How to easily choose the best E-commerce Payment Gateway for your business

Use our comprehensive guide to help you evaluate and select a e-commerce payment gateway for your e-commerce business in Singapore

Picking an e-commerce payment gateway for your business is a crucial decision.

Your e-commerce payment process should enhance the checkout process and build trust among your customers.

But if you’re just starting your e-commerce business, how do you choose the best payment gateway in Singapore? What factors should you look for when choosing an e-commerce payment gateway? Not to worry, we’ve compiled an in-depth guide to help you make your decision.

What is an e-commerce payment gateway and how is it relevant for my e-commerce business in Singapore?

A good e-commerce payment gateway keeps your e-commerce transactions safe and customers happy.

Your payment gateway is a digital cash register for your e-commerce store; accepting and authorising multiple payment methods from your customers.

Some popular payment methods for e-commerce businesses in Singapore:

- Credit and debit card payments

- Bank transfer

- E-wallets like Shopee Pay and GrabPay

- Card-based digital wallets like Google and Apple Pay

Your payment gateway needs to be versatile, fast, and secure so your customers don’t lose interest (abandon their cart) while trying to pay for their purchases during checkout.

It allows your customers to pay for their purchases in their preferred method by supporting multiple payment methods.

Why choosing the right e-commerce payment gateway for your business in Singapore is crucial

Improves sales by reducing cart abandonment:

If your e-commerce payment gateway is of poor quality, you might be turning off otherwise interested customers from making a purchase.

A study by e-commerce UX consultancy Baymard found the quality of an e-commerce business’s checkout process directly impacts cart abandonment rate:

- 18% of American adults abandoned their cart on an online store because the checkout process was too long or complicated

- 17% said it was because they didn’t trust the site with their credit card information

- 7% said it was because the gateway didn’t offer enough payment methods.

Image source: Baymard

The situation is no different here in APAC; a third of Japan’s online shoppers abandon their cart when their preferred payment method isn’t available.

Hence, your payment gateway directly affects your business’s bottom line.

E-commerce in Southeast Asia is growing rapidly

In Indonesia, 55% of shoppers say they buy more online now compared to at the start of the pandemic. Online sales in Malaysia grew by nearly 800% in 2020, while 70% of Filipinos switched to online shopping during the pandemic.

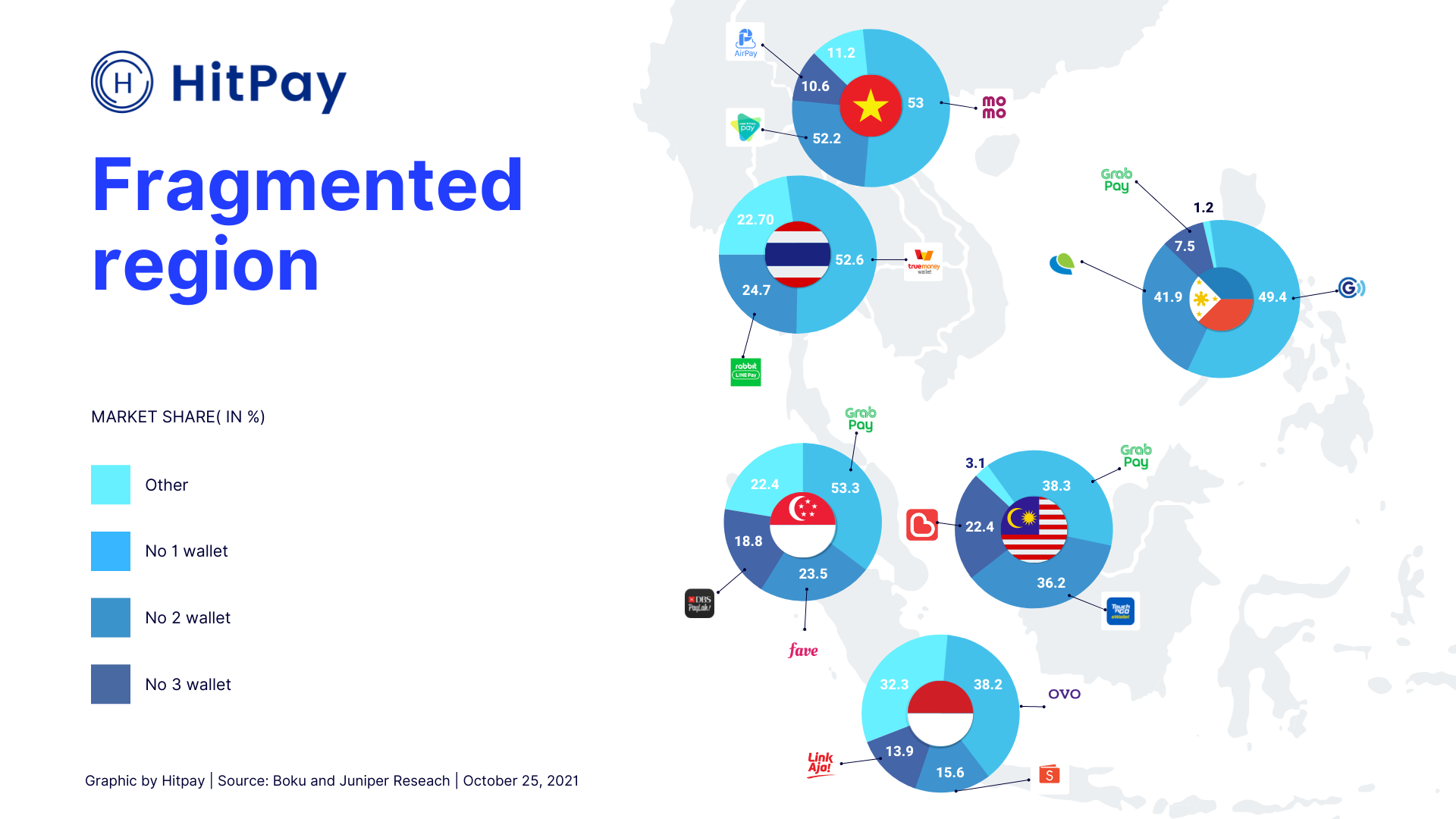

Consumers in Southeast Asia are more open to digital payments

More consumers have adopted a diverse range of digital payment methods thanks to their convenience, perceived safety and acceptance by e-commerce merchants.

According to Visa’s Consumer Payment Attitudes Study in 2021:

- 85 percent of consumers across Southeast Asia embrace a number of digital payment methods including cards, contactless cards, mobile payments, e-wallets and QR code payments.

- Two-thirds of consumers in Southeast Asia (64%) have also attempted to go cashless, especially consumers in Vietnam (84%), Thailand (82%) and the Philippines (79%).

Thanks to these three trends, your customers will be looking out for an even better customer experience at your store.

How do I select the best e-commerce payment gateway for my business in Singapore?

Now that we’ve covered what consumers are looking for in their e-commerce store experience, let’s talk about how to fulfil these needs and select your e-commerce payment gateway.

How many local and cross-border payment methods does your payment gateway support?

When evaluating e-commerce payment gateways, businesses need to think beyond their physical borders. Instead, think regionally and globally.

Offering local payment methods to your customers show you understand how your customers choose to pay in their respective location.

This is a win-win for you and your customers; more sales conversions, fewer abandoned carts and improved customer satisfaction.

Select a payment gateway that allows you to customise your payment methods offered at checkout:

Select a payment that provides access to local payment methods in ASEAN.

What are popular local payment methods in some ASEAN countries?

Other different types of local payment methods and why customers may prefer them:

Credit cards:

Most popular option. Also internationally recognised. Although, be aware of credit cards limited to use for domestic purchases only in which you can process these domestic-only cards through a local business entity.

Examples: Visa or Mastercard

Card-based digital wallets:

These offer both security and ease of use as they’re often compatible across multiple devices (smartphone/smartwatch apps, computer and QR code scanning) Furthermore, they don’t need to be linked to a bank account and are easily topped up electronically.

Examples: Apple Pay, Google Pay

Bank transfer:

Ideal for customers without a credit card (or those who do not wish to use a credit card), consumers can transfer money to and from their bank account to other bank accounts in the world. Bank transfers tend to be safe, customer-friendly, without the possibility of chargebacks or payment reversals

Examples: PayNow, Financial Process Exchange (FPX), PromptPay

Stored value mobile wallets:

For Southeast Asian citizens, Grab and Shopee are household names. They offer a hard-to-beat level of convenience and accessibility for consumers, while allowing them to earn customer rewards and benefits with each transaction.

Examples: ShopeePay, GrabPay, WeChat Pay

Can you use the same e-commerce payment gateway in multiple markets?

You might be wondering; why not set up multiple payment gateways if my current payment gateway doesn’t cover a specific market?

You could, but we don’t recommend this approach for early-stage businesses and SMEs. Here’s why

More payment gateways = more moving parts to think about:

Payment gateways integrate with existing systems at different rates, and developing processes to integrate all these moving parts is both cumbersome and resource-draining.

The hassle doesn’t stop there after integration. You still need to invest time and resources for administration, constant reconciliation of figures and management.

All these costs and trade-offs might be possible with a team of people behind you. But depending on your stage of business growth, this is all time you’d rather spend growing your business as an entrepreneur.

Save on integration efforts, streamline reconciliation processes by selecting one payment provider for multiple markets. This is the best result we’ve seen working with many SME’s and small businesses here in Singapore who want to focus their efforts on business growth, not managing administrative tasks.

It’s costly - both financially and operationally:

Setting up multiple payment gateways is expensive.

Plus when you add up tracking, transaction processing fees, these fees can whittle down your profits drastically.

On the operational side, multiple payment gateways means processing data in different forms and dimensions. There’s an administrative effort and risks of error that exponentially increases trying to reconcile these figures in one, consistent format.

Why not avoid all these needless complexity and think about payment gateways that can natively handle multiple markets?

Does your payment gateway have (either native or integrations) to e-commerce business tools to sell on any online or offline channel?

Payment gateways are a crucial part of your e-commerce business, but it’s only one of your business tools.

When evaluating your e-commerce payment gateway for your Singapore business, think about how it integrates to your existing business tools:

Some common business tools e-commerce business owners need to consider as part of their tech stack.

- Invoicing and accounting software

- E-commerce solutions

- Integration of payment methods on both your online or offline sales channels

- Payment links

- Inventory management

- Point of sale (POS) software and card readers

Note: HitPay integrates with popular e-commerce platforms like Shopify, WooCommerce and PrestaShop and accounting platforms like Xero so you can focus on running your business and not worry about setting up business tools

These elements form the basis of your payment infrastructure which you need for your e-commerce store to function.

Frequently asked questions about payment gateways in Singapore:

1. What’s the difference between payment gateways and payment processors?

You need both to process online transactions.

Customers use the payment gateway to enter their credit card information. They’ll know if the transaction was approved or denied.

Payment processors (also known as payment service providers or acquirers) manage the credit card transaction process. They help communicate information from your customer’s card to your bank and the customer’s bank.

2. Do I need a merchant account and an e-commerce payment gateway?

Yes, you need both. In fact, they serve different functions.

A payment gateway enables online transactions and allows you to process them. A merchant account is a temporary holding account that receives all payments from your customers before the money is deposited into your business’s bank account.

3. What is no-code?

Basically, no-code is a way to build an application for your e-commerce business without writing code. It’s a faster, more intuitive way for non-technical business owners to build the apps they need so they can focus on their strengths.

Choose the right e-commerce payment gateway for your Singapore business

Choosing the best e-commerce payment gateway for your e-commerce business can be a daunting decision.

But now with this comprehensive guide, you can overcome analysis paralysis and have the confidence that you know what to look out for when choosing an e-commerce payment gateway for your business.

Now evaluate potential payment gateway solutions for your e-commerce store in Singapore with confidence!

About HitPay

HitPay is a one-stop commerce platform that aims to empower SMEs with no code, full-stack payment gateway solutions. Over 7,000 merchants have grown with HitPay's products, helping them receive in-person and online contactless payments with ease.

Join our growing merchant community today!