the world in 2021. This type of gateway must follow strict rules and obtain an SSL certificate. Both you and the gateway share responsibility for security, so you must also take steps to protect the data.

Traditional Payment Gateways

Traditional payment gateways connect to physical payment machines in stores. They are commonly used by shops that sell products in person and are designed for card payments at the point of sale.

These gateways come with specific costs and are less frequently discussed in the context of online transactions. However, they remain essential for businesses that primarily operate offline.

White Label Payment Gateways

White label payment gateways allow businesses to brand a payment service as their own. This option provides flexibility while outsourcing the actual payment processing to another provider. It is ideal for businesses that want to maintain strong brand identity and ensure secure transactions without handling the technical aspects of payment processing themselves.

| Type of Payment Gateway | Advantages | Disadvantages |

|---|---|---|

| Hosted Payment Gateways | PCI compliant, easy to use, cost-effective for smaller businesses | Lack of control over consumer journey, potential delays due to redirection |

| Self-Hosted Payment Gateways | Full control of customer experience, excellent customer service | Higher setup and maintenance costs, limited support |

| API Payment Gateways | Fully customizable, quick processing, integrates with various setups | Strict compliance requirements, responsibility for security on the merchant |

| Traditional Payment Gateways | Common for in-store purchases, reliable transaction processing | Limited to physical payments, less flexibility for online sales |

| White Label Payment Gateways | Branding flexibility, outsourcing transaction handling | May require negotiations with provider, varying reliability levels |

How To Choose A Payment Gateway for Your Business in the Philippines

Choosing a payment gateway in the Philippines needs careful thought. You must look at several factors for selection that fit your business and what your customers want. The right payment gateway can make transactions smoother, improve cash flow, and boost sales by offering more ways to pay.

Factors to Consider

- Compatibility: Make sure the payment gateway works well with your current systems.

- Transaction Fees: Look at fees from different Payment Gateway Providers to find the best deal.

- Security Features: Check that the gateway keeps payments safe to protect your customers' info.

- Customer Service Support: Good support is key for a smooth experience and quick help when needed.

- Variety of Payment Methods: A gateway that accepts many payment types can draw in more customers.

Popular Payment Gateway Service Providers in the Philippines

There are many Philippine Market Payment Solutions out there, each with features for different business needs. Here are some top providers:

HitPay

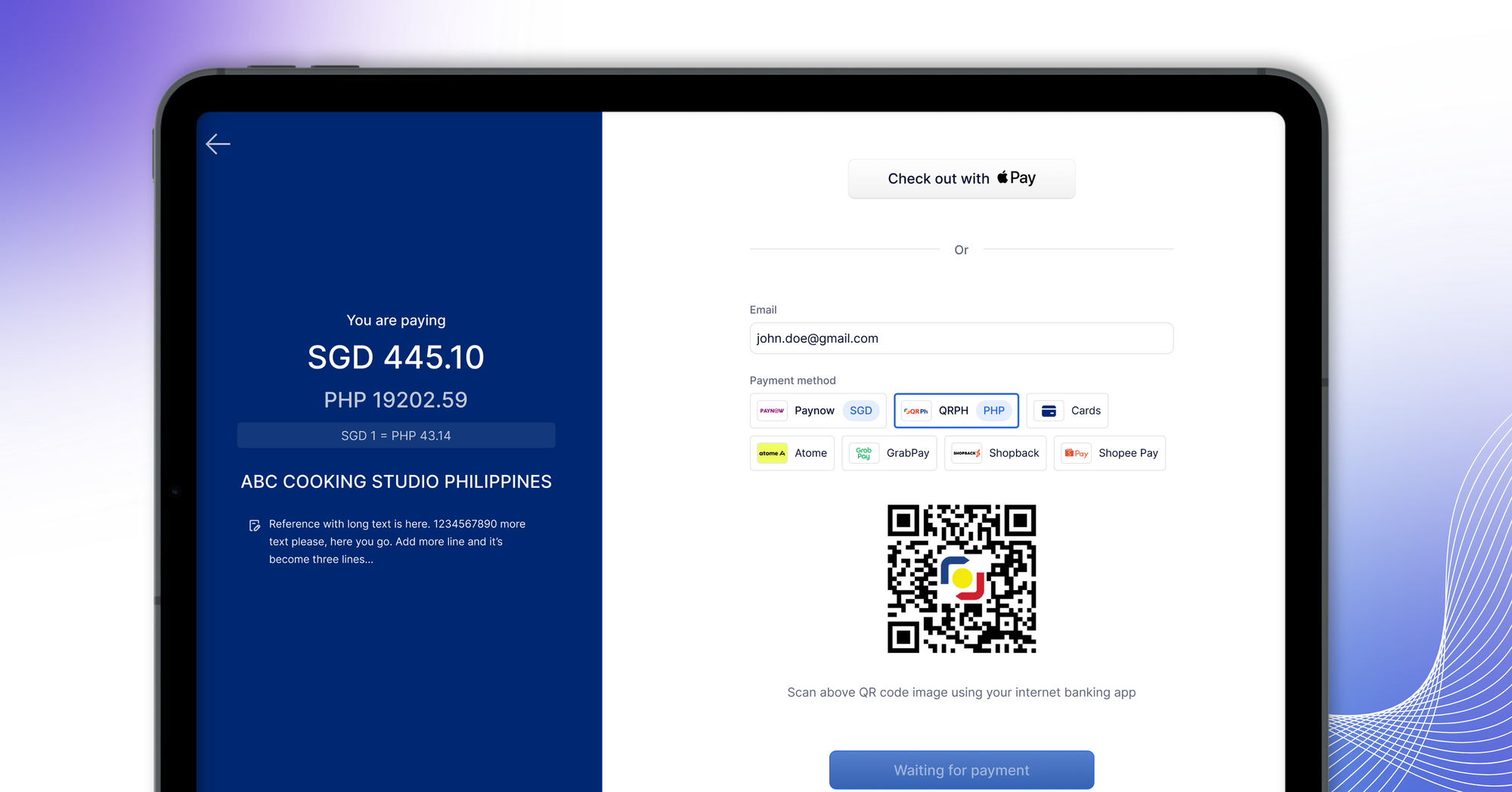

HitPay is a versatile payment gateway that's easy to set up and integrates seamlessly with platforms like Shopify, WooCommerce, and Magento—no coding required. It supports a wide range of payment methods, including credit/debit cards, e-wallets, and bank transfers, making it suitable for both local and international customers.

HitPay stands out with its comprehensive business software features, offering more than just payment processing. It provides a full suite of tools including a POS system, mobile app, and online store builder. This makes it an all-in-one solution for businesses looking to manage their operations efficiently.

With a transparent pricing model, fast payouts (often within a day), and strong security features like PCI DSS compliance and fraud detection, HitPay is a reliable and cost-effective solution for businesses of all sizes.

Paymongo

Paymongo is well-regarded in the Philippines for its simple setup and user-friendly interface. It operates on a pay-per-transaction model, where businesses are charged a fee only for successful transactions. They don't charge setup, one-time, or monthly fees. This pricing structure allows businesses to only pay for the services they use, making it a flexible option for companies of various sizes.

While popular for its ease of use, Paymongo has some limitations, including the absence of certain local payment methods and fewer e-commerce plugin options. It also has a weekly payout schedule, which may affect cash flow for some businesses.

Xendit

Xendit provides a payment processing solution with a focus on secure transactions and quick setup. It's particularly favored by e-commerce sites looking to streamline their payment processes.

Xendit supports advanced features like invoicing and recurring payments. Its pricing model is competitive, though it lacks some local payment methods and has limited plugin support for certain e-commerce platforms in the Philippines.

Maya

Formerly known as PayMaya, Maya is a leading name in the e-wallet space in the Philippines. It offers a wide range of payment methods with a competitive fee structure.

Maya is ideal for businesses seeking a straightforward payment solution, although it may not be the best choice for those looking to scale, as it lacks certain e-commerce plugins and accounting integrations.

Dragonpay

Dragonpay is known for supporting many payment methods, including in-person transactions. It offers a cost-effective pricing model, making it an attractive option for businesses wanting to offer a diverse range of payment options.

While Dragonpay is favored by large brands for its advanced features like recurring payments and mass payout, it does have limitations, such as the lack of certain e-commerce plugins and accounting integrations.

Ensuring Secure Online Payments: Are Payment Gateways Safe?

Keeping online payments safe is key for keeping customers happy and businesses honest. Payment gateways have strong security steps to make transactions safe. They use data encryption and follow industry rules to keep info like credit card numbers safe.

Common Security Features

Safe Payment Gateways have many security steps to stop fraud and keep user data safe. These include:

- Fraud detection systems that check for odd transaction patterns.

- Address Verification Service (AVS) checks to match entered address info.

- Multi-factor authentication (MFA) to make sure only the right person can make a purchase.

Importance of Payment Data Encryption

Data Encryption is very important for safe online payments. Payment gateways use both kinds of encryption to keep data secret when it's sent. Symmetric encryption uses one key for both making and breaking the code.

Asymmetric encryption uses a public key for making the code and a private key for breaking it. This mix makes it hard for hackers to get into your data.

Payment Card Industry Data Security Standard (PCI DSS)

Following PCI DSS is a must for safe payment handling. This set of rules helps protect card info at every step of the transaction. To follow PCI DSS, businesses must keep their networks safe, protect cardholder data, and check their networks often. This not only builds trust with customers but also protects businesses from losing money if there's a data breach.

Implementing Secure Payment Solutions for Your Online Store

To keep your online store safe, pick secure payment solutions that fit your needs. Look for gateways that offer strong security, easy use, and work well with your website. It's important that your gateway follows PCI DSS rules and has the best security practices.

How to Protect Payment Data and Prevent Fraudulent Transactions

To keep payment data safe, you need to be proactive. Teach your team about cybersecurity and keep your security up to date. Use tokenization to replace important data with safe codes. Also, use secure digital wallets that keep payment info safe and make buying things easy.

| Security Feature | Description | Benefit |

|---|---|---|

| Data Encryption | Makes payment info unreadable to others. | Keeps data safe and private. |

| Tokenization | Changes important info into safe codes. | Lowers the chance of data being seen by others. |

| Multi-Factor Authentication (MFA) | Needs more proof of who you are to log in. | Makes your account safer by checking your identity. |

| Fraud Detection Systems | Looks for odd patterns in transactions. | Stops unauthorized transactions right away. |

| PCI DSS Compliance | Follows rules set by the payment industry. | Builds trust and lowers risk from data breaches. |

Integrating Online Payment Gateways into Your Business

Adding a payment gateway to your business makes online buying easier and better for customers. It covers setting up APIs for payments, making payment pages, and customizing payment options. This makes shopping smoother and more fun.

Setting Up API for Seamless Payment Processing

API setup for payments helps businesses run smoothly and manage money through their websites. It makes sending data safely and quickens the checkout. Developers use APIs from gateways like Stripe for a quick setup and lots of help.

This makes the whole buying experience better by cutting down on wait times.

Creating Payment Links and Payment Pages

Creating good payment pages is key to getting payments right. You can make payment links that work on many platforms, making buying easy for customers. A page that's easy to use means less people leave their carts, which is good for business.

Today's shoppers want fast and easy checkouts. Making it simple can keep more customers coming back.

Customizing Payment Options for Customers

Custom payment solutions let you offer many ways to pay that fit what customers like. Adding support for cards, digital wallets, and bank transfers makes customers happier. Being ready for different online stores and adjusting payment options based on what customers do can increase sales and keep customers loyal.

Conclusion

Payment gateways are key in today's digital world. They make buying things online safe and easy. This keeps customers happy and helps businesses grow.

In the Philippines, where online shopping is getting bigger, having a good payment gateway is a big plus. It helps you stand out from others.

These systems make paying easy and safe. They protect your personal info as it moves from you to the seller. With more people paying online, these gateways are a must for handling different kinds of payments.

Businesses use them to make paying simpler. This lets them focus on making customers happy. Payment gateways do more than just keep data safe. They use strong security tools to fight fraud. This is very important for online payments.

Choosing the right payment gateway can really boost your sales. It can cut down on lost sales by half and make more customers buy. There are different kinds of gateways for different businesses.

In the end, payment gateways are vital for online stores. Knowing how they work and what they do can help businesses in the Philippines do well. Picking the right one can make your business safer and help it grow in the online world.

Get Started With HitPay’s Secure Payment Gateway Solution

Enhance your e-commerce business with HitPay's advanced payment gateway. Accept local and international payments with seamless integration and no coding required. Enjoy low fees, fast payouts, and extensive plugin support.

Get started today with HitPay's simple, pay-per-transaction pricing and no hidden costs. Sign up now and start selling within days.

Have questions? Our support team is ready to assist you on your preferred platform.

Frequently Asked Questions About Payment Gateways

Businesses often wonder about payment gateways. They are key to keeping transactions safe and fast. They use strong encryption and follow strict rules to protect your money info.

How Secure are Payment Gateways?

Payment gateways use strong encryption and follow rules like PCI DSS. This keeps your info safe and stops fraud. With tools like Kount's AI, they can spot fraud early.

Can Small Businesses Benefit from Payment Gateways?

Absolutely! Small businesses can greatly benefit from payment gateways as they provide access to a wide range of payment methods. This allows them to accept various types of payments, enhancing customer convenience. Understanding the associated costs, such as fees and setup charges, also helps in effective budget planning.

What Costs are Involved with Payment Gateways?

The cost of payment gateways changes based on the provider and features. You might pay for each transaction, a monthly fee, or extra for special services. Picking the right provider means staying within your budget.

How to Integrate a Payment Gateway into Your Website?

To add a payment gateway, first pick one that fits your business. Then, the gateway will help you add it to your site. This makes checking out safe and easy for your customers.