How to Build Your Own Payment Gateway: A Comprehensive Guide

The article provides a detailed guide on creating a custom payment gateway for businesses. It covers the importance of secure payment processing, key steps in development, costs involved, and essential features.

Whether you’re running an e-commerce store, offering services online, or managing B2B transactions, having a reliable payment gateway is essential for success. But what if you could create a custom payment gateway tailored to your specific business needs?

HitPay, trusted by over 20,000 businesses across Southeast Asia and globally, is an all-in-one payment platform that simplifies payment processing for small and medium enterprises (SMEs). By integrating online, point-of-sale, and B2B payments into a single, easy-to-use system, HitPay makes managing transactions effortless.

In this article, we’ll provide a step-by-step guide, discuss costs, and highlight common challenges so you can confidently take control of your payment processes.

Key Takeaways

- Creating a payment gateway gives you control over your payment process.

- Following PCI DSS rules is key for security and trust.

- Using white-label solutions can save time and money for businesses with tight budgets.

- Knowing the costs and upkeep is crucial for a successful gateway.

- Investing in a secure payment gateway protects customer data and builds trust.

What is a Payment Gateway and Why is it Important?

A payment gateway is an essential technology that manages and verifies online payments, especially in e-commerce. It securely connects the merchant’s website with banks to transfer payment information safely. This technology is crucial for smooth and secure online shopping.

Payment gateways play a vital role in today’s digital economy. With the global e-commerce market projected to reach $6.3 trillion in 2024, secure and seamless payment solutions are more important than ever for businesses to succeed.

As online sales continue to grow, businesses need advanced payment gateways to accept various payment methods, including credit cards, digital wallets, and even Bitcoin. This not only enhances the shopping experience but also helps businesses expand globally.

Payment gateways process payments more quickly than traditional methods, improving cash flow. They also include tools to detect and prevent fraud, ensuring secure transactions and building customer trust.

Payment gateways do more than just process payments. They improve customer experiences, make businesses run better, and help them grow worldwide. Adding a good payment gateway to your business can lead to lasting success and loyal customers in the fast-changing digital market.

Understanding the Payment Process

The payment process involves several steps to ensure transactions are fast and secure:

- Encryption: When you make a purchase, the payment gateway encrypts your credit card information to protect it from hackers during transmission.

- Verification: The encrypted data is sent to the payment processor, which checks with your bank to confirm sufficient funds.

- Authorization: Once the bank approves the transaction, the processor finalizes it by securely transferring the funds and updating the merchant’s system.

This seamless process builds trust between customers and businesses, enhancing overall satisfaction.

Understanding how payment processing works is essential. A well-designed payment system offers multiple payment options, helps businesses manage costs, and enhances the customer experience.

The Role of a Payment Processor

Payment processors play a vital role in ensuring secure transactions by:

- Managing data flow between businesses and banks.

- Supporting various payment methods, including credit/debit cards and digital wallets.

- Offering solutions tailored to different business needs, such as independent processors or card networks.

For businesses growing fast or not wanting to use third-party services, making your own payment gateway can be an option.

Payments go through systems that work with processors. These can be banks, card networks, or independent processors. Each one has special features for different needs.

Keeping payments secure is a top priority. Techniques like tokenization protect credit card information by replacing sensitive data with secure tokens, safeguarding it from potential threats.

Maintaining customer trust is essential, and achieving 3DS certification from EMV is a crucial requirement for businesses handling chip-enabled card payments. This layered approach ensures both compliance and security while enhancing the overall payment experience.

Why You Should Create Your Own Payment Gateway

Building a custom payment gateway offers control and efficiency, enabling you to tailor the payment process to your business needs and deliver a better customer experience. By avoiding third-party services, you can reduce costs over time and customize the system to fit your unique requirements, enhancing customer satisfaction and loyalty.

With 93% of customers likely to make repeat purchases with businesses offering excellent service, a tailored payment gateway can be a powerful tool for building long-term relationships. High transaction fees from other providers can eat into profits—creating your own system could save you around 20 cents per transaction, which adds up quickly.

Custom gateways also provide enhanced security, meeting the growing demand for robust fraud prevention and compliance. As customer expectations for secure transactions rise, having a system that prioritizes security can set you apart.

While the upfront and ongoing costs may be higher, businesses with high transaction volumes stand to benefit significantly. For smaller businesses, the investment might be challenging initially, but the control, security, and customer loyalty can make it worthwhile.

However, for businesses looking for a comprehensive, ready-made solution, HitPay offers a seamless alternative that combines the benefits of an all-in-one platform without the hassle of building from scratch.

How to Build Your Own Payment Gateway?

Building a payment gateway takes a careful plan. It needs to focus on security, work well, and be easy for users. Knowing how to make a payment gateway is key for success. It mixes technical skills with knowing what customers want.

Steps to Develop a Payment Gateway from Scratch

To make a payment gateway from the start, planning is crucial. Here are the main steps:

- Do market research to see what's popular and what others offer.

- Use surveys to find out what customers want.

- Plan the back-end, making sure it meets standards like PCI DSS.

- Put in strong security, like encrypting data and spotting fraud.

- Look at different payment processors to find the right ones for you.

- Make the interface easy for customers to use during transactions.

Choosing the Right Payment Gateway Solution

Picking the right payment gateway is key for your business. Look at these things when choosing:

- Check the fees and costs.

- See if it follows legal rules and has good security.

- Make sure it fits with your current systems.

- Look for good customer support and clear instructions.

- Make sure it can grow with your business.

Key Features of a Custom Payment Gateway

When making your own payment gateway, add important features for better performance and happy users. Think about these:

- Make it easy to work with different platforms and payment ways.

- Use strong security, like security certificates and following rules.

- Have automated features to make transactions smoother.

- Use detailed reports to understand transactions and user actions.

- Support many currencies for international deals.

What are the Costs Involved to Build A Payment Gateway?

Building a custom payment gateway has many costs. These costs can greatly affect your budget. Knowing these expenses helps with better financial planning for your project.

Development Cost Breakdown

The cost to start a payment gateway is between $150,000 to $250,000 for a basic version. This includes research, security, software, and financial institution integration. It usually takes about six months to build a basic version, depending on what you need.

- Hardware and infrastructure expenses

- Testing and quality assurance costs

- Marketing and sales expenses

- Legal and administrative tasks

- Integration with various payment processors

Ongoing Maintenance and Support Fees

After your payment gateway is up and running, you'll have ongoing costs. These costs change based on how much you use it, updates, and security. Keeping it maintained is key for security and to stay current with new tech and rules.

- Routine software updates

- Technical support and customer service

- Continuous compliance checks

- Upgrades for security and functionality improvements

How to Ensure Secure Payment Processing?

Keeping customer data safe is key to trust with your customers. A secure payment gateway makes payments safer. It lowers the chance of data theft and fraud, especially online.

Importance of a Secure Payment Gateway

A secure payment gateway protects against cyber threats. It keeps customer information safe and follows payment rules like PCI DSS. Following these rules keeps your payment systems safe and builds trust with customers.

More than 5 billion cyber attacks were reported daily in the Philippines in the first quarter of 2024, highlighting the critical need for businesses to prioritize payment security. Data breaches can result in severe financial loss and damage to a brand’s reputation.

By using a secure payment gateway, you lower the risk of data breaches and fraud. These risks can hurt your reputation and profits.

Implementing Security Measures in Your Payment System

Adding security layers to your payment system is smart. Encryption keeps data safe during transactions. Multi-factor authentication adds more security by needing more verification, like passwords and biometric data.

Fraud prevention systems that use machine learning can spot suspicious activity. This makes payments even safer.

Compliance with Payment Data Regulations

Following payment rules is key to keeping customers trusting you. It's important to know and follow standards like PCI DSS. This ensures your payment gateway is secure and meets industry standards.

For businesses worldwide, it's important to follow different security rules in each area. This helps avoid legal issues and keeps customers trusting you.

How to Choose the Right Payment Service Provider?

Choosing the right payment service provider is crucial as digital payments continue to grow rapidly. The right partner not only enhances customer satisfaction but also ensures secure and compliant transactions.

Evaluating Payment Processing Services

When looking at Payment Service Providers, think about what your business needs:

- Transaction Fees and Pricing Structure: Understand all costs, including transaction fees, subscription plans, and any hidden charges.

- Integration Compatibility: Ensure the provider integrates seamlessly with your existing systems and software.

- Support for Multiple Payment Types: Opt for a provider that offers the payment options your customers prefer, such as cards, e-wallets, and bank transfers.

- Quality of Customer Support: Reliable and responsive customer support is essential, especially during critical transactions.

- Payment Gateway Availability: Confirm that the provider operates in your region and supports your target markets.

- Currency Support: Multi-currency capabilities are crucial if you plan to expand globally or cater to international customers.

- Compliance Standards: Choose a provider that complies with PCI DSS and other industry regulations to keep customer data secure.

- Fraud Management Solutions: Effective fraud detection and prevention tools are vital for safeguarding your business and customers.

How HitPay Can Support Your Payment Gateway Venture

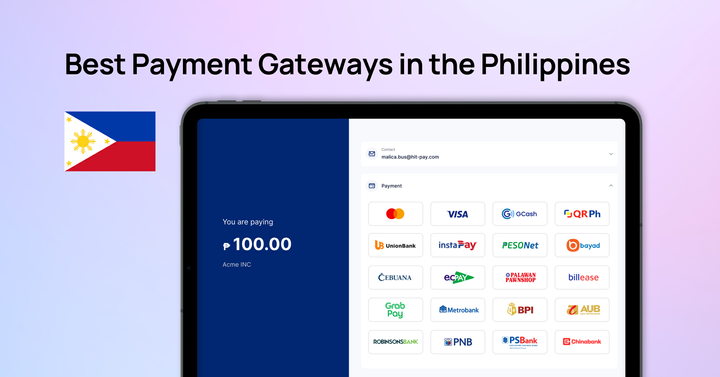

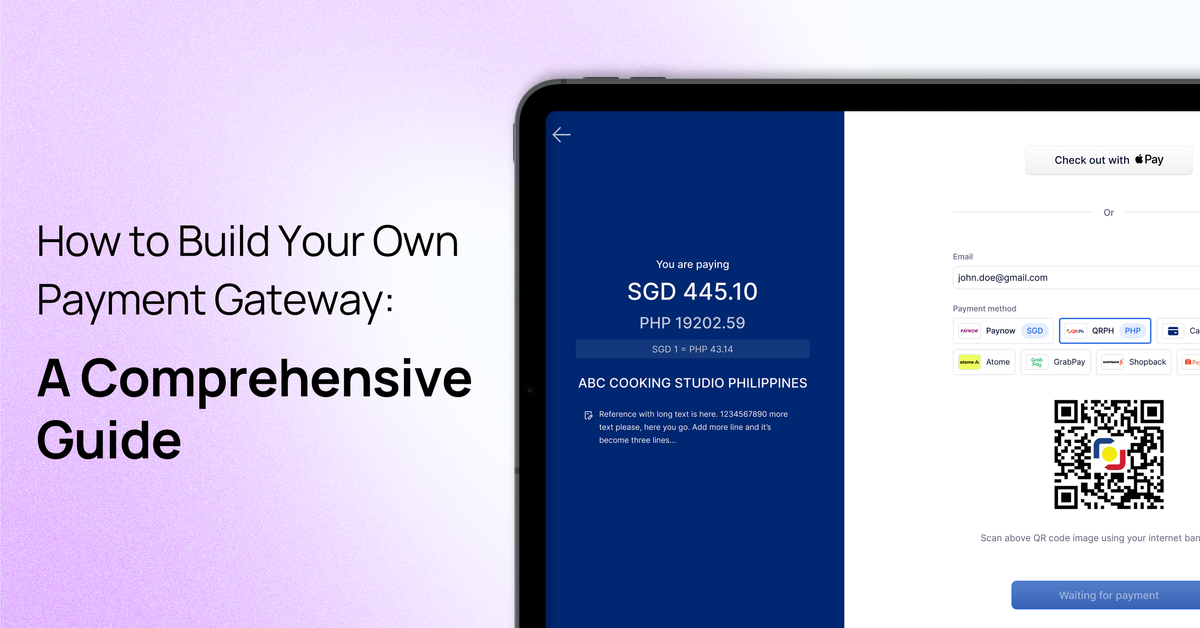

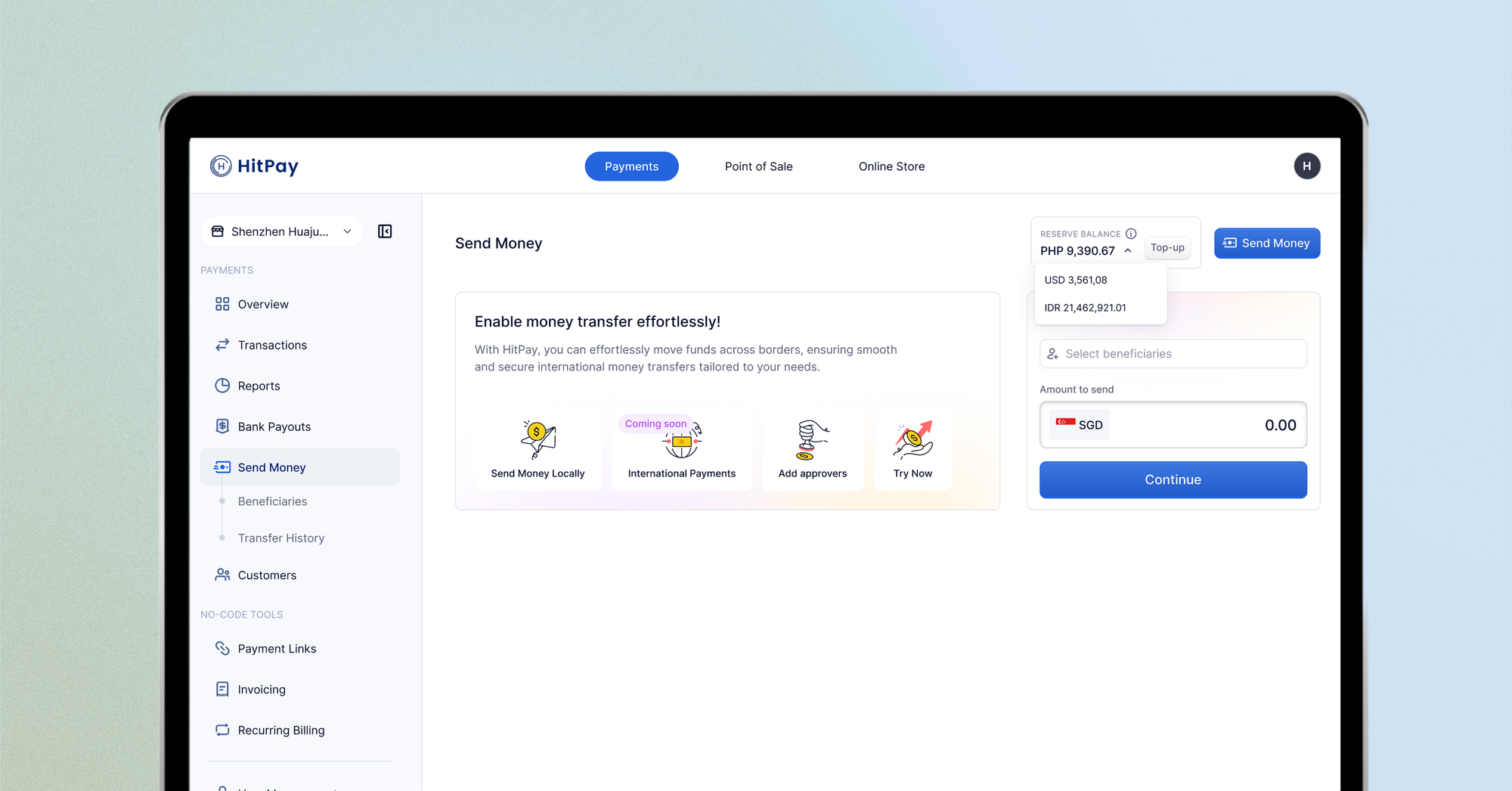

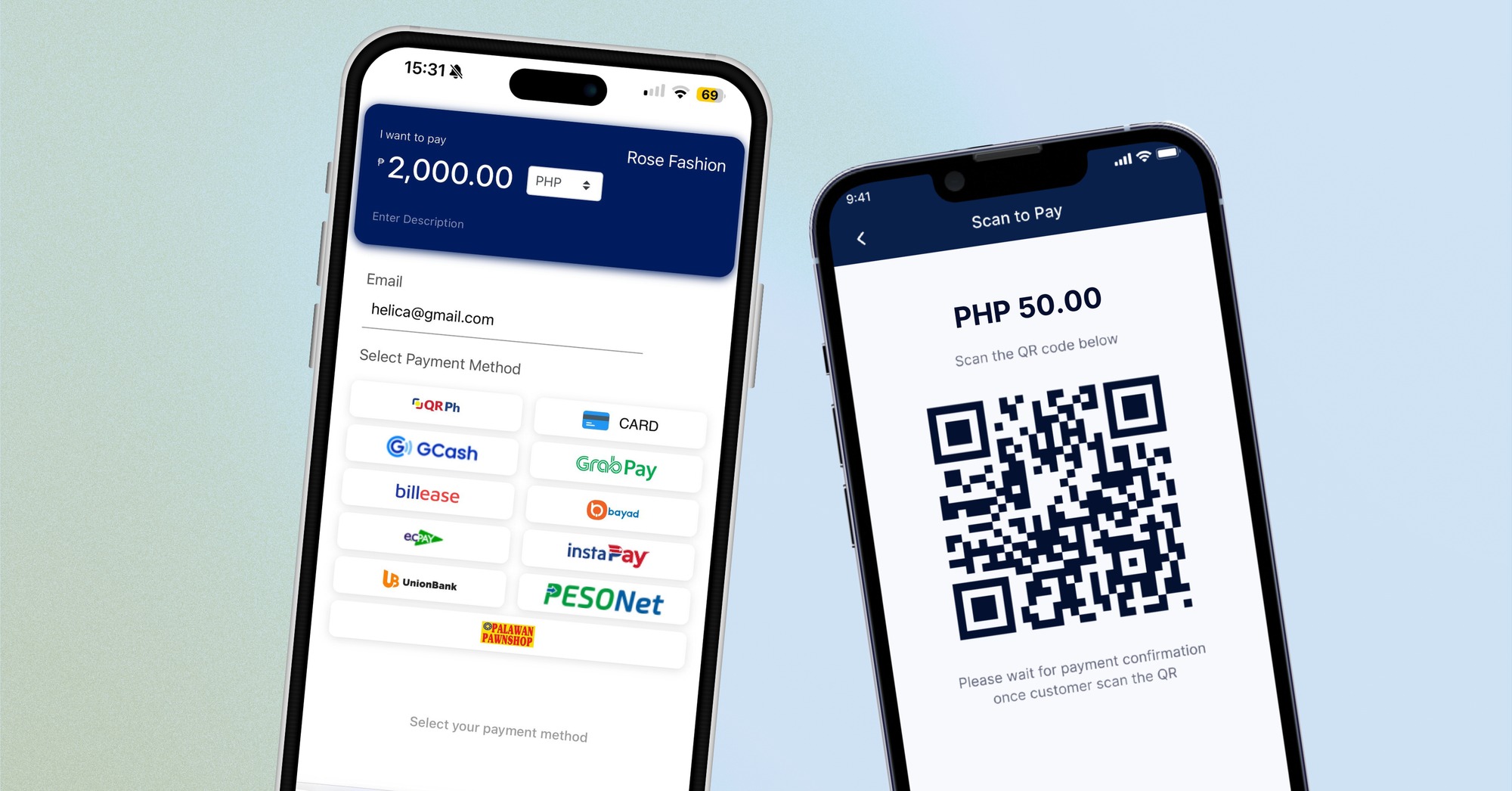

If building a custom payment gateway is too complex, third-party solutions like HitPay offer a great alternative without the hassle. HitPay combines everything you need in one package, making it a convenient choice for businesses that want efficiency, flexibility, and simplicity.

With HitPay, you can easily accept a wide range of payment methods, including credit cards, bank transfers, and e-wallets, catering to both local and international customers. Integration is seamless, requiring no coding skills—just create an account, get verified, and start accepting payments in a matter of days.

HitPay’s transparent pricing model means you only pay per transaction, with no setup fees or hidden costs. Plus, you benefit from low transaction fees and fast payouts, often within the same or next day. The platform is designed with SMEs in mind, offering tailored support and a user-friendly dashboard that simplifies managing payments and transactions.

For businesses looking to enhance their payment gateway experience without the complexity of building one from scratch, HitPay offers a powerful, easy-to-use solution that helps you scale efficiently.

Benefits of Partnering with HitPay

Working with HitPay brings big advantages. It cuts down on costs and makes transactions safer. You get to use advanced tools to track your performance.

Get Started With HitPay’s Secure Payment Gateway Solution

Building your own payment gateway offers control over your payment processes and enhances the customer experience, especially as digital payments rise. While challenges like regulatory compliance, technical hurdles, and costs are significant, the benefits—improved security, custom features, and stronger customer trust—can outweigh them.

To succeed, careful planning and reliable partners are key for secure, efficient transactions. Important factors include customer onboarding, transaction management, and robust security measures. Creating a gateway requires not just technology, but a deep understanding of your market, user needs, and regulations.

For businesses seeking a simpler solution, HitPay’s payment gateway offers seamless integration with local and international payments, no coding required. Enjoy low fees, fast payouts, and extensive plugin support to drive your digital growth.

Get started today with HitPay's simple, pay-per-transaction pricing and no hidden costs. Sign up now and start selling within days.

Have questions? Our support team is ready to assist you on your preferred platform. Elevate your payment process with HitPay!

Frequently Asked Questions About Payment Gateways

What is a payment gateway?

A payment gateway is a technology that facilitates the transfer of payment information between a customer and a merchant. It acts as a bridge between the customer and the payment processor, ensuring that sensitive data, such as credit card numbers and personal information, are securely transmitted.

Why is a payment gateway important?

The importance of a payment gateway lies in its ability to provide a secure payment experience, which is crucial for maintaining customer trust and complying with regulations like the payment card industry data security standards.

What are the essential components of a payment gateway system?

A comprehensive payment gateway system typically consists of several key components: payment processor, merchant account, payment gateway software and customer interface.

How do I build my own payment gateway from scratch?

To build your own payment gateway from scratch, you will need to follow several steps such as researching regulations, choosing a payment processor, developing the gateway software and testing the gateway.