Payment Gateway vs POS: Understanding the Roles of Payment Processors and Virtual POS

The article explains the roles of payment gateways, POS systems, and payment processors in e-commerce. It highlights how these systems work together to improve payment experiences for customers and streamline business operations.

As e-commerce continues to grow, businesses need to offer seamless payment experiences to meet customer expectations.

Understanding the differences between payment gateways, POS systems, and payment processors is key to optimizing your sales strategy and improving customer satisfaction.

HitPay, a trusted all-in-one payment platform supporting over 20,000 businesses across Southeast Asia and globally, is designed to help SMEs manage payments more efficiently. By integrating online, in-person, and B2B payments into one system, HitPay simplifies the payment process for businesses.

In this article, we’ll dive into how payment gateways, POS systems, and payment processors work together to enhance your business operations and make transactions easier for your customers.

Key Takeaways

- Understanding the distinctions between Payment Gateways and POS Systems is essential for optimizing transactions.

- Diverse payment methods significantly influence customer purchase decisions.

- A successful online transaction requires both a Payment Gateway and a Payment Processor.

What is a POS System?

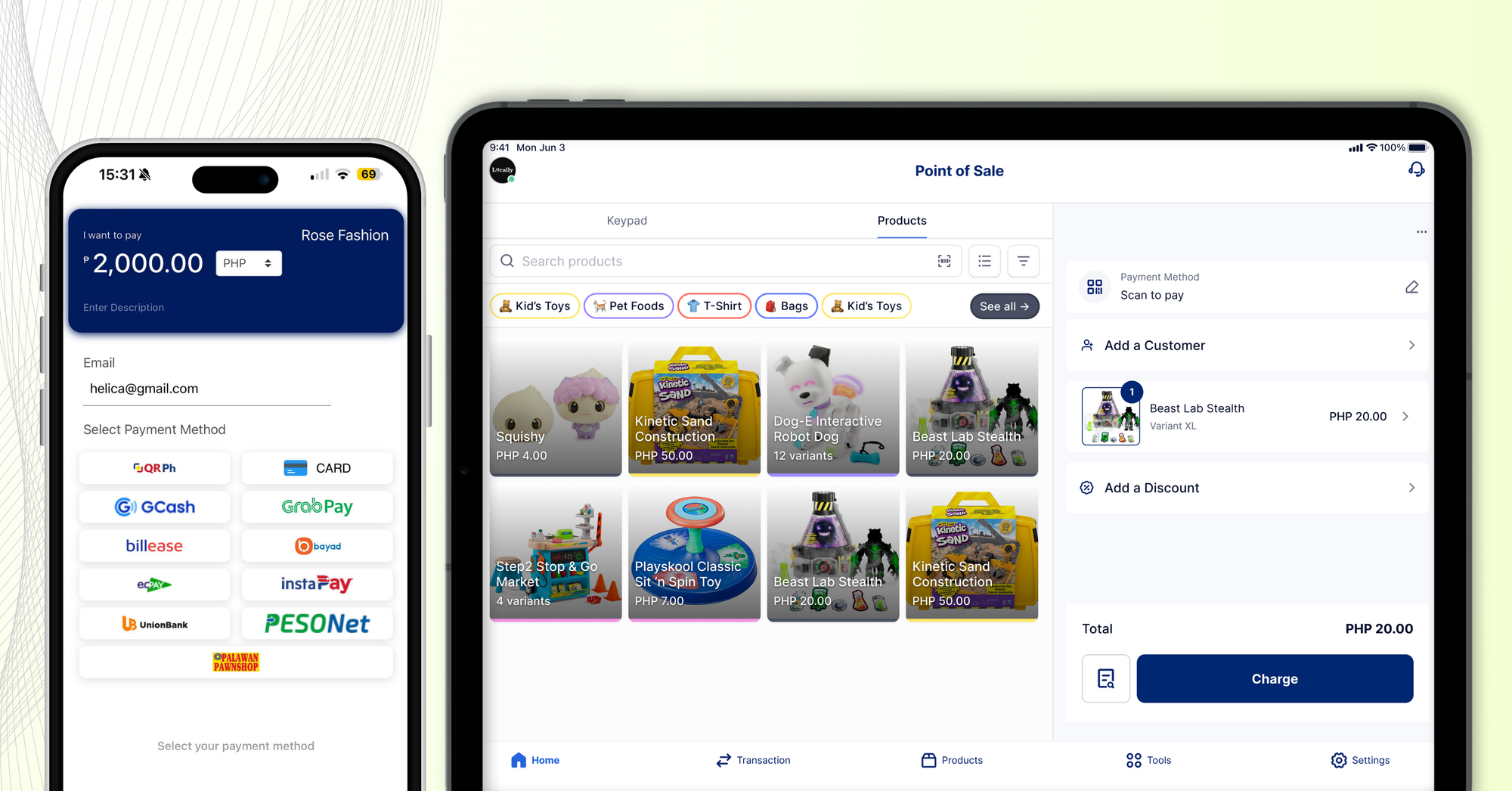

A POS (Point of Sale) system is a combination of hardware and software used for processing sales in retail environments. It’s essential for businesses as it streamlines customer payments, manages inventory, and generates sales reports.

Transaction value in the Mobile POS Payments market in the Philippines is projected to reach US$4.62bn in 2024. Understanding how POS systems work allows retailers to enhance their operations and deliver a better customer experience.

Key Functions and Advantages of POS Systems

POS systems do more than just take payments. They help manage inventory efficiently, track sales data, and even assist with employee management.

- Transaction Processing: Handles various payment methods including cash, credit, and debit.

- Inventory Management: Tracks stock levels in real-time, reducing the risk of out-of-stock situations.

- Data Collection: Gathers sales data and trends to inform business strategies.

- Customer Management: Maintains customer purchase history and preferences for targeted marketing.

- Employee Management: Logs employee hours and performance metrics.

- Security Features: Protects sensitive customer data during transactions.

- Cost Efficiency: Reduces the need for multiple systems by integrating various functionalities.

Examples of POS Systems in the Philippines

In the Philippines, many POS systems meet different business needs. They show how flexible POS systems can be. Some examples include:

What is a Payment Gateway?

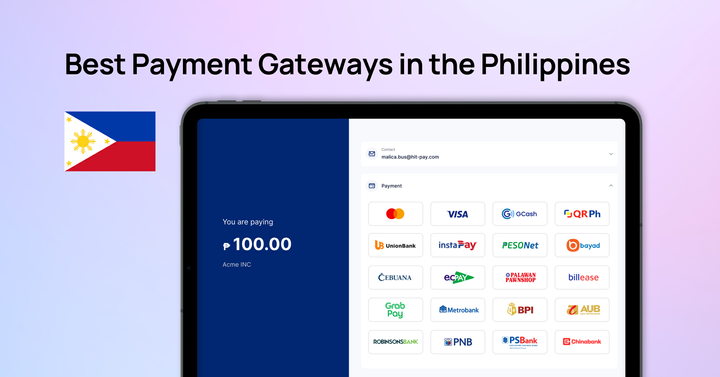

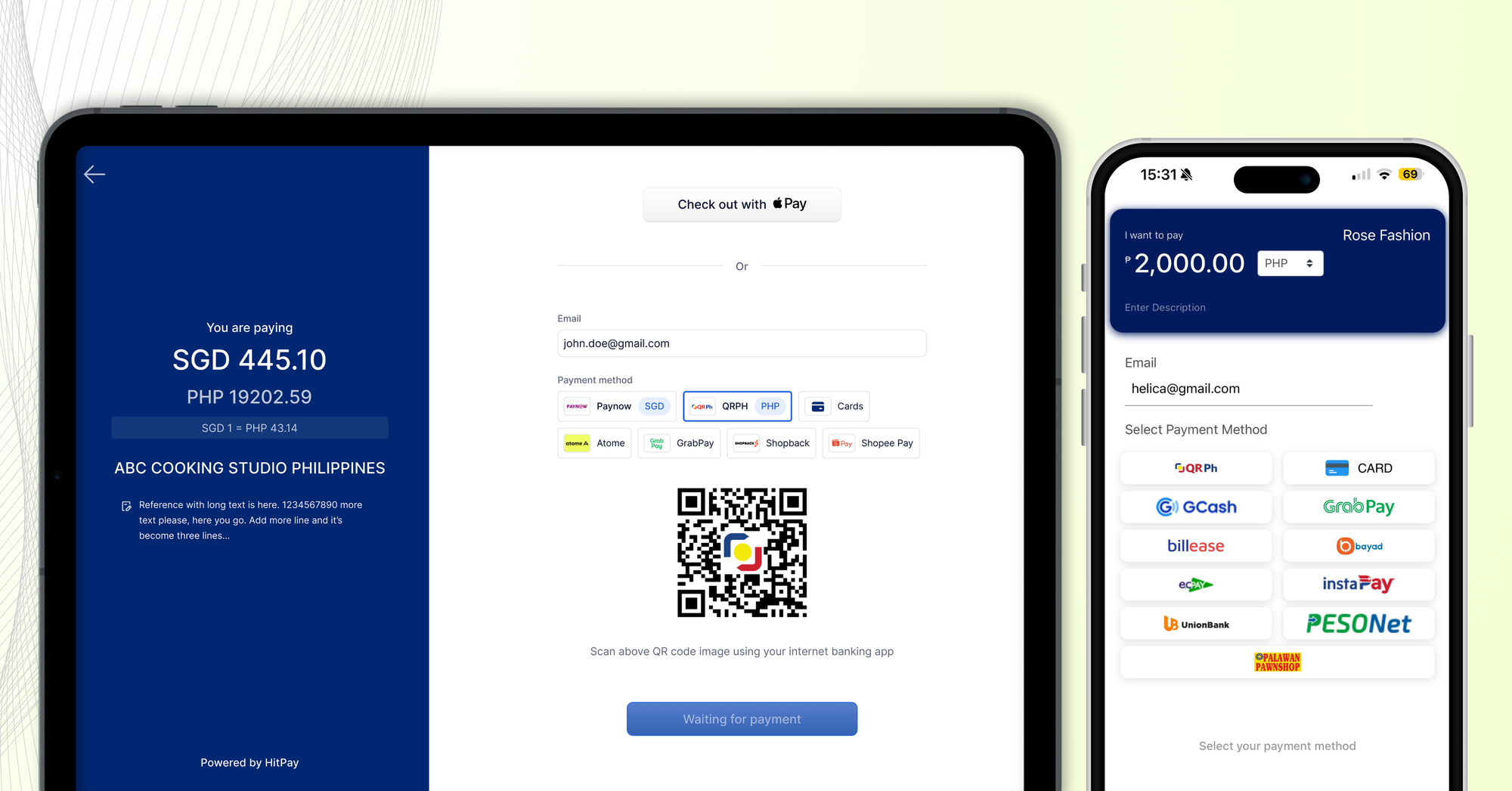

A payment gateway connects customers, businesses, and banks to facilitate online payments. It enables you to accept a variety of payment methods, including credit and debit cards, mobile payments, and digital wallets, which can help increase your sales.

Understanding how a payment gateway works ensures smoother transactions and enhances customer satisfaction.

How Does a Payment Gateway Work?

A payment gateway securely handles customer payments online. When a customer makes a purchase on your website, the gateway encrypts their payment details to protect them from potential threats. It then transmits the encrypted information to banks for approval.

The process typically involves these steps:

- The customer enters their payment details at checkout.

- The gateway encrypts this data and sends it to the payment processor.

- The processor verifies with the customer’s bank to confirm sufficient funds.

- Once approved, the funds are transferred to your account.

Key Features of a Payment Gateway

Payment gateways include essential features that ensure effective payment processing:

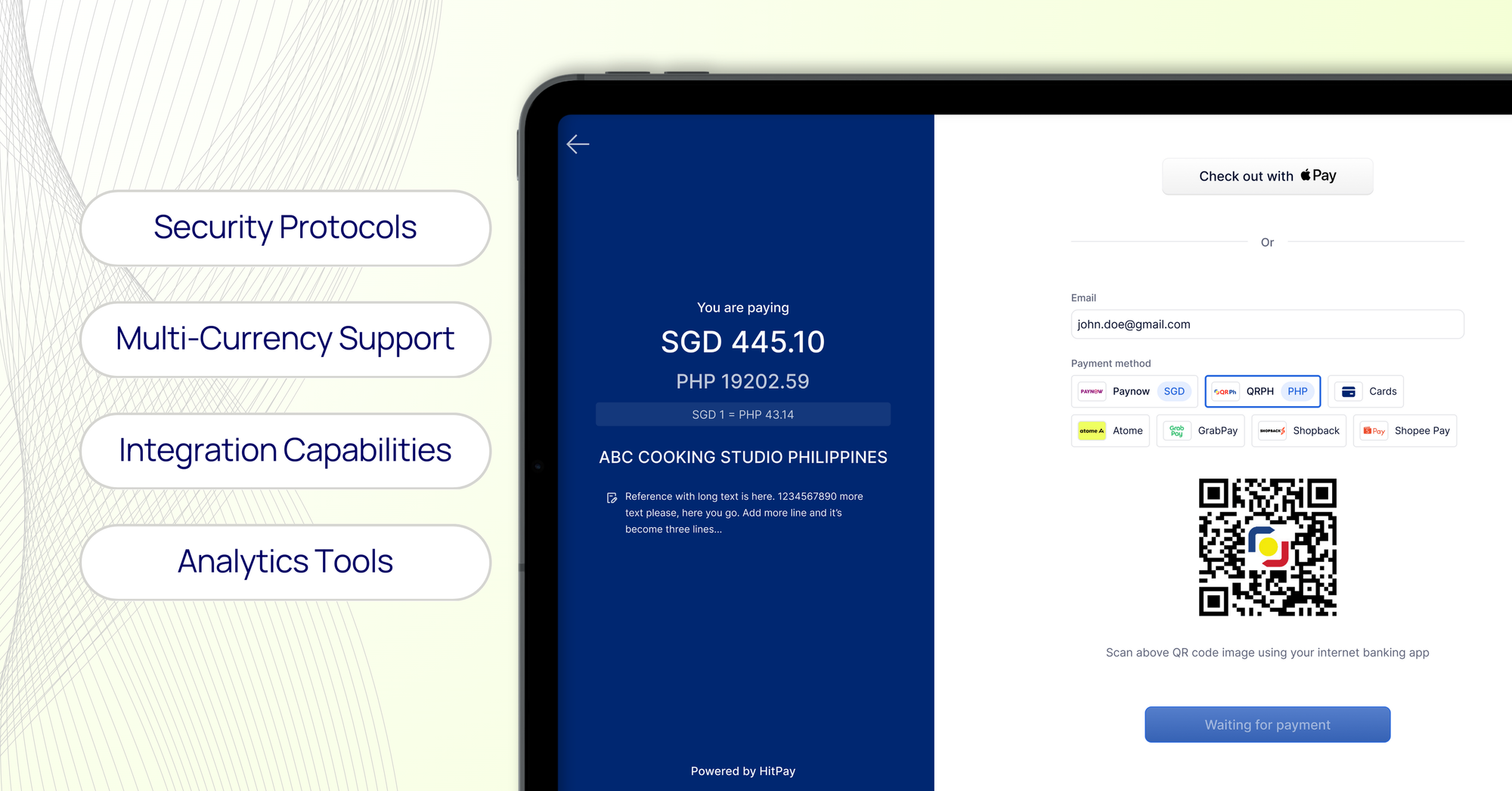

- Security Protocols: They use advanced encryption to safeguard customer data during transactions.

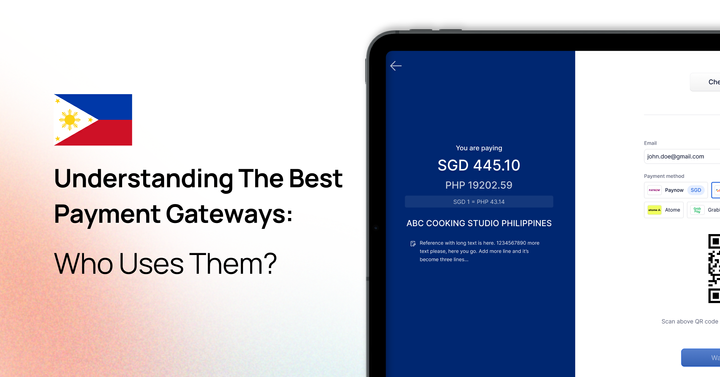

- Multi-Currency Support: Many gateways handle multiple currencies, allowing you to reach a global audience.

- Integration Capabilities: They integrate seamlessly with online stores and retail POS systems.

- Analytics Tools: Gateways provide valuable transaction data, enabling better business insights and management.

Types of Payment Methods Accepted by Payment Gateways

Payment gateways offer many payment options to meet what customers like:

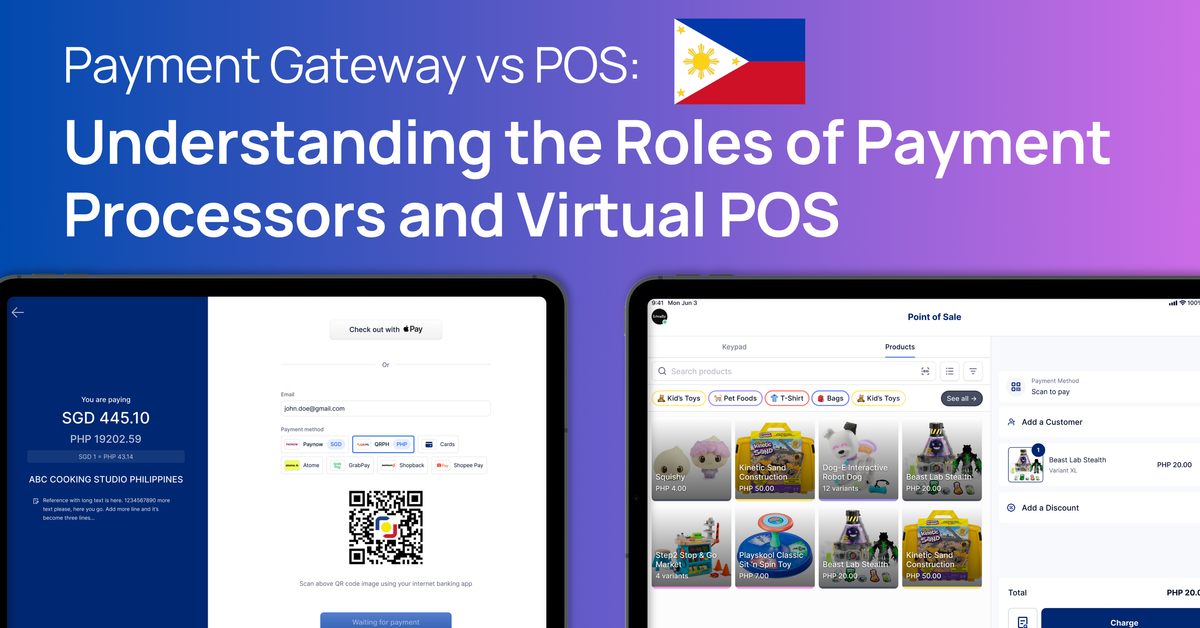

POS Systems and Payment Gateways: Understanding the Differences

The Philippines ranks as the 23rd largest eCommerce market, with projected revenue of US$17.4 billion by 2024. This growth is fueled by the rising shift toward online shopping and digital payment solutions.

To keep pace with evolving payment methods and simplify transactions, businesses need reliable payment gateways.

POS systems and payment gateways both play critical roles in handling transactions, but understanding their differences can help optimize business operations and enhance customer experience.

What is the Difference Between a POS System and a Payment Gateway?

A POS system is primarily used in physical stores to manage sales, track inventory, and generate sales reports. It facilitates in-person payments through cash or cards.

In contrast, a payment gateway handles online transactions by securely encrypting payment information, ensuring safe e-commerce purchases.

While POS systems are best suited for in-person transactions, payment gateways are essential for secure online payments, connecting customers, merchants, and banks to complete transactions smoothly.

However, with a solution like HitPay, you don’t need separate solutions—HitPay unifies online, in-store (POS), and B2B payments into a single, integrated system, offering a seamless experience for both your business and customers.

Can a POS System Function Without a Payment Gateway?

Yes, a POS system can operate without a payment gateway for businesses that focus solely on in-person sales, handling cash or card payments directly. However, integrating a payment gateway expands the system’s capabilities to include online sales, enhancing customer convenience and driving business growth.

Without a payment gateway, the system is limited to in-store transactions, potentially restricting business opportunities.

For businesses aiming to grow through e-commerce or offer more flexible payment options, integrating a payment gateway is vital for long-term success.

How Do POS Systems Integrate with Payment Gateways?

POS systems and payment gateways work together through API integration, allowing seamless communication between platforms and ensuring smooth transactions.

HitPay’s all-in-one solution eliminates the need for separate integrations, making it easy for businesses to unify their online and in-person payments under a single system, all while enjoying fast setup and seamless operation.

Here's how it works:

This teamwork between POS and payment gateways makes transactions faster and operations smoother. It lets businesses focus on serving customers and growing sales.

What is a Payment Processor?

A payment processor is essential for managing transactions between a merchant and a customer’s bank. It facilitates the secure transfer of payment information, enabling smooth and successful transactions both online and in-store.

Payment processors play a vital role in ensuring funds move safely from the customer’s bank to the merchant’s account. They also offer crucial features like fraud detection and chargeback management, protecting businesses and customers from financial risks.

With global fraud losses exceeding $55 billion in 2021, the need for robust payment security is more critical than ever. As digital transactions grow, businesses must rely on secure payment processors to protect sensitive payment data and maintain customer trust.

How Does a Payment Processor Operate?

A payment processor handles transactions by performing several key steps, including verifying funds, confirming the payment, and transferring the money. Here’s a simplified breakdown of how it works:

- The customer makes a payment using their card.

- The payment processor securely encrypts the card details for safe transmission.

- It communicates with the customer’s bank to verify if the payment is possible.

- Once approved, the funds are transferred to the merchant’s account.

Role of a Payment Processor in Transactions

Payment processors are essential for ensuring seamless transactions. They verify the customer’s identity, manage transaction data, and comply with strict security standards like PCI DSS. By safeguarding customer data, payment processors help build trust between customers and merchants.

POS and Payment Processor Are Not the Same

It’s important to distinguish between POS systems and payment processors. A POS system manages in-store sales and operations, while a payment processor handles the financial aspect, especially card transactions. Understanding these differences helps businesses choose the right tools to meet their needs.

Payment Gateway vs Payment Processor: Key Differences and Their Roles

Payment gateways and processors work together to manage transactions efficiently, each playing a unique role in ensuring smooth and secure payments. Understanding how they collaborate can help you choose the best setup for your business.

Payment gateways collect and securely transmit customer payment information, while payment processors verify the payment and transfer funds. The process starts when a customer enters their payment details at the gateway, which encrypts the data and sends it to the processor. The processor checks if the funds are available and, if approved, confirms the transaction back through the gateway.

Using both systems is essential for secure payment processing. The gateway handles the secure transfer of payment details, while the processor ensures the funds are transferred to the merchant’s account. Together, they offer a comprehensive solution for online and in-person transactions.

Combining these systems not only boosts security but also simplifies operations, leading to faster, more reliable transactions and improved customer satisfaction. The streamlined process may also reduce costs and help businesses run more smoothly.

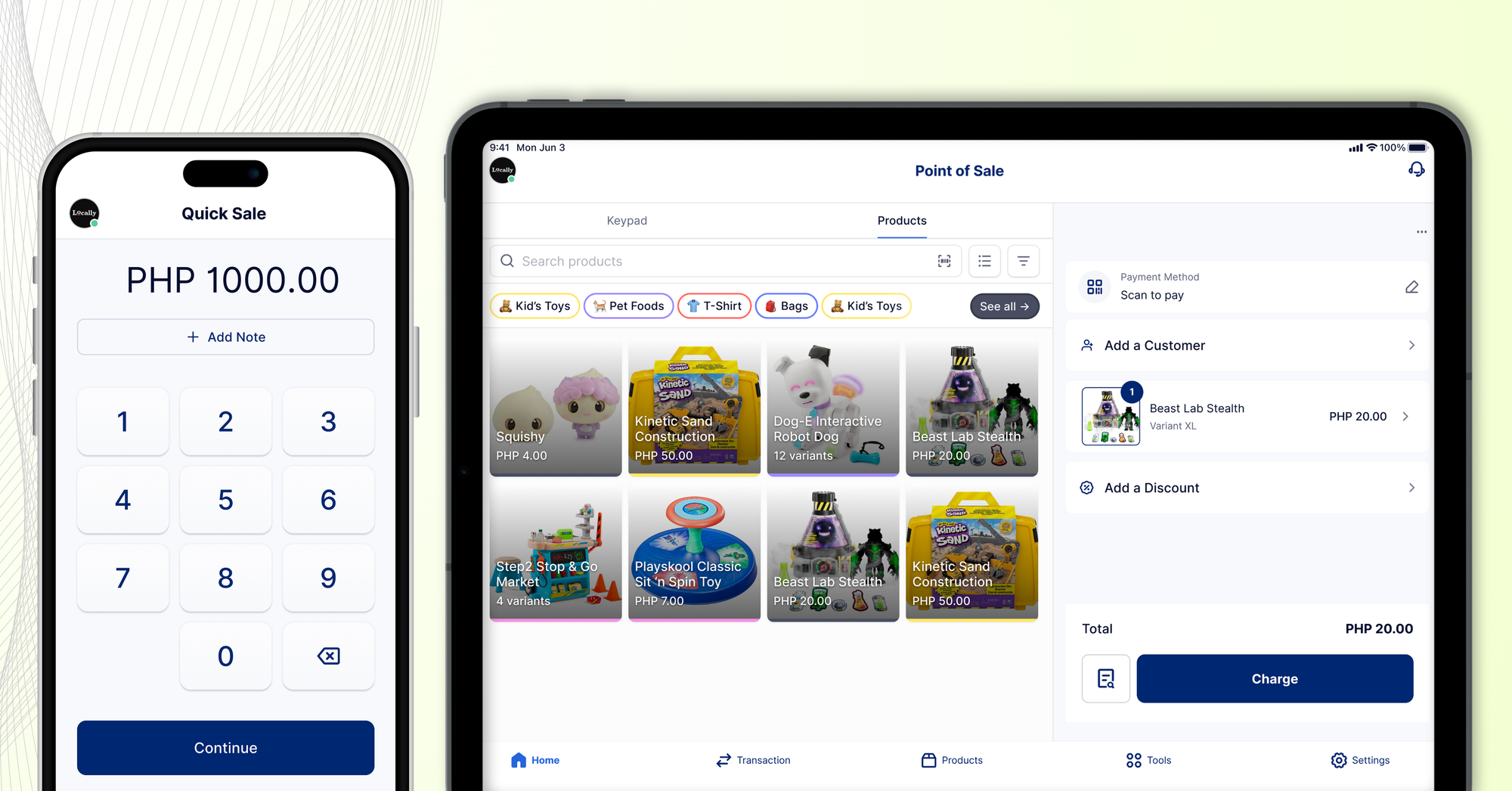

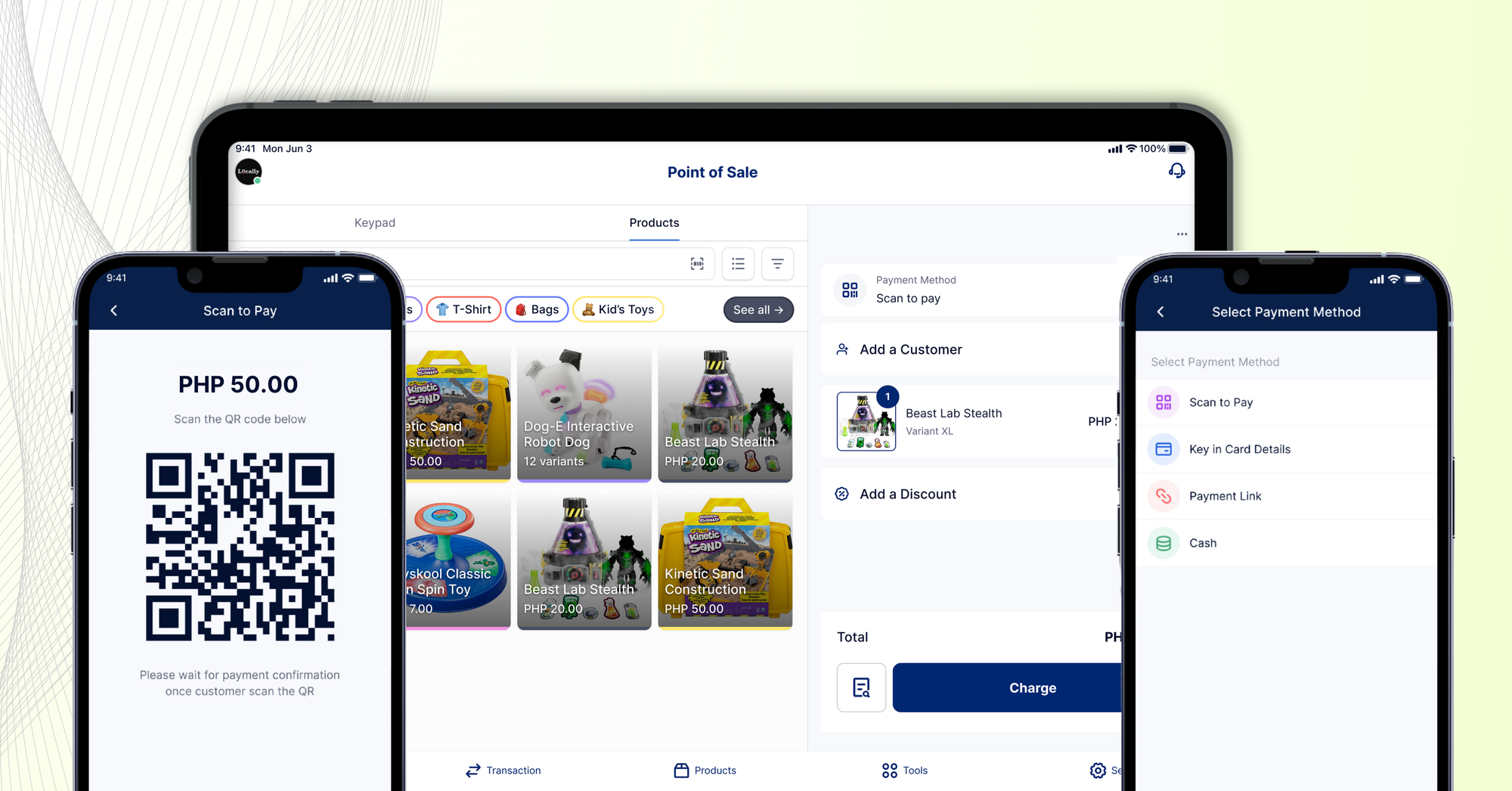

Understanding Virtual POS Systems

The use of cash in Filipino POS payments dropped below 50 percent in 2021 as consumers increasingly shifted toward using cards and digital wallets.

A virtual POS system allows businesses to accept payments securely without the need for physical hardware. This modern solution offers convenience and flexibility, making transactions both efficient and contactless.

Virtual POS systems enable businesses to process online payments by integrating with payment gateways to accept credit cards, digital wallets, and more. The process typically involves setup, logging in, initiating a transaction, verifying payment, obtaining authorization, and completing the sale.

Additionally, virtual POS systems can automatically update inventory, generate invoices, calculate taxes, and ensure data security.

Advantages of Using a Virtual POS

Using a virtual POS has many benefits for your online store:

- It saves money by needing less hardware

- It's easy to set up and work with your online store

- You can accept many payment types

- It's secure with PCI DSS compliance and tokenization

- It gives real-time sales and performance data

Choosing the Right Payment Gateway, Processor, and POS System for Your Business

In today's fast-changing online shopping world, picking the right payment solutions is key for your business's success. By 2026, online sales will make up almost 25% of all retail sales. This shows how important payment systems are.

Factors to Consider When Selecting a Payment Gateway

When looking at different payment gateways keep an eye on these things:

- Transaction Fees: Payment processors charge fees, usually between 1% and 4% of the sale. Knowing about these fees helps avoid surprises.

- Supported Payment Methods: Make sure the gateway takes many kinds of payments like credit and debit cards, checks, and digital wallets.

- Compatibility: Check if the gateway works well with your current POS system to make things run smoothly.

- Customer Support: Good customer support is key for fixing any problems that come up.

Which Payment Processors Offer the Best Services for Small Businesses?

For small businesses, picking the right provider is very important. Some top payment processors for small businesses are:

- HitPay: An all-in-one payment platform designed for SMEs, offering seamless integration, multi-currency support, and no monthly fees. It’s user-friendly and supports local and international payments, making it ideal for small businesses looking to expand.

- Stripe: Supports over 135 currencies and is an API-hosted payment gateway, making global sales easy.

- Square: Great at handling credit and debit card payments and has features for logistics.

- PayPal: Very accepted in the market, reliable, and easy to use, especially for online shops.

How HitPay Can Support Your Payment Solution Needs

HitPay provides comprehensive payment solutions for businesses in the Philippines, offering a unified platform that includes a payment gateway, processor, and POS system. This seamless integration makes it easy to connect with popular online stores and manage your business efficiently.

Benefits of Using HitPay for Your Business

HitPay offers a wide range of payment options, including credit cards, digital wallets, and bank transfers, supporting over 100 currencies for both local and international transactions.

Key features include:

- Customizable checkout interfaces to match your branding

- Integration with leading eCommerce platforms like Shopify, WooCommerce, and Magento

- Real-time transaction reporting for valuable insights and analytics

- Secure processing with bank-grade encryption and PCI DSS compliance

HitPay is an ideal solution for businesses of all sizes, with no setup or subscription fees—only pay-per-transaction costs. This transparent pricing model is particularly beneficial for small businesses looking to manage their finances efficiently.

With its user-friendly interface, HitPay also enhances the customer experience, leading to higher conversion rates and more sales.

Get Started With HitPay’s Secure Payment Gateway Solution

Understanding the differences between POS systems, payment gateways, and payment processors is crucial for optimizing business operations and enhancing customer experiences. POS systems manage in-store transactions and inventory, while payment gateways securely handle online payments, and payment processors move funds between banks.

Integrating these solutions ensures smooth transactions, better customer satisfaction, and increased business efficiency. With digital payments becoming more dominant, especially in markets like the Philippines, businesses must adopt flexible, secure payment systems.

Enhance your e-commerce business with HitPay's advanced payment gateway. Accept local and international payments with seamless integration and no coding required. Enjoy low fees, fast payouts, and extensive plugin support.

Get started today with HitPay's simple, pay-per-transaction pricing and no hidden costs. Sign up now and start selling within days.

Have questions? Our support team is ready to assist you on your preferred platform. Elevate your payment process with HitPay!

Frequently Asked Questions About Payment Gateways

Is a POS System Necessary if I Have a Payment Gateway?

A POS system makes selling more efficient. A payment gateway helps with online payments. Having both can make your business run smoother. They work together to make handling in-store and online sales easy.

Can I Use a POS System Without a Payment Gateway?

You can use a POS system on its own for things like managing stock and keeping track of customers. But, without a payment gateway, you might only take cash or checks. This could make things less easy for your customers.

What Should I Consider When Choosing Between a POS System and a Payment Gateway?

Think about what your business really needs, like how many sales you have, what your customers like, and your budget. Knowing about POS and payment gateways can help you pick the right one for your goals. Look at things like how easy they are to use, how well they work together, and the support they offer.

How Secure are POS Systems Compared to Payment Gateways?

Keeping payments safe is very important today. Both POS systems and payment gateways use strong security like encryption and follow strict rules to fight fraud. It's key to pick systems with strong security to keep customer info safe and stop unauthorized deals.