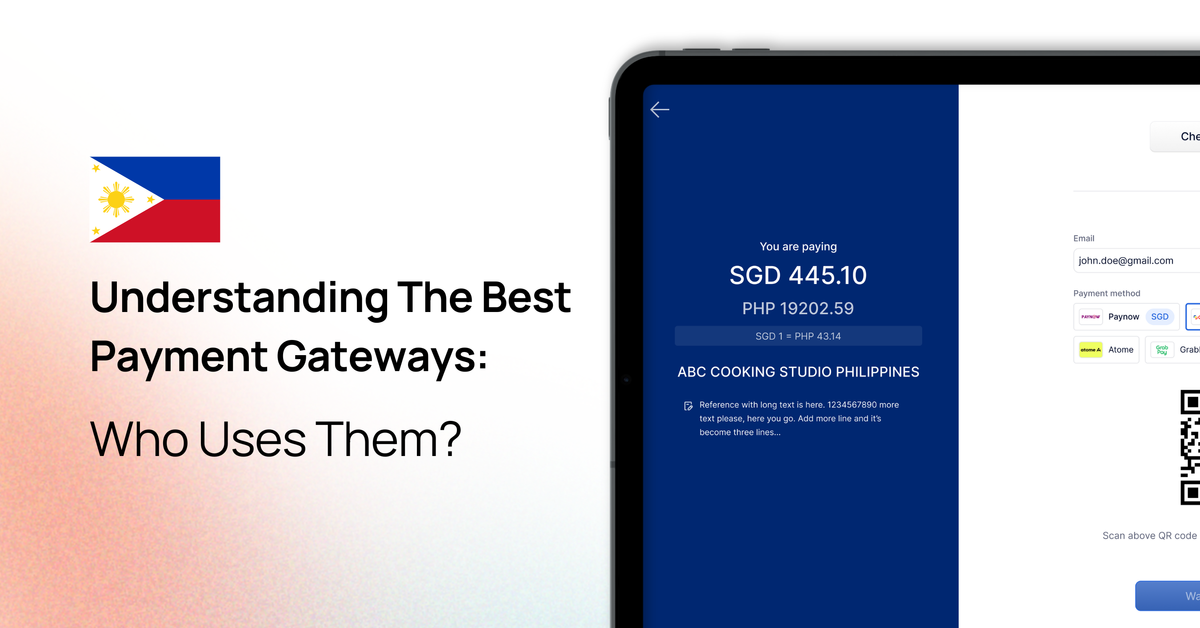

Understanding The Best Payment Gateways: Who Uses Them?

The article explains the importance of payment gateways for various businesses, from e-commerce stores to freelancers and non-profits, highlighting how they ensure secure transactions and enhance customer satisfaction.

As more businesses move online, payment gateways have become essential for securely handling transactions between customers and businesses. These tools ensure money is transferred safely, whether the purchase is made online or in person.

Payment gateways are not just for online stores; they play a vital role for retail shops, freelancers, and even non-profits, allowing them to accept payments easily and securely.

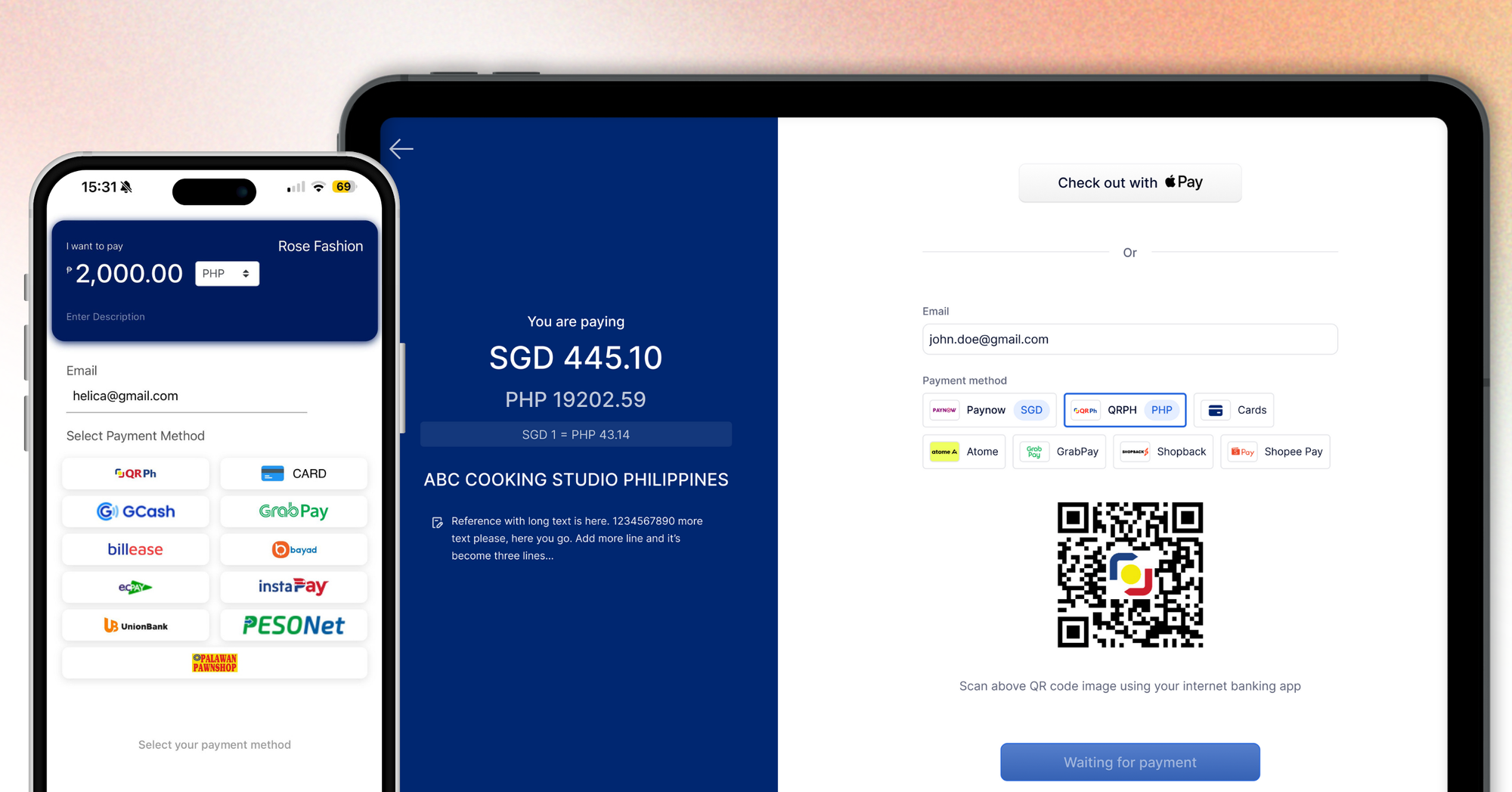

HitPay is an all-in-one payment platform that supports over 15,000 businesses across Southeast Asia and around the world, providing a seamless solution for managing different types of transactions.

This article will explain who uses payment gateways, why they are crucial for businesses, and how selecting the right one can benefit your operations.

Key Takeaways

- Payment gateways are essential for secure online transactions in today's digital marketplace.

- The global e-commerce market is expected to grow significantly, increasing the demand for payment solutions.

- Businesses from various sectors, including retail and services, benefit from adopting payment gateways.

- Understanding the use of payment gateways helps underline their importance in modern commerce.

- Security and efficiency are paramount, as many consumers abandon carts due to cumbersome checkout processes.

Understanding Payment Gateways: A Brief Overview

A payment gateway is key in the online payment world. It helps merchants take payments safely through their websites or apps.

This technology encrypts sensitive info, making sure payments are safe between customers and banks. To process payments well and safely, merchants must add a payment gateway to their systems.

What is a Payment Gateway?

The payment gateway process is about making sure customer payment information gets to the merchant's bank safely. It takes in customer payment information, encrypts it, and sends it to the bank for processing.

These gateways support many payment types like credit and debit cards, net banking, and mobile wallets. There are hosted, self-hosted, and API-hosted gateways, each offering different levels of control for merchants.

How Payment Gateways Work in the Philippines

Payment gateways in the Philippines are designed to fit local needs, especially with the growing use of online payments. When a customer makes a purchase, their payment details are securely sent to local payment processors, which then work with banks to approve and complete the transaction.

This process allows payments to be processed quickly, using modern tools like QR codes for easy mobile payments and NFC for contactless transactions.

Merchants should be aware of the different fees that come with using payment gateways, such as setup fees to start using the service, transaction fees for each payment, and monthly fees to keep the service running.

Understanding these costs can help businesses choose a payment gateway that fits their budget and needs. Some payment gateways also offer flexible pricing options to match different business sizes and transaction volumes.

Businesses That Use Payment Gateways

Payment gateways are key in many business areas. They make transactions smoother and boost customer happiness by providing secure and convenient payment options.

Various businesses use these systems to improve their services and operations, reducing manual work and speeding up payment processing. This helps build customer trust and encourages repeat purchases, ultimately supporting business growth.

E-commerce Stores: Facilitating Online Transactions

E-commerce stores rely on payment gateways for secure online transactions, ensuring that sensitive customer data, such as credit card information, is protected against fraud and breaches.

This level of security builds trust with customers, making the checkout process smoother and more efficient, which can help reduce cart abandonment rates and increase sales.

Payment gateways also provide multiple payment options, such as credit cards, e-wallets, and bank transfers, catering to diverse customer preferences and enhancing the shopping experience.

Retail e-commerce sales are estimated to exceed 6.3 trillion U.S. dollars worldwide, reflecting the rapid growth of online shopping and digital transactions. This expansion is driven by increasing internet accessibility, mobile device usage, and consumer preference for convenient, contactless shopping experiences.

This rapid growth underscores the need for businesses to implement reliable payment gateways to stay competitive and meet the evolving demands of online shoppers.

Retail Businesses: Integrating Online and Offline Payments

Retail shops are improving by adding payment options that work both online and in-store. This makes the shopping experience easier for customers, who can choose their preferred payment method, like cash, credit card, e-wallet, or contactless options like QR codes.

By offering these flexible payment choices, stores can speed up checkout, reduce waiting times, and keep customers happy. This approach helps businesses meet customer needs and encourages them to come back.

Service Providers: Simplifying Payment Collection

Freelancers, consultants, and other service providers use payment gateways to make getting paid simpler and faster. These platforms help by automating payment collection, reducing delays, and sending clear invoices right away, which helps avoid common problems like late payments.

Payment gateways also provide different ways for clients to pay, such as through bank transfers, credit cards, or digital wallets, making it easy to suit different preferences.

This is important in today’s fast-moving world, where quick and smooth payments help keep clients satisfied and ensure steady cash flow.

Freelancers and Solopreneurs Using Payment Gateways

Payment gateways are invaluable tools for freelancers and solopreneurs, streamlining transactions and simplifying the process of receiving payments from clients globally.

They make getting paid easier and cut down on billing trouble. With the right payment solutions, you can focus more on your work and building client relationships.

Using good payment processing for solopreneurs also means you get paid on time, which boosts your productivity.

Streamlining Payment Processes for Independent Professionals

Independent professionals, such as freelancers and consultants, gain several advantages by using payment gateways tailored for their needs:

- Quick and Affordable Payments: These gateways offer fast and cost-effective solutions, enabling freelancers to receive payments quickly from both local and international clients without high fees.

- Instant Transfers and Currency Support: Features like instant transfers and support for multiple currencies simplify cross-border payments, ensuring freelancers can easily handle transactions in various currencies without delays.

- Automated Invoicing: Automated invoice generation helps streamline payment management, reducing manual work and minimising errors associated with billing.

- Increased Productivity: Automating payment and invoicing tasks can reduce domestic work time by up to 42%, allowing freelancers to focus more on important client work, boost productivity, and lower the risk of errors from repetitive tasks.

By leveraging these features, independent professionals can improve efficiency, reduce administrative burdens, and create a more professional image to attract and retain clients.

Popular Payment Gateways for Freelancers in the Philippines

- HitPay: The top-rated payment platform for freelancers, offering competitive rates, easy integration, and fast payouts. An ideal choice for those looking to streamline their payment processes.

- PayPal: A user-friendly option, but it may have higher fees for small transactions, such as a 4% fee for withdrawing foreign currency.

- Razorpay: Provides flexible pricing models, making it a good fit for solopreneurs who need adaptable payment solutions.

- GCash: Simplifies local transactions, helping freelancers stay efficient and manage payments easily within the Philippines.

Choosing the right payment gateway, like HitPay, is crucial for freelancers to save time, reduce costs, and enhance their professional image.

Non-Profit Organisations and Payment Gateways

Non-profit groups now use payment gateways to make online donations easier, which helps them collect money safely and builds trust with donors. In fact, 63% of donors prefer to give online with a credit or debit card, highlighting the need for secure and convenient payment options.

Trust is essential for donors when deciding to contribute to non-profits, and payment gateways help by providing a secure and straightforward donation process.

Facilitating Donations and Contributions Online

To facilitate donations and contributions online, nonprofits need a payment gateway that ensures security, affordability, and convenience for their donors. The right payment gateway not only helps in minimising costs but also simplifies the donation process, allowing donors to give easily and confidently.

Offering multiple ways to donate—such as credit and debit cards, bank transfers, and digital wallets—can significantly enhance donor satisfaction and increase the likelihood of recurring contributions.

Additionally, features like automated receipts, recurring payment options, and multi-currency support can further streamline the donation experience, making it easier for both the organisation and its donors.

Small and Medium Enterprises (SMEs) Adopting Payment Gateways

A growing number of Filipino SMEs are recognising the benefits of digital transactions and are turning to payment gateways to transform their businesses.

These tools not only make transactions more secure but also improve the customer experience by providing a range of payment options. This flexibility allows businesses to accept various forms of payment—like credit cards, bank transfers, and e-wallets—opening up more opportunities to make sales and reach a wider customer base.

Benefits of Payment Gateways for Filipino SMEs

For SMEs in the Philippines, payment gateways offer several key advantages:

- Simplified Payment Process: Payment gateways make transactions quicker and more efficient, enhancing trust and customer satisfaction.

- Encourages Repeat Business: When customers can pay quickly and securely, they are more likely to return, increasing the chances of repeat purchases.

- Multiple Payment Options: Gateways provide various payment methods, such as online banking, credit card processing, and mobile payments, giving customers flexibility and improving the likelihood of completing a sale.

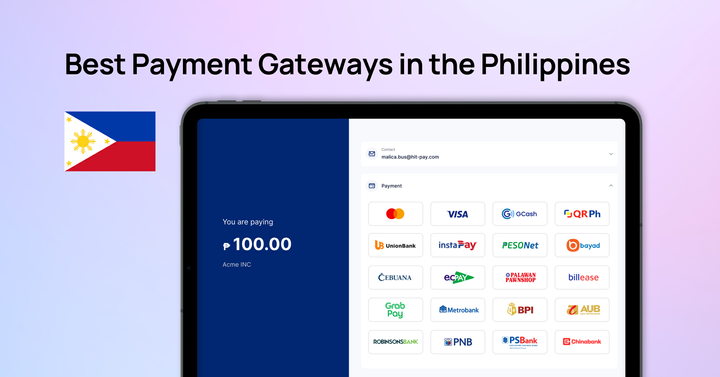

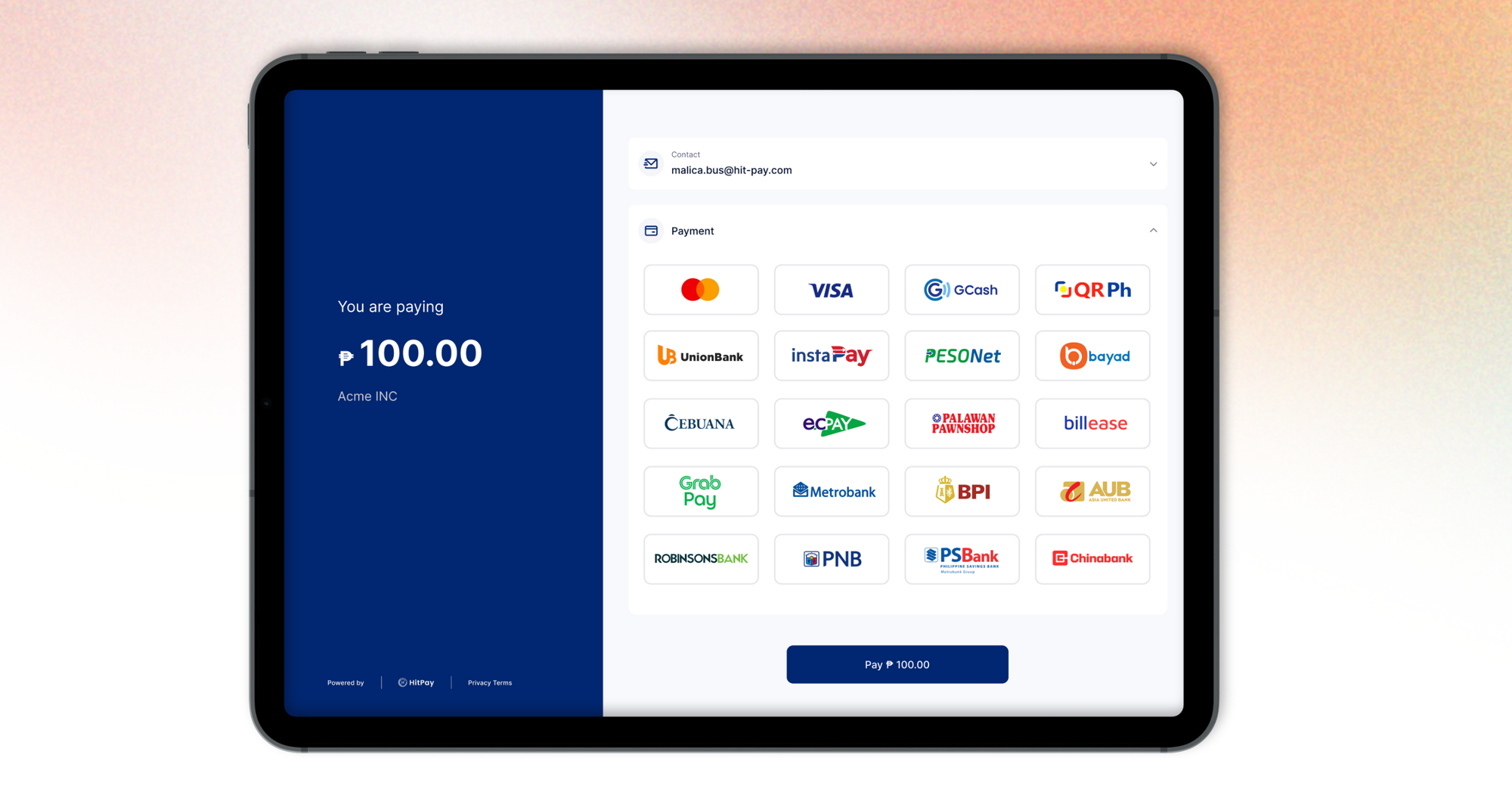

Local Payment Gateway Providers Catering to SMEs

Several local providers in the Philippines, such as HitPay and Dragonpay, specialise in solutions for SMEs. These companies offer platforms that are easy to use and compliant with local regulations, making it simpler for businesses to handle transactions and manage their finances.

Their user-friendly interfaces and local support services help SMEs navigate the digital payment landscape with ease, ensuring a smooth experience for both businesses and customers, ultimately leading to increased customer satisfaction and loyalty.

Key Considerations When Choosing a Payment Gateway

Selecting the right payment gateway is crucial for businesses in the Philippines. It’s essential to evaluate several factors to ensure it meets your specific needs. Prioritising security is vital to protect customer data and ensure compliance with local regulations.

Security and Compliance in the Philippines

When choosing a payment gateway, security should be at the forefront of your decision, especially as there were about 1.59 million online attacks targeting businesses in the Philippines in 2022 alone.

In the Philippines, compliance with the Payment Card Industry Data Security Standard (PCI DSS) is mandatory to safeguard sensitive information.

To achieve this, payment gateways utilise encryption to secure data during transactions, ensuring it is accessible only to authorised parties.Additional protective measures, like tokenization—where card details are replaced with unique tokens—add another layer of security.

Integration with Existing Business Systems

Ensuring your payment gateway integrates seamlessly with your existing business systems, such as e-commerce platforms or point-of-sale (POS) systems, is essential.

Look for gateways that offer flexible integration options, whether hosted, self-hosted, or API-based, depending on your technical requirements. If your business processes recurring payments, verify that the gateway can support this functionality to streamline operations.

Cost and Transaction Fees for Filipino Businesses

Understanding the costs associated with payment gateways is critical for businesses in the Philippines. These fees typically include a combination of monthly charges and per-transaction fees, which might consist of a percentage of each sale plus a fixed amount.

As your transaction volume grows, some gateways provide tiered pricing that reduces costs over time. It’s also beneficial to explore gateways with no setup fees, which can be particularly advantageous for startups looking to minimise initial expenses.

Conclusion: Choosing the Best Payment Gateway for Your Business in the Philippines

The way payments are made in the Philippines is changing quickly, with payment gateways leading the shift to digital transactions. More people are choosing online and cashless payments, and businesses are using payment gateways to make these transactions safer and easier, improving the shopping experience for everyone.

As more people and businesses switch to digital payments, there is a great opportunity to improve services and make customers happier. With the growing use of payment gateways, both businesses and customers can enjoy a faster, more convenient way to handle their transactions.

Enhance your e-commerce business with HitPay's advanced payment gateway. Accept local and international payments with seamless integration and no coding required. Enjoy low fees, fast payouts, and extensive plugin support.

Get started today with HitPay's simple, pay-per-transaction pricing and no hidden costs. Sign up now and start selling within days.

Have questions? Our support team is ready to assist you on your preferred platform. Elevate your payment process with HitPay!

Frequently Asked Questions About Payment Gateways

What is a payment gateway?

A payment gateway is a technology that enables businesses to securely accept payments online or in stores. It acts as an intermediary, safeguarding payment information as it transfers between the customer and the bank.

Who uses payment gateways?

Payment gateways are widely used by online retailers, brick-and-mortar stores, freelancers, service providers, charities, and small businesses. They enhance payment security and improve the overall customer experience.

What benefits do payment gateways provide for e-commerce stores?

For e-commerce stores, payment gateways facilitate secure online transactions, streamline the checkout process, increase sales, and boost customer satisfaction.

How do freelancers benefit from payment gateways?

Freelancers use payment gateways to manage payments, automate invoicing, and minimise payment delays or disputes, allowing them to focus more on their work and client relationships.

Why do non-profit organisations use payment gateways?

Nonprofits utilise payment gateways to simplify online donations, extend their reach, and build donor trust, ultimately leading to increased contributions.

What should businesses consider when choosing a payment gateway?

Businesses should consider factors like security, compatibility with their systems, transaction fees, and user experience, especially in the Philippine market.