Are Payment Gateways Safe and Secure?

The article discusses the importance of payment gateways for secure online transactions, detailing how they facilitate payments and enhance customer trust. It highlights key factors for selecting a gateway.

A reliable payment gateway is essential for businesses that want to thrive. A payment gateway securely handles online transactions, allowing businesses to accept credit cards, digital wallets, and bank transfers with ease.

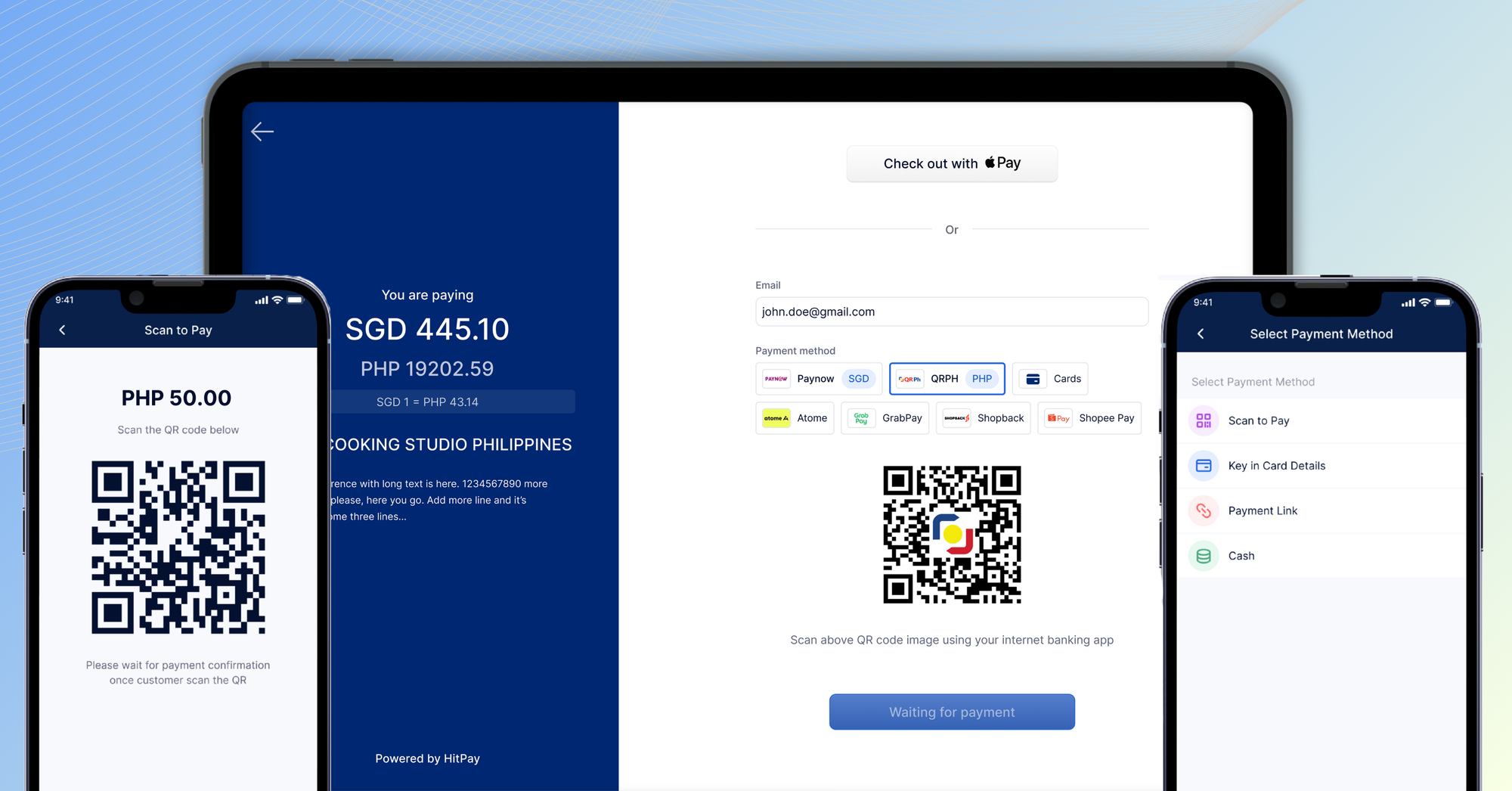

HitPay, trusted by over 20,000 businesses across Southeast Asia and beyond, offers an all-in-one solution for SMEs. It simplifies payment processing by unifying online, point-of-sale, and B2B transactions into one easy-to-use system.

In this article, we’ll guide you through the key factors to consider when selecting a payment gateway, discuss how the right choice can enhance customer trust and experience, and explore why HitPay stands out as a top option for businesses.

Key Takeaways

- Payment gateways are essential for secure transactions with features like encryption, 2FA, and fraud monitoring.

- Hosted gateways redirect customers for payments while integrated gateways keep the process on-site for a smoother experience.

- Choosing the right gateway depends on factors like security, ease of integration, and your business’s specific needs.

- HitPay offers an all-in-one payment solution for SMEs with easy integration, no setup fees, and robust security.

What is a Payment Gateway and How Does it Work?

A payment gateway is a tool that connects your business to banks for secure online payments. When a customer buys something on your website, they enter their payment details. The gateway securely sends this information to a payment processor.

The processor checks if the customer has enough funds and approves the transaction, allowing the payment to go through smoothly. This process makes online shopping quick and easy for both buyers and sellers.

In fact, nearly two-thirds of customers say that speed is as important as price when deciding to buy. By offering fast and secure payments, you can reduce cart abandonment and improve customer satisfaction.

Understanding the Payment Process

The payment process involves several steps to ensure payment information is securely handled:

- The customer enters their payment details on the website.

- The payment gateway encrypts the information and sends it to the payment processor.

- The processor checks with the bank to verify the payment details.

- The bank either approves or declines the payment.

- The gateway then informs the merchant and customer of the result.

These steps work together to ensure secure and efficient online payments.

How Payment Gateways Work for Online Stores

Online stores can integrate payment gateways in different ways, such as API, plugin, or SDK. Each option gives you flexibility in how payments are handled:

Key Components of a Payment Gateway

Understanding the key components of a payment gateway is essential for ensuring safe online payments. Here are the main parts:

- Payment Processor: Acts as the bridge between the payment gateway, acquiring bank, and issuing bank, facilitating the flow of information.

- Merchant Account: Required to receive funds from sales, enabling businesses to accept payments.

- Acquirer Bank: Handles payment processing on behalf of the merchant.

- Issuer Bank: Represents the customer in the transaction, approving or declining the payment.

- Encryption: Secures sensitive data during the transaction, ensuring that information remains protected.

With these components working together, you can deliver a secure and seamless payment experience. As technology evolves and customer needs shift, staying updated with the latest in payment gateway systems is key to maintaining smooth and safe online transactions.

What Are the Types of Payment Gateways Available?

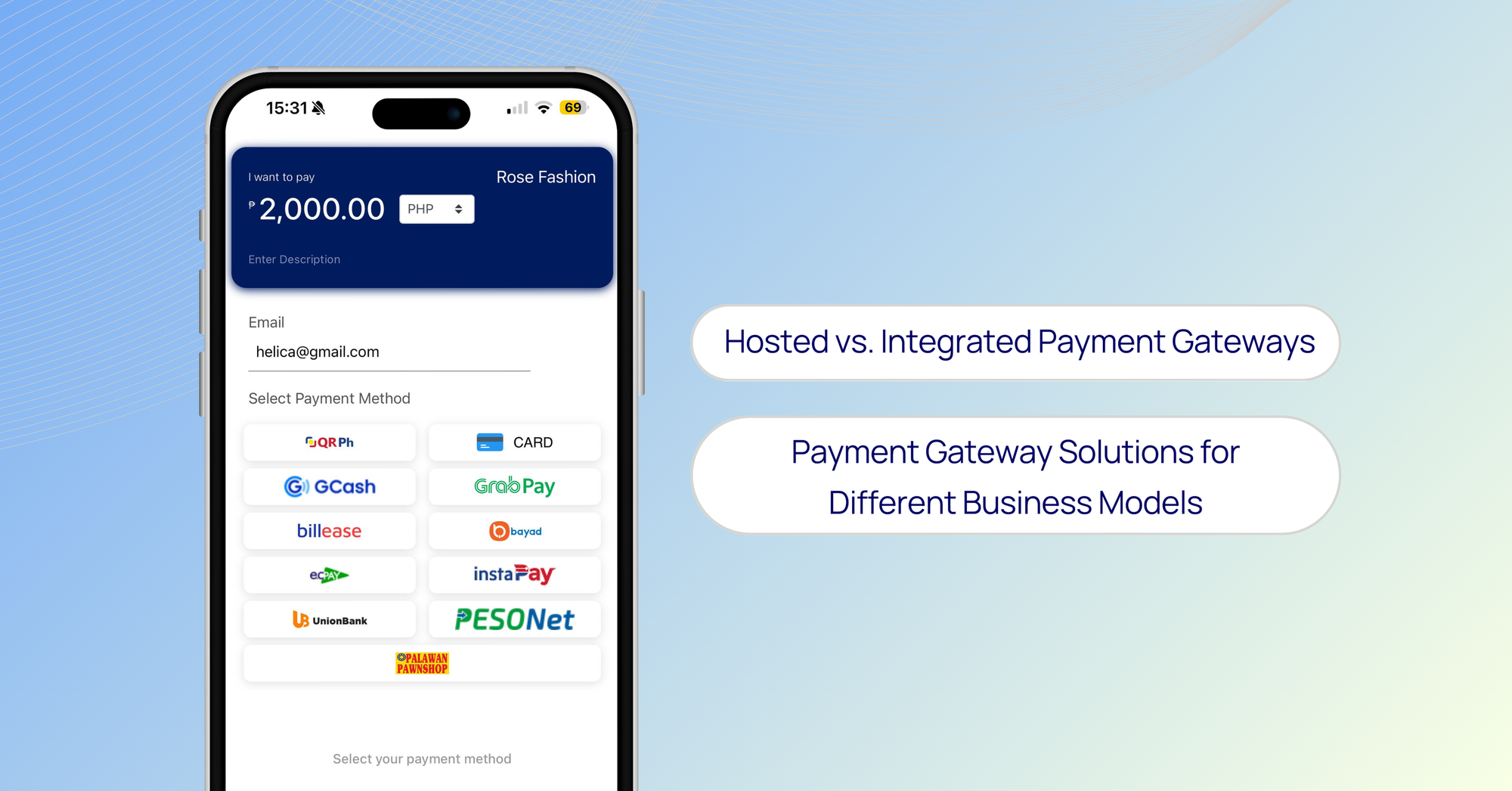

For businesses, knowing about payment gateways is key to better online sales. There are two main kinds of payment gateways: hosted and integrated.

Each has its own benefits and fits different business needs. They affect how you handle payments and talk to customers on your site.

Hosted vs. Integrated Payment Gateways

Hosted gateways redirect customers to an external page for payment. This approach is highly secure and ensures compliance with industry regulations. It’s ideal for small businesses due to low startup costs and pay-per-transaction fees. However, the redirect can cause delays during checkout, potentially leading to customer frustration.

Integrated gateways, on the other hand, allow customers to complete their payment directly on your website. This provides a smoother, more seamless checkout experience, which can enhance customer satisfaction.

However, maintaining security and compliance falls on your business, which can involve significant upfront costs and ongoing management. Robust security measures are essential to protect customer data.

Payment Gateway Solutions for Different Business Models

Choosing the right payment gateway is crucial for businesses like e-commerce stores, subscription services, and mobile apps.

API-hosted gateways offer flexibility and scalability by charging based on transaction volume. They also support faster payments and allow you to customize your branding.

Partnering with a local bank for payment processing can boost customer trust, as it conveys reliability. While this option may limit customization, it adds a layer of credibility that can be especially valuable for building customer confidence.

Comparing Payment Processors and Gateways

Understanding the difference between payment processors and payment gateways is crucial for online transactions.

- Payment processors are responsible for connecting merchants to banks and handling the actual payment processing. They authorize credit and debit card payments and manage the flow of funds.

- Payment gateways, on the other hand, act as a secure bridge that transmits payment information between customers, businesses, and payment processors.

While both are essential, they serve different roles. Payment gateways focus on securely encrypting and transmitting payment data for both online and in-person transactions. However, they typically do not manage fraud detection—that’s where payment processors come in.

Payment processors offer additional services such as fraud detection, chargeback management, and compliance with financial regulations. Businesses pay fees to use these services, usually in the form of a small charge per transaction.

Payment processors and gateways work together to make transactions smooth. Processors offer detailed services like reports and analytics.

Gateways focus on security and connecting with other systems. Knowing about both helps businesses pick the right services for their needs.

What Security Measures Should You Look for in a Payment Gateway?

Choosing a payment gateway for online transactions is very important. It's key to keep your business and customers' data safe. Here are the main security things to think about:

Importance of PCI DSS Compliance

In 2023, around 8.3% of digital transactions by consumers in the Philippines were flagged as potentially fraudulent.

This highlights the critical role of PCI DSS (Payment Card Industry Data Security Standard) compliance in payment gateway security.

PCI DSS establishes guidelines to protect cardholder data during transactions, significantly reducing the risk of security breaches for businesses that adhere to it. Choosing a payment gateway that complies with PCI DSS demonstrates your commitment to safeguarding customer payments and minimizing security threats.

Encryption and Data Protection Techniques

Encryption plays a crucial role in protecting data during online transactions. Payment gateways utilize Secure Sockets Layer (SSL) to establish secure connections, preventing hackers from intercepting sensitive information.

To enhance security further, tokenization is used to convert real credit card details into unique tokens, making it extremely difficult for cybercriminals to exploit stolen data. Additionally, Two-Factor Authentication (2FA) adds an extra layer of protection by requiring users to verify their identity with a code. 2FA reduces the risk of account compromise by 99.22% overall and by 98.56% in cases involving leaked credentials, proving to be a highly effective tool in securing payment processes.

How to Identify Secure Payment Gateways

When selecting a secure payment gateway, look for the following key features:

- SSL Certificates: Ensure the gateway uses SSL encryption to securely transmit data.

- Advanced Fraud Detection and Prevention: Look for systems that leverage intelligent technology to detect and prevent fraudulent activities.

- Regular Security Audits: Choose a provider that conducts routine security checks to maintain up-to-date protection.

- Positive Customer Feedback: Check for reviews that highlight strong security and customer trust.

Incorporating these features enhances transaction safety and strengthens your business’s credibility. Opting for a secure payment gateway is essential for protecting both your business and your customers’ data in today’s digital landscape.

How to Choose a Secure Payment Gateway for Your Business?

Choosing the right payment gateway is key for smooth transactions. Look at different providers based on security, ease, fees, and e-commerce solutions. This ensures your business runs smoothly.

Evaluating Payment Gateway Providers

Think about these points when picking a payment gateway:

- Security Measures: Check for PCI DSS compliance to protect customer data.

- User Experience: A simple checkout process helps avoid cart abandonment. If a customer's preferred payment method isn't there, they might leave.

- Fees: Fees vary from 0.5% to 3% per transaction.

- Integration Ease: Choose gateways with easy APIs and plugins for your platform.

- Customer Support: Good support is key, especially if your work spans across various countries.

Factors to Consider When Choosing a Payment Processor

Keep these points in mind to match your business needs:

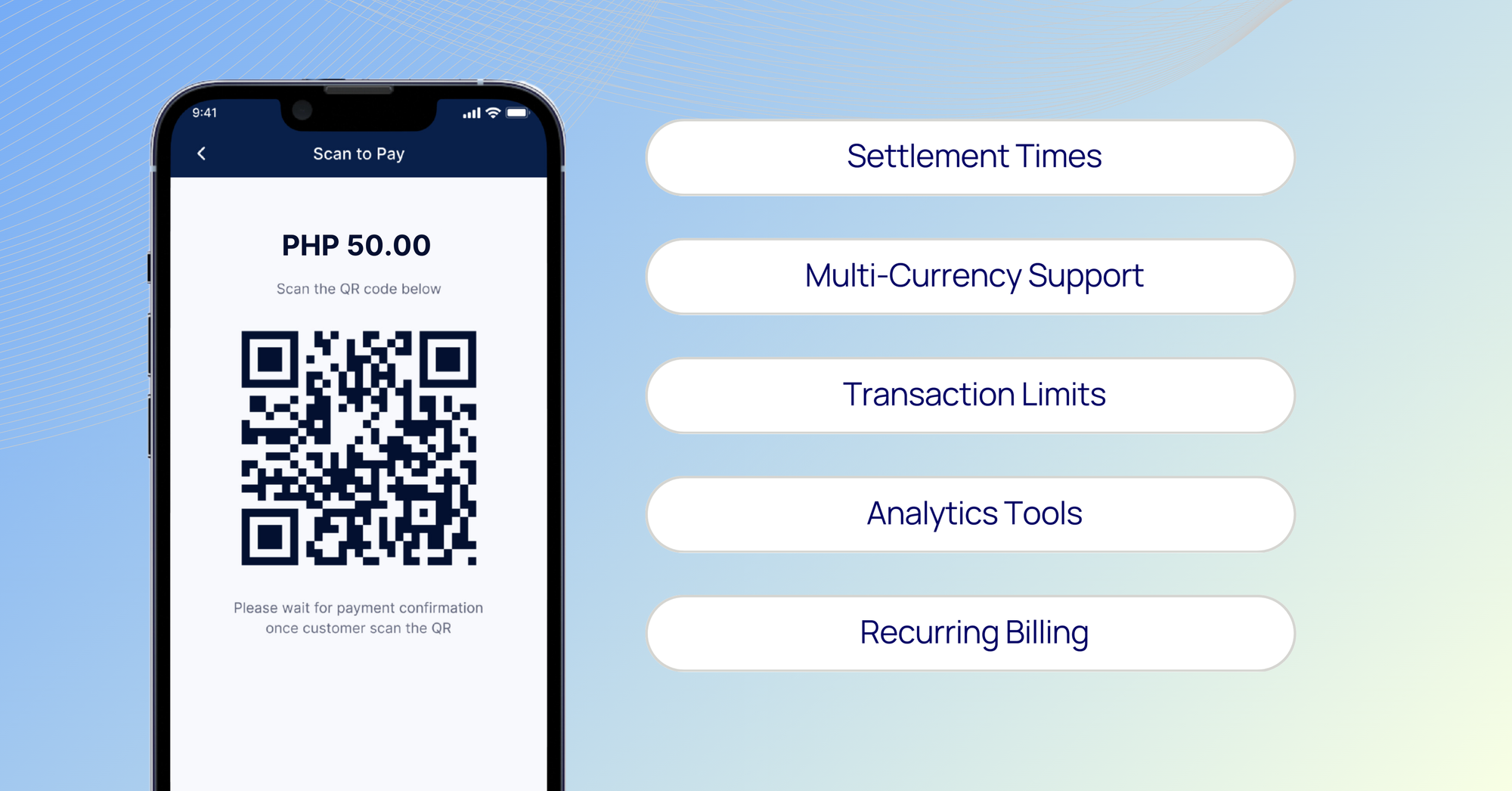

- Settlement Times: Settlement times affect cash flow. Daily or weekly options can help.

- Multi-Currency Support: Real-time currency conversion helps with international customers.

- Transaction Limits: Make sure limits match your sales and needs.

- Analytics Tools: Good reporting and management tools help your business grow.

- Recurring Billing: For subscriptions, check if your processor can handle recurring payments well.

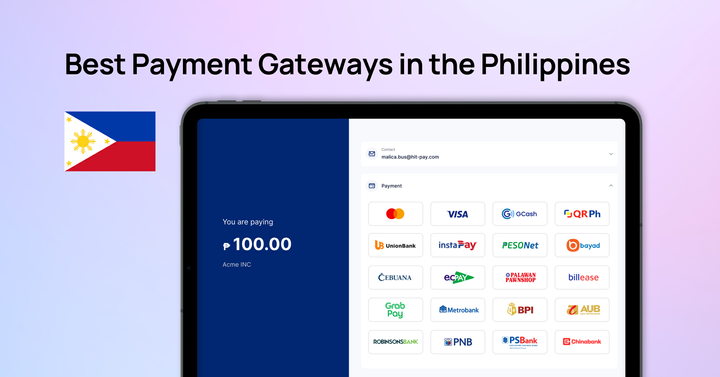

Best Payment Gateways for E-commerce Websites

Top e-commerce payment gateways include:

- HitPay: A versatile payment gateway for SMEs with easy integration into platforms like Shopify and WooCommerce. Offers a full suite of tools (POS system, mobile app, online store builder) with no setup or monthly fees, fast payouts, multi-currency support, and robust security with PCI DSS compliance.

- Paymongo: A simple, user-friendly gateway popular in the Philippines. It operates on a pay-per-transaction model with no setup or monthly fees, though it has limited local payment options and weekly payouts.

- Xendit: Known for secure transactions and quick setup. Xendit offers invoicing and recurring payments, but lacks some local payment methods and has limited plugin support for certain platforms.

- Dragonpay: Supports a broad range of payment options, including in-person transactions, with a cost-effective model. However, it has limited e-commerce plugin and accounting integration support.

Focus on these points to pick a payment gateway that's secure and boosts your business. It will make your operations better and please your customers.

What Are the Benefits of Using a Secure Payment Gateway?

Using a secure payment gateway has many benefits for your business. It makes payments safer, builds trust with customers, and speeds up transactions. By using strong security, you lower the chance of fraud and make shopping better for customers.

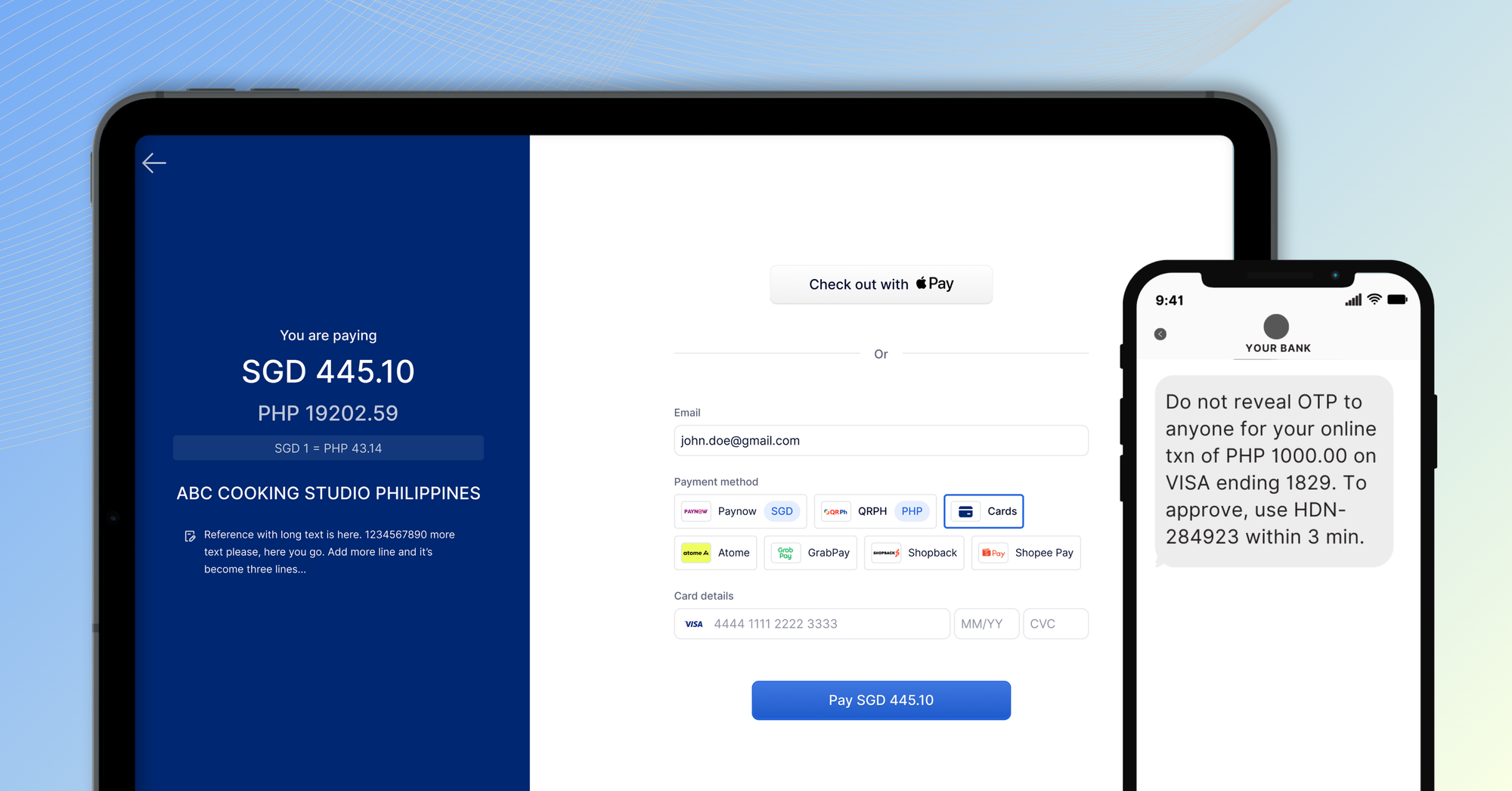

How Do Payment Gateways Ensure Transaction Security?

Transaction security is crucial for both merchants and customers in online commerce. Payment gateways employ advanced encryption and multiple layers of security protocols to safeguard sensitive data, ensuring that transactions remain secure and trustworthy.

Role of Encryption in Online Payments

Encryption is a key factor in protecting payment information. When a customer enters payment details, the data is encrypted—transformed into a coded format that’s difficult for hackers to intercept or decipher during transmission.

Industry-standard encryption technologies, like Transport Layer Security (TLS), ensure that sensitive financial information is securely transferred, fostering trust between customers and merchants.

Understanding Gateway Security Features

Payment gateways use several advanced features to enhance security and protect against fraud:

- Two-Factor Authentication (2FA): Requires users to confirm their identity through a second method, like a code sent to their phone, adding an extra layer of protection.

- Tokenization: Replaces sensitive card details with unique tokens that are meaningless if intercepted, ensuring secure storage and transmission of payment information.

- Fraud Detection Tools: Advanced algorithms analyze transaction patterns in real-time, flagging suspicious behavior for further review.

- SSL/TLS Encryption: Secures the communication channel between the customer and the gateway, making it difficult for unauthorized parties to intercept sensitive data.

Monitoring and Responding to Security Threats

Payment gateways continuously monitor transactions in real-time to detect and respond to potential security threats. Sophisticated fraud detection algorithms identify suspicious activities and trigger immediate alerts, allowing swift action to prevent breaches.

This constant vigilance helps protect both merchants and customers from fraud, ensuring that transactions remain secure from start to finish.

Get Started With HitPay’s Secure Payment Gateway Solution

E-commerce is growing fast in the Philippines. Secure payment gateways are key to this growth. They make sure online transactions are safe and secure.

You can protect your transactions by choosing payment gateways with strong security, many payment options, and easy-to-use systems. This also make customers more loyal to your business.

Enhance your e-commerce business with HitPay's advanced payment gateway. Accept local and international payments with seamless integration and no coding required. Enjoy low fees, fast payouts, and extensive plugin support.

Get started today with HitPay's simple, pay-per-transaction pricing and no hidden costs. Sign up now and start selling within days.

Have questions? Our support team is ready to assist you on your preferred platform. Elevate your payment process with HitPay!

Frequently Asked Questions About Payment Gateways

What are the key features to look for in a payment gateway?

When picking a payment gateway, look for strong security and easy setup. Also, check the prices, payment options, and support. This ensures smooth online payments.

How does PCI DSS compliance relate to payment gateways?

PCI DSS compliance is key for payment gateways. It sets the rules for handling card data safely. Choosing a compliant gateway helps protect customer info during online buys.

Can payment gateways support mobile transactions?

Yes, many payment gateways now support mobile buys. They let customers use their phones or tablets to shop. Look for gateways with mobile-friendly features and options.

What steps can I take if I suspect fraud in transactions?

If you think fraud is happening, call your payment gateway right away. They can look into it and help keep your transactions safe. They offer tools like two-factor authentication and watchful systems.